14 APR 2025 Market Close & Major Financial Headlines: Tech Stocks Surge as Tariff Reprieve Sparks Market Rally

Summary Of the Markets Today:

The Dow closed up 312 points or 0.78%,

NASDAQ closed up 107 points or 0.64%,

S&P 500 closed up 43 points or 0.79%,

Gold $3,226 down $18.60 or 0.57%,

WTI crude oil settled at $62 up $0.17 or 0.28%,

10-year U.S. Treasury 4.376 down 0.113 points or 2.515%,

USD index 99.65 down 0.24 points or 0.24%,

Bitcoin $84,853 up $950 or 1.13%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

Global stock markets rallied on April 14, 2025, driven by the White House’s decision to temporarily exempt smartphones, computers, and other electronics from new U.S. tariffs, providing a significant boost to technology shares, especially Apple, which surged as much as 6% before paring gains. The Dow Jones, S&P 500, and NASDAQ all opened sharply higher, with the S&P 500 and NASDAQ rising over 1% and the Dow up more than 400 points at one stage, as investors welcomed the reprieve for tech imports amid ongoing trade tensions with China. However, market optimism was tempered by continued uncertainty, as administration officials signaled that these exemptions might be short-lived, with new sector-specific tariffs potentially on the horizon and no clear resolution to the broader tariff dispute. Volatility remained elevated, fueled by record trading in zero-day options and whipsawing headlines about tariffs. At the same time, investors also braced for a busy week of corporate earnings and watched for further policy signals. Despite the relief rally, analysts and strategists warned that the lack of clarity on trade policy and the risk of renewed tariffs could keep markets volatile and cap further gains in the near term.

Click here to read our current Economic Forecast: –

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

In March 2025, the Federal Reserve Bank of New York’s Survey of Consumer Expectations revealed mixed inflation expectations, with median one-year-ahead inflation rising 0.5 percentage points to 3.6 percent, three-year-ahead expectations holding steady at 3.0 percent, and five-year-ahead expectations dipping slightly by 0.1 percentage point to 2.9 percent, signaling varied consumer outlooks across short-, medium-, and long-term horizons. Concurrently, consumers grew more pessimistic about their financial futures, as 30 percent of households anticipated a worse financial situation in a year—the highest share since October 2023. Labor market confidence also weakened significantly, with mean unemployment expectations spiking 4.6 percentage points to 44.0 percent, the highest since April 2020, reflecting fears of a rising U.S. unemployment rate. Additionally, the mean perceived probability of job loss over the next twelve months climbed 1.6 percentage points to 15.7 percent, a peak not seen since March 2024, with the sharpest increases among households earning less than $50,000 annually, underscoring growing economic unease.

Sponsored Content:

"Trump Coins:" The Next Big Thing

Have you heard of "Trump Coins?" (Click here for details)

Even though these coins are not associated with or endorsed by President Trump...

Tech legend Jeff Brown believes his policies will help send these coins higher than anyone can imagine in 2025.

Click here to see the details because these coins have been called "the next big thing in the cryptocurrency market."

6303/3

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

Infographic of the Day from Visual Capitalist:

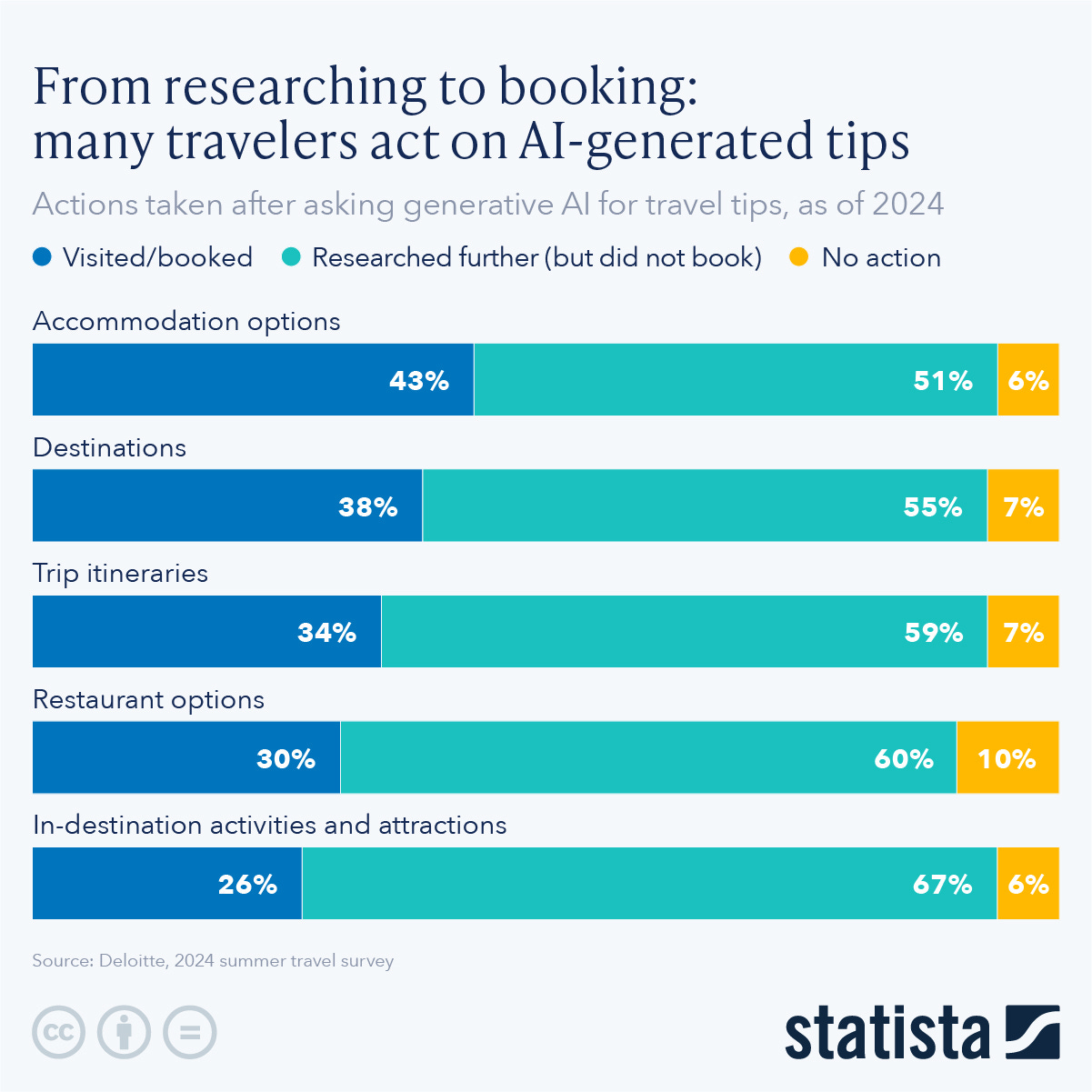

Statista Graphic of the Day:

You will find more infographics at Statista

Here are the headlines we are reading:

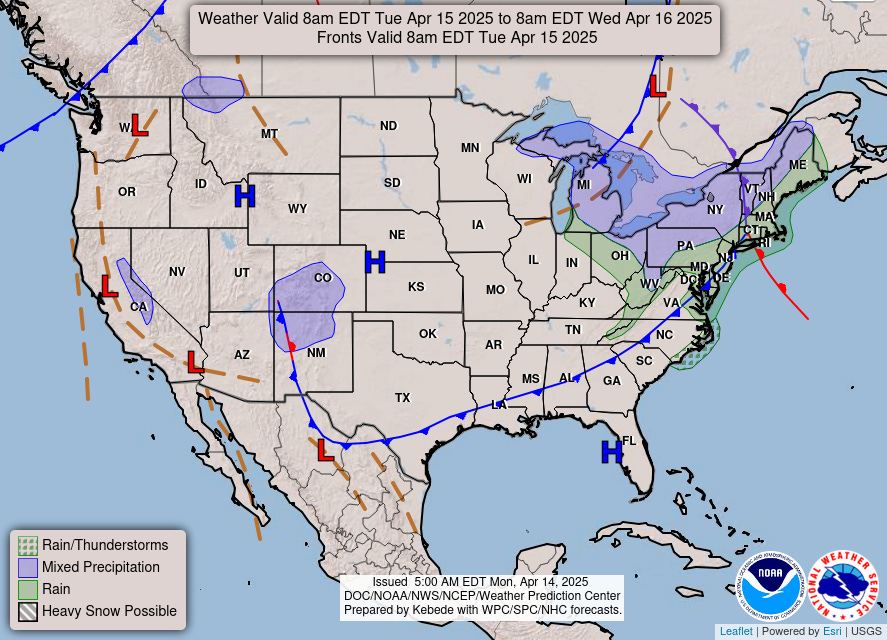

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings click HERE and enter your city, state or zip code in the upper left corner.

Reshoring Shipbuilding

Building ships is important to national security yet too costly. The United States produced a total of 124,000 ships of all types during World War II. These production figures underscore the massive industrial mobilization that characterized World War II. In 2024, U.S. shipyards constructed only 5 commercial ships, based on data from the Congressional Research Service and industry reports. Add to this, one Virginia-class submarine, one Arleigh Burke-class destroyer, and possibly one amphibious ship (LPD-32) suggest 2-3 naval vessels were launched in 2024.

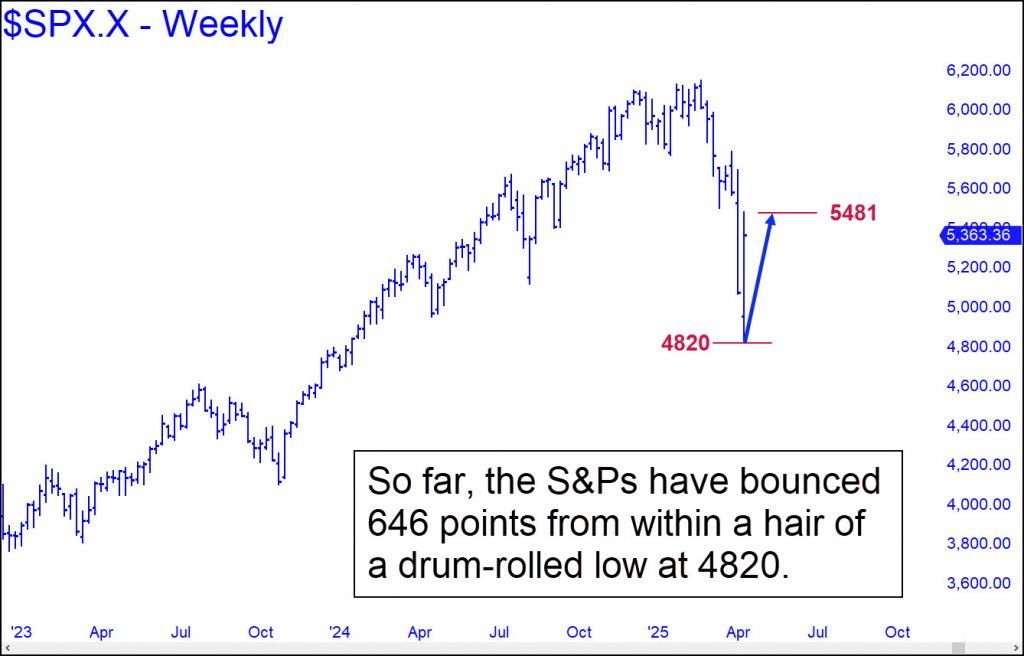

Round One vs. The Bear Goes to Trump

[Just ahead of last Monday’s steep plunge, I predicted here that an S&P reversal from 4820 would mark the end of the bear market. So far, SPX has rallied 646 points off an actual low at 4835. Bulls are not yet out of the woods, however, since a relapse could occur at any time. The stock market remains spooked by Europe’s dumping of Treasury paper in a deliberate attempt to destabilize the U.S. financial system. With the EU economy swirling down the crapper, the globalists are desperate to force Powell to ease in order to rescue big hedge funds that were leveraged up to their eyeballs with Treasury paper. So far, the Fed chairman has stood his ground, and it appears the EU attempt to sabotage the U.S. bond market will fail. In any event, the commentary below will continue to run until such time as the S&Ps crash the 4820 Hidden Pivot and prove me wrong. If you keep my thesis in mind — that as long as 4820 holds, there will be no recession, nor any harmful effects from tariffs — you will be better able to judge the jaw-dropping stupidity of the mainstream media’s coverage of Trump 2.0. Because of their blind hatred of the president, the eggheads, reporters, pundits and benighted editorialists will continue to get everything wrong until stocks are once again soaring to new all-time highs. RA]

A word of advice if you’re looking for bankable information on the direction of the economy: tune out the mainstream media’s cavalcade of Trump-deranged bozos and focus on the 4820 target in the SPX chart above. Think of it as Trump’s lucky number, but also a very good place for these all-too-interesting times to find temporary equilibrium. That is my worst-case target for a bear market that many believe is only just getting started. As a die-hard permabear myself, I’ve been eagerly anticipating the Mother of All Bears since, like, 2010. The global economy was badly in need of a reset and still is. It will happen, but not now. Instead, it looks like Trump is about to achieve the impossible, averting a catastrophic debt deflation while also staving off recession. Even the already certain collapse of commercial real estate will have to wait.

Auto stocks rise as Trump says he wants to 'help' some car companies

The comments pushed stocks such as Ford, GM and Chrysler parent Stellantis higher, swinging from trading levels or negative to being up between 1% and 4%.

Fed Governor Waller sees tariff inflation as 'transitory' in 'tush push' comparison

The central banker embraced a term that got the central bank in trouble during the last bout of inflation.

U.S. businesses sue to block Trump tariffs, say trade deficits are not an emergency

The Trump administration's argument is undercut by its imposing tariffs on countries the U.S. does not have a trade deficit with, the plaintiffs say.

Dow jumps 300 points, S&P 500 closes higher as tech shares rise after tariff exemptions: Live updates

The moves come after the market saw one of the most volatile trading weeks ever last week.

Trump tariffs won't lead supply chains back to U.S. but companies will go low-tariff globe-hopping: CNBC survey

President Trump's U.S. manufacturing boom is unlikely result from tariffs, with costs too high and a global hunt for low-tariff regimes coming: CNBC survey.

Buy these stocks that can better ride out tariff market volatility, Trivariate says

Trivariate Research recommended stocks with more achievable relative growth rates and earnings estimates for investors seeking a volatility hedge.

Zero-day options are fueling the unprecedented volatility on Wall Street amid tariff chaos

Zero-day- to-expiration options are contracts that expire the same day that they're traded.

DOJ charges man in arson attacks on Tesla showroom, Republican HQ in New Mexico

Tesla has become a target as CEO Elon Musk has courted controversy for his oversight of President Donald Trump's government-slashing DOGE initiative.

Nvidia to mass produce AI supercomputers in Texas as part of $500 billion U.S. push

Its Blackwell AI chips have started production in Phoenix at Taiwan Semiconductor plants.

Why bitcoin showed resilience amid recent market turmoil: CNBC Crypto World

On today's show, ether climbs to start the week amid new headlines related to tariffs. Plus, Kraken announces the crypto exchange is expanding to stocks and ETFs. And, Andy Baehr, managing director at CoinDesk Indices, weighs in on why crypto has held up well amid the recent market turmoil.

Airlines bank even more on splurging vacationers as clouds form on economy

Carriers are hoping that wealthier leisure travelers will continue to treat themselves to pricier, roomier seats.

Blue Origin launches an all-female celebrity crew with Katy Perry, Gayle King and Lauren Sanchez

Jeff Bezos' Blue Origin launched his fiancee Lauren Sanchez into space Monday with an all-female celebrity crew that included Katy Perry and Gayle King.

Billionaire Ray Dalio: 'I'm worried about something worse than a recession'

Bridgewater founder Ray Dalio said he is worried about a breakdown of the global monetary order.

Tariff Shock Delayed For Dollar Tree & Home Depot By Several Months

Although President Trump rolled back reciprocal tariffs (excluding China) last week and a temporary exemption for smartphones, computers, chips, and other consumer electronics over the weekend, the uncertainty sparked by the trade war has left corporate America, including major retailers, on edge.

Goldman analysts Kate McShane, Mark Jordan, and others shared key insights with clients on Monday from conversations with the management teams of retail giants Dollar Tree and Home Depot. Both retailers import a significant volume of products from Asia, including China.

McShane noted that one key takeaway from conversations with Dollar Tree executives is that Trump's tariff "bazooka" won't impact store shelves for several months. Once the tariffs take effect, margins could become volatile; however, they expect products to remain competitively priced with peers, in ...

Yield Spreads Suggest The Risk Isn't Over Yet

Authored by Lance Roberts via RealInvestmentAdvice.com,

In November last year, I discussed the importance of yield spreads, historically the market’s “early warning system.” To wit:“

“Yield spreads are critical to understanding market sentiment and predicting potential stock market downturns. A credit spread refers to the difference in yield between two bonds of similar maturity but different credit quality. This comparison often involves Treasury bonds (considered risk-free) and corporate bonds (which carry default risk). By observing these spreads, investors can gauge risk appetite in financial markets. Such helps investors identify stress points that often precede stock market corrections.”

In other words, the yield spreads reflect the perceived “risk” in the financial markets. The spread between risky corporate bonds and safer Treasury bonds remains narrow when the economy performs well. This is because investors are confident in corporate profitability and willing to accept lower yields despite higher risks. Conversely, during economic uncertainty or stress, investors demand higher yields for holding corporate debt, causing spreads to widen. T ...

UAW Boss Sides With Trump On Tariffs, Stuns MSNBC Panel

Anti-Trumper—perhaps now reformed—UAW union boss Shawn Fain stunned far-left MSNBC hosts Alicia Menendez, Symone Sanders-Townsend, and Michael Steele over the weekend by echoing MAGA talking points and defending President Trump's tariffs.

President Shawn Fain is about to go live on @CNN to talk about Trump, Harris, and our fight against corporate greed. #StandUpUAW pic.twitter.com/BhJGxrOZ9c

— UAW (@UAW) August 20, 2024

"We know that tariffs will influence these companies to do the right thing and reinvest in this country," Fain said, who oversees 400,000 union members across America's auto industry.

Fain continued: "We believe Stellantis and these companies will bring work back because of these tariffs ... look what these auto manufacturers have done without them..."

He praised former presidential candidate Ross Perot, who famously warned about the consequences of NAFTA in the early 1990s, calling him a "prophet."

Fain emphasized that Perot was right: "Since NAFTA's inception in 1993, we've lost 90,000 manufacturing facilities in this country. Millions of jobs."

Vitalik Buterin Says Ethereum's App Layer Needs "Good Social Philosophy" Most

Authored by Stephen Katte via CoinTelegraph.com,

Ethereum co-founder Vitalik Buterin argues it’s Ethereum’s application layer, not its infrastructure layer, where Ethereum needs “good social philosophy” the most.

The app layer is where developers build decentralized applications on top of Ethereum’s base infrastructure and where they make decisions about how these programs operate.

In an April 12 post on the social media platform Warpcast, Buterin responded to a user’s argument that Ethereum needs a new generation of developers rooted in Ethereum’s core values to

Net Zero Policies Losing Favor Among Business Owners

The majority of small and medium-sized firms (SMEs) have sidelined net zero practices, according to a survey of around 500 business owners, in signs that net zero policies are increasingly falling out of fashion. President Donald Trumps abandonment of Biden-era green policies has driven a global trend that is seeing firms and governments move away from prioritising climate change. Now this survey appears to suggest that UK firms are following suit as higher cost pressures bite. More than half of business owners have deprioritised

World Bank Under Scrutiny Over Tajikistan Hydropower Project

The World Bank is under fire over allegations of impropriety in financing the Rogun Dam project in Tajikistan. Specifically, bank officials are facing accusations that they failed to comply with procedures to account for potential environmental and socio-economic harms associated with the project. A statement issued April 8 by the World Banks Inspection Panel, an independent investigative body, announced the registration of a formal Request for Inspection, in effect a complaint, concerning the banks involvement in the Rogun hydropower

Gasoline Prices Fall for First Time in a Month, Still Higher YoY

Average national prices for a gallon of gasoline at the pump on Monday fell for the first time in a month, according to GasBuddy, dropping 8.2 cents per gallon compared to a week ago, with prices still 7.8 cents higher than a month ago, and 46.9 cents higher than this time last year. Diesel is also tracking this month with gasoline, with the national average per gallon of diesel dropping 4.8 cents week-on-week, resting at $3.546 per gallon on Wednesday, according to GasBuddy data. After oils sharp drop over the last

Iran Faces Tough Decisions in Nuclear Negotiations

Nuclear talks in Oman marked the first formal engagement between Iran and the United States in years, and though progress may have been slight, it was enough to signal a willingness to temper tensions through diplomacy rather than military action. Iranian and US negotiators agreed on April 12 to continue their high-level talks over Tehran's nuclear program on April 19, with the venue likely moving to Europe from the Middle East. Axios on April 13 cited sources as saying the second round would likely be in Rome, but there has been no official comment

OPEC Lowers 2025 Oil Demand Forecast on Trade Tensions

OPEC has revised its global oil demand growth forecast for 2025, citing escalating trade tensions and weaker-than-expected economic indicators. The cartel now anticipates a demand increase of 1.3 million barrels per day (bpd) for 2025, down 150,000 bpd from its previous projection. Similarly, the 2026 forecast has been adjusted downward to 1.28 million bpd. OPEC's latest report highlights that Trumps tariff war has dampened economic activity, leading to a more cautious outlook on oil consumption. The organization also revised its global

Trump's Trade Policies Baffle Economic Forecasters

The Office for Budget Responsibility (OBR), one of the UKs central forecasters, prepared itself for President Trumps tariff war or at least partially. At a presentation after Chancellor Reeves Spring Statement, OBR chair Richard Hughes admitted the fiscal watchdogs central forecast risked being completely undermined by global events. Hughes came up with three possible scenarios for what Trump could announce and how much pain the UK economy would suffer. In one scenario, where the UK was slapped with

Shales About to Make a Comeback for the Ages: Energy Secretary

Oil prices are sagging like a tired trampoline, and U.S. shale producers are feeling the bouncejust not in a good way. With WTI dancing around $60 and analysts wringing their hands over breakeven levels near $65, you'd be forgiven for assuming the shale patch was in full panic mode. But U.S. Energy Secretary Chris Wrightformer CEO of Liberty Energy and now the governments top oil whispererseems utterly unbothered. The U.S. shale industry is going to survive and thrive, Wright declared this week in Abu Dhabi,

Electric Rate Hike in Virginia Makes Headlines Internationally

Electric rate hike requests in Virginia dont generally make the headlines globally, but the Financial Times featured a story about one: Dominion Energys request for a 14% rate increase for its Virginia customers. It wasnt a slow news day, either. Donald Trump had just hiked tariffs and the pages were filled with discussions about why the administration had singled out Lesotho and Madagascar for extreme tariff punishment, to say nothing of the penguins. The FTs story suggested that there would be more of the same from

Did Oil Markets Overreact to Trump's Tariffs?

Last weeks price crash, which saw Brent Crude prices dip below $60 per barre, was an excessive market reaction to the U.S. tariffs, with speculators assuming there would be no growth in oil demand due to recession fears, Gunvors head of research Frederic Lasserre told Bloomberg. I think the market overreacted, Lasserre told Bloomberg in an interview, commenting on last weeks market rout. I think this was a bit too aggressive, at least for now, and from here I see a bit more upside than downside because

Russia Targets Major Surge in Natural Gas Exports by 2050

Russia expects its natural gas exports, including via pipeline and LNG, to jump twofold by 2030 and threefold to 2050 under its new long-term energy strategy approved by the government on Monday. Russia sees its pipeline and LNG overseas deliveries surge from 146 billion cubic meters (bcm) in 2023 to 293 bcm in 2030, and further up to 438 bcm by 2050. Crude oil and condensate production is targeted to increase from 531 million metric tons per year, or 10.66 million barrels per day (bpd), in 2023 to 540 million tons, or 10.8 million bpd, by 2050.

Keystone Oil Pipeline Set to Resume Operations by April 15

The Keystone oil pipeline, which was shut last week after a leak, is expected to resume service by Tuesday, April 15, or at least this is the targeted start date announced by pipeline operator South Bow. The Keystone pipeline, with a capacity to carry more than 600,000 barrels per day (bpd) of oil from Alberta, Canada, to the United States, was shut last week following an oil leak near Fort Ransom, North Dakota. Last Wednesday, South Bow said that the affected segment was isolated, and the release was contained. The estimated release volume is

Oil Prices Inch Higher, but Traders Remain Cautious

Oil prices began the day with gains as US stock markets opened, driven by eased trade tensions and strong Chinese import data. OPEC revised its 2025 and 2026 global oil demand growth forecasts downward, citing uncertainties related to the ongoing trade war. Despite the positive start, traders remain cautious due to previous volatility and the mixed signals from supply dynamics and geopolitical factors. End of live blog 4h ago 10:10am CST U.S. Oil Output Faces Risk of Decline Amid Tariff Uncertainty The U.S. oil sector, a cornerstone of Trumps

EU to Seek LNG Purchase Deal With Trump in Trade Talks

The European Union is considering offering a specific deal to the United States to buy American LNG to address President Trumps grievances against the U.S. trade deficit with Europe, POLITICO reported on Monday, quoting anonymous European officials familiar with internal EU discussions. The EU is weighing aggregating LNG demand across its members to place a large bulk-buy offer. Still, the EU would be ideally looking to buy the American LNG at competitive prices, according to POLITICOs sources. Last week, Lithuanias Energy

BP Makes Deepwater Oil Discovery in Gulf of Mexico

BP has made an oil discovery in the deepwater U.S. Gulf of Mexico 120 miles off the coast of Louisiana, the UK-based supermajor said on Monday. The discovery at the Far South prospect comes as BP announced a few weeks back a strategy reset to shift focus back to growing oil and gas production and investments after a few years of trying to be an integrated energy company with a major presence in renewables. BP made the oil discovery at the Far South prospect in an exploration well drilled in Green Canyon Block 584, located in western Green Canyon

Chinas Oil Imports Hit 20-Month High as Iran and Russia Flows Rebound

Chinese crude oil imports topped 12 million barrels per day (bpd) in March, the highest volume since August 2023, as flows of Iranian and Russian crude rebounded from the lows seen early this year with the U.S. sanctions. China imported a total of 51.41 million metric tons of crude oil in March, data from the Chinese General Administration of Customs showed on Monday. Thats equivalent to 12.1 million bpd in crude arrivals last month, per Reuters calculations. The import volumes in March were the highest since August 2023 and were much higher

No 10 'confident' British Steel furnaces will stay on

Vital materials stored nearby to the Scunthorpe plant will arrive in the "coming days", Downing Street says.

US stock markets rise on Trump tariff rollback

The US president exempts some Chinese goods such as smartphones from levies but says it is temporary.

Trump threatens new tariffs on smartphones days after exempting them

President Trump says Chinese-made electronics are simply moving to a different levy "bucket".

Goldman sees glittering future for gold. Boosts year-end target to $3,700

The bank attributes the bullish revision to stronger-than-expected central bank demand and mounting recession risks, which have contributed to a surge in gold-backed ETF inflows.

Navratnas of the market: 9 investing mantras from Devina Mehra’s new book

Investment mantras aren’t morning chants you recite with closed eyes and crossed legs. "They are what you believe are at the foundation of your whole investment and portfolio management strategy," the PMS fund manager, who runs First Global, writes in her book published by Penguin.

Explained: Will NRIs be liable for capital gains tax on mutual fund sales in India?

The case involved A Shah, a Singapore tax resident, who declared capital gains of Rs 88.75 lakh from debt mutual funds and Rs 46.91 lakh from equity mutual funds for the financial year 2021–22.

‘The whole thing feels predatory’: My grandma, 97, pays $170 a month for a $10,000 life-insurance policy. Should we stop payments?

“After what quickly became a heated discussion, the agent advised me that canceling the policy would end any chance of a payout.”

MicroStrategy reverts to selling just common stock to buy bitcoin

The company, doing business as Strategy, sold nearly one million of its shares to the public so it could use the money to buy more bitcoin on the dip.

Fresh debt from JPMorgan, Morgan Stanley draws warm reception from investors in hopeful sign

As big Wall Street banks issue billions in new debt, yield spreads against U.S. Treasurys drop in a sign of strong demand.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.