23 June 2025 Market Close & Major Financial Headlines: Markets Rebound as U.S.-Iran Tensions Ease, Oil Prices Plunge

Summary Of the Markets Today:

The Dow closed up 375 point or 0.89%,

NASDAQ closed up 184 points or 0.94%,

S&P 500 closed up 57 points or 0.96%,

Gold $3,395 up $8.60 or 0.25%,

WTI crude oil settled at $69 down $4.99 or 6.76%,

10-year U.S. Treasury 4.340 down 0.035 points or 0.800%,

USD index 98.39 down $0.32 or 0.33%,

Bitcoin $103,279 up $4,379 or 4.24%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

On June 23, 2025, global stock markets were shaped by escalating geopolitical tensions after U.S. airstrikes on Iranian nuclear sites, which triggered Iranian missile retaliation against a U.S. base in Qatar. Despite initial losses and heightened anxiety over possible disruption to oil supplies through the Strait of Hormuz, U.S. equities rebounded as Iran’s response appeared measured and oil prices plunged over 7%, easing inflation fears. The Dow, S&P 500, and Nasdaq all posted gains, with tech stocks leading the recovery. Investors also digested company-specific news: Tesla shares surged after launching its robotaxi service in Austin, Northern Trust jumped on merger speculation with BNY Mellon, and Stellantis fell as a new CEO took charge amid industry headwinds. Meanwhile, cautious sentiment lingered among institutional investors, reflected in rising cash holdings, as they weighed ongoing macroeconomic uncertainties, including the impact of U.S. tariffs and the broader implications of the Middle East conflict for global markets.

Read the June 2025 Economic Forecast: Recession Winds - Is the Glass Half Empty or Half Full

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

In May 2025, existing-home sales were down 0.7% year-over-year driven by persistently high mortgage rates, according to NAR Chief Economist Lawrence Yun. Total housing inventory rose significantly, up 6.2% from April 2025 and 20.3% from May 2024, with a 4.6-month supply of unsold inventory, compared to 4.4 months in April and 3.8 months a year earlier. The median existing-home price reached a record high for May at $422,800, up 1.3% from the previous year, marking 23 consecutive months of year-over-year price increases. Yun noted that lower interest rates could boost buyer and seller participation, enhancing workforce mobility and economic growth, with expectations of increased home sales in the second half of 2025 due to strong income growth, healthy inventory, and record-high job numbers.

Sponsored Content:

Grow to $13,503 Per Year (Starting Small)

This isn't some distant possibility-it's happening right now for those who know where to look. Position yourself before the masses find out.

Join The Informed Few.

ref: 7548/2

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

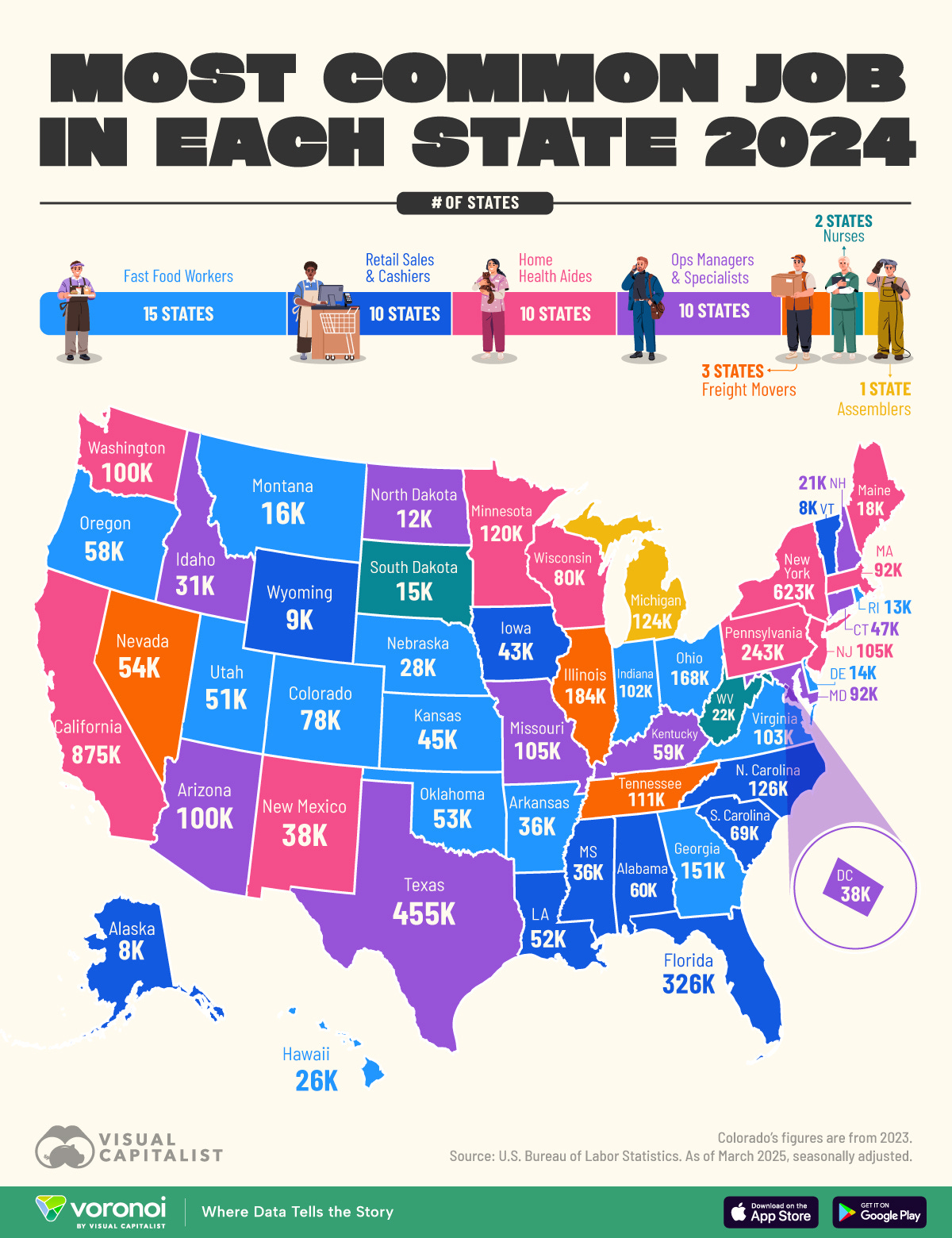

Infographic of the Day from Visual Capitalist:

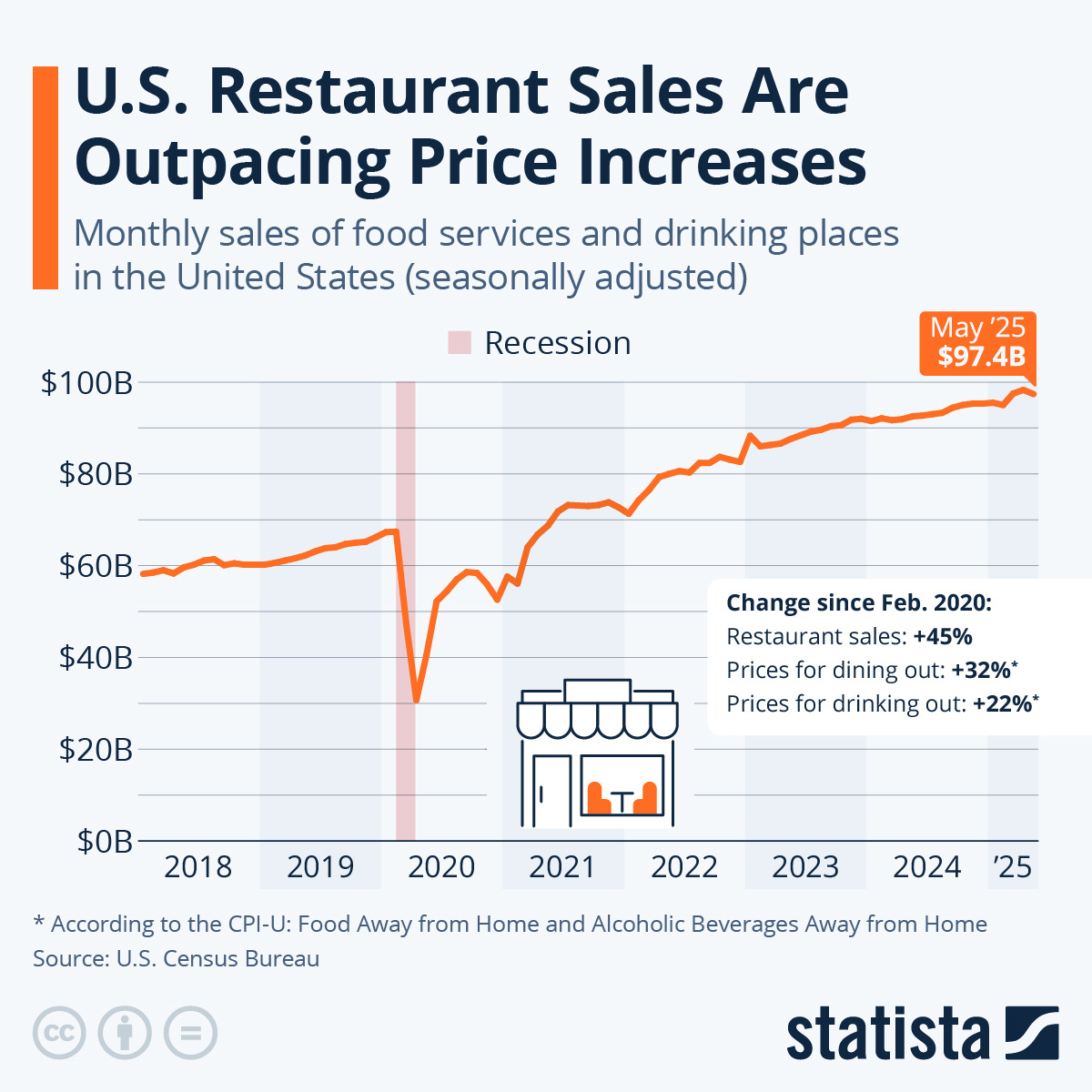

Statista Graphic of the Day:

[editor’s note: this is a little misleading as it is not inflation-adjusted]

You will find more infographics at Statista

The headlines we are reading:

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks, which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings, click HERE and enter your city, state or zip code in the upper left corner.

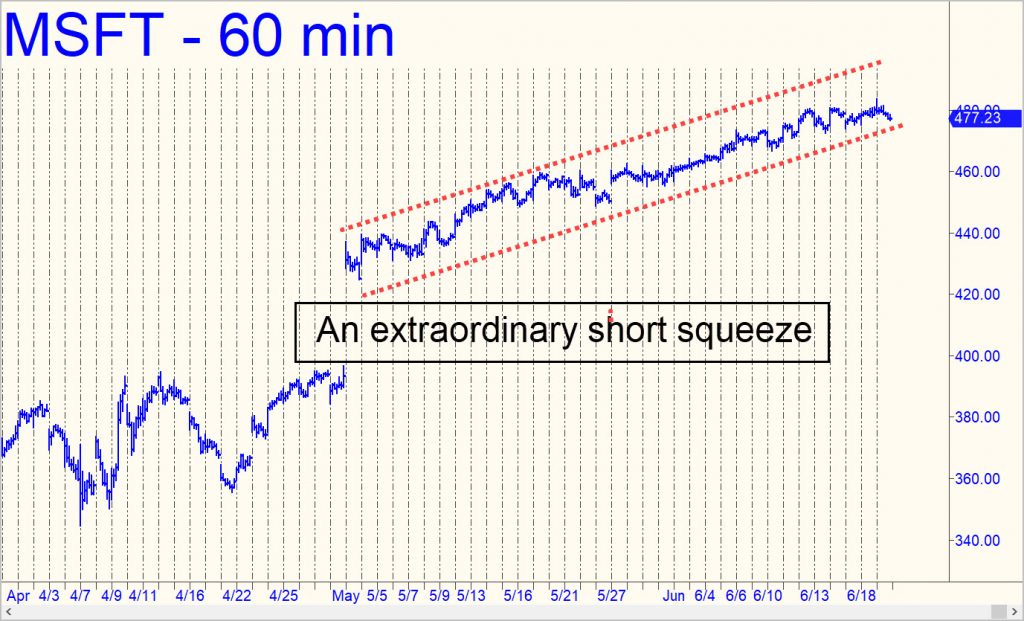

Wall Street’s Epic Bunco Game

Tulipmania and the South Sea Bubble have nothing on the bunco game Wall Street has been running with Microsoft shares. I write on this subject often because the numbers are so huge, and because the game, which is intertwined with the biggest financial con-job in history, is not one you will ever read about in The Wall Street Journal or on Bloomberg.com. It thrives on the madness of crowds and grows bigger with every uptick in MSFT and the galaxy of stocks in its vortex. Microsoft’s share price has gone from 393 to 483 since April, adding roughly $687 billion to the macro ledger. That is twice the size of California’s budget for 2025. It would buy a Porsche 911 for every man, woman and child in New York and Chicago, or a super-deluxe Disney World vacation for every family in America.

Trump says Iran gave U.S. advance notice of missile attack in Qatar: Live updates

Iran's armed forces said they struck a U.S. military base in response to the bombings of key Iranian nuclear facilities over the weekend.

Oil prices fall 7% after Iran strike on U.S. base in Qatar leaves no reported casualties

Oil markets are reacting to the impact of a U.S. decision to directly enter the Iran-Israel conflict.

U.S. intel found Iran did not move nuclear material from Fordo ahead of attack, Sen. Mullin says

President Trump said air strikes on Fordo and two other facilities at Natanz and Isfahan, "completely obliterated" Iran's major nuclear enrichment sites.

Dow rises more than 350 points Monday as oil slides on Iran’s restrained retaliation to U.S. attacks: Live updates

Stocks rose Monday, with oil prices declining, following a restrained response by Iran to U.S. attacks over the weekend.

Airlines divert, cancel more Middle East flights after Iran attacks U.S. military base

Airlines diverted flights in the Middle East on Monday after Iran's armed forces said the country launched a missile strike on a U.S. military base in Qatar.

Fundstrat's Tom Lee says he is not surprised by market's resilience after U.S. attack on Iran

Fundstrat's Tom Lee believes Monday's market moves could actually strengthen the bull case for stocks heading into year's end.

Trump slams Russia's Medvedev for claiming countries will give Iran nuclear warheads

Trump's nuclear saber-rattling could suggest he feels emboldened after ordering the bomb attacks against Iranian nuclear sites.

Trump says 'everyone' should keep oil prices lower or they're playing 'into the hands of the enemy'

Trump's message comes after the U.S. bombed Iran's nuclear sites, putting the world on edge that the Islamic Republic might target energy supplies.

Fed Governor Bowman favors July interest rate cut if inflation stays low

Bowman is the second central banker in recent days to suggest tariffs are likely to have a temporary and muted impact on prices.

This make-up stock is forming a promising chart pattern, says Katie Stockton

Katie Stockton breaks down the action in Estee Lauder.

U.S. House tells staffers not to use Meta’s WhatsApp

Meta is pushing back against a ban on WhatsApp from government devices.

Health-care cuts in GOP’s budget bill may add up to $22,800 in medical debt for some families: Report

The Republican bill and failure to extend existing programs may prompt about 16 million Americans to lose health-care coverage. Medical debts may climb higher.

Crypto rises even after Iran launches missiles in response to U.S. strikes: CNBC Crypto World

On today's episode of CNBC Crypto World, cryptocurrencies rise even as tensions in the Middle East continue to escalate. Plus, Wall Street keeps its eye on stablecoins as Fiserv launches a stablecoin and digital assets platform. And, Pete Najarian of RW3 Ventures breaks down the crypto market reaction to geopolitical tensions.

"Too Early For Turnaround": Goldman Finds Target Boycott Persists As Democratic Shoppers Begin Losing Faith

Goldman analysts, led by Kate McShane, note that the ongoing social media-driven boycott continues to pressure Target's traffic and sales. McShane maintains a "Neutral" rating on the stock—downgraded from "Buy" in April—as consumer perception of the woke retailer has yet to recover.

McShane and her team analyzed X activity, sentiment, app downloads, and in-store foot traffic trends to gauge where Target stands in the current boycott cycle—and their findings suggest a continuation:

"Looking at historical trends, transactions appear to be the lowest 3-6 months following the call for a boycott, and we would note that NPS and NPI at TGT appear to be improving. That said, in our view, it is still too early to call a turnaround given the difficult macro backdrop for discretionary categories."

Negative sentiment on social media persists into June...

Leftist Senate Parliamentarian Cuts Immigration Enforcement, Other Items In GOP Megabill

Senate parliamentarian Elizabeth MacDonough (D) has booted several major provisions from the Republican megabill to enact President Trump's agenda - including language which would authorize states to conduct border security and immigration enforcement (which are traditionally duties of the federal government).

The U.S. Capitol building in Washington on May 22, 2025. Madalina Vasiliu/The Epoch Times

The reason - whatever's in the bill needs to adhere to the "Byrd Rule" - named for the late Sen. Robert Byrd (D-WV-KKK Exalted Cyclops-Hillary Clinton's

Victor Davis Hanson: Ten Iranian Questions

Authored by Victor Davis Hanson via American Greatness,

1. What are we to make of Saturday night’s destruction of the three Iranian nuclear sites at Fordow, Natanz, and Isfahan?

Trump and the U.S. military took a great risk and succeeded in astounding fashion. Operationally, the destruction of the nuclear sites seems to have gone perfectly, in contrast to a long history of America’s Middle East debacles from the failed 1980 Carter rescue mission to the 2021 flight from Kabul.

The long-overdue message to Iran is that there are finally consequences for a half-century effort of killing Americans, promising death to the U.S. and Israel, and attempting to murder a U.S. president.

It’s also surreal to see leftist critics now say that Trump deviated from past presidents’ heroic, peaceful efforts to negotiate an end to the Iranian nuclear threat, when suddenly, after assuming office, Trump was apprised that Iran was weeks away from getting a bomb.

So, how did that happen after all those heroic diplomatic efforts? Why was the Iranian bomb program not ended during the Biden administration’s last four years? And who but Barack Obama opened the floodgates of Iranian revenue to fund these monstrous programs?

How strange the legal criticisms of the left are. In 2011, repeatedly bombing and killing hundreds of Libyan civilians and setting off a decade of chaos and mayhem were constitutionally okay, but a one-mission taking out a rogue nation’s nuclear facilities that threatened world peace and likely killed few, if any ...

Russia Ready To Help Iran, Says Has 'Every Right' To Nuclear Energy Program

The Kremlin has announced Monday that Russia stands ready to help Iran in its ongoing conflict with Israel and the United States in the Middle East, based on specific requests.

Such assistance "all depends on what Iran needs," presidential spokesman Dmitry Peskov explained, as quoted in TASS. "We have offered our mediation efforts. This is concrete. We have stated our position, which is also a very important form of support for the Iranian side."

"Going forward, everything will depend on what Iran needs at this moment," Peskov continued, while Iranian Foreign Minister Abbas Araghchi is currently in Moscow, preparing to meet with President Vladimir Putin.

"Just today, the Iranian Foreign Minister [Abbas Araghchi] will meet with Russian President Vladimir Putin, where they will be able to exchange views in the wake of this traumatic escalation," Peskov stated. That's when he made clear, "And, in fact, the Iranian side will be able to inform us about its proposals and its vision of the current situation."

Energy and Water Scarcity: The Hidden Drivers of Global Conflict

It should come as no surprise that the two major conflicts raging in the world today involve large energy producers and exporters, namely, Iran and Russia. Energy resources, especially fossil fuels, attract conflicts because they are so unevenly distributed in the world and because despite this, everyone needs those resources. The simple fact is that nothing gets done without energy and fossil fuels are still the dominate fuels in the world. But it's not just energy, of course, which invites conflict. Water resources are becoming increasingly a

UK Government to Slash Industrial Energy Costs

The government plans to slash industrial energy prices for British manufacturers, enabling them to better compete with key European rivals. Ministers will unveil a multibillion pound package of taxpayer-funded support for the UKs most energy intensive industries, as part of the governments industrial strategy on Monday, according to reports. Proposals to make energy prices more competitive have been central to final discussions between the Department for Business and Trade and the Treasury Industries such as steel, ceramics and chemicals

Oil Prices Crash After Iran Strikes U.S. Bases

Just hours after the U.S. launched attacks on Irans uranium enrichment facilities, the Iranian parliament expressed support for shutting down the Strait of Hormuzone of the worlds most critical routes for fossil fuel transportation, particularly oil and LNG. The Middle East conflict, which began on June 13, 2025, following Israeli airstrikes targeting Iranian military bases and commanders, has now entered its tenth day. The situation escalated dramatically with the U.S. joining Israel in directly bombing Irans nuclear

Key Players and Production Trends in the Steel Industry

Via Metal Miner According to the World Steel Association (worldsteel), one of the leading providers of steel market information, the China Baowu Group was the largest steelmaker group in 2024, with production remaining stable on the year. In its June 5 report, titled 2025 World Steel in Figures, worldsteel stated that the Shanghai-headquartered company poured just over 130 million metric tons in 2024, compared with almost 131 million tons in 2023. The report focused specifically on companies producing over 3 million metric tons

Qatari LNG Output Steady Despite Buyer Caution Over Iran Conflict

Qatars liquefied natural gas (LNG) production remains steady despite growing geopolitical concerns in the Gulf following U.S. airstrikes on Iranian nuclear sites and Tehrans retaliation, according to shipping data released by Independent Commodity Intelligence Services (ICIS). According to ICIS, 43 LNG vessels have departed Ras Laffan over the past 15 days, a volume that mirrors the same period last year, indicating zero disruption. Despite this, analysts are seeing signs of hesitation among buyers. A noticeable uptick in ballast

Lammy Warns Iran Against Hormuz Blockade

Foreign secretary David Lammy has warned Iran that blocking the crucial Strait of Hormuz shipping lane would be a mistake after the nation vowed repercussions following the US attacks. Lammy told the BBC this morning: It would be a catastrophic mistake. It would be a mistake to blockade the Strait of Hormuz. The foreign secretary said he believed the countrys supreme leader Ayatollah Ali Khamenei gets that preventing access through the waterway would be a crucial misstep. The Strait of Hormuz,

Trump Orders Oil Sector to Keep Prices Low After Strikes on Iran

President Donald Trump on Monday called on U.S. and global oil producers to keep crude prices from spiking, following coordinated airstrikes on Irans nuclear facilities. The strikes targeted key sites at Natanz, Isfahan, and Fordow, escalating tensions in the Gulf. Trump posted on Truth Social: EVERYONE, KEEP OIL PRICES DOWN. IM WATCHING! YOURE PLAYING RIGHT INTO THE HANDS OF THE ENEMY. DONT DO IT! He added: DRILL, BABY, DRILL!!! And I mean NOW!!!, framing energy as a national security issue

The Strait of Hormuz: What It Is, Where It Is, and Why It Matters

Of all the vast oceans and seas that cover our planet, no single waterway holds more influence over the global economy than a narrow, 21-mile-wide channel of water separating Iran from the Arabian Peninsula. Every day, a silent, steady procession of the world's largest supertankers navigates this passage, a liquid pipeline carrying a fifth of the entire world's oil supply. This is the Strait of Hormuz, the world's most important energy chokepoint and its most dangerous flashpoint. While it may seem like a distant geographical feature, the

China Smashes Solar Installation Record

China installed its highest solar power capacity for a single month in May, according to official data, which showed mind-boggling figures that the country installed more solar capacity in a month than any other nation did for the entire 2024. With 93 gigawatts (GW) of solar capacity installed in May, China smashed its own record of 71 GW in December 2024, per data from the National Energy Administration cited by Bloomberg. The 93 GW in May means that the Chinese capacity additions last month were more than the

The Oil Price Shock No One Saw Coming

Less than two weeks ago, the U.S. was discussing a new nuclear deal with Iran, the International Energy Agency was forecasting an oil market oversupply, and commodity analysts were reiterating their expectations of an average Brent price around $60. Now, Brent is heading towards $80. And it may be just the beginning. Oil prices rose after Israel started bombing Iran, which was little surprise, and then they stopped rising as traders saw there was no direct threat of supply disruption. The wild card this time turned out to be President Trump. In

EU Commissioner Calls for Strategic Rare Earths Reserve

The European Union needs to create a joint strategic reserve of rare earth elements to avoid supply chain disruptions and economic blackmail from China, Stephane Sejourne, European Commissioner for Prosperity and Industrial Strategy, has told German business daily Handelsblatt. Nowadays, all European countries have strategic reserves for oil and gas. We should do the same for strategic raw materials, Sejourne told the German newspaper in an interview published on Monday. The reserve would make the EU more resilient in the face of

Oil Tankers on Edge in the Strait of Hormuz

After U.S. airstrikes on Iran, some oil tankers did U-turns, paused, or avoided spending even a minute longer than necessary when crossing the Strait of Hormuzthe worlds most vital oil flow chokepoint. Iran has hinted that it may block the Strait in retaliation. At least two supertankers made U-turns at the Strait of Hormuz since the U.S. strikes, vessel-tracking data monitored by Reuters showed on Monday. Other tankers are waiting outside the Strait before it is absolutely necessary to enter the lane to load oil or LNG. Greece, which

Eni Sells 20% in Its $14-Billion Low Carbon Business Plenitude

Eni has signed a deal to sell 20% in its low-carbon energy business Plenitude to Ares Management Corporation in a deal valuing the unit at an enterprise value of $13.8 billion (12 billion euros). Under the agreement, global alternative investment manager Ares Management will buy 20% in Plenitude for $2.3 billion (2 billion euros), Eni said on Monday. The completion of the transaction is subject to customary regulatory approvals. At the end of 2023, Eni agreedto sell 9% in Plenitudeto Energy Infrastructure Partners (EIP). Plenitude is

Iran Vows to End This War

Iran on Monday vowed to retaliate against the U.S. strikes on Iranian nuclear facilities, claiming the U.S. attacks expand the scope for the Iranian military to respond. Mr Trump, the gambler, you may start this war, but we will be the ones to end it, Ebrahim Zolfaqari, a spokesperson for Irans Khatam al-Anbiya central military headquarters, said in English at the end of a recorded video statement carried by Reuters. The U.S. bombed this weekend three of Irans nuclear sites Fordow, Natanz, and Isfahan

UK Government Promises to Cut Industrial Energy Bills

The Starmer government has promised it would reduce industrial users electricity bills by up to 25% from 2027 as part of its energy strategy, due to be released this week. How the cuts will be implemented has not been made clear for the time being, except a statement saying energy intensive industries will be made exempt from certain levies, such as the Renewables Obligation. The mechanism obliges electricity distributors to source part of their electricity from wind and solar installations, per government plans to reduce the countrys

US asks China to stop Iran from closing Strait of Hormuz

Iran's Press TV had earlier reported that parliament had approved a plan to close the Strait.

How the attacks on Iran could affect energy bills and petrol prices

Conflict in the Middle East often leads to higher energy prices, which can feed through to inflation.

Cheaper energy part of 10-year plan for industry

Plans to cut energy bills by up to 25% for more than 7,000 UK businesses is announced alongside other plans to boost growth.

Kalpataru raises Rs 708 crore from 9 anchor investors; Singapore’s GIC, Bain Capital lead

Realty developer Kalpataru has raised over Rs 708 crore from nine anchor investors including GIC Singapore, Bain Capital’s GSS Opportunities Investment, SBI Mutual Fund, ICICI Prudential Mutual Fund, SBI General Insurance, Aditya Birla Sun Life, and 360 ONE WAM.

Dixon Technologies promoter sells 2.77% stake for over Rs 2,221 crore

Dixon Technologies (India) promoter Sunil Vachani on Monday divested a 2.77 per cent stake in the homegrown contract manufacturer for over Rs 2,221 crore through an open market transaction.

Top 5 mutual funds for lumpsum investment with a horizon of 3 years

If you are looking for the best mutual funds for lumpsum investment with an investment horizon of three years. Here is a help for you (Source: Value Research)

Why this stock-market wizard is 100% invested in the S&P 500 right now — even after the U.S. strike on Iran

Mark Minervini shares what’s worked for him over his long trading career and talks about how to invest in the stock market now.

Hims & Hers’ stock plunges. Here’s why Wegovy parent ended its partnership with the company.

Hims & Hers Health’s stock was headed for record losses Monday after Novo Nordisk, maker of the weight-loss drug Wegovy, said it was ending a collaboration with the telehealth company less than two months after it started.

Trump’s Iran strike is a major win for your stock portfolio. Here’s how to play it.

Take a close look now at U.S. manufacturers, semiconductor producers, agricultural exporters, cybersecurity firms and defense contractors.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.