25 March 2025 Market Close & Major Financial Headlines: Stocks Eke Out Gain as Trump Hints at Lighter Levies, New Targets

Summary Of the Markets Today:

The Dow closed up 4 points or 0.01%,

Nasdaq closed up 83 points or 0.46%,

S&P 500 closed up 9 points or 0.16%,

Gold $3,025 up $9.10 or 0.31%,

WTI crude oil settled at $69 unchanged,

10-year U.S. Treasury 4.313 up 0.018 points or 0.416%,

USD index $104.18 down $0.08 or 0.07%,

Bitcoin $88,086 up $625 or 0.71%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

On March 25, 2025, U.S. stock markets eked out gain. Investors were cautiously optimistic as they evaluated President Trump's indications that the reciprocal tariffs set to take effect on April 2 might be less extensive than initially anticipated. This optimism helped alleviate concerns about a potential U.S. recession. However, Trump also mentioned plans for new tariffs targeting the pharmaceutical and automotive sectors in the “near future”. The market's weak performance was caused in part by poor consumer confidence and new home sales data for February. In individual stock movements, Tesla aimed to capitalize on its previous 12% increase, while Trump Media & Technology Group shares surged 9% following the announcement of a partnership with Crypto.com. Investors remained attentive to upcoming economic reports on consumer confidence and February's new home sales.

Click here to read our current Economic Forecast: –

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

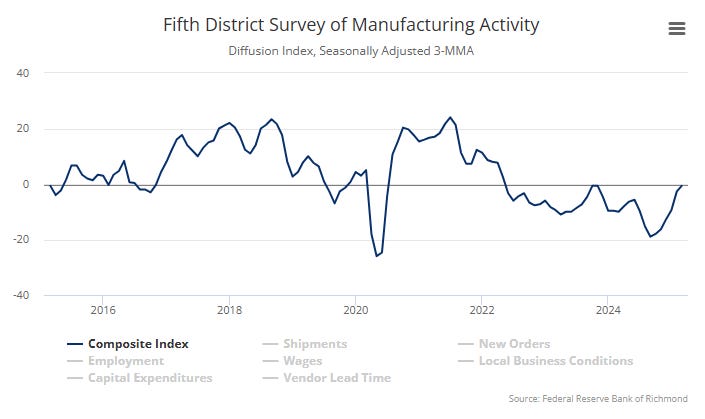

Federal Reserve Bank of Richmond' manufacturing activity experienced a slowdown in March. The composite manufacturing index dropped to -4 in March from 6 in February, primarily driven by a significant decline in the shipments index, which fell from 12 to -7. Additionally, new orders decreased slightly to -4, while employment levels fell from 9 to -1. This downturn reflects a contraction in manufacturing conditions within the region, which includes Maryland, North Carolina, the District of Columbia, Virginia, most of West Virginia, and South Carolina. It is beginning to look like manufacturing has not escaped recession territory.

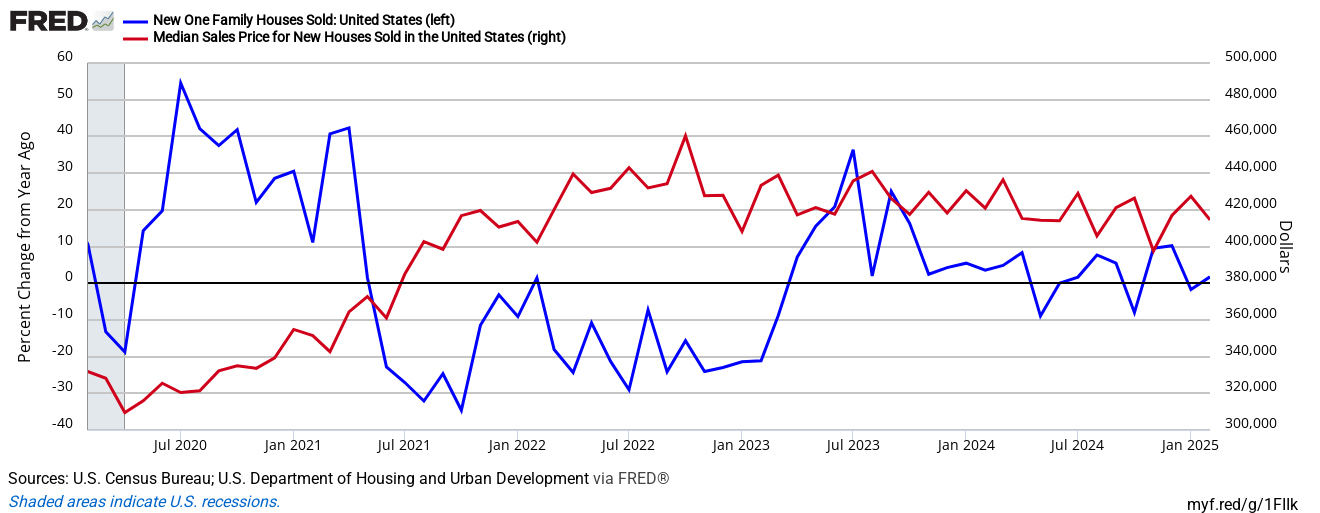

Sales of new single-family houses in February 2025 is 5.1% above February 2024. The median sales price of new houses sold was $414,500. The average sales price was $487,100. The seasonally-adjusted estimate of new houses for sale at the end of February was 500,000. This represents a supply of 8.9 months at the current sales rate. There is little growth now in new home sales, and the month’s supply of homes at the current sales rate has been rending up since October 2020 when there was a 3.3 month’s supply.

The S&P CoreLogic Case-Shiller U.S. National Home Price 20-City Composite posted a year-over-year increase of 4.7%, up from a 4.5% increase in the previous month. New York again reported the highest annual gain among the 20 cities with a 7.7% increase in January, followed by Chicago and Boston with annual increases of 7.5% and 6.6%, respectively. Tampa posted the lowest return, falling 1.5%. Rising home prices are not good for people who do not own homes.

In remarks at the Macroeconometric Caribbean Conference, President Williams discussed the economy and monetary policy in the context of a changing and uncertain landscape. "Uncertainty is high, and there are many scenarios that could play out, depending on fiscal and trade policies and geopolitical and other developments," he said. "Whatever the economy has in store for us, I am committed to supporting maximum employment and returning inflation to our 2 percent objective."

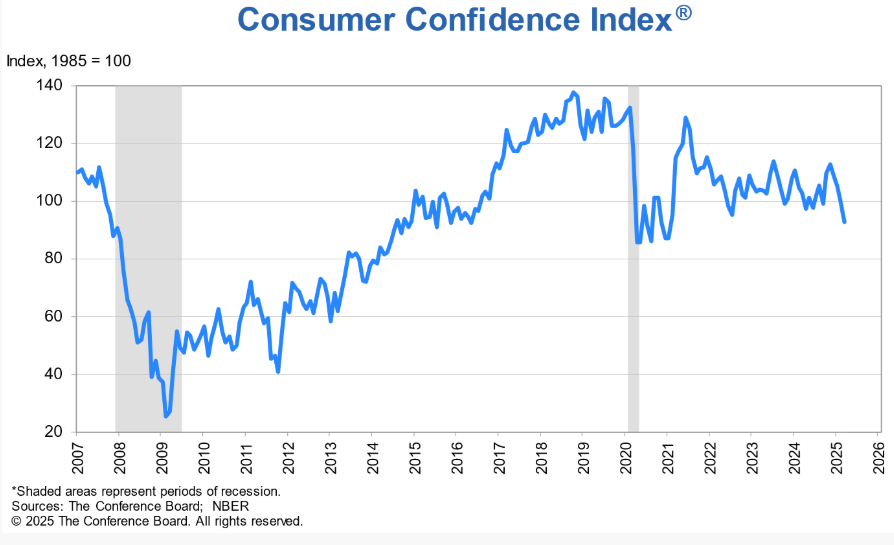

The Conference Board Consumer Confidence Index experienced a significant decline in March 2025, dropping 7.2 points to 92.9. This marks the fourth consecutive month of decline, with the Present Situation Index decreasing to 134.5 and the Expectations Index plummeting to a 12-year low of 65.2, well below the recession-signaling threshold of 80. Stephanie Guichard, Senior Economist at The Conference Board, noted that consumers' expectations were particularly gloomy, with pessimism about future business conditions deepening and confidence in future employment prospects falling to a 12-year low. The decline was most pronounced among consumers over 55 years old and those between 35 and 55, while confidence slightly increased among those under 35. The drop was broad-based across income groups, except for households earning more than $125,000 annually

Sponsored Content:

The REAL REASON Behind America's Wealth Inequality

Every year, the wealthy elite become richer, while 99% of Americans grow poorer.

This trend is only speeding up, not slowing down… and few can explain why.

This is exactly why Matt McCall recorded his own "TED TALK" to help explain the hidden force causing this phenomenon... and more importantly, how anyone can use this force to grow wealthy.

Click here to learn more in 15 minutes... than the mainstream media could explain in 15 years.

6314/2

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

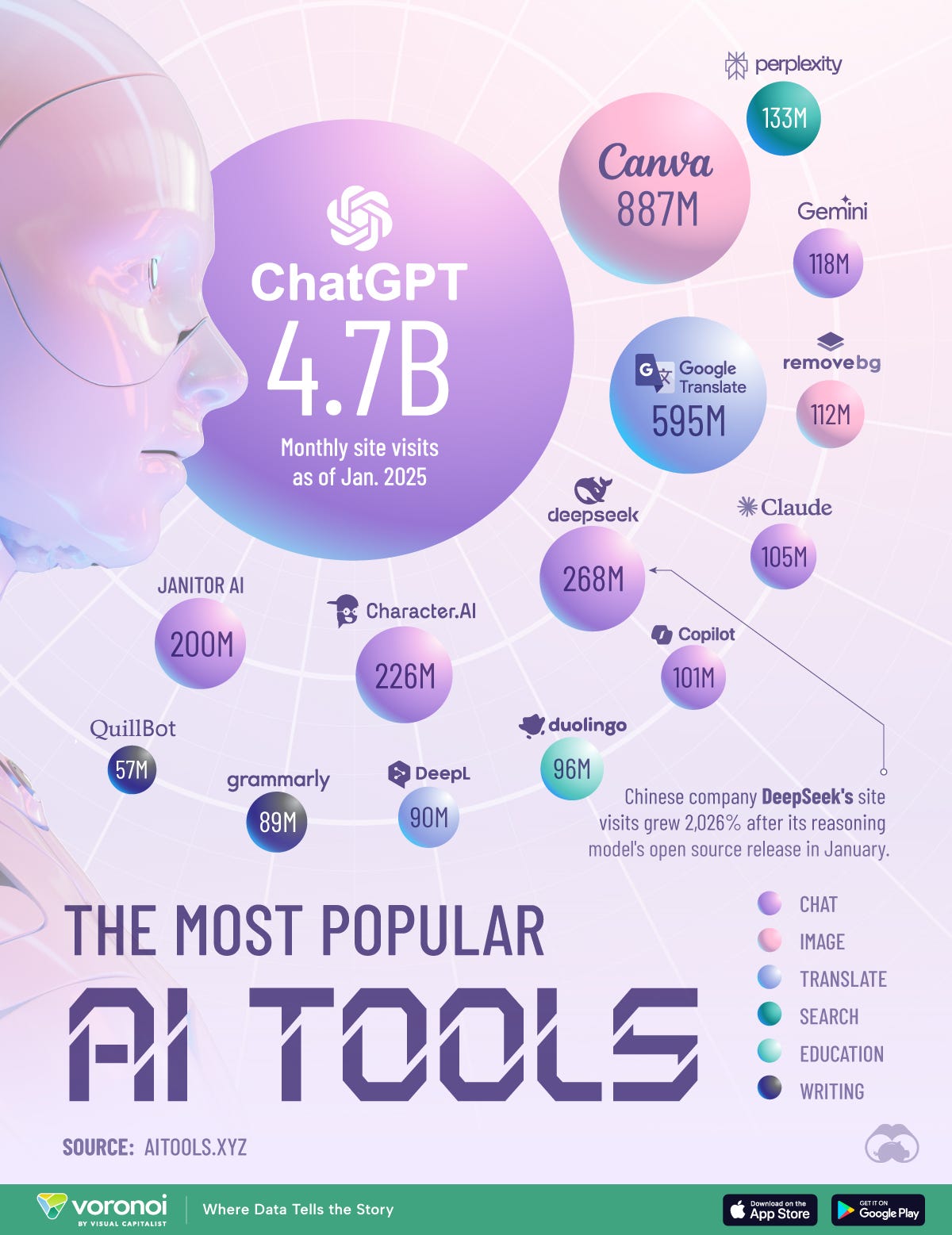

Infographic of the Day from Visual Capitalist:

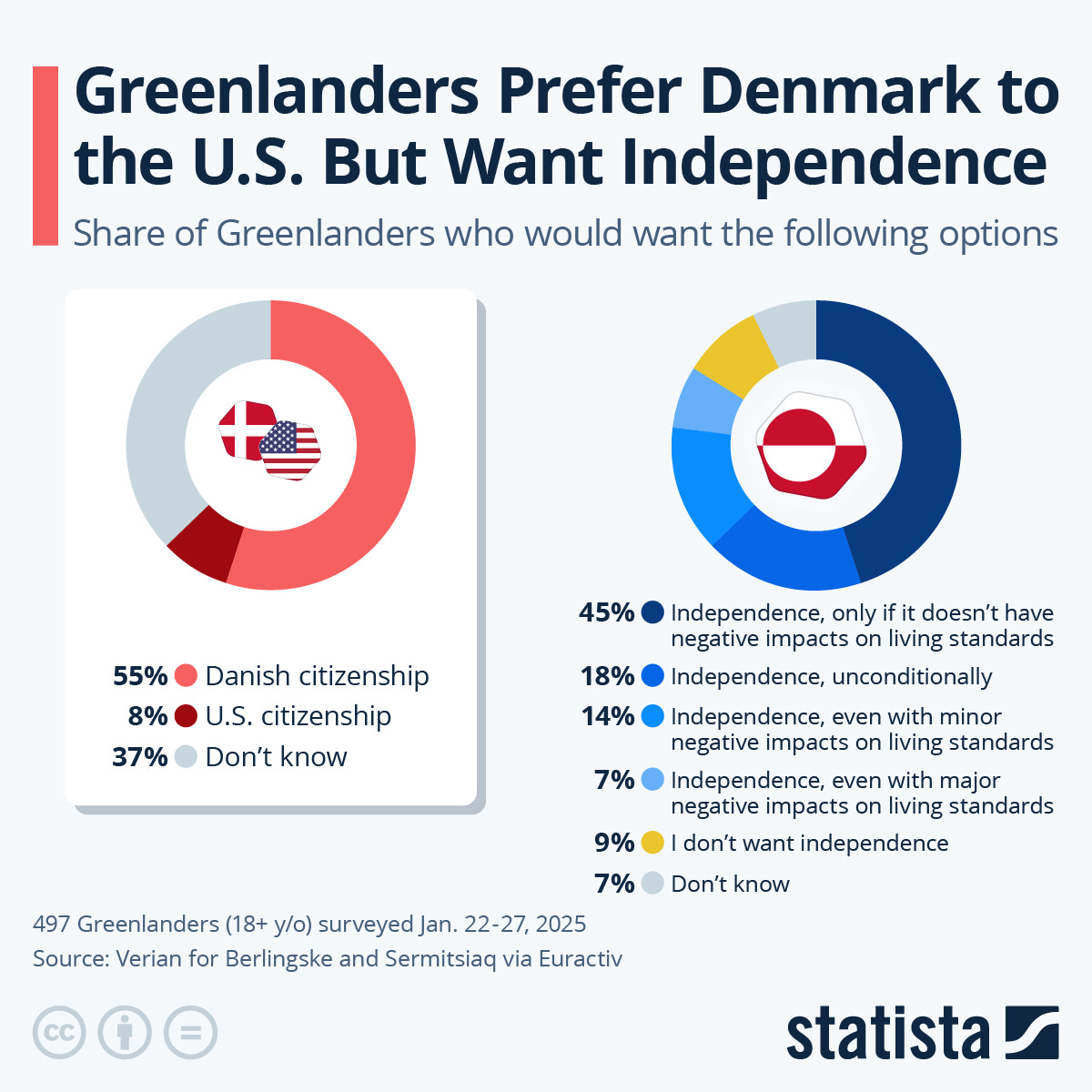

Statista Graphic of the Day:

You will find more infographics at Statista

Here are the headlines we are reading:

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings click HERE and enter your city, state or zip code in the upper left corner.

Ukraine Considers U.S. Role in Power Infrastructure

The US could have boots on the ground in Ukraine -- though not in the way many might expect. During a recent phone call between US President Donald Trump and Ukrainian President Volodymyr Zelenskyy, where Ukraine agreed to pause attacks on Russia's energy infrastructure for 30 days, the idea emerged of establishing a US presence at Ukrainian nuclear power plants. Zelenskyy said that in the conversation with Trump, he discussed the possibility of US assistance in restoring Zaporizhzhya, Europe's largest nuclear power station, which has been under

Glencore Cuts Coal as Market Glut Smothers Prices

Turns out the coal party might be winding down earlyat least for Glencore. The worlds biggest exporter of thermal coal has finally said enough is enough and announced its cutting output at its Colombian Cerrejon mine by up to 10 million tons this year. Thatll leave production somewhere between 11 and 16 million tons, depending on how grim things get. Coal prices are in the gutter. Newcastle coal futures have sunk to around $100 per ton, a far cry from the $450 highs we saw in 2022 during the post-invasion

Cathie Wood Remains Bullish Despite Tesla Sales Slump

Tesla faces mounting headwinds in Europe, with sales declining for the 10th time over the past 12 months. The slump is driven by an aging vehicle lineup, intensifying competition, and growing backlash over Elon Musk's increasingly active role in European politics to save the imploding continent from radical leftists in Brussels. According to the European Automobile Manufacturers' Association (ACEA), Tesla's sales in Europe fell for the second straight month in February, with 16,888 vehicles solddown 40% from the same month last year. ACEA

Russia Not Releasing Details of Talks with the U.S. on Ukraine

Russia on Tuesday said that it would not make public details of the 12 hours of talks with the U.S. on Ukraine which ended on Monday amid expectations that a joint U.S.-Russia statement would be issued shortly. After all, this is about technical talks, Kremlin spokesman Dmitry Peskov said on Tuesday. Technical - meaning the talks with getting into details so, certainly, the content of these talks will not be made public for sure. This is something that should not be expected, Russian news agency TASS quoted Vladimir

Dutch Lawmakers Consider Debt Hike to Offset Energy Costs

The Dutch Parliament (2de Kamer) is proposing to increase state debt levels to counter energy bills of consumers and industry. A proposal by liberal-left wing party D66 has received the support of a large majority in the Dutch parliament to assess the options of increasing overall national debt levels by transferring billions of Euros to state-owned company TenneT. The latter is presumably going to result in lower energy bills overall. A proposal has been voted in to assess these options, as TenneT is currently confronted with multibillion-dollar

China’s Purchases Stall After Trumps Tariff Threat on Buyers of Venezuelan Oil

China, the biggest buyer of oil from Venezuela, saw trade with Venezuela stall on Tuesday after U.S. President Donald Trump threatened on Monday 25% tariffs on the goods of any country buying Venezuelan oil. Traders and refiners in China were caught off guard by Mondays executive order and are waiting to see whether Beijing will have some direction on the matter, trading sources told Reuters. China is the biggest buyer of Venezuelan oil and is estimated to be importing via various often opaque channels about 500,000 barrels

Trump's Tariffs on Venezuelan Crude Spark Bullish Sentiment in Oil Markets

Trump's decision to place sanctions on any country buying Venezuela's oil has sparked some bullishness in oil markets this week.- As London-based energy major Shell (LON:SHEL) issued its 2024 annual report ahead of this years Annual General Meeting, its general pivot back to fossil energy set the stage for other companies to follow suit.- In line with higher shareholder returns in the US, Shell hiked its distribution target to 40-50% of operations cash flow, up from the current 30%-40% range, whilst also trimming its investment budget by

Shell Flags Uncertain Outcome of $1.6-Billion Russian Court Claim

The outcome of a Russian claim against Shell for alleged unpaid natural gas deliveries is uncertain, the supermajor said on Tuesday, adding that it is not possible to estimate the amounts of any possible payments and obligations. Shell withdrew from its operations in Russia shortly after the Russian invasion of Ukraine in February 2022. In early October 2024, a Russian prosecutor filed a court claim in Moscow against eight Shell group entities, including Shell plc and Shell Energy Europe Limited (SEEL). The prosecutor seeks, among other things,

Britains North Sea Oil and Gas Sector Sees a Surprise Investment Surge

So much for the sunset industry narrative. Britains North Sea oil and gas sector just pulled a fast one on the doomsters. The UKs North Sea Transition Authority (NSTA) says 2024 investment came in at nearly 6 billionmore than 50% above what it predicted last fall. And while 2025 spending is expected to cool a bit to 4.8 billion, thats still miles ahead of previous projections. Why the sudden confidence? It turns out that, despite windfall taxes and policy zigzags, companies are still finding

Biggest Indian Oil Producer Seeks to Diversify to Withstand Supply Glut

Indian state-owned Oil and Natural Gas Corporation Limited (ONGC), the biggest oil and gas explorer and producer in the country, plans to diversify in refining, petrochemicals, LNG trading, and renewable energy as it expects lower oil prices amid a looming crude supply glut. Globally, we are heading to a glut in oil supplies which means prices will reduce, Arunangshu Sarkar, director for strategy at ONGC, told Bloomberg in an interview published on Tuesday. It will be difficult for a company like ONGC to survive in a low oil-price

Shell to Boost Shareholder Returns in LNG-Focused Strategy

On Tuesday, Shell pledged to boost shareholder distributions in a strategy to deliver more to investors focused on its strengthsraising LNG production and sales and sustaining oil production at current levels through 2030. The UK-based supermajor, which has been looking to close the valuation gap with the U.S. giants Exxon and Chevron, will raise shareholder distributions to 40-50% of cash flow from operations (CFFO), up from 30-40%. Shell will also continue to prioritize share buybacks, while maintaining a 4% per annum progressive dividend

India’s Peak Electricity Demand Set to Jump By 10% in 2025

More heat waves are expected to push up Indias peak power demand by 9-10% this summer, according to industry experts. In 2024, Indias peak electricity demand surged in May above forecasts due to intense heat waves, and peak demand topped 250 gigawatts (GW) at the end of May. Power demand in India hit record-high levels in May and June last year as more consumers use electricity for cooling during the heat waves. The more frequent and more intense heat waves are pushing higher the demand for cooling and air conditioning, which is set

Alaska Seeks South Korean Investors for Its $44-Billion LNG Project

On Tuesday, Alaska Governor Mike Dunleavy discussed the Alaska LNG project and other potential energy and trade cooperation with South Korean Industry Minister Ahn Duk-geun, as the U.S. Administration is looking to attract Asian investors in the $44-billion Alaska LNG export project. Dunleavy and other Alaska state representatives and energy officials have been touring Americas north Asian allies Japan, Taiwan, and South Korea to pitch the benefits of Alaskas LNG for Asian markets. State firm Alaska Gasline Development Corporation

UK Could Cover Half of Its Energy Needs With Local Oil and Gas

The UK could produce about half of the energy it consumes locally, in the North Sea, the energy industry association, Offshore Energies, said this week, as quoted by the Financial Times. For that, however, the industry needs the right business conditions. Offshore Energies UK said that local energy production was estimated at some 2 billion to 3 billion barrels of oil equivalent until 2050, under the governments net-zero plans, which estimate total energy demand of 13 to 15 billion barrels of oil equivalent in that period.

Venezuela Rations Energy With Shorter Work Days

The Venezuelan government has reduced the work week for public servants in the country in a bid to reduce energy consumption amid a weather-related supply crunch, Bloomberg has reported, citing a government document mentioning a climate event affecting hydropower supply. We will have six weeks of energy savings, Diosdado Cabello, interior minister, said, as quoted by the publication. We must take precautions to avoid taking more drastic measures in the future. According to the Bloomberg report, warm weather

Stocks waver as Wall Street digests Monday's strong rally: Live updates

U.S. stocks hovered near the flatline on Tuesday. The previous session saw strong gains fueled by tariff-related hopes.

Why oil companies may not love Pres. Trump's 'drill, baby, drill' agenda

President Donald Trump is seeking lower energy costs for U.S. consumers. His policies may affect oil and gas companies' profit margins.

Google quantum exec says tech is '5 years out from a real breakout'

Julian Kelly, Google Quantum AI's director of hardware, told CNBC quantum computers may only be about five years from a breakthrough.

Federal housing agency will not cut Fannie Mae and Freddie Mac loan limits, new director says

The new director of the FHFA said he has no intention of shrinking the limit on loans bought and guaranteed by Fannie Mae and Freddie Mac.

These 100-bagger stocks are up the most in the past 25 years

Almost 20 stocks have soared 10,000% or more since the dot-com bubble peaked 25 years ago, according to Bespoke Investment Group.

Russia, Ukraine agree to truce at sea and ban on energy attacks

The agreements, if implemented, would represent the clearest progress yet towards a wider ceasefire that Washington sees as a stepping stone toward peace talks.

SOL climbs as BlackRock expands $1.7B tokenized money market fund to Solana: CNBC Crypto World

On today's show, Solana's SOL token climbs as BlackRock expanded its $1.7 billion tokenized money market fund to the network. Plus, President Trump's crypto project World Liberty Financial launches a stablecoin, while Trump Media shares jump following an announcement of a deal with Crypto.com to launch ETFs and related products. And, Uranium Digital founder Alex Dolesky explains how the company is using blockchain and tokens to modernize the trade of fuel for nuclear power.

Treasury scraps reporting rule for U.S. small business owners

The Treasury Department issued a rule that significantly waters down the number of businesses that must report information about their owners.

With 23andMe entering bankruptcy, here's how to delete your genetic data

Now that 23andMe has filed for bankruptcy, another company could take control of its genetic database.

Trump defends advisor Mike Waltz for Signal texts to reporter about Houthi strike

Trump blamed a staffer for adding The Atlantic's Jeffrey Goldberg to a Signal thread with Vice President JD Vance, Defense Secretary Pete Hegseth and others.

How much eggs cost every year since 1980—in one chart

Egg prices are the highest they've been in 45 years, with no relief in sight.

Berkshire Hathaway employee wins $1 million in Warren Buffett's March Madness bracket challenge

The 94-year-old Oracle of Omaha was finally able to give out the big prize after relaxing the rules multiple times since the competition's inception in 2016.

Stocks making the biggest moves midday: Mobileye, Trump Media, CrowdStrike and more

These are the stocks posting the largest moves in midday trading.

Vance Cautioned Against Bombing Yemen, Calling It A 'Mistake'

Authored by Dave DeCamp via AntiWar.com,

Vice President JD Vance cautioned against bombing Yemen before the US restarted its airstrikes on the country, calling it a "mistake," and suggested delaying the attack by one month, according to a leaked Signal conversation between administration officials.

Jeffrey Goldberg, a reporter for The Atlantic, was included in the Signal thread, apparently by accident, which is how he obtained the conversation. An account believed to be Secretary of Defense Pete Hegseth shared details of the March 15 airstrikes on Yemen two hours before they happened, and the White House confirmed that the Signal conversation appeared to be authentic.

A day before the airstrikes, an account labeled "JD Vance" expressed misgivings about the idea of targeting the Houthis. "Team, I am out for the day doing an economic event in Michigan. But I think we are making a mistake," the Vance account said.

Commercial Real Estate Delinquency Rates Increase In 4th Quarter

Authored by Naveen Athrappully via The Epoch Times,

Mortgage delinquency rates for U.S. commercial properties rose in the fourth quarter of 2024 from the previous quarter.

The Mortgage Bankers Association (MBA) published the latest figures as commercial loans worth almost $1 trillion are set to mature this year.

The state of commercial real estate is a key economic indicator. If the sector is under stress, it can trigger a chain of loan defaults, creating challenges for the financial system and posing a risk of broader economic decline.

The MBA looked at delinquency rates for the top five capital sources for commercial mortgages—life insurance companies, commercial and thrift banks, Fannie Mae, Freddie Mac, and commercial mortg ...

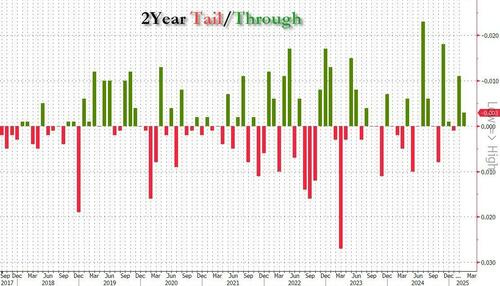

Stellar 2Y Auction Stops Through Amid Solid Foreign Demand

The week's first coupon auction just took place, and in response to the Treasury offering $69BN in 2 year paper, the demand was nothing short of superb.

The high yield in today's auction was 3.984% (resulting in a coupon of 3.875%), which was the first sub-4% auction since Sept 2024 (when it was 3.520% and followed the Fed's 50bps jumbo rate cut). The auction stopped through the When Issued 3.987% by 0.3bps, the 4th through auction in the past 5.

The bid to cover was 2.656, up from 2.559 in February and the highest since December.

The internals were solid, as Indirects took down 75.8%, down from 85.5%, but above the recent average of 71.7%. And with Directs awarded 13.6%, Dealers were left holding 10.7%, above last month's near record low 6.9% below the recent average of 12.0%.

Ignore The Collapsing Soft Data: Bank Of America Says "Watch What They Do, Not What They Say"

The data - as in actual, hard data, not vibes, or sentiment, or feelings, or expectations, also known as soft data - on the US economy in the last two weeks have pushed back on growing recession concerns sparked by weaker sentiment.

Last Monday retail sales were better than we expected as the control group rose by 1.0% m/m. This was followed by the latest industrial production (IP) which soared past expectations due to a surge in manufacturing—particularly autos and durables ex autos. Yesterday we were struck by far stronger than expected US PMI data. Yet all of this hard data has been in stark contrast to increasingly weak soft data, with today's collapse in the Conference Board's consumer confidence, where expectations plunged to a 12 year low, being the latest example.

Echoing what we say all the time about the Bank of ...

'I'm changing job to make £12.24 an hour - it'll help keep me afloat'

As the chancellor prepares to update her plans for the economy we hear how ordinary people are tackling their own financial challenges.

Everything you need to know about the Spring Statement

Chancellor Rachel Reeves will give more detail about the government's plans for the economy.

Faisal Islam: No tax rises and no return to austerity but will it last?

The Spring Statement is "not a Budget", but the chancellor is facing major tax and spending challenges.

Axis AMC, former CEO Nigam, others pay Rs 6.27 cr to Sebi to settle MF norms violation case

Axis Asset Management Company (AMC), its Trustee, former CEO Chandresh Kumar Nigam and three other individuals have settled with Sebi a case of alleged failures in monitoring the activities of dealers, leading to the front-running of Axis Mutual Fund trades.

Passive mutual funds offer up to 71% returns in FY25. Do you own any?

Mirae Asset Hang Seng TECH ETF and Nippon India ETF Hang Seng BeES have offered returns of 71.15% and 54.38%, respectively, in FY25 so far.

Breakout Stocks: How to trade SBI Cards & Payment Services, Bajaj Finance & Shree Cement that hit fresh 52-week high?

Indian markets ended flat with a positive bias for the seventh straight session. The Sensex closed above 78,000, while Nifty50 edged up 10 points to 23,668. IT stocks gained, while metals, utilities, energy, and realty saw selling pressure.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.