18 July 2025 Market Close & Major Financial Headlines: Wall Street Hits Pause After Record Rally; Investors Eye Tech Earnings

Summary Of the Markets Today:

The Dow closed down 142 points or 0.32%,

NASDAQ closed up 10 points or 0.05%, (New Historic high 20,981, Closed at 20,884)

S&P 500 closed down 1 points or 0.01%, (New Historic high 6,316, Closed at 6,297)

Gold $3,355 up $9.2 or 0.28%,

WTI crude oil settled at $67 down $0.18 or 0.27%,

10-year U.S. Treasury 4.429 down 0.034 points or 0.762%,

USD index 98.48 down $0.25 or 0.25%,

Bitcoin $117,481 down $1,480 or 1.26%, (24 Hours),

Baker Hughes Rig Count: U.S. +7 to 544 Canada +10 to 172

U.S. Rig Count is up 7 from last week to 544 with oil rigs down 2 to 422, gas rigs up 9 to 117 and miscellaneous rigs unchanged at 5.

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

On July 18, 2025, U.S. stock markets were little changed or slightly lower, following record-high closes for both the S&P 500 and NASDAQ from the previous day, as investors processed the latest corporate earnings and a wave of economic data. Market participants exercised caution ahead of major earnings reports from prominent technology firms in the following week. Corporate results such as Netflix’s better-than-expected performance helped sustain positive sentiment, although their shares did not see a proportional rise. Other key factors affecting the markets included a dip in U.S. Treasury yields after comments from Federal Reserve officials about potential rate cuts, a softening dollar, and improvements in consumer sentiment and inflation expectations. Internationally, uncertainty persisted due to possible tariffs in the U.S. and political developments abroad.

Read the July 2025 Economic Forecast: Progress on a Rough Path

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

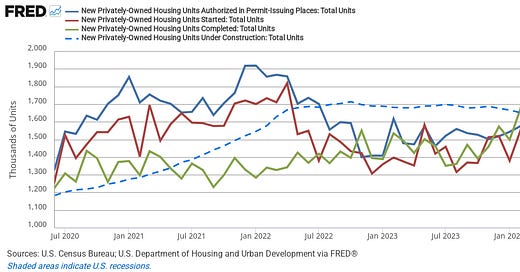

Privately-owned housing units authorized by building permits in June 2025 were down 4.4% year-over-year (YoY). Privately-owned housing starts were down 0.5% YoY.

Privately-owned housing completions is down 24.1% YoY. The reason home construction is down is that there is a surplus of homes for sale (see second graph below).

The July 2025 University of Michigan Consumer Sentiment remained nearly unchanged from June, slightly increasing by about one index point to 61.8, marking its highest level in five months but still trailing 16% below December 2024 and significantly under its historical average. While short-run business conditions saw an 8% improvement, expected personal finances dipped by about 4%, suggesting that consumers will likely remain cautious about the economy unless reassured that inflation won’t worsen, such as through stable trade policies, with little evidence that recent policy changes like the tax and spending bill have significantly influenced sentiment. Meanwhile, year-ahead inflation expectations dropped for the second consecutive month from 5.0% to 4.4%, and long-run inflation expectations fell for the third month from 4.0% in June to 3.6% in July, both the lowest since February 2025 but still above December 2024 levels, indicating ongoing consumer concerns about potential future inflation increases. As most of you know, I consider this survey as biased to the left - but between inflation and uncertainty consumer confidence is definitely at lower levels.

Sponsored Content:

This Device Will Help Elon Build a Virtual Monopoly

See this strange device? It could help Elon build his next trillion-dollar business...

Launch the biggest IPO of the decade...

And make a lot of people rich in the process.

Click here to get the details because Reuters even called it...

"An emergent monopoly."

ref: 7258/3

Learn how to spot high-confidence trade setups in real time!

That’s the power of the Wave Principle. And for a limited time, you can see it in action inside Trader’s Classroom: 30 days of expert lessons for just $30.

Offer ends tonight at midnight ET – go! 👉 < LINK>

#ElliottWave #TradingTips #TradingStrategy #TradingLesson #daytrading

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

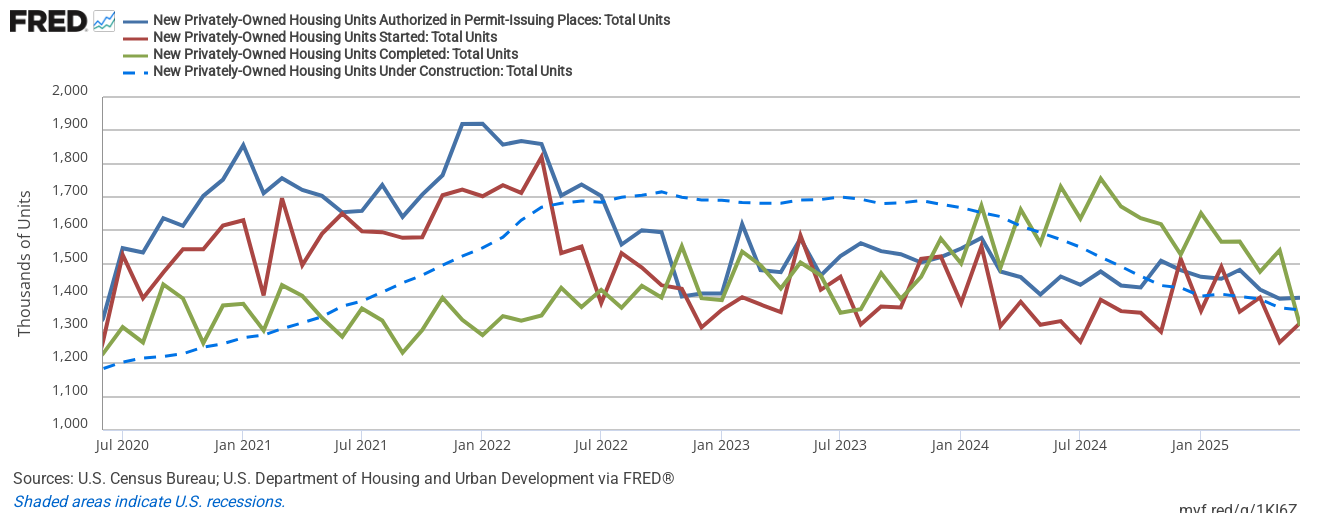

Infographic of the Day from Visual Capitalist:

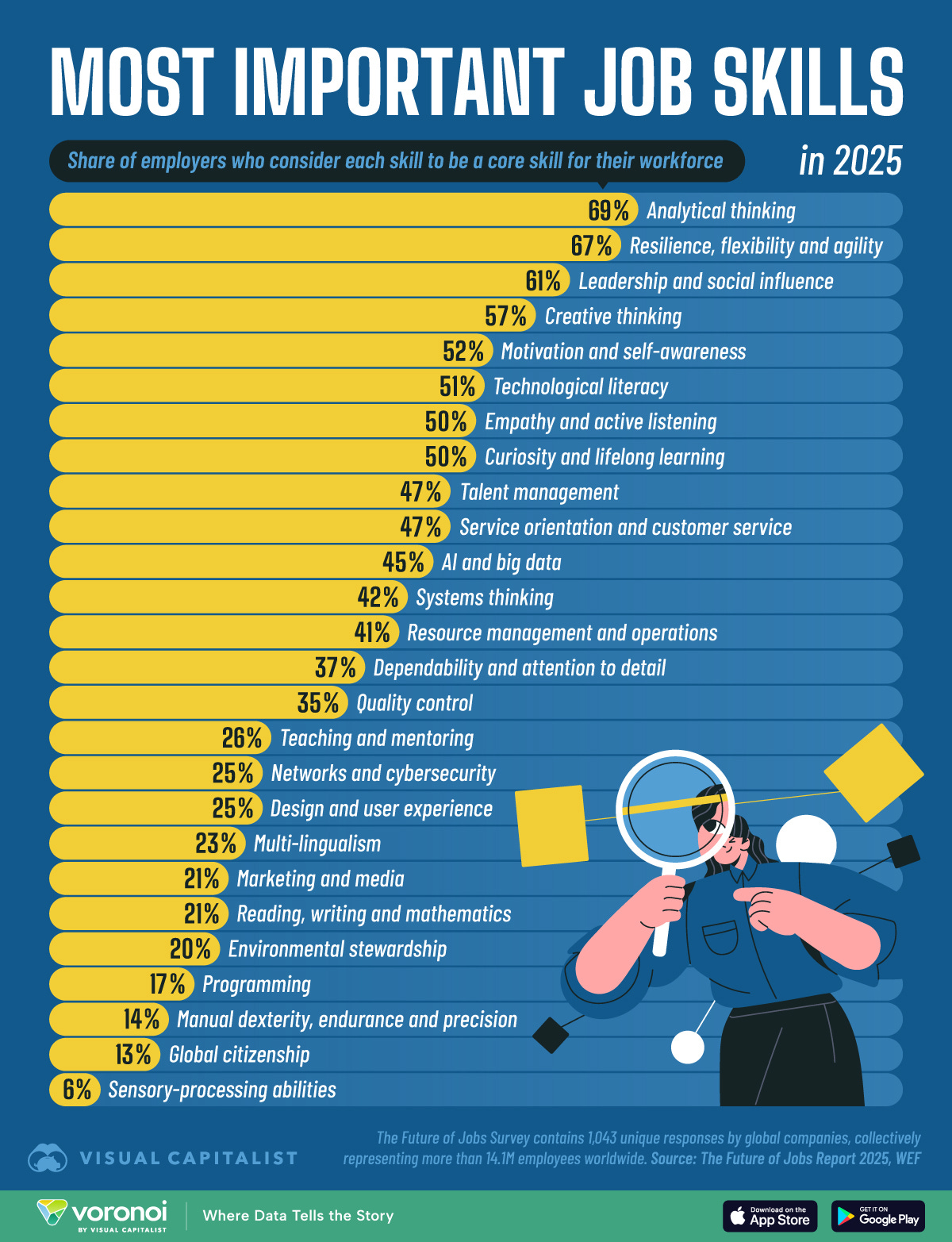

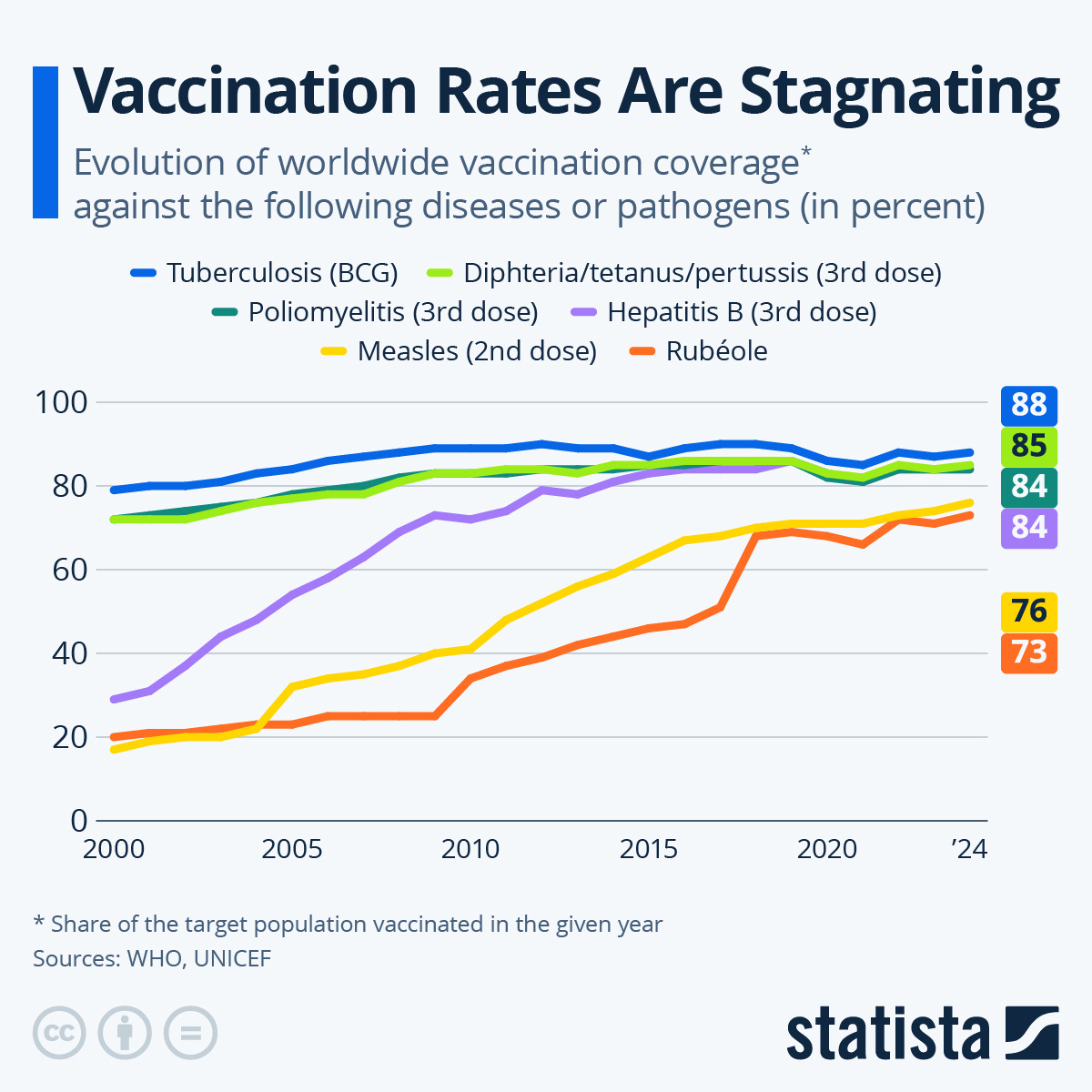

Statista Graphic of the Day:

You will find more infographics at Statista

The headlines we are reading:

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks, which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings, click HERE and enter your city, state or zip code in the upper left corner.

Why Delta and United are pulling away from the airline pack

U.S. airlines are struggling from weaker domestic spring and summer demand and lower fares.

Trump pushes for up to 20% minimum tariffs on European Union: FT

Trump has escalated his demands on the EU following weeks of negotiations over a possible framework deal, the Financial Times reported.

Sarepta shares plunge 40% as future of its gene therapy appears at risk

Sarepta reported a third death tied to its gene therapies.

Dow closes more than 100 points lower after report says Trump seeks at least 15% tariff on EU imports: Live updates

The S&P 500 scaled to a fresh record high on Friday, adding to its weekly advance, thanks to gains in tech.

What a Trump, Powell faceoff means for your money

Tensions are escalating between the White House and the Federal Reserve, with consumers caught in the middle.

Insurers just marked the costliest first half of the year since 2011

Global insured losses for the first half of this year have reached $84 billion, according to a recent Gallagher Re report.

International stocks, AI beneficiaries are set to outperform in a complicated second half, JPMorgan Asset Management says

Gabriela Santos of JPMorgan Asset Management said the two themes will continue to benefit as investors wade through the fallout from higher tariffs.

Clothing tech entrepreneur charged with $300 million fraud in U.S.

Authorities said Christine Hunsicker promoted CaaStle to investors as a more than $1.4 billion business despite knowing it was financially distressed and short of cash.

Rich American Express customers continue to spend freely, with one exception

American Express said Friday that travel spending in the quarter was weaker than transactions for goods and services.

President Trump signs GENIUS Act, creating stablecoin regulatory framework: CNBC Crypto World

On today's episode of CNBC Crypto World, bitcoin dips while ether and solana rise to close out the week. Plus, the GENIUS Act stablecoin regulation bill heads to President Trump's desk to sign Friday afternoon. And, Ryan Peters, assistant professor of finance at Tulane University's Freeman School of Business, discusses what the new law means for the crypto industry and the next steps for regulation in the United States.

Stephen Colbert's 'Late Show' run will come to an end next year as CBS cancels franchise

The decision "is not related in any way to the show’s performance, content or other matters happening at Paramount," the network said.

Travelers to the U.S. must pay a new $250 'visa integrity fee' — what to know

Travelers to the U.S. must pay a new "visa integrity fee" to visit, but questions remain as to how and when it will be implemented. Here's what we know so far.

Magnificent Seven earnings kick off next week with stocks near all-time highs

Magnificent Seven earnings kick off in the week ahead, with Alphabet and Tesla the first of the megacaps to report.

Capping Crypto Week: All You Need To Know About The Three Crypto Bills Passed By Congress

On Thursday, July 17, capping off what was dubbed “Crypto Week” by Congress, the US House just passed three digital assets related bills. Here is a breakdown of all that was passed:

The GENIUS Act:

The Senate’s stablecoin bill, by a vote of 308-122. By bringing regulatory clarity to the asset class, the law is expected to stimulate the growth of the stablecoin industry. The GENIUS Act first passed the Senate on June 17 by a vote of 68-30, with 18 Democrats supporting the bill and 2 Republicans (Senators Hawley and Paul) voting against it. Two Senators were not present (Senators Cotton and Kelly). Broadly, the GENIUS Act creates a regime for the issuance and regulation of U.S. dollar-backed payment stablecoins. By bringing regulatory clarity to the asset class, the legislation, if passed into law, is expected to stimulate the growth of the stablecoin industry.

What the bill does

The bill sets forth standards for regulatory oversight, striking a balance between federal and state authorities.

The bill allows payment stablecoins to be issued by subsidiaries of banks and non-bank entities. Banks would be overseen by their primary federal regulator, while non-bank entities would be overseen at a federal level by the Office of the Comptroller of the Currency (OCC) or under qualifying state regimes.

Sets up reserve requirements, supervision and enforcement, ie at least 1 to 1 backing with U.S. dollars, short-term ...

Nasdaq Files Application To Add Staking For BlackRock iShares ETH ETF

Authored by Vince Quill via CoinTelegraph.com,

The Nasdaq stock exchange filed an application with the US Securities and Exchange Commission (SEC) on Wednesday on behalf of BlackRock to add staking to the asset manager’s iShares Ether exchange-traded fund (ETF).

If the application is approved, the fund would give investors exposure to staking rewards accrued from using the underlying Ether as collateral security for Ethereum’s proof-of-stake consensus algorithm.

In May, the SEC released guidance classifying staking rewards earned from validation services on proof-of-s ...

Pope Leo Under Fire For 'Vague' Statement On Israel's Bombing Of Gaza Catholic Church

Via Middle East Eye

Pope Leo is facing growing criticism over his response to an Israeli air strike on the only Catholic church in the Gaza Strip on Thursday, which killed three people and wounded several others, including a pastor.

The Latin Patriarchate in Jerusalem confirmed that Father Gabriel Romanelli was among the wounded and said the strike caused significant structural damage to the Holy Family Church, where displaced Palestinian civilians had been sheltering.

Italian Prime Minister Giorgia Meloni condemned the strike and said “the attacks against the civilian population that Israel has been carrying out for months are unacceptable".

In a statement, Pope Leo expressed sorrow and called for peace, but stopped short of naming Israel as ...

4 Oil Market Myths That Just Won't Die

Authored by Tsvetana Paraskova via OilPrice.com,

Despite claims of energy independence, the U.S. remains a net crude oil importer, though it is a net petroleum exporter overall.

Oil prices are influenced by a complex interplay of supply, demand, and geopolitical events, not solely by OPEC or U.S. presidents.

While renewables are growing, oil is not expected to be entirely replaced soon due to its essential role in various sectors like transportation and petrochemicals.

They've been debunked. Repeatedly. But like zombies in a horror movie, these oil market myths just won’t stay dead. From campaign slogans to cocktail party arguments, here's what the data really says.

1) The U.S. is Energy Independent

Energy independence has been a key slogan in the campaigns and presidential terms of President Donald Trump. Make America Gre ...

Tariffs and Interest Rates Squeeze Construction Budgets

The Construction MMI (Monthly Metals Index) traded flat month-over-month, with no noteworthy price movement in either direction. Meanwhile, the U.S. construction industry is bracing for fallout from a new round of tariffs on key building materials. Industry groups warn that these tariffs, alongside persistently high interest rates, threaten to squeeze project budgets. Surging Costs for Steel, Aluminum and Other Metals As metal prices remain somewhat volatile, contractors nationwide report mounting cost pressures. Now that President Trump

Baker Hughes Reports Uptick in U.S. Rig Count

The total number of active drilling rigs for oil and gas in the United States rose this week, according to new data that Baker Hughes published on Friday, following a string of losses for US drillers. The total rig count in the US rose by 7 to 544 rigs, according to Baker Hughes, down 42 from this same time last year. The number of oil rigs fell by 2 to 422 after falling by 7 during the previous weekand down by 55 compared to this time last year. The number of gas rigs rose by 9 this week, at 117 for a gain of 14 active gas rigs from

Houthi Attacks Trigger Unpaid-Debt Shutdown of Israels Eilat Port

Israels only Red Sea port at Eilat is on the verge of a full commercial halt as municipal authorities freeze the operators accounts, citing unpaid taxes and concession fees totaling around NIS 10 million (~$3 million). The financial crisis reflects the sharp fallout from nearly 20 months of Houthi missile and drone attacks in the Red Sea, which have slashed port revenues by over 90%, according to the Times of Israel. The closure, which is set to begin on July 20, has been confirmed by both Israels Ports Authority and National

Mexico's Water Crisis Could Undermine Its Clean Energy Plans

Mexicos new president is making a major play to reform the countrys energy industry for greater energy independence and sovereignty, as well as a cleaner energy future. While this bodes well for the Mexican economy and for global climate goals, there is a critical tradeoff for this new plan: a major shortage of freshwater in the regions where the energy industry plans to expand. A former climate scientist, President Claudia Sheinbaum is picking up the energy sovereignty torch where former president and fellow Morena party candidate

NEOM's Future Hangs in Balance as Riyadh Tightens Fiscal Belt

Saudi Arabia is reassessing the scope and timeline of its $500-billion NEOM initiative, according to Bloomberg and CNBC, with officials reportedly reviewing key components of The Line in response to deepening financial strain across the kingdoms Vision 2030 infrastructure program. The move comes amid mounting vendor arrears and a liquidity crunch that has prompted an urgent reallocation of energy-sector capital and personnel. According to sources cited by CNBC, planners have frozen development on large portions of The Line, NEOMs

Oil Prices Climb After the EU Imposes New Sanctions on Russia

Oil prices moved higher on Friday morning after the EU agreed to an 18th package of sanctions against Russia, but the effectiveness of the sanctions is yet to be seen. Friday, July 18th, 2025The constant drumbeat of Russian sanction announcements is keeping Brent futures around $70 per barrel, with the European Union and its concept of a floating price cap taking centre stage this week. The bullish momentum was further supported by assumed Iraqi drone strikes on Kurdish oil fields, taking out all the major producing assets in less than a

Why Isn't Canada Cutting Oil Production?

Why Isnt Canada Cutting Oil Production? Canadas oil sands giants, Suncor and Imperial Oil, have become North Americas lowest-cost producers, a key transformation in the upstream landscape as shale producers struggle to break even with new wells as WTI prices still linger around $65-68 per barrel. Whilst Albertas oil sands require substantial capital expenditures upfront, once the projects are online, operational costs can be greatly reduced by means of autonomous mining vehicles, smarter water management, and AI integration.

Oil Prices Slide Under Trade and Inventory Pressures

WTI crude oil traded between a high of $68.34 and low of $64.11 before reaching $66.28 as of Thursday's close, down $0.86 or -1.28%. The price action reflected competing fundamental forces: escalating geopolitical tensions that initially supported prices, followed by trade policy uncertainties and mixed inventory data that pressured the market lower. Geopolitical Tensions Drive Early Week Strength The period began with significant geopolitical risk as President Trump prepared statements on Russia with direct oil supply implications. Trump confirmed

Why Trump Reversed His Stance on Russia

Politics, Geopolitics & Conflict Trumps sudden reversal on Russia (shifting from passive tolerance to a 50-day ultimatum backed by tariff threats and conditional arms for Ukraine) is not rooted in strategy or ideology. Its ego-centric. Its not a policy shift in the traditional sense. Trump is attempting to reassert dominance after concluding that Putin is no longer playing by his rules. The tariffs, like the deadline, are not structured instruments aimed at isolating Russia economically. They are improvised leverage or

Explaining Israel's Airstrikes in Syria

Israeli airstrikes in Syria this week have been publicly framed as a response to threats against the Druze community after massacres of Druze that are being traced back to the new Syrian leadership in Damascus. The actual agenda is a bit more complicated. Western media has largely framed Israels recent strikes in Syria as a defensive move to protect the Druze community from escalating sectarian violence. Why the Druze and what they have to do with the sectarian violence against the Alawites is rather complicated and not entirely logical.

Oil Prices Climb as EU Sanctions Target Russian Trade

Oil prices rose on Friday after the EU adopted its 18th sanctions package against Russia, lowering the price cap, targeting Russian oil trade, and closing a loophole that has so far allowed EU imports of fuels processed from Russian crude. As of 9:50 a.m. EDT on Friday, the U.S. benchmark, WTI Crude, rose by 1.36% to $68.51 per barrel. The international benchmark, Brent Crude, was trading higher by 1.19%, and returned above the $70 a barrel mark, at $70.39. The European Union lowered the price cap on Russian crude oil to $47.60 from $60 per

EU Lowers Russian Oil Cap to $47.60

The European Union lowered the price cap on Russian crude oil to $47.60 from $60 per barrel as it adopted on Friday the 18th sanctions package against Russia, targeting a hundred more shadow fleet tankers, energy trade, and traders and banks enabling it. Following weeks of negotiations and Slovakia holding up the required unanimous approval of the sanctions package, the EU finally agreed on the fresh sanctions after Slovakia lifted its veto. Slovakia had tied dropping its veto with receiving sufficient energy security guarantees

Restart of Kurdistans Oil Export Isnt Imminent

Despite Baghdads assurances that oil exports from Kurdistan will resume immediately after more than two years, the semi-autonomous Iraqi region isnt prepared to restart exports, sources familiar with the matter told Reuters on Friday. Amid drone attacks on oilfields in Kurdistan this week, which have shut in about 200,000 barrels per day (bpd) in production, the federal Iraqi government said on Thursday that the Kurdistan Regional Government (KRG) would immediately begin delivering at least 230,000 bpd to Iraqs state oil marketing

Fortescue Halts New U.S. Green Energy Projects

Australias energy and metals group Fortescue is reassessing timelines and pausing green energy project developments in the United States following the latest U.S. legislation to phase out renewable energy incentives, Fortescues founder and executive chairman, Andrew Forrest, told the Wall Street Journal in an interview. President Trumps tax and spending act, the One Big Beautiful Bill Act, passed earlier this month, contains punitive provisions on renewables in the U.S. The legislation includes a faster phase-out of the tax

Slovakia Lifts Veto on New EU Energy Sanctions on Russia

Slovakia will lift its veto with which it was holding up the required unanimous approval of the EUs 18th sanctions package against Russia, Slovakia's Prime Minister Robert Fico says. Earlier this week, Fico said that Slovakia would drop its veto on the EUs new sanctions against Russia if it receives an exemption to continue importing Russian pipeline gas for nearly another decade. On Monday, the EUfailed to approvethe package, which is set to include a floating oil price cap for Russias crude and a ban on the use

Buy now, pay later affordability checks to come into force

Long-promised regulation of the sector will come into force next July, but lenders will have some flexibility.

Serious water pollution incidents up 60% in England, Environment Agency says

Last year had the highest number of pollution events by water companies ever recorded.

Sub-postmistress conviction referred to appeal court

A Kent woman's case is the first conviction linked to the Post Office Capture system to be referred.

JioStar posts Rs 581 crore net profit in Q1 driven by IPL

JioStar, the RIL-Disney joint venture, posted a Q1FY26 net profit of ₹581 crore and ₹9,601 crore revenue, driven by IPL’s record performance on TV and digital. Despite weak FMCG ad spends, strong sports and subscription income lifted earnings.

High margin requirements will discourage undue speculation in electricity futures: Sebi Chief Pandey

A high initial-margin requirement will discourage "undue speculation" in the newly-launched electricity futures segment, Sebi chief Tuhin Kanta Pandey said on Friday.

IndusInd Bank to consider raising funds via long-term bonds

IndusInd Bank is set to discuss raising funds through long-term bonds at its upcoming board meeting on July 23. This consideration follows a $230 million loss due to past misaccounting, which led to the resignations of its CEO and deputy in April. The bank is also evaluating potential capital increases via depository receipts and qualified institutional placements.

Here’s what interest-rate changes may mean for bond returns as traders watch Fed

The higher yields found in the bond market provide a bigger buffer against volatility compared with a few years ago — and greater potential for upside than downside as interest rates change, according to Vanguard.

Alphabet’s stock is on a winning streak. Can it stay hot after next week’s earnings?

While there are lingering concerns about Google’s search business in the long run, analysts see some positives ahead of upcoming second-quarter results.

Genius Act ushers in a new era for stablecoins. Here’s what that means for Americans’ wallets.

Cryptocurrency has gained a hold in Americans’ investment portfolios and their retirement accounts — and now it’s a step closer to their wallets for everyday use.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.