Joe Sixpack’s Wallet: Why the Average American Feels Poorer in 1Q2025

Beyond the Numbers: Why Americans Feel Poorer Despite a Growing Economy

Research indicates that how wealthy people feel—their subjective sense of wealth—significantly influences their spending habits, sometimes even more than their actual (objective) wealth.

A recent series of studies found that among objectively wealthy individuals, those who feel subjectively richer spend less money overall, including on high-status goods. How much wealth is needed to be considered objectively wealthy?

In the United States, surveys consistently find that a net worth of at least $2 million to $2.5 million is the threshold for being considered objectively wealthy at the national level. This figure varies by location. In high-cost cities like San Francisco, the required net worth rises sharply—locals say you need about $4.4 million to be considered wealthy, while in New York City, the number is around $2.9 million. Across major U.S. cities, the "wealthy" threshold generally ranges from $2.2 million to $4.4 million in net worth, depending on local living costs and social expectations. According to IRS standards, a monthly income of about $45,000 (or $540,000 annually) qualifies someone as wealthy. However, to be in the top 1% of earners, you'd need an income of about $68,277 per month (over $819,000 annually).

Conversely, among objectively poor individuals, feeling subjectively richer leads to more spending, both in total and on status items. For the wealthy, this reduced spending when feeling rich is partly attributed to a lower susceptibility to social influence—they are less driven to impress others or respond to social pressure through consumption.

This post analyzes the feeling of wealth among people not objectively wealthy, and the not objectively wealthy generally fall within three groups:

Paychecks - roughly 1/3 of households are living paycheck-to-paycheck, and do not own any financial assets except for a bank account or car.

The Sixpacks - who owns a house with a mortgage, has a job, and no other assets

Middle Man - the Sixpacks with financial assets and real estate assets

This post will look at the change in wealth and income in 1Q2025. An increase in the growth of wealth in this group should drive consumption upward (a positive effect on GDP). Conversely, feeling less wealthy should curtail consumption. The economic health of the population is important for driving GDP growth.

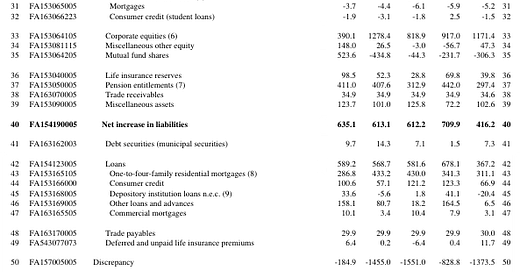

The Federal Reserve data release (Z.1 Flow of Funds) released on 12 June 2025 provides insight into the finances of the average household – shows most Americans are much worse off in the first quarter of 2025 than they were in the fourth quarter 2024. Unfortunately, the Z.1 is issued almost 3 months later than real time. The net worth of households and nonprofits fell to $169.3 trillion during the first quarter of 2025 (see the following table).

The following table looks at the financial situation of households in 1Q2025 compared to 2024;

A look at the growth rate of certain elements of wealth:

Consumer credit year-over-year growth was -1.1% according to Fed data (blue line on the graph below) but it is -3.5% inflation-adjusted (red line on the graph below). It is obvious that consumer credit is contracting, which suggests the consumer is hunkering down.

[the rest of this post is for paid subscribers]

Keep reading with a 7-day free trial

Subscribe to EconCurrent’s Substack to keep reading this post and get 7 days of free access to the full post archives.