21 May 2025 Market Close & Major Financial Headlines: Wall Street’s Wild Ride With Political Uncertainty and Soaring Yields Trigger Massive Sell-Off

Summary Of the Markets Today:

The Dow closed down 817 points or 1.91%,

NASDAQ closed down 270 points or 1.41%,

S&P 500 closed down 96 points or 1.61%,

Gold $3,322 up $37.00 or 1.13%,

WTI crude oil settled at $61 down $0.67 or 1.08%,

10-year U.S. Treasury 4.595 up 0.114 points or 2.544%,

USD index 99.64 down 0.47 points or 0.47%,

Bitcoin $108,668 up $1,945 or 1.79%, (24 Hours), (New Bitcoin Historic high 109,709)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

On May 21, 2025, U.S. stock markets experienced a sharp decline as mounting concerns over fiscal stability, surging Treasury yields, and political uncertainty weighed on investor sentiment. The sell-off was triggered by several factors: persistent infighting among Congressional Republicans over President Donald Trump’s proposed tax-cut bill, which raised doubts about fiscal discipline; the recent Moody’s downgrade of U.S. sovereign debt, stripping the nation of its last perfect credit rating and intensifying worries about the federal deficit and debt servicing costs, and a weak 20-year Treasury auction that sent yields on the 10-year and 30-year notes to multi-year highs, further pressuring equities. Technology stocks, particularly NVIDIA, led the losses as higher yields reduced the appeal of future profits. Additional market volatility stemmed from disappointing earnings at Target, renewed U.S.-China semiconductor tensions, and a major Bloomberg terminal outage affecting traders early in the day. In contrast, Bitcoin hit a new all-time high above $109,000 before retreating, and Alphabet shares surged nearly 5% on optimism following AI announcements at Google I/O.

Read the May 2025 Economic Forecast: The Supply Chain Shock And A Recession This Year

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

no releases today

Sponsored Content:

Is Big Tech on the Road to Ruin?

The world's wealthiest insiders are sounding the alarm.

Billionaires from Buffett to Zuckerberg are dumping shares of Big Tech stocks a record pace, in a move that could cause trillions to drain out from under everyday investors.

Fortunately, there's a way to protect your portfolio BEFORE the worst damage is done - allowing you to profit massively throughout the panic.

Click here to find out how.

6309/2

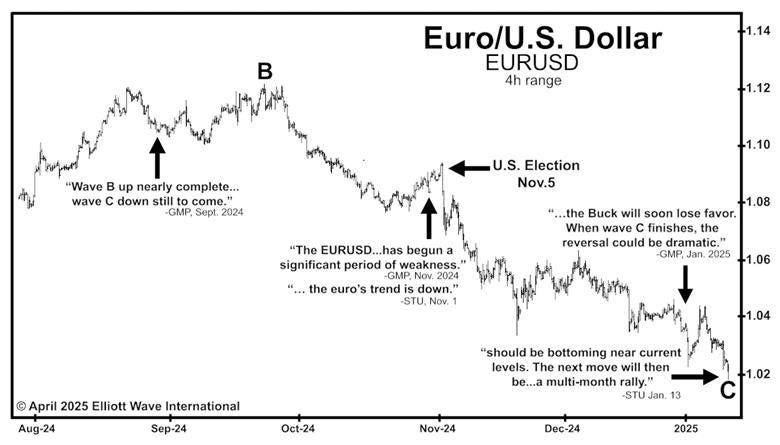

EURUSD: What the News Reported After the Fact -- and What Our Subscribers Knew in Advance

Over the past six months, major currency markets have seen some dramatic moves.

Mainstream financial media has largely pointed to two key drivers:

The 2024 U.S. presidential election

The Federal Reserv

These explanations may seem logical in hindsight. But markets rarely move in neat correlation with headlines. A more useful question might be: Who was tracking these moves before they happened?

Take EURUSD -- the world's most actively traded currency pair. From October 2024 to mid-January 2025, the pair declined sharply, reaching a 14-month low.

Elliott Wave International's September 2024 Global Market Perspective (GMP) noted that a B wave peak was likely in place, and it projected a downward C wave to follow. That analysis came well before the U.S. election on November 5.

Then on November 1, just days before the vote, GMP called for "significant weakness" in EURUSD. That same day, EWI's Short Term Update (STU) identified that "the trend is down." This wasn't based on political speculation -- it was based on market patterns we've studied for decades.

Fast-forward to January: on the 3rd, GMP anticipated a major reversal in EURUSD. Ten days later, on January 13, STU called for "a multi-month rally" -- which began the very same day.

As prices climbed into February and March, STU kept subscribers informed of short-term pullbacks and the larger upward trend. And ahead of another sharp move on April 21, financial headlines once again turned to political themes.

Yet on April 16, STU had already flagged a notable sentiment shift and the potential for a downturn.

The takeaway? While news tends to explain moves after they happen, EWI's analysis focuses on anticipating them -- using Elliott wave patterns and market behavior.

See What’s Next for Key Currency Pairs

Join EWI Senior Currency Strategist Michael Madden on Thursday, May 22 at 1PM Eastern for a real-time look at the Elliott wave patterns in the U.S. dollar -- and what they might mean for major currency pairs in the days ahead. There are two ways to attend the live session.

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

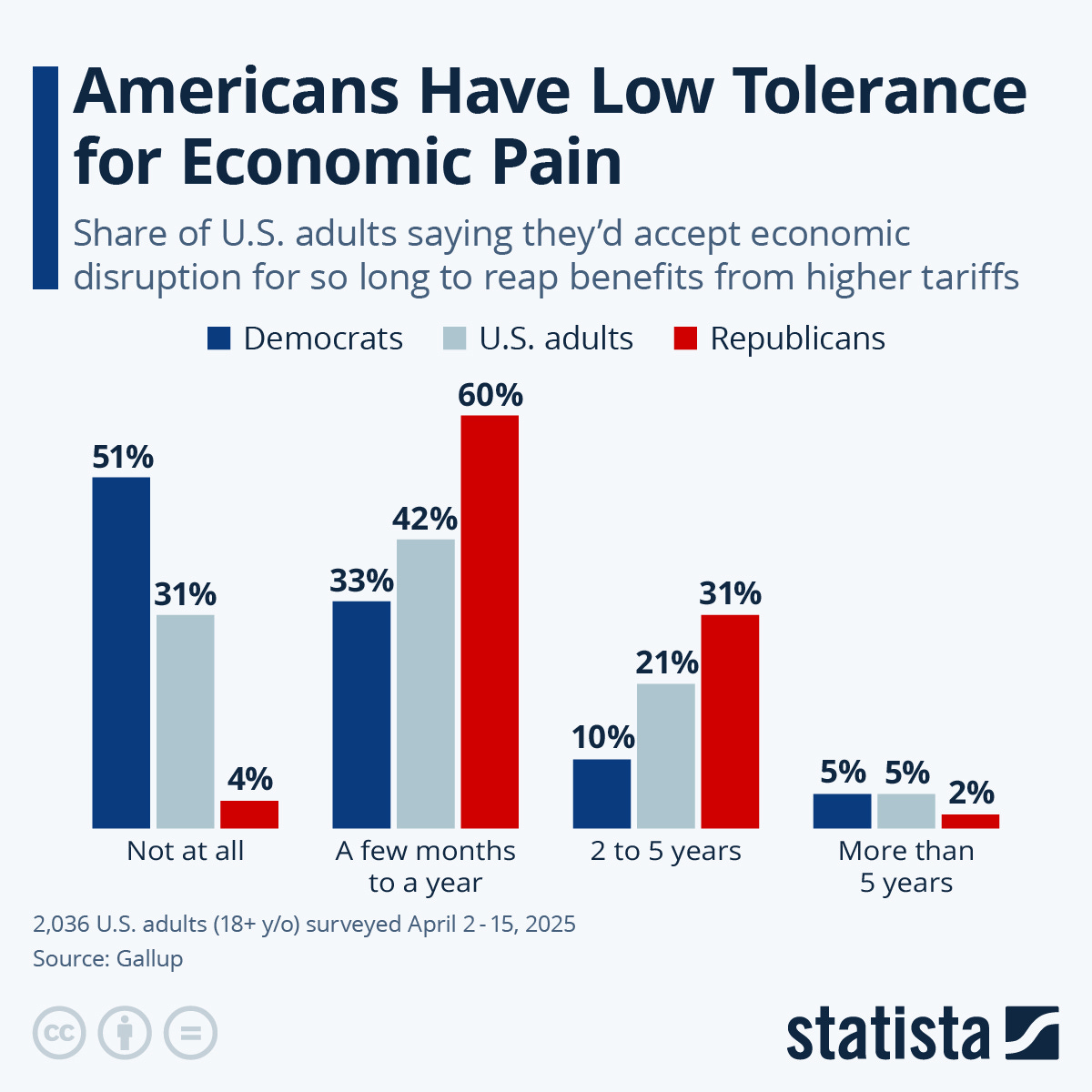

Infographic of the Day from Visual Capitalist:

Statista Graphic of the Day:

You will find more infographics at Statista

The headlines we are reading:

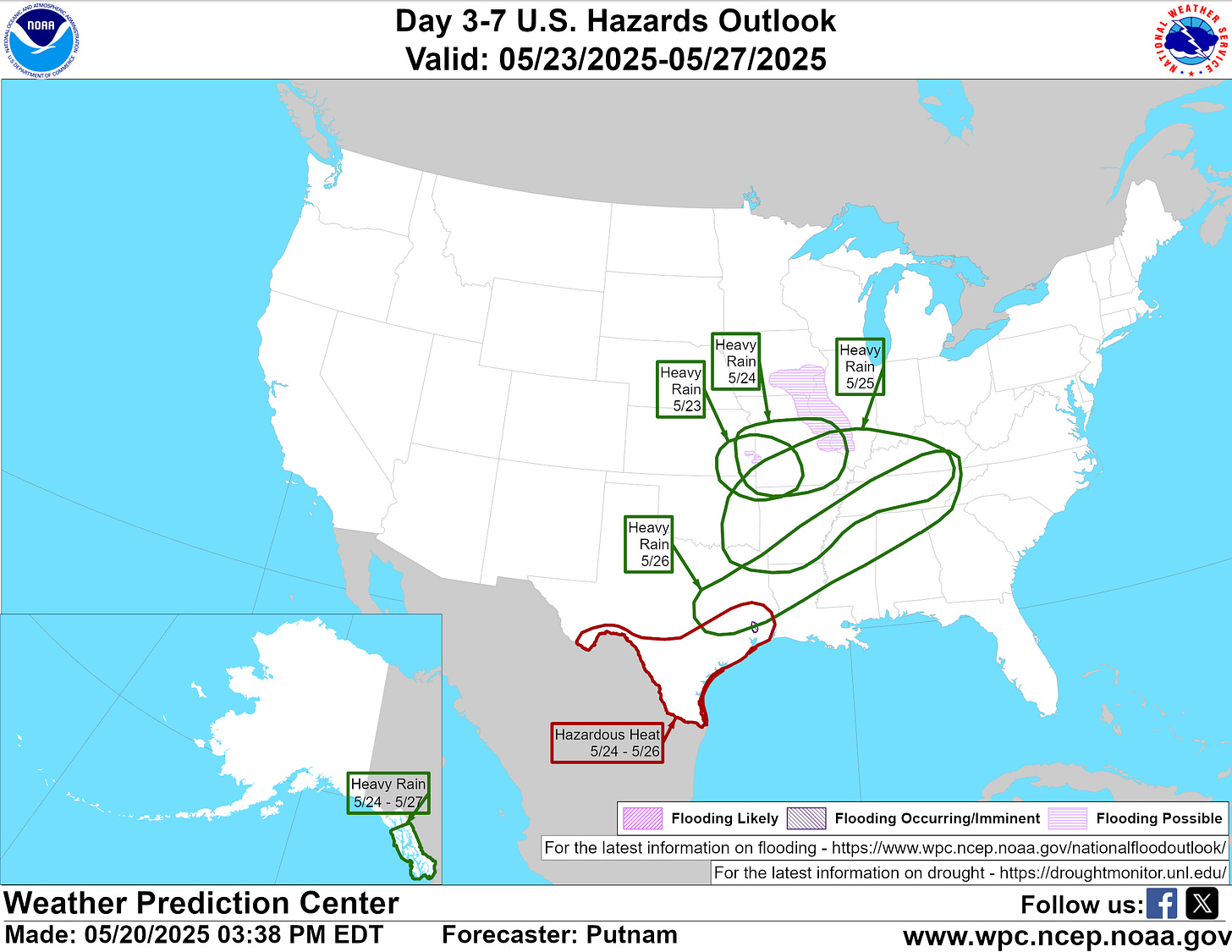

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks, which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings, click HERE and enter your city, state or zip code in the upper left corner.

Dow slides more than 800 points as spiking Treasury yields and deficit fears spur a sell-off: Live updates

Investors worried a new U.S. budget bill would put even more stress on the country's already large deficit.

The Republican spending bill is sending yields soaring and creating a major market headache

For now, Wall Street experts are not optimistic about what happens from here.

Trump tax bill faces fresh hurdles, with holdouts invited to White House last-minute

House Speaker Mike Johnson must unify his conference's hard-line conservatives and its moderate Republicans from blue states.

Trump administration formally accepts gift jet from Qatar

Qatar's gift to the Trump administration has drawn accusations of bribery from Democrats and warnings about cost and timeline from aviation experts

OpenAI is buying iPhone designer Jony Ive's AI devices startup for $6.4 billion

OpenAI said on Wednesday that it's acquiring Jony Ive's artificial intelligence devices startup io for about $6.4 billion.

These stocks could be key players in Trump's 'Golden Dome' project

The president on Tuesday announced plans for a missile defense system akin to one currently employed by Israel.

Bitcoin falls after hitting new record high of $109,500: CNBC Crypto World

On today's episode of CNBC Crypto World, Bitcoin sets a new record price. Plus, the SEC files charges against the crypto firm Unicoin and its top executives for alleged fraud. And, Eric Chen, co-founder of Injective, reacts to bitcoin's new record and provides his outlook for the cryptocurrency.

CoreWeave shares soar 19% after $2 billion debt offering

CoreWeave shares popped more than 19% after the renter of artificial intelligence data centers announced a $2 billion debt offering.

Microsoft says 394,000 Windows computers infected by Lumma malware globally

Hackers used the malware to steal passwords, credit cards, bank accounts and cryptocurrency wallets.

Investors got a ‘mulligan’ after market recovered from tariffs — what they should do next

Financial experts give advice for investors' next moves following the market's remarkable one-month turnaround from the tariff-induced selloff.

Toyota redesigns America's top-selling RAV4 SUV to exclusively be a hybrid

Toyota Motor will offer the 2026 RAV4 only as a hybrid or plug-in hybrid, eliminating a traditional gas engine in the vehicle.

Senate passed a surprise 'no tax on tips' bill. Here's what it could mean for workers

Senate passed a surprise 'no tax on tips' bill. If enacted, here's how could qualify for the deduction.

Amazon CEO Andy Jassy says tariffs haven't dented consumer spending

Amazon CEO Andy Jassy said the company hasn't seen any signs of consumers tightening their wallets in the face of President Donald Trump's sweeping tariffs.

Schiff: Strong Dollar Or Exports? Pick One...

Via SchiffGold.com,

Last week, Peter joined Glenn Diesen for an interview on the post-trade deal economy. Peter takes on the myths surrounding Trump’s trade war with China, the real impact of tariffs on Americans, and where he sees the dollar heading as the world’s reserve currency. He explains why the perceived victories of protectionist trade policy are little more than marketing stunts, and warns about the risks of continued US borrowing and a potential dollar crisis.

Peter opens with his signature candor, cutting through the narratives around Trump’s approach to China and the broader trade war. He stresses that Americans have been misled about the true causes of trade deficits and the effectiveness of tariffs:

Well, first of all, Trump declared war and then surrendered and called it a victory. You know, the victory is that he saved us from ourselves, although it� ...

SBA Overhauling Biden-Era Loan Program Following High Default Rates

Authored by Naveen Athrappully via The Epoch Times (emphasis ours),

The Small Business Administration (SBA) is overhauling a Biden-era lending initiative, citing its “alarmingly high rates” of loan default, the agency said in a May 19 statement.

Signage thanking customers for shopping at a small business. Tim Mossholder/Unsplash.com

The Community Advantage Small Business Lending Company program was designed to issue 7(a) loans to “underserved communities,” the SBA said. In the 7(a) loan program, the government offers loan guarantees to lenders, which allows the loan providers to advance credit to small businesses with spec ...

China Demands US Scrap Golden Dome Missile Defense System As It Will 'Turn Space Into A Battlefield'

China has reacted fiercely to President Trump's newly unveiled plans to develop a cutting edge massive missile defense system to cover the entire territory of the United States, dubbed the "Golden Dome" - and which would utilize space.

The plan is for space-based interceptors to be able to shoot down the most advanced missiles in the world. Trump touted that the hugely ambitious project would cost $175 billion and would be completed within three years; however, the Congressional Budget Office anticipates a price tag of $500 billion over 20 years. An allotted $25 billion for next year's budget will kick off the construction.

Chinese foreign ministry spokesperson Mao Ning reacted Wednesday saying China is "gravely concerned" as the Golden Dome will "exacerbate the risk of turning outer space into a battlefield" and likely start arms race which will redefine the global order and international security system.

FDA No Longer Recommends COVID Vaccine For Healthy Babies

Via Headline USA,

The U.S. government no longer recommends the COVID-19 vaccine for healthy babies thanks to new guidelines from the Trump administration, which said Tuesday it will limit approval for seasonal COVID-19 shots to seniors and others at high risk pending more data on everyone else.

Top officials for the Food and Drug Administration laid out new standards for updated COVID shots, saying they’d continue to use a streamlined approach to make them available to adults 65 and older as well as children and younger adults with at least one high-risk health problem.

But the FDA framework, published Tuesday in the New England Journal of Medicine, urges companies to conduct large, lengthy studies before tweaked vaccines can be approved for healthier people.

Previously, federal policy recommended an annual COVID shot for all Ame ...

Do EU Sanctions Still Have Enough Weight To Hurt Russia?

With the ink still drying on the European Union's freshly printed 17th sanctions package on Russia, work is already under way on a next step that European leaders say will be "massive." But some analysts warn that, in many ways, the EU has already played its best cards and doesn't have many left, especially at a time when Washington seems reluctant to join in as it pushes peace talks between Kyiv and Moscow. "The cards that we still have to play largely include measures for which we would need the United States," Benjamin Hilgenstock, senior economist

Is Freight Decarbonisation Viable?

One of the most difficult sectors to decarbonise is freight, and yet its one of the industries we most rely on in the modern world. While several countries are making leaps and bounds in terms of renewable energy production, little progress has been seen in decarbonising hard-to-abate sectors, despite the introduction of several national policies and international targets. So, just how hard will it be to decarbonise freight in the coming decades as many countries strive to achieve net-zero carbon emissions? Freight transportation contributes

Uzbekistan Leads Central Asia in Electric Vehicle Adoption

The International Energy Agency is spotlighting Uzbekistan for the countrys rapid embrace of electric vehicles. An IEA report, titled Global EV Outlook 2025, notes that electric vehicle sales have skyrocketed in Uzbekistan, making the country the leading adopter in Central Asia. The report adds that the cost of imported electric vehicles has fallen almost threefold in recent years. The Uzbek State Customs Committee reported earlier this year the number of imported electric and hybrid vehicles in 2024 exceeded that of gasoline-powered

Tariff Uncertainty Fuels Copper Price Volatility

Via Metal Miner The Copper Monthly Metals Index (MMI) retraced to the downside with a 4.23% decline from March to April. Looking at copper prices today, analysts seem to be struggling with ongoing trade policy shifts. Copper Prices Zigzag Amid Uncertain Trade Policy Comex copper prices have experienced wild swings over the past few months. First, they hit a new all-time high in March before plunging in April. By mid-May, they entered into a shaky sideways trend. Source: MetalMiner Insights Tariffs continue to drive the market. This

Indonesia Signs Swap Deals to Ensure Domestic Gas Supply

Indonesian natural gas producers have signed a multi-party gas swap agreement with Indonesian and Singaporean traders aimed at increasing gas supply security in western Indonesia. As gas production in Sumatra in western Indonesia is falling, local companies and regulators looks to redirect domestic gas supply to meet local demand while selling overseas gas from other areas. In a deal signed on Wednesday, Indonesian gas producer Medco Energi Internasional signed a multi-party swap agreement with companies including state energy firm PT Pertamina

New York Wind Project Revived With Natgas Quid Pro Quo

A wind project in New York mothballed by the Trump administration is getting a new lease on life through a compromise that would also see an abandoned natural gas pipeline from Pennsylvania to New York revived. Norways Equinor was three months into Empire Wind, a $5 billion offshore wind farm, when Trump came to power and set about dismantling the Biden administrations wind power program. On his first day in office, the second-term president issued an executive order pausing new leasing and permitting of wind projects, which he said

SSE Cuts Renewables Spending in Blow to UKs Green Goals

SSE, a major energy company and renewable projects developer in the UK, is reducing spending on renewables in its five-year plan to 2027 by $2 billion (1.5 billion) in a changing macro environment, in yet another blow to Britains clean energy ambitions. SSE said on Wednesday that it is reducing its five-year investment expectations by $4 billion (3 billion) to around $23.4 billion (17.5 billion). Of the $4 billion reduction in the updated plan, $2 billion is in the renewables business and the other $2 billion

EIA Reports Crude, Product Builds All Around

Crude oil inventories in the United States saw an increase of 1.3 million barrels during the week ending May 16, according to new data from the U.S. Energy Information Administration released on Wednesday. Crude oil prices were trading up prior to the crude data release by the U.S. Energy Information Administration. On Tuesday, the American Petroleum Institute (API) reported a build in US crude oil inventories of 2.499 million barrels in U.S. crude oil inventories with draws in gasoline and distillate stocks. At 10:14 am in New York, the Brent

Oil Giant Rosneft Buys Russias Biggest Rare Earths Deposit

Russias top oil producer, state-controlled Rosneft, has acquired the company that holds the license to operate and develop a giant rare earths deposit in Siberia, the largest such reserve in Russia and one of the worlds biggest. Rosneft has taken over control of Vostok Engineering, the company which holds the license for the Tomtor rare earth metals deposit in Yakutia, the Russian national companies registry showed on Wednesday. At the end of 2024, Russian President Vladimir Putin urged the Tomtor deposit to be developed, either by

Indias Oil Imports From Russia on Track for 10-Month High

India is on track to import nearly 1.8 million barrels per day (bpd) of crude oil from Russia in May, which would be a 10-month high, according to vessel-tracking data by Kpler. Indian refiners have increased buying activity for lighter Russian grades, such as ESPO, showed the Kpler data cited by Reuters. The strong Indian imports of ESPO crude are set to continue in June and July as refiners have booked more than 10 cargoes of the grade loading in June, traders told Reuters. Indias latest surge in ESPO purchases came before the new round

Solar Power Set to Surpass Nuclear Generation This Summer

This summer, solar power generation globally could exceed electricity from nuclear power plants for the first time ever, as solar capacity soars and sunlight and daylight hours are long in the northern hemisphere. Global solar power generation jumped by 34% in the first quarter of 2025 from the same period in 2024, according to data from Ember cited by Reuters columnist Gavin Maguire. If the pace of growth is sustained though June, July, and August, solar output is set to top 260 terawatt hours (TWh) in the summer months. This

Turkey Announces Major Shale Oil Reserve Discovery

Continental Resources, the U.S. shale producer, has estimated that the Diyarbak?r basin in Turkeys southeast has a reserve of 6.1 billion barrels of shale oil, Turkish Energy and Natural Resources Minister, Alparslan Bayraktar, has said. Turkey's current annual (crude) oil import amounts to 365 million barrels. So a 6.1 billion barrel reserve is a great figure, Reuters quoted Bayraktar as saying in southeast Turkey. In March this year, Turkeys national oil company TPAO signed an agreement with Continental

CATL Predicts Major Shift to Electric Trucks in China

Half of Chinas truck sales are set to be electric vehicles by 2028, according to the top executive of Chinese battery giant CATL, which holds more than a third of the global EV battery market. Trucks with CATL batteries could cut cost per ton-kilometer by 35% versus trucks running with internal combustion engine, CATLs chairman and chief executive officer, Robin Zeng, told the Financial Times in an interview. More than a dozen truck manufacturers in China are using a CATL standardized battery on about 30 electric truck

Centrica Divests North Sea Gas Field Stake

Centrica has announced plans to sell off a big chunk of its holding in the Cygnus gas field in the southern North Sea. The deal will see Spirit Energy a subsidiary of Centrica offload its 46.25 per cent stake in the site for around 215m to Ithaca Energy. Centrica, which owns British Gas, said the transaction aligned with its strategy to maximise value from Spirits remaining reserves and deliver an attractive upfront cash consideration. Cygnus is one of the largest gas fields in the UK section

Indonesian Pertamina Imports Sanctions-Compliant Russian Crude

Pertamina has been importing Russian crude oil complying with the Western sanctions, a top official at Indonesias state energy firm said on Wednesday. We have opened (to imports from Russia) since last May, Taufik Aditiyawarman, the chief executive of the Kilang Pertamina International refinery unit, said on the sidelines of a conference of the Indonesian Petroleum Association, as carried by Reuters. The company imports Russian crude for its domestic refineries and complies with the sanctions imposed on Russian

No money left at the end of the month and smaller food shops: How inflation rise affects you

Inflation has risen by more than expected on higher water, energy and food bills grew - how are ordinary people making their income stretch?

Inflation surprise suggests the outlook could be gloomier than we thought

Bills, food prices, and service costs are all rising - but there is some good news

How much is the winter fuel payment and who can still get it?

A government decision to limit the payment have been criticised by some MPs, unions and charities.

Gold trading hits $298 billion daily in March, says WGC report

Gold's daily trading volume surged to $298 billion in March 2025, reinforcing its status as a highly liquid, resilient asset. The World Gold Council highlights gold’s role in portfolio stability, inflation hedging, and long-term performance.

These 5 stocks show consistent growth in quarterly EPS

Five Nifty200 companies—ICICI Prudential Life, TVS Motor, Yes Bank, PNB, and Indian Bank—have posted rising EPS for four straight quarters through March 2025, reflecting improving profitability.

Gold rallies Rs 1,910 to Rs 98,450/10 g amid global uncertainty

Gold prices rebounded by Rs 1,910 to Rs 98,450 per 10 grams in the national capital as rising global uncertainties triggered a fresh wave of safe-haven buying. According to the All India Sarafa Association, the precious metal of 99.9 per cent purity had closed at Rs 96,540 per 10 grams on Tuesday.

Here’s why OpenAI is buying iPhone designer Jony Ive’s startup for $6.5 billion

The ChatGPT maker is acquiring io to build physical AI products beyond its on-screen applications — and sees possibilities beyond traditional hardware

Target’s weak results were the quarter’s ‘least-well-kept secret,’ but immediate improvement seems elusive, analysts say

The past few years of cost-of-living increases, which have forced many shoppers to focus on the basics, have shifted that narrative for Target.

Trump’s IRS pick may have a ‘DOGE’ problem on his hands

Billy Long has pledged to improve customer service and protect taxpayer data — two areas where “DOGE” actions have drawn scrutiny.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.