24 June 2025 Market Close & Major Financial Headlines: Wall Street Soars as Middle East Ceasefire Sends Oil Tumbling and Stocks Near Records

Summary Of the Markets Today:

The Dow closed up 507 point or 1.19%,

NASDAQ closed up 282 points or 1.43%,

S&P 500 closed up 67 points or 1.11%,

Gold $3,338 down $57.00 or 1.68%,

WTI crude oil settled at $65 down $3.59 or 5.24%,

10-year U.S. Treasury 4.289 down 0.033 points or 0.764%,

USD index 97.91 down $0502 or 0.51%,

Bitcoin $105,539 up $2,565 or 2.43%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

U.S. stocks surged on Tuesday. This rally followed a sharp drop in oil prices and growing optimism that the conflict between Israel and Iran would not escalate further or disrupt global crude supplies.

The principal driver behind today's market gains was the announcement of a tentative ceasefire between Israel and Iran, made by President Donald Trump late Monday. This news eased fears of a broader Middle East conflict, prompting a rapid decline in oil prices—West Texas Intermediate crude fell over 4%, and Brent crude dropped 5%. Lower energy costs boosted sectors sensitive to fuel prices, such as airlines and cruise operators, which saw outsized gains. The ceasefire also led to a pullback in safe-haven assets like gold and the U.S. dollar, further supporting risk appetite in equities.

Read the June 2025 Economic Forecast: Recession Winds - Is the Glass Half Empty or Half Full

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Richmond Fed manufacturing activity stayed subdued in June 2025. The composite manufacturing index edged up to -7 from -9 in May, but remained in negative territory. Among its three main components, shipments improved to -3, while new orders rose to -12. Manufacturing remains very soft in the U.S., and shows no sign of improving.

The chart below illustrates the annual returns for the S&P CoreLogic Case-Shiller U.S. National, 10-City Composite, and 20-City Composite Home Price Indices. In April 2025, the U.S. National Home Price NSA Index—which encompasses all nine U.S. census divisions—showed a 2.7% increase compared to the previous year. Meanwhile, the 10-City Composite rose by 4.1% year-over-year, and the 20-City Composite saw a 3.4% annual gain. Dr. Selma Hepp, Chief Economist, Cotality stated:

While annual national home price growth continues to slow, a weak spring home-buying season has also resulted in relatively muted home price gains so far this year. April’s Cotality Home Price report showed a 0.6% monthly gain in April, lower than the 0.9% increase seen pre-pandemic. Since the beginning of the year, prices are up about 1.6%, down from 2.7% increase during the same period last year. And while slower gains reflect affordability challenges in many markets, rising inventory levels are also helping keep home price growth muted. Softness remains concentrated in the markets in Florida, Texas and Desert West, however even in the other markets that experienced a typical spring bump in prices, those gains lagged the typical jumps seen in the years prior to the pandemic. On the other side, there are affordable markets, particularly in Indiana, New Jersey, Wisconsin, where spring gains have exceeded pre-pandemic trends and home buying demand has been solid, but are also the markets with less inventory improvements this spring. Looking ahead, the national home price appreciation is likely to pick up pace again due to the base effect of comparison with flat home prices in second half of 2024.

The June 2025 Livingston Survey, conducted by the Federal Reserve Bank of Philadelphia, shows that its 21 participants now expect significantly lower output growth for 2025 and the first half of 2026 compared to their December 2024 projections. The forecasters anticipate real GDP will grow at an annualized rate of just 0.5 percent in the first half of 2025 and 0.9 percent in the second half, before rising to 1.8 percent in the first half of 2026. They also predict a gradually rising unemployment rate, holding steady at 4.3 percent in June 2025, then increasing to 4.6 percent by December 2025 and 4.7 percent by June 2026. Year-over-year CPI inflation is now expected to remain steady at 3.0 percent for both 2025 and 2026, an upward revision from the previously forecast 2.3 percent, while PPI inflation for finished goods is projected at 2.5 percent this year and 1.8 percent in 2026, both higher than earlier estimates. Interest rates on three-month Treasury bills are predicted to decline from 4.30 percent in June 2025 to 3.40 percent by December 2026, and rates on 10-year Treasury bonds are expected to fall from 4.40 percent in June 2025 to 4.10 percent by December 2026, though these are also upward revisions from prior forecasts. The S&P 500 index outlook has been revised downward, with the index now expected to reach 5850.0 by mid-2025, dip to 5801.7 by year-end, and then rise to 6027.3 by mid-2026 and 6210.3 by the end of 2026, all lower than previously predicted. Remember this is a survey and not data.

In his Semiannual Monetary Policy Report to Congress, Federal Reserve Chair Jerome Powell emphasized the Fed’s continued commitment to its dual mandate of maximum employment and stable prices. Powell noted that the U.S. economy remains solid, with low unemployment and a labor market near maximum employment, while inflation has eased significantly from its 2022 highs but remains slightly above the Fed’s 2 percent target. Recent data show steady economic growth, though business and consumer sentiment has declined amid trade policy uncertainties, especially regarding tariffs, which may temporarily push up prices and dampen activity. The Fed has maintained its current interest rate range and is cautiously reducing its asset holdings, prepared to adjust policy as needed based on incoming data and risks. Powell concluded by reaffirming the Fed’s dedication to supporting the economy and ensuring that inflation expectations remain anchored, recognizing the broad impact of monetary policy on American communities and families.

Sponsored Content:

DOGE Threatens Social Security Cuts

While millions could watch their benefits shrink, you could be collecting from a new income stream that actually INCREASES over time.

See how to get started immediately. Secure Your Growing Income.

ref: 7547/2

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

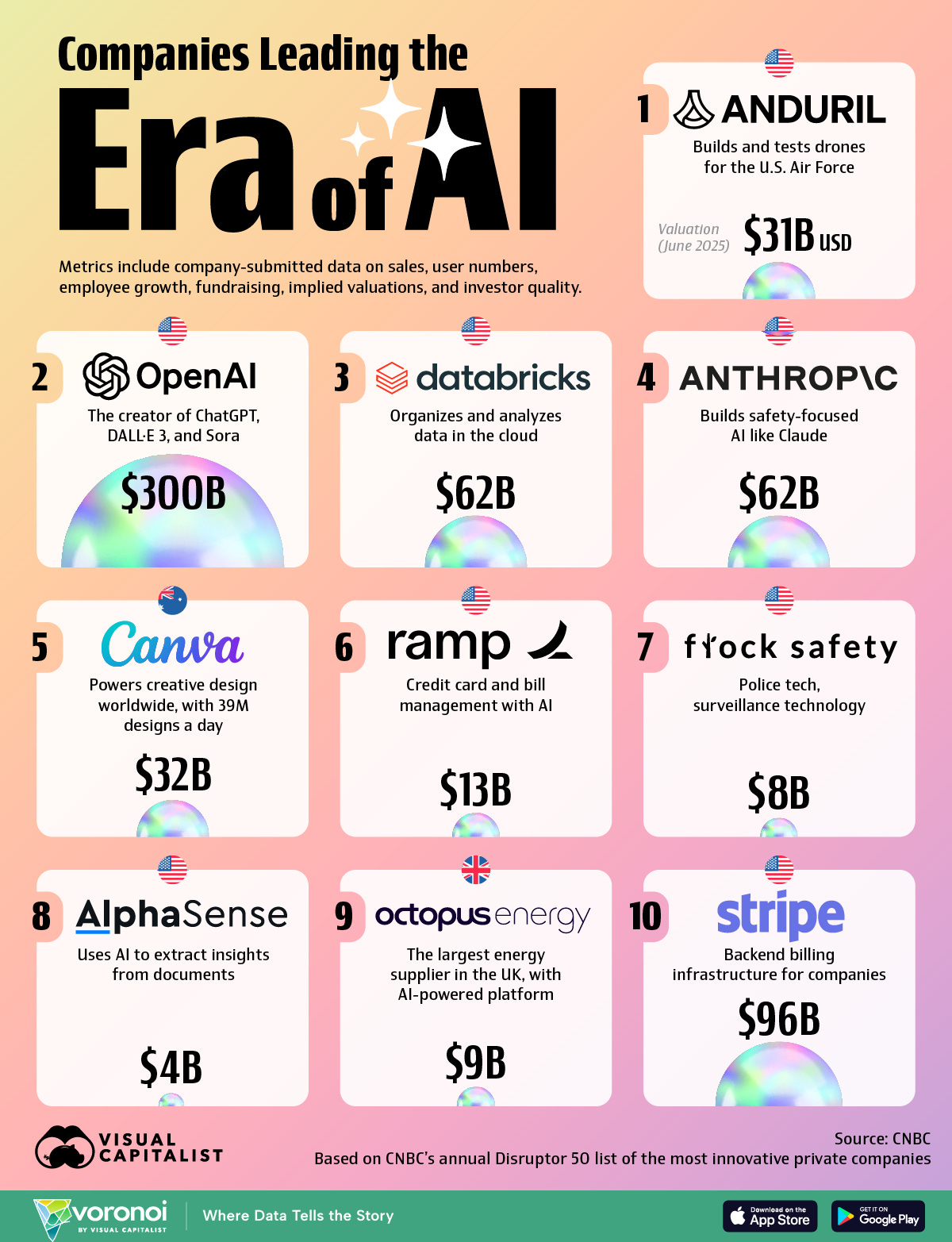

Infographic of the Day from Visual Capitalist:

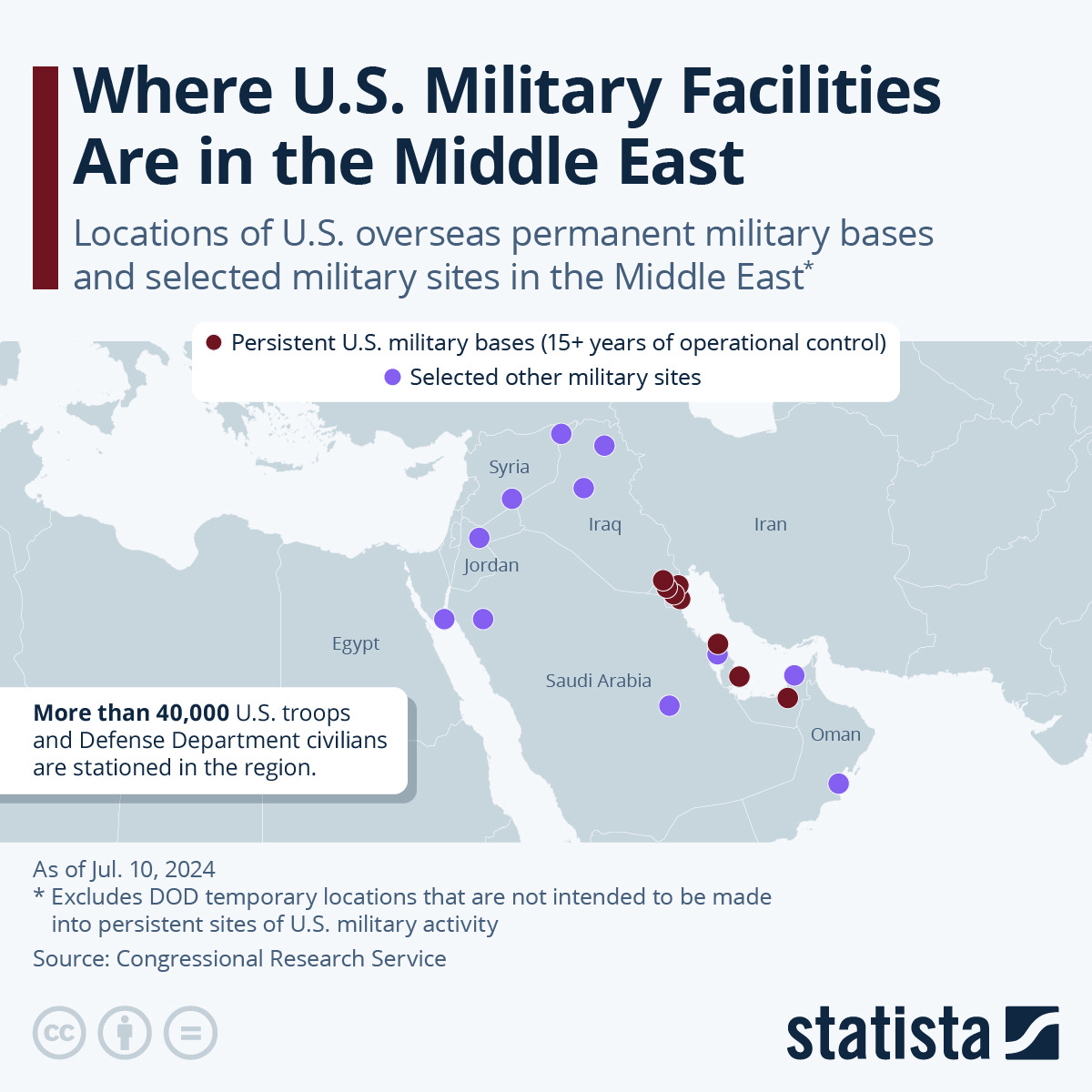

Statista Graphic of the Day:

You will find more infographics at Statista

The headlines we are reading:

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks, which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings, click HERE and enter your city, state or zip code in the upper left corner.

Dow jumps 500 points, oil prices crater as investors bet Israel-Iran truce will hold: Live updates

Stocks rose while oil prices plummeted again on Tuesday, as investors bet that a delicate ceasefire between Israel and Iran will hold.

Live updates: Israel airport reopens after ceasefire; atomic agency finds 'localized' radioactive leaks at Iran nuclear sites

A ceasefire agreed to by Israel and Iran appears to be holding after it was announced by President Donald Trump.

Trump to Congress: 'NO ONE GOES ON VACATION' until spending bill passes

President Donald Trump's pressure comes as the bill still faces an uphill climb ahead of Republicans' self-imposed July 4 deadline.

Powell emphasizes Fed's obligation to prevent 'ongoing inflation problem' despite Trump criticism

The cautious tones from Powell could further antagonize President Donald Trump, who has ramped up his long-standing criticism of Powell.

Home price hikes are slowing more than expected

Home prices are starting to weaken due to higher mortgage rates, more supply on the market and waning demand from homebuyers concerned about the economy.

Tim Seymour reveals global 'Mag 7' for U.S. investors as international markets outperform

The investor and "Fast Money" trader spoke to CNBC Pro about an international opportunity emerging for U.S. investors.

California ports see new wave of freight containers as ships try to beat China tariff hike

A new wave of shipping containers from China is arriving to Port of Los Angeles and Long Beach, California, to beat an upcoming deadline for Trump tariffs.

House Speaker Johnson argues the War Powers Act is unconstitutional

President Donald Trump called Republican Rep. Thomas Massie, who introduced a War Powers resolution to bar U.S. military engagement in Iran, a "LOSER."

Trump judge nominee told DOJ lawyers to ignore court orders on deportations: Whistleblower

Department of Justice official Emil Bove once served President Donald Trump as a criminal defense lawyer. Trump has nominated him to a federal appeals court.

Josh Brown reveals largest stock position personally, expects benefit from autonomous boom

He said this play is poised to benefit from robotaxi rollouts as the technology experience eliminates the most costly part of the operation — the human driver.

How the gay anti-bullying ad with Hilary Duff became a cult classic

TikTok videos, social media posts, and celebrities are referencing Duff's ad, which discourages people from using the word "gay" as an insult.

Tesla robotaxi incidents caught on camera in Austin draw regulators' attention

NHTSA pressed Tesla for more information about robotaxi incidents caught on camera and shared widely on social media.

Systemic failures led to a door plug flying off a Boeing 737 Max, NTSB says

An NTSB investigation over the past 17 months found that bolts securing what is known as the door plug panel were removed and never replaced during a repair.

Senate Parliamentarian Rejects 'Drill Baby Drill' Provisions In GOP Megabill

Senate Parliamentarian Rejects 'Drill Baby Drill' Provisions In GOP Megabill

Update (1412ET): First it was the judges. Now Democrat Senate Parliamentarian Elizabeth MacDonough is shredding a ton of provisions in the Big Beautiful Bill - most recently a provision that automatically certifies offshore oil and gas projects as being compliant with the National Environmental Policy Act - skipping the environmental review process that was deemed not germane to the so-called 'Byrd Rule.'

The rule allows bills to pass via 'reconciliation,' or a simple majority in the Senate - otherwise they require 60 votes to advance. The Byrd Rule requires that reconciliation bills be related to the federal budget, revenue, and the national debt - and MacDonough has been having her way with it.

Other measures she tossed include a portion that would have required the interior secretary to allow the construction of a controversial mining thorough fare - Ambler Road - in Al ...

China Reportedly On Verge Of 100 DeepSeek-Like Breakthroughs Amid Aspirations For World Domination

China Reportedly On Verge Of 100 DeepSeek-Like Breakthroughs Amid Aspirations For World Domination

China is preparing to launch a tsunami of domestic AI innovation, with more than 100 DeepSeek-like breakthroughs (more here) expected within the next 18 months, according to former PBOC Deputy Governor Zhu Min, as reported by Bloomberg. This development signals Beijing's intent to rapidly close the technological gap ahead of the 2030s.

Speaking at the World Economic Forum's "Annual Meeting of the New Champions" in Tianjin, China, Min told the audience that 100 DeepSeek-like breakthroughs "will fundamentally change the nature and the tech nature of the whole Chinese economy."

The emergence of DeepSeek, a low-cost, powerful AI model, has fueled Chinese tech stocks and underscored China's AI competitiveness despite U.S. restrictions on advanced chips and domestic macroeconomic headwinds. Bloomberg Economics projects high-tech's contribution to China's GDP could rise from 15% in 2024 to over 18% by 2026.

Traders are rotating into Chinese equities, with the Hang Seng Index surging 25% year-to-date, significantly outperforming the S&P 500, which is up just 3.3% and effectively flat in real terms. China stocks outperformed soon after DeepSeek's launch in January.

Global Equities YTD Performance

DOJ Accuses Biden-Appointed Judge Of 'Unprecedented Defiance' After Rejecting SCOTUS Ruling Allowing Deportations

DOJ Accuses Biden-Appointed Judge Of 'Unprecedented Defiance' After Rejecting SCOTUS Ruling Allowing Deportations

Authored by Debra Heine via AmericanGreatness.com,

The U.S. Department of Justice on Tuesday accused an activist Biden-appointed judge of engaging in a “lawless act of defiance” against a Supreme Court decision that came down on Monday.

The Supreme Court ruled that the Trump administration may resume expedited deportations of criminal illegal aliens to countries other than their own.

The 6-3 decision stayed U.S. District Judge Brian Murphy’s May 21 order blocking the administration’s attempt to deport a group of violent criminals to South Sudan.

Late Monday night, Murphy issued an order blatantly defying that ruling.

Goldman Weighs In On Tesla Robotaxi Launch

Goldman Weighs In On Tesla Robotaxi Launch

Tesla officially launched its long-anticipated self-driving Robotaxi service in Austin, Texas, on Sunday. A select group of early-access users—many of them FSD beta testers and Tesla influencers on X—have begun sharing their experiences as the AI car company sets its sights on competing near-term with Waymo and, more broadly, becoming a leader in the autonomous ride-hailing industry by 2030.

A team of Goldman analysts, led by Mark Delaney, provided their initial assessment of the robotaxi service in Austin, which features a fleet of self-driving Model Ys.

They discuss three key items from the launch, including:

Our initial thoughts on performance of the early rides, which generally show a good degree of drive smoothness in our opinion but with one user posting a navigation issue with improper use of a left turn lane and the vehicle driving temporarily in the turn lane for traffic going the other direction;

How Tesla's Austin service currently compares to Waymo, including the operating a ...

Auto Tariffs Add $2,000 to New Car Prices

President Trumps tariffs are hitting car buyers hard, with prices expected to rise nearly $2,000 per vehicle, according to consulting firm AlixPartners. The firm estimates that automakers will pass on 80% of the $30 billion tariff cost, adding about $1,760 per car, according to Bloomberg. These tariffs bring a big wall of cost, said Mark Wakefield, AlixPartners global auto lead. We see consumers taking the majority of the hit. General Motors and Ford have already projected tariff-related hits of $5 billion

Hungary's Veto Complicates EU Enlargement Aspirations

A day after the NATO summit in The Hague ends, EU leaders will take the short journey south to Brussels for their regular summer European Council. Kicking off on the morning of June 26, this summit may continue into the next day as there are plenty of items on the agenda -- most notably Iran, where the EU is struggling to stay relevant. According to the Brussels diplomats I have spoken with, however, the bloc still aims to act as a conduit for potential direct talks between the United States and Tehran. That said, there are also several key political

Trump Signals Strategic Shift: China Can Buy Iranian Oil

President Trump dropped a geopolitical bombshell: in a post on Truth?Social, he announced that "China can now continue to purchase Oil from Iran. Hopefully, they will be purchasing plenty from the US, also." This declaration signals a notable pivot from the so-called "maximum pressure" campaign Trump reinstated in February?2025, which aimed to slash Iranian oil exports to near zero. Instead, Trump appears to be leveraging this concession to coax China into importing American energylinking geopolitical maneuvers with trade incentives. Coming

Senate Parliamentarian Blocks Fast Track for Oil, Gas Projects

The U.S. Senates top rule-keeper just threw a wrench into Republican plans to speed up fossil fuel development. Senate parliamentarian Elizabeth MacDonough has ruled that key provisions in the sweeping OBBB Actaimed at fast-tracking oil, gas, and mining projectscant bypass environmental review unless they clear a 60-vote threshold. That means GOP efforts to use budget reconciliation to skirt the National Environmental Policy Act (NEPA) are dead on arrival unless they gain bipartisan support. The parliamentarian flagged

Trump-Era Reforms Pave Way for New U.S. Nuclear Project

New York is going to build the first major new US nuclear-power plant in more than 15 years, in what the Wall Street Journal described as "a big test of President Trump's promise to expedite permitting for such projects." Governor Kathy Hochul told the outlet that she has directed the New York Power Authority, the states public electric utility, to add at least 1 gigawatt of new nuclear-power generation to its portfolio - enough to power approximately one million homes. Im going to lean into making sure that every company

Canadas Oil Sands Production Set for Record High in 2025

Despite lower oil prices, Canadas oil sands production is expected to reach an annual all-time high of 3.5 million barrels per day (bpd) this year, thanks to optimization and efficiency at producing assets, S&P Global Commodity Insights said on Tuesday in its latest outlook. Output from Canadas oil sands will continue to rise beyond this year, according to S&P Global Commodity Insights 10-year production outlook. This year, production is set for a record annual average of 3.5 million bpd, up by 5% compared to the 2024

FTSE 100 Gains Limited by Oil Price Drop

The FTSE 100 made minor gains on Tuesday but Londons blue-chip stocks rebound was held back by the falling price of oil. The UKs flagship index nudged up 0.3 per cent in early trading to around 8,783. But significant gains were held back by a slump from oil giants BP and Shell. BP topped the fallers down over five per cent to near 366p while Shell was not far behind at four per cent. The oil majors had benefitted from a surge in oil prices as Middle Eastern conflict escalated and analysts had praised the firms for keeping

Former CFO of Nigerias State Oil Firm Arrested Over Alleged $7-Billion Fraud

Nigerias Economic and Financial Crimes Commission has arrested two ex-oil officials, including the former chief financial officer of Nigerias state energy firm NNPC, over an alleged $7.2-billion fraud, corruption, and abuse of office. The financial crimes authorities have arrested Umar Ajiya Isa, a former CFO at NNPC, as well as Jimoh Olasunkanmi, a former managing director of the Warri refinery in Nigeria. Three other officials are being investigated, according to a statement from the commission carried by Bloomberg. The two former

Europe Struggles To Find Diplomatic Role in Israel-Iran Conflict

Europe is still looking for a role in the Israel-Iran conflict after it was caught by surprise following the United States strikes on Iran over the weekend. But it is fair to say they say there is a sense of humiliation as the American attack on various nuclear facilities in Iran came some 24 hours after the foreign ministers of the E3 (France, Germany, the United Kingdom) and the EU foreign policy chief Kaja Kallas met with their Iranian counterpart Abbas Araqhchi in Geneva on June 20. Now, those talks didnt lead to much, not even

Russia Considers AI Data Centers as Collapsing Gas Sales Create Glut

Russia could use its excess natural gas to power AI data centers or crypto mining operations, Russian officials have said, as Moscows pipeline gas exports to Europe have collapsed and led to an oversupply at home. Russian gas supply via pipelines to Europe has slumped since 2022, after Russia cut off many EU customers from its gas deliveries, and Nord Stream stopped supplying gas to Germany, after Russia reduced flows and after a sabotage in September 2022. Previously, half a billion cubic meters per day went through the gas pipelines

Brent Drops Below $70 as Israel-Iran Ceasefire Holds

Oil prices dropped dramatically after a surprisingly speedy ceasefire was agreed between Israel and Iran, although the peace remains fragile.- US electricity demand is expected to soar to levels not seen since the summer of 2013 as regional operator PJM warned of consumption potentially reaching 158 GW, with temperatures nearing 100F.- Power demand in the US averaged 36.5 BCf/d over the weekend before skyrocketing to 47.5 BCf/d on 24-25 June, greatly slowing down the pace of US natural gas storage injections this week.- Henry Hub gas futures

Alberta Exceeded Its Flaring Limit for Years Before Scrapping It

Oil and gas companies in Alberta exceeded last year the Canadian oil-producing provinces self-imposed limit on natural gas flaring, for a second year running, according to estimates by Reuters. Flaring, the controlled burning of natural gas that takes place during the production and processing of gas and oil, was regulated for 20 years by a self-imposed limit on the flaring volumesuntil last week. The Alberta Energy Regulator (AER) last week issued a bulletin to announce the removal of the provincial solution gas flaring limit,

Alberta Expects Private Proposal for a New Oil Pipeline to B.C.

Alberta could receive within weeks a proposal from a private company for a new pipeline from the oil-rich province to British Columbias northwest coast, Alberta Premier Danielle Smith told Bloomberg News in an interview published on Tuesday. A new pipeline to Canadas northwest Pacific coast is the most credible and the most economic of all of the pipeline proposals the private sector would consider, Smith told Bloomberg, declining to name any companies potentially involved in the project. Earlier this month, Smith said

Japan to Partner With Siemens to Create Wind Power Supply Chain

Japans Ministry of Economy, Trade and Industry (METI) will sign a cooperation agreement with Siemens Energy to create a local supply chain for the offshore wind sector, an official at the ministry told Reuters on Tuesday. The deal will look to establish a domestic supply chain in cooperation with global wind power technology giants. As part of the cooperation agreement, Siemens Energys wind turbine division, Siemens Gamesa, is expected to sign a deal with Japanese electronics equipment manufacturer TDK. The Japanese firm is set to

LNG Shipping Costs Soar to 8-Month High Amid Middle East Turmoil

LNG shipping costs have surged to the highest in eight months as shipowners assess Middle East risks and hold off chartering vessels, reducing available ships, while price signals in Asia are favoring cargoes going to the Pacific market. Both the Atlantic and Pacific freight rates jumped on Monday to their highest levels since October 2024, but the Atlantic shipping rates were much higher, according to data from Spark Commodities cited by Reuters. Spark Commodities assessed that the daily rate for chartering the most common type of LNG carrier

Oil prices tumble after Israel agrees to Iran ceasefire

Crude has dropped by more than 5% with prices now below the level when Israel first launched its attack.

Google may be forced to link to rival search platforms in the UK

The Competition and Markets Authority says it wants to open up the UK search market.

'A slap in the face' - Asos bans shoppers for making too many returns

The retailer has been cracking down on customers with high return rates - but some say it is unfair.

These 8 stocks gained over 25% in the last two quarters, turned multibaggers in CY25

To ensure quality in terms of market size and investor participation, we applied two key filters: a market cap exceeding Rs 2,000 crore and an average daily trading volume of more than 10,000 shares.

US Federal Reserve to take longer to cut interest rates, says Jerome Powell

The Federal Reserve will continue to wait and see how the economy evolves before deciding whether to reduce its key interest rate, Chair Jerome Powell said on Tuesday, a stance directly at odds with President Donald Trump's calls for immediate cuts.

Sebi proposes to limit powers of stock exchange chiefs

India's markets regulator on Tuesday proposed to increase the board oversight of key exchange functions, including the ones related to trading, risks, regulatory and compliance operations, a consultation paper showed.

Apple was one of the few stocks down today. Why acquiring Perplexity could be key.

The tech giant could find a way out of the “penalty box” and cure the perception that it’s an AI laggard.

My job is offering me a payout. Should I take a $61,000 lump sum or $355 a month for life?

“My S&P 500 investments have roughly doubled every seven years.”

‘He doesn’t seem to care’: My secretive father, 81, added my name to a bank account. What about my mom?

“Neither my mom nor I know anything about their finances.”

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.