25 June 2025 Market Close & Major Financial Headlines: Wall Street Pauses as Markets Digest Ceasefire Gains and Await Fed Signals

Summary Of the Markets Today:

The Dow closed down 107 point or 0.25%,

NASDAQ closed up 61 points or 0.31%,

S&P 500 closed down 0.02 points or 0.00%,

Gold $3,347 up $13.50 or 0.40%,

WTI crude oil settled at $65 up $0.80 or 1.24%,

10-year U.S. Treasury 4.294 up 0.001 points or 0.023%,

USD index 97.75 down $0.12 or 0.12%,

Bitcoin $107,756 up $1,918 or 1.78%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

Wall Street’s main indexes delivered a mixed performance on Wednesday, following a robust two-day rally fueled by easing tensions in the Middle East and anticipation of further comments from Federal Reserve Chair Jerome Powell. This comes after all three major indexes surged more than 1% on Tuesday, with the S&P 500 now less than 1% away from its all-time high.

The primary catalyst for the recent market strength and today’s cautious trading has been the de-escalation of the Israel-Iran conflict, with both sides signaling an end to their aerial war and a fragile ceasefire taking hold. This geopolitical relief led to a sharp drop in oil prices—West Texas Intermediate crude futures fell 6%—boosting investor sentiment and risk appetite. Lower oil prices are seen as a positive for inflation, keeping hopes alive for potential Federal Reserve interest rate cuts later in the year.

Investors are also closely monitoring Federal Reserve Chair Jerome Powell’s ongoing congressional testimony for hints about future monetary policy. Powell has maintained a cautious stance, noting that unexpectedly low inflation or labor market weakness could prompt rate cuts, but he remains wary of tariff-related inflationary pressures

David L. Bahnsen of The Bahnsen Group in their Dividend Cafe yesterday stated:

The market rally today should not be taken as a sign that “this was so obvious markets would rally once…” because it wasn’t. What it should be taken as is yet another reminder of the easiest principle in investing to validate:

Those who believe they can time their way around current events as an investment strategy get their faces ripped off.

The people who knew what markets would do around various Trump/trade/tariff announcements were wrong. For that matter, those who claimed to know what the President, himself, would do were wrong. Those who knew what the U.S. would do in Iran were wrong. Those who knew how Iran would respond were wrong. Those who knew what markets would do in response were wrong. And all of this is just as true if I change out any of the variables above about trade or tariffs or Iran with any other news event you want. The whack-a-mole of predicting current events is the most futile thing I have ever seen, matched only by the futility of predicting market response to current events. And because this process is almost always accompanied by a substantial (unwarranted) self-confidence, undoing it is even harder once it has worked against you because, well, ego and pride are a real part of the human condition.

Do not be shocked that markets are up big and oil down big just after the U.S. bombed Iran’s nuclear ambitions into oblivion. Be shocked that there are still some who are perpetually shocked, and with it, undermining their own financial success.

Read the June 2025 Economic Forecast: Recession Winds - Is the Glass Half Empty or Half Full

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The National Federation of Independent Business (NFIB) released its Small Business and Technology Survey, which examines how small businesses with at least one employee adopt technologies like artificial intelligence (AI), new or improved software and equipment, and websites. The survey reveals that while small businesses are innovative, many struggle to integrate new technologies, potentially hindering their growth and competitiveness. Key findings include that 24% of small employers use AI tools, with adoption varying by firm size (21% for 1-9 employees, 48% for 50+ employees), and 63% anticipate AI becoming important in their industry within five years, primarily for communications (29%) and marketing (27%). Additionally, 57% of small employers introduced new or significantly improved technologies in the past two years, with 65% reporting it helps them stay competitive. Website usage is high, with 82% of small businesses having a website, though only 19% accept payments online. The report underscores the challenges and opportunities small businesses face in leveraging technology to enhance productivity and market position.

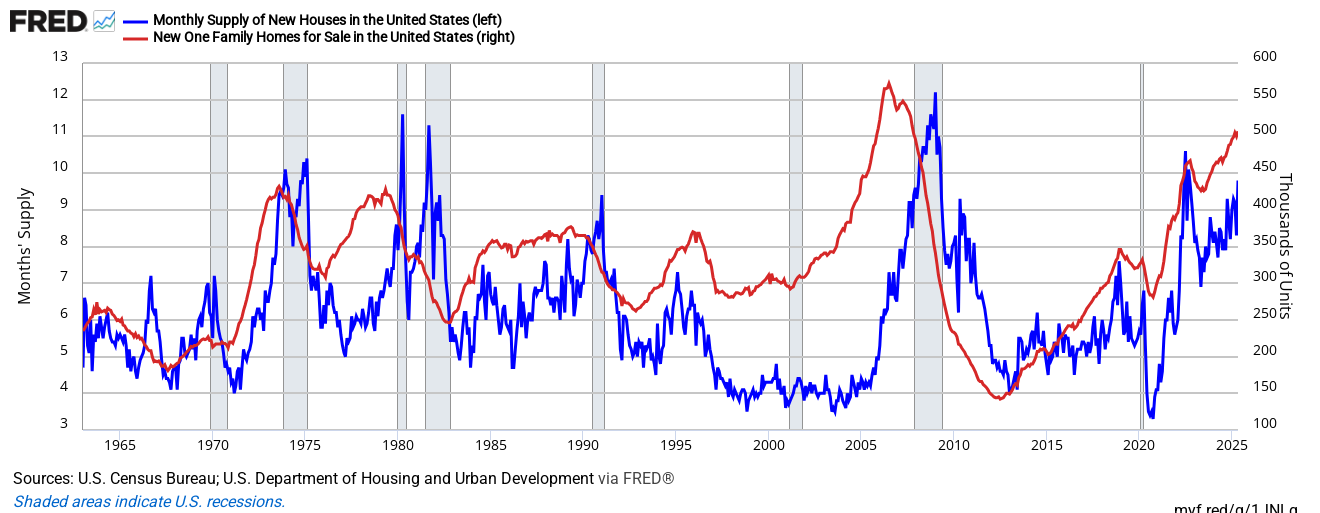

Sales of new single-family houses in May 2025 were down 6.3% year-over-year (YoY). The estimate of new houses for sale was up 8.1% YoY. This represents a supply of 9.8 months at the current sales rate which is up 15.3% YoY. The median sales price of new houses sold in May 2025 was $426,600. This is up 3.0% YoY. The backlog of unsold houses is slowing residential construction and likewise is slowing residential construction’s contribution to the economy.

Sponsored Content:

Collect up to $4,290 Monthly

This mysterious opportunity is structured to pay you regardless of which direction the market moves. Discover how to tap into this income stream today.

Learn How To Collect Monthly Payments.

ref: 7546/2

Since 1913, the U.S. dollar has lost 99.4% of its value in gold terms.

@elliottwaveintl writes:

“Gold has outperformed all stock indexes since 1999… Of course, gold hasn't ‘gone up.’ The value of the dollar has gone down—a lot.”

A dollar once bought 1/20th of an ounce of gold. Today? Just 1/3450th!

No wonder so many Americans are stretched thin.

Get more eye-opening insights: (LINK)

#gold #goldprice #inflation #DXY #economy #recession #wagegap

Sample Post (Short Version):

Since 1913, the U.S. dollar has lost 99.4% of its value in #gold terms.

@elliottwaveintl: “People should really be talking about the gold price of a U.S. dollar.”

A #dollar once bought 1/20 oz of gold. Today? Just 1/3450!

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

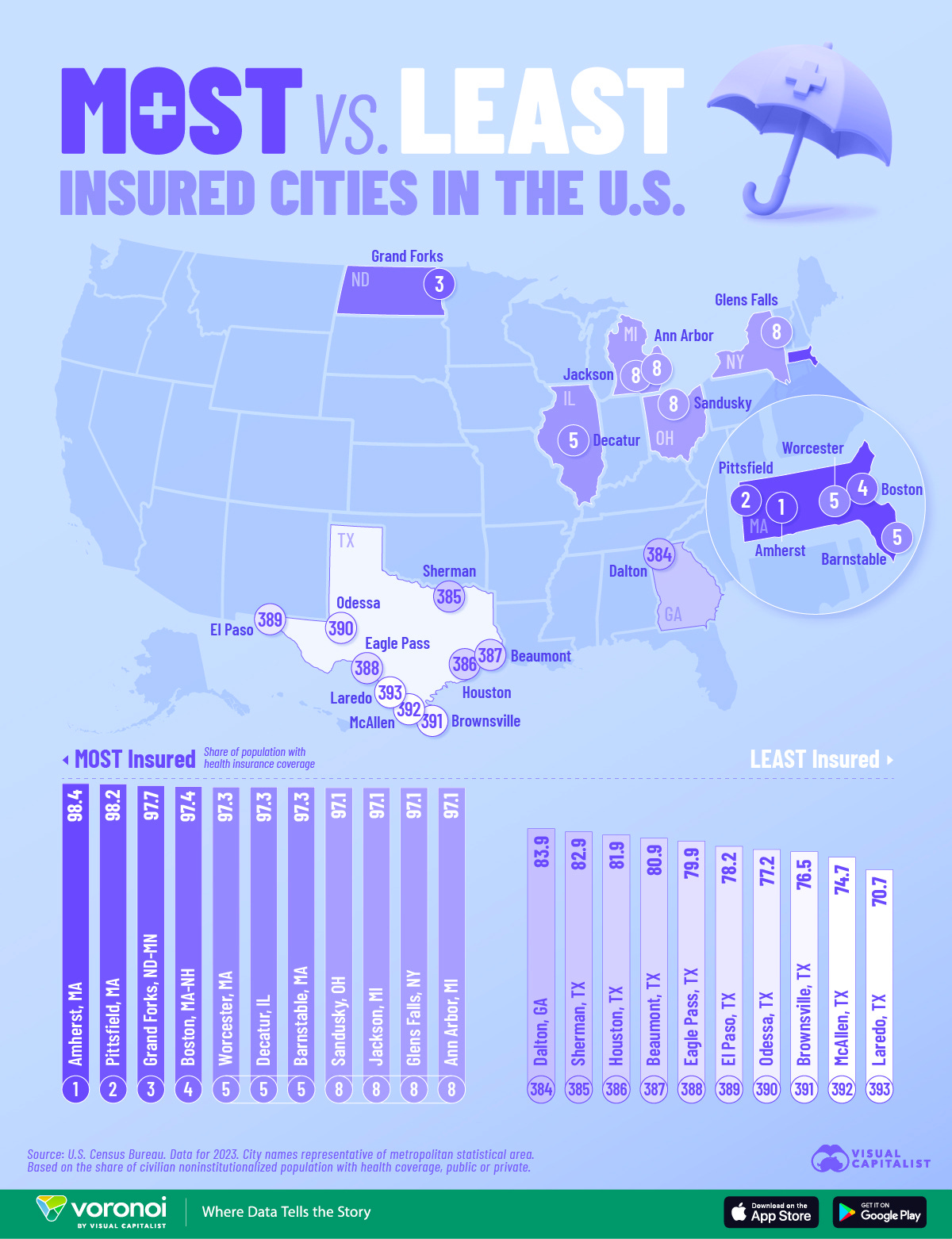

Infographic of the Day from Visual Capitalist:

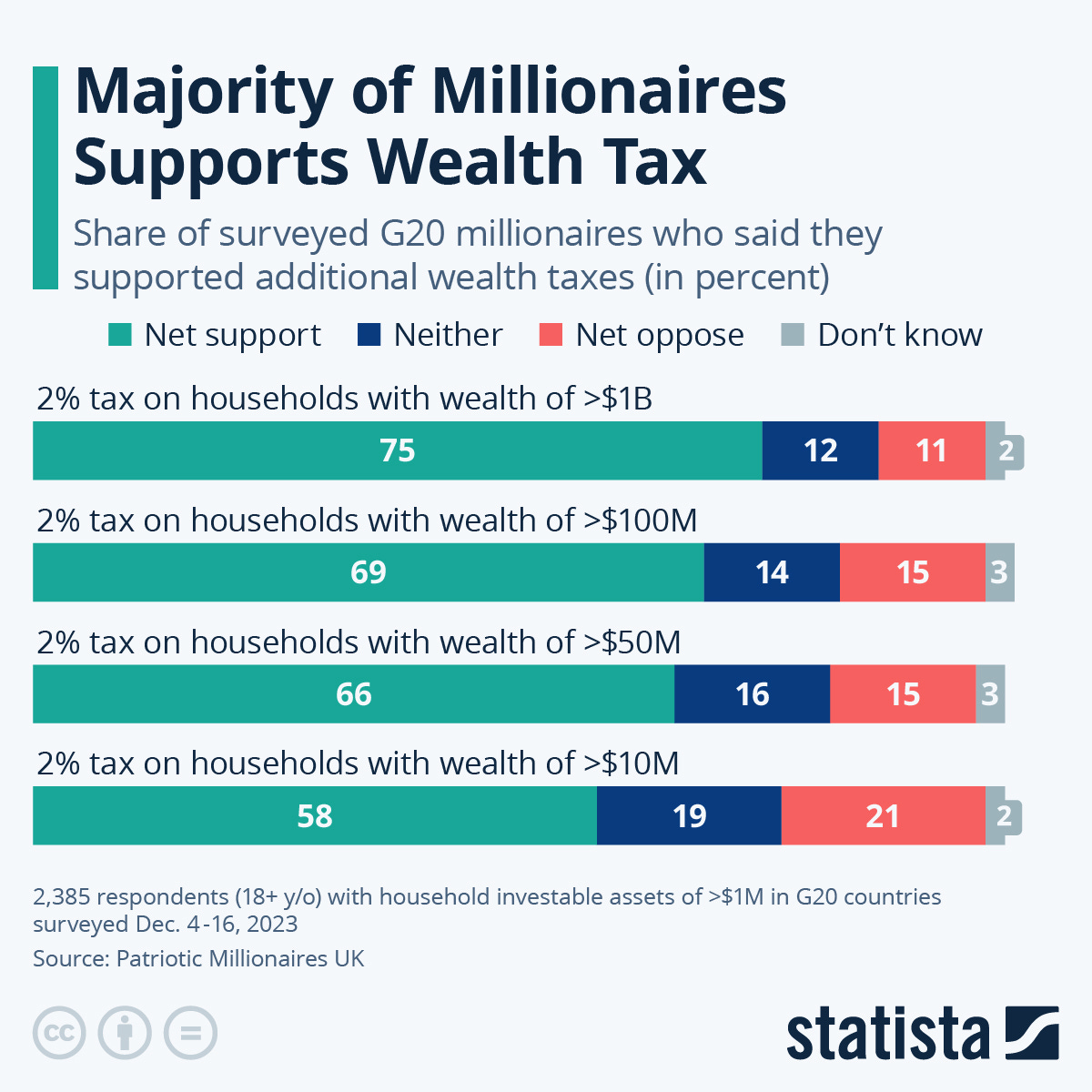

Statista Graphic of the Day:

You will find more infographics at Statista

The headlines we are reading:

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks, which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings, click HERE and enter your city, state or zip code in the upper left corner.

Nvidia shares hit record as AI chipmaker again becomes world's most valuable company

Nvidia closed at an all-time high as investors gain confidence that the chipmaker will power through China restrictions.

Trump downplays U.S. intelligence report on Iran strikes at NATO presser

Trump ordered U.S. strikes on Iranian nuclear sites as part of its support for Israel, then days later announced a ceasefire agreement between the countries.

Divided Fed proposes rule to ease capital requirements for big Wall Street banks

The Federal Reserve on Wednesday proposed easing a key capital rule that banks say has limited their ability to operate.

Trump threatens tough trade deal for Spain after it refuses to meet NATO defense spending target

"We're negotiating with Spain on a trade deal and we're going to make them pay twice as much," Trump said after the country refused to meet the spending target.

NATO allies agree to higher 5% defense spending target

U.S. President Donald Trump has been exercising pressure for NATO allies to increase their defense spending across both of his terms in office.

Intel is forming a bunch of bullish chart patterns like the cup-and-handle and golden cross

Fran Cappelleri uncovered some cool patterns forming for the chipmaker's chart.

Bitcoin rises, NYSE battles for Trump ETF, and crypto may be coming to mortgage next

Bitcoin's price rose on Wednesday as markets stayed in rally mode, the Fed chair talked stablecoin, and a key housing regulator mortgages may consider crypto.

U.S. crude oil rises after steep selloff following Israel-Iran ceasefire

Oil prices sold off on Monday and Tuesday after Iran held back from targeting regional crude supplies, and Trump pushed Jerusalem and Tehran into a truce.

Why BlackRock's Rick Rieder is confident in equities in the second half as S&P 500 nears high

BlackRock's Rick Rieder is confident a stock market nearing all-time highs can go even higher as inflation comes down because of artificial intelligence.

Sen. Schumer taken to hospital and treated for dehydration

Schumer was absent Wednesday morning from a press conference on the major tax bill that President Donald Trump is pushing Republicans to pass through Congress.

To land Meta’s massive $10 billion data center, Louisiana pulled out all the stops. Will it be worth it?

Meta is building the largest data center in the Western Hemisphere on a sprawling site in rural Northeastern Louisiana, and the state gave up a lot to get it.

Airport lounges, Europe and premium class are on the table, Southwest CEO says

Southwest CEO Bob Jordan said the airline is open airport lounges and higher-end service like Europe flights and more premium classes to woo travelers.

Retailers are rushing returns back to resale market as Trump tariff costs hit item economics

Retailers are processing returned goods as fast as they can to get products already subject to higher tariffs back out on the resale market.

The Great Bond Scam: Wall Street's Biggest Myth Exposed

The Great Bond Scam: Wall Street's Biggest Myth Exposed

Authored by Nick Giambruno via InternationalMan.com,

There’s a ridiculous and pervasive notion in finance that US Treasuries are “risk free.”

People repeat it without thinking. Financial institutions build portfolios around it. And for decades, the world has blindly accepted this trope as gospel.

As a result, bonds—especially US Treasuries—became the de facto savings account for many in the post-1971 fiat currency era. Widely regarded as a safe, conservative place to park capital, US Treasuries are the foundation of the massive global bond market.

The global bond market is now estimated to be worth more than $300 trillion. Why? Because the masses were told this was the smart, safe thing to do.

Compare that to all the gold ever mined in the world: worth about $22 trillion. That’s a mere 7% of the global bond market.

"Gold Is Money Good" - Ed Dowd Warns "Deflationary Scare" Will Prompt Fed Panic

"Gold Is Money Good" - Ed Dowd Warns "Deflationary Scare" Will Prompt Fed Panic

Via Greg Hunter’s USAWatchdog.com

Former Wall Street money manager and financial analyst Ed Dowd of PhinanceTechnologies.com has been forecasting “Danger of Deep Worldwide Recession in 2025.” It looks like his thesis is turning out correct.

He predicted interest rates would be declining. They did. And inflation has been going down right along with the economy as illegal immigration was being stopped and deportations ramped up. Dowd says:

“Our friend Joe Biden spent anywhere between $500 billion to $2 trillion to bring these people in and set them up. Now, that’s all going the wrong way. Trump has shut down the border crossings, and as deportations heat up, that will only add to the problem. There will be a lot of supply, and prices have already started coming down in certain regions, and that is going to accelerate.

Inflat ...

Russian Troops Take Another Eastern Ukraine Town As NATO Leaders Wrangle Over 'What's Next'

Russian Troops Take Another Eastern Ukraine Town As NATO Leaders Wrangle Over 'What's Next'

As NATO leaders met in The Hague for their major annual summit - where the focus was collective increased defense spending, Trump's proclamation of Iran's nuclear program having been 'obliterated', and more support for Ukraine - Russian forces gained another town in Eastern Ukraine.

According to Reuters on Wednesday, "Russian forces have taken control of the settlement of Yalta in Ukraine's eastern Donetsk region, the state-run RIA news agency reported on Wednesday citing the Russian Defense Ministry."

Via Al Jazeera

"Battlegroup East units liberated the settlement of Yalta in the Donetsk People’s Republic through active and decisive actions," the defense ministry said in the statement.

While Reuters and others are not able to independently verify the battlefield report, this is part of Russian forces' slow but steady momentum in the east, and even lately expanding west of Donetsk as part of establis ...

Stockman: Washington's Fiscal Doomsday

Stockman: Washington's Fiscal Doomsday

Authored by David Stockman via The Brownstone Institute,

If you don’t think Washington is in the maws of a Fiscal Doomsday Machine, think again. And the place to start is with the 30-year CBO projections, expressed as the dollar increase from the current $29 trillion level of publicly held US Treasury debt.

If Washington does nothing except leave current tax, spending, and structural deficit policies in place (i.e. baseline policy), the publicly-held debt will grow by $102 trillion over the next three decades, reaching a staggering 154% of what would be $85 trillion of GDP by 2054.

Moreover, that outcome assumes that Rosy Scenario does not lose her footing for even a moment through the middle of the century. Stated differently, the underlying CBO projections presume that there will be no recession during the 34-year span from 2020 to 2054, and that, in fact, there wil ...

What Would Happen if the Strait of Hormuz Shut Down?

There are several important energy chokepoints around the world, but none is more significant and vulnerable than the Strait of Hormuz. Now, following the U.S. bombing of Iranian nuclear facilities on Saturday, the Iranian Parliament has reportedly voted to close this important energy transit chokepoint. Such a move could severely disrupt the worlds energy markets. While the final decision still rests with Irans Supreme National Security Counciland Iran has failed to follow through on previous threats to close the Straitthe

Israel-Iran Conflict Was a Boon for Coal

In a world scrambling to wean itself off coal, the black rock might just be staging a comebackthanks to a war halfway across the globe. Oil and gas prices pulled back sharply on Tuesday after U.S. President Donald Trump called for a ceasefire between Iran and Israel, a day after the United States Air Force and Navy attacked three nuclear facilities in Iran. Iranian President Masoud Pezeshkian says Tehran is ready to respect the truce as long as Israel does not break it, with the two sides accusing each other of continuing attacks. Brent

China Launches Phase 2 Deep-Sea Gas Field Adding 4.5BCM To Supply

China National Offshore Oil Corporation (CNOOC) has fully launched the second phase of its Deep-Sea No. 1 natural gas project in the South China Sea, boosting domestic output by 4.5 billion cubic meters (bcm) per year. The project, Chinas largest deepwater gas development to date, officially reached full capacity on June 26, according to CNOOC officials cited by China Daily. With total geological reserves exceeding 150 bcm, Deep-Sea No. 1 is seen as a cornerstone of Chinas efforts to strengthen energy security and reduce reliance

Armenia Faces Mounting Pressure Due to Middle East Unrest

It is too early to say whether an uneasy ceasefire between Iran and Israel will hold, granting Armenia a reprieve from the ominous strategic implications of the conflict. With the prospect of continued war hanging over Tehran, Armenia may find itself cut off from a crucial trade outlet, as well as have a weakened ability to resist Russian and Azerbaijani diplomatic pressure on issues with significant implications for Armenian sovereignty. Prior to the start of the Iranian-Israeli conflict on June 13, Iran could be considered Armenias sole

BP Stock Sees Brief Jump on Report of Merger Talks With Shell

BP shares jumped nearly 7% Wednesday before paring the bulk of those gains after The Wall Street Journal reported that Shell is in early-stage discussions to acquire its British rival. If confirmed, the deal would represent one of the largest energy mergers in recent history and signal a dramatic consolidation of European oil and gas majors. Shell, in the meantime, denied that takeover talks are taking place. A Shell spokesperson told the FT that This is further market speculation. No talks are taking place,who added that the company

Tariffs Will Hit These Car Brands the Hardest

Tariffs on imported goods can have a wide ripple effect on prices, especially in the auto industry where supply chains are global, complex, and highly sensitive to cost changes. In this graphic, Visual Capitalist's Marcus Lu reveals how tariffs will impact U.S. car prices, assuming a flat 25% tariff is applied onto vehicles imported from outside North America. Data & Discussion The data for this visualization comes from Insurify, which projected price increases for various car brands based on their exposure to overseas manufacturing and parts.

Shuttered Three Mile Island Nuclear Plant Poised for 2027 Restart

Constellation Energy announced Tuesday it is accelerating plans to restart Unit 1 of the Three Mile Island nuclear plant by 2027, as mounting power demand and evolving energy policy breathe new life into the once-retired facility. The proposal could make Three Mile Island the first U.S. nuclear plant to resume operations after decommissioning, a powerful symbol amid renewed bipartisan support for nuclear power. Speaking to reporters and regulators, Constellation CEO Joseph Dominguez emphasized the grids growing need for clean baseload electricity,

New York to Become a Major Nuclear Power Hub

The U.S. is investing heavily in a future in nuclear power, through the development of new conventional reactors and power plants, as well as small modular reactors (SMRs). While several states with nuclear plants plan to expand operations in the coming decades, to help deliver more clean power, one area that has big plans for new nuclear power projects is New York. This month, New Yorks Governor Kathy Hochul announced plans to develop an advanced nuclear plant to provide reliable, clean electricity. The U.S. has developed a strong

Russia to Boost Exports of Chinas Favorite Russian Crude in July

Russia is set to raise the shipments of the ESPO Blend crude from its Far East port of Kozmino in July, after lower exports this month due to maintenance, trading sources told Reuters on Wednesday. ESPO loadings from Kozmino are expected at 4 million tons, or about 970,000 barrels per day (bpd) in July, up from 3.6 million tons in June. According to Reuters calculations, daily exports of ESPO from Russias Far East, predominantly to Chin,a are set to rise by 7.5% in July compared to June, which is a day shorter. Going forward, ESPO crude

Oil Jumps on Significant Crude, Product Inventory Slide

Crude oil inventories in the United States fell by 5.8 million barrels during the week ending June 20, according to new data from the U.S. Energy Information Administration (EIA) released on Wednesday. The drop brings commercial stockpiles to 415.1 million barrels, roughly 11% below the five-year average for this time of year. Crude prices were trading up ahead of the report. The American Petroleum Institute (API) on Tuesday had estimated a 4.277-million-barrel drop for the week ending June 20 after analysts had estimated a much smaller 600,000-barrel

IEA Calls for More Investment in Ensuring Universal Energy Access

The world has made progress in increasing access to basic electricity, but developing nations need much more financial support to reach 666 million people in vulnerable and rural areas who lack access to energy, the International Energy Agency (IEA) said in a report on Wednesday. The report tracks the progress toward achieving the UNs Sustainable Development Goal 7 to ensure access to affordable, reliable, sustainable and modern energy for all by 2030. The report, in which the IEA collaborated with the International Renewable

Iran Votes to Suspend Cooperation with UN Nuclear Watchdog

Iranian lawmakers have overwhelmingly voted to suspend Tehrans cooperation with the International Atomic Energy Agency (IAEA) after the countrys nuclear sites were bombed over the weekend in the 12-day conflict with Israel. The bill, which state media reported on June 25 as passing by a 221-0 vote, will need to be approved by the constitutional watchdog, the Guardian Council. The decision to implement it ultimately lies with the Supreme National Security Council (SNSC). The SNSC is technically led by the president, but like all key

Judge Orders Trump Administration to Unfreeze EV Infrastructure Funds

A federal judge in Seattle has blocked the Trump Administrations decision to withhold $5 billion in funds that the Biden administration had approved for expanding the EV charging infrastructure in the U.S. Shortly after taking office, President Donald Trump froze the Department of Energys (DOE) $50 billion budget and withheld $5 billion in funding approved by bipartisan majorities in Congress for electric vehicle (EV) charging infrastructure. California co-led a coalition of 17 attorneys general who in May sued the Trump Administration

April Price Crash Dragged Saudi Arabias Oil Revenues to 4-Year Low

Saudi Arabias revenues from oil exports crashed in April by 21% from a year earlier to the lowest level in nearly four years as international oil prices dipped amid concerns about oversupply and potentially weaker global economic growth. Saudi Arabia, the worlds top crude oil exporter and leader of the OPEC+ group, saw its export revenues from oil at $16.5 billion in April, per data from the Kingdoms General Authority for Statistics (GASTAT) out on Wednesday. The figure showed a decline of 21.2% year over year,

Giant Leviathan Gas Field Offshore Israel Resumes Operations

The massive Leviathan gas field offshore Israel is resuming production on Wednesday, following two weeks in which it was shut down due to the Israel-Iran conflict. Leviathan, operated by U.S. supermajor Chevron, was shut down on June 13, after the Israeli strike on Iranian nuclear sites that escalated hostilities in the region. Following the ceasefire from earlier this week, Chevrons unit, Chevron Mediterranean Limited, received a notice from the Israeli Ministry of Energy and Infrastructures, whereby the Leviathan platform may be restarted

Bumble to axe almost a third of staff as dating app struggles

The firm's founder became the world's youngest self-made female billionaire when it launched on the US stock market.

People owe billions in council tax ahead of rises

Figures show households are more than £8bn in arrears, as campaigners call for a change of approach.

I lost £15,000 after going to an IVF middleman

Companies that act as "middlemen" between patients and doctors are not regulated by the fertility watchdog.

Stop obsession with 1-year returns: Radhika Gupta on how to be a better investor

Radhika Gupta, MD & CEO of Edelweiss Mutual Fund, suggests investors should not focus on one-year returns. She says this creates unrealistic expectations. Gupta emphasizes rolling returns for better investment decisions. Edelweiss's campaign, 'Advice Zaroori Hai', promotes investor education. Rolling returns show fund performance across market conditions. Gupta urges platforms to educate investors about long-term strategies.

Reliance Infrastructure jumps 5% as defence arm bags Rs 600-crore export deal from Germany’s Rheinmetall

Reliance Infrastructure share price: Reliance Infrastructure shares surged 5% after its arm, Reliance Defence, bagged a Rs 600-crore export order from Germany’s Rheinmetall, boosting global defence ties and investor sentiment. The order supports its “Make in India” growth plans.

Gold slips Rs 300 to Rs 98,600/10 g, silver plunges Rs 1,000 amid weak global cues

Gold prices slipped Rs 300 to Rs 98,600 per 10 grams in the national capital on Wednesday due to unabated selling by stockists in line with weak global trends, according to the All India Sarafa Association.

Mamdani’s victory casts a chill on New York City real-estate stocks

Worries about higher taxes for companies and ultrawealthy people and more regulations is hurting the stocks of some New York-focused real-estate investment trusts.

Does Nike need to look to the ’90s to make a comeback? Wall Street braces for potentially ‘painful’ earnings, awaits stock to bottom out.

With Nike Inc.’s fourth-quarter results due on Thursday, some analysts say the company’s sluggish sales and stock price should reach the bottom soon — if not now, then in the months ahead — after struggling with competition, squeezed consumers and weaker sneaker demand over the past few years.

Nvidia’s $1.4 trillion comeback is now complete. The stock just closed at a record.

How the stock reached a new all-time closing high and reclaimed its spot as the largest company by market capitalization.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.