17 July 2025 Market Close & Major Financial Headlines: PepsiCo & United Airlines Spark Rally as "Strong" Retail Numbers Deceive Investors

Summary Of the Markets Today:

The Dow closed up 230 points or 0.52%,

NASDAQ closed up 154 points or 0.74%, (New Historic high 20,912, Closed at 20,884)

S&P 500 closed up 34 points or 0.54%, (New Historic high 6,305, Closed at 6,297)

Gold $3,346 down $13.2 or 0.39%,

WTI crude oil settled at $68 up $1.25 or 1.88%,

10-year U.S. Treasury 4.457 up 0.002 points or 0.045%,

USD index 98.64 up $0.24 or 0.25%,

Bitcoin $118,918 down $155 or 0.13%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

On July 17, 2025, U.S. stock markets were buoyed by notable corporate earnings and what they mistakenly believed was strong economic data. The NASDAQ and S&P 500 reached record highs and pushed the Dow Jones into positive territory. Investor sentiment was lifted by robust retail sales figures for June 2025 (which were poor - see our analysis below), as well as upbeat earnings from United Airlines and PepsiCo. PepsiCo rallied nearly 7% on demand for healthier beverages, while United Airlines surged on improved travel demand. Rumors that President Trump was considering removing Federal Reserve Chair Jerome Powell, a claim Trump later denied, helped stabilize markets. The outlook for Federal Reserve rate cuts remains cautious as inflation stays slightly above the 2% target. Technology and airline stocks led market gains, propelled by positive results from semiconductor firms like TSMC and anticipation of Netflix’s upcoming earnings. Does the inflation-adjusted retail sales graph below look like strong growth?

Read the July 2025 Economic Forecast: Progress on a Rough Path

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

Import prices fell 0.2% year-over-year (YoY in June 2025. Those were the largest annual decreases since the index fell 0.9% for the year ended February 2024. If fuel is ignored in import prices, the index was down 1.2% YoY (down from 1.4% the previous month). Meanwhile, export prices rose 2.8% YoY. Surprisingly, there is little evidence of a price impact yet from the tariff wars.

U.S. retail and food services sales for June 2025 were up 3.7% YoY. This was up from 3.2% YoY last month. Before one thinks retail sales are going gangbusters - the inflation-adjusted growth was up 1.2% YoY - up from last month’s 0.9% YoY. Most of the categories of retail sales were little changed, with food services, non-store retailers, and auto sales driving the increase.

The July 2025 Philly Fed Manufacturing Survey indicated an expansion in manufacturing activity, with the general activity index rising to a positive 15.9, its highest since February, driven by increases in new orders (up 16 points to 18.4) and shipments (up to 23.7). Employment also improved as the employment index turned positive, reflecting job growth. Could it be that hard data will confirm manufacturing is improving.

In the week ending July 12, the advance figure for seasonally adjusted initial unemployment claims 4-week moving average was 229,500, a decrease of 6,250 from the previous week's revised average. The previous week's average was revised up by 250 from 235,500 to 235,750.

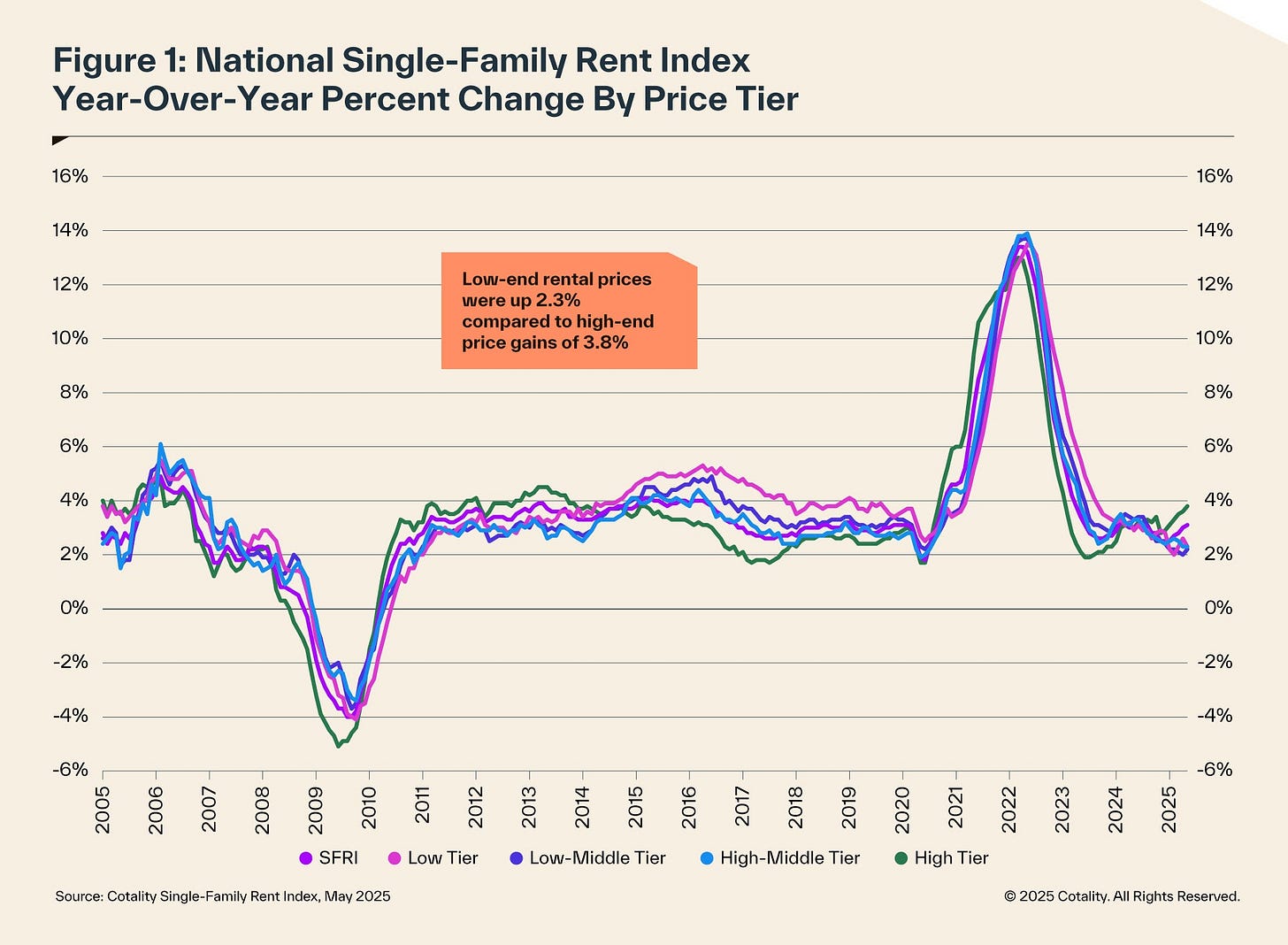

In May 2025, Cotality's Single-Family Rent Index (SFRI) reported a year-over-year rent increase of 3.1%, up from 3% in May 2024, marking the fourth consecutive month of accelerating annual rent growth and aligning with pre-pandemic growth rates of 3.4%. Molly Boesel, Cotality's senior principal economist, noted that this sustained momentum in the rental market contrasts with slowing home price growth, as high home prices and interest rates push would-be buyers to remain renters, boosting demand. Monthly gains in the SFRI have consistently exceeded seasonal norms in 2025, indicating that annual rent growth may surpass 3% for the year. High-end properties saw a 3.8% year-over-year rent increase, up from 3% in May 2024, while low-end properties experienced a 2.3% increase, down from 2.9% the previous year.

Sponsored Content:

DOGE Phase 2?

Musk's days in politics aren't over yet.

That's according to tech legend Jeff Brown, who believes Musk and Trump may be working on DOGE Phase 2...

And, this time, it could cause a $12 trillion market megashift.

If recent market swings caught you off guard...

Click here to see what could be next, while there's still time.

ref: 7748/3

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

Infographic of the Day from Visual Capitalist:

Statista Graphic of the Day:

You will find more infographics at Statista

The headlines we are reading:

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks, which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings, click HERE and enter your city, state or zip code in the upper left corner.

Homebuilders are slashing prices at the highest rate in 3 years

More homebuilders are cutting prices as interest rates remain stubbornly high, and potential buyers pull back over concerns in the economy.

S&P 500 rises to new closing record, boosted by solid earnings and U.S. economic data: Live updates

Quarterly earnings reports released this week have exceeded Wall Street's expectations, fueling investor confidence.

Netflix earnings are after the bell. Here's what to expect

Netflix reports second-quarter earnings after the closing bell Thursday.

Here's where Walmart prices are changing — and staying the same — as Trump's tariffs hit

Price increases on things like baby gear and home goods at Walmart reflect broader trends following President Donald Trump's tariffs.

Kevin Warsh touts 'regime change' at Fed and calls for partnership with Treasury

Warsh called for sweeping changes on how the Fed conducts business and suggested a policy alliance with the Treasury Department.

These stocks could benefit if Trump expands private markets access in 401(k) plans, analysts say

A few asset managers could catch a tailwind if the Trump administration expands access to private market investments in retirement plans.

Defense manufacturing startup Hadrian closes $260 million funding round led by Peter Thiel's Founders Fund

Defense startup Hadrian on Thursday announced the closing of $260 million Series C funding round led by Peter Thiel's Founders Fund and Lux Capital.

Rep. Bryan Steil says he hopes President Trump can sign crypto bill this week: CNBC Crypto World

On today's episode of CNBC Crypto World, bitcoin trades flat while ether and XRP rise. Plus, Coinbase announces an 'everything app' to replace the Coinbase Wallet. And, Rep. Bryan Steil (R-Wisc.) discusses the House's plans to pass crypto regulation bills after an hours-long delay.

House passes crypto industry-backed market structure bill

The U.S. House of Representatives passed the Digital Asset Market Clarity Act of 2025.

Fired Jeffrey Epstein prosecutor Comey: 'Fear is the tool of a tyrant'

President Donald Trump is under pressure to have the Justice Department release files on Jeffrey Epstein, the pedophile who killed himself in jail.

New York City braces for wealth flight with Mamdani's political rise

Zohran Mamdani's primary win in New York City's mayoral race and proposal to raise taxes on millionaires have touched off fears of a new wave of wealth flight.

These 10 states offer homebuyers and sellers the most stable housing markets in America

Mortgage rates and low inventory are making real estate decisions hard for homebuyers across the U.S., but value can be found in these 10 state housing markets.

One Wall Street stock bucking the weak trend, according to the charts

David Keller breaks down the charts on Apollo.

US Spot Ether ETFs Post New Record Inflow As Altcoins Pump

US Spot Ether ETFs Post New Record Inflow As Altcoins Pump

Authored by Tarang Khaitan via CoinTelegraph.com,

US spot Ether exchange-traded funds recorded an inflow of $726.6 million on Wednesday as altcoins rallied.

BlackRock's ETHA also saw a daily inflow record, contributing $499 million to the day’s results, while Fidelity’s FETH fund saw the second highest net inflow of $113 million, according to Farside Investors.

US spot Ether ETFs now collectively hold more than 5 million ETH, accounting for more than 4% of the circulating supply, according to Trader T.

Seeya! Trump Ships 5 Illegals With Violent Crime Records To Tiny African Kingdom

Seeya! Trump Ships 5 Illegals With Violent Crime Records To Tiny African Kingdom

In something that rings a little like a dandy practical joke, five violent illegal immigrants from all over the world woke up this morning in a tiny African kingdom none of them ever heard of, thanks to the Trump administration's latest third-country deportation flight.

The five undesirables who hail from Vietnam, Jamaica, Cuba, Yemen and Laos are now in a local jail in the landlocked kingdom of Eswatini, which was known as Swaziland until 2018. About the size of Connecticut, the country is ruled by 57-year-old King Mswati III, who has absolute power to rule by decree. He has 11 wives and an estimated net worth of between $200 million and $500 million. In 2019, he sparked controversy with a purchase of 19 Roll Royce and 120 BMW vehicles for r ...

Yield Curve Control? Why Not...

Yield Curve Control? Why Not...

By Peter Tchir of Academy Securities

There is a lot of chatter surrounding the Federal Reserve. The FOMC, etc. What the President will or will not do. What can be “successfully” done or not. Will Powell be fired?

Today, Kevin Warsh is floating the idea of better aligning the Fed and Treasury, as has been the case in the past (so I’m told).

Warsh: "we need another Treasury-Fed accord" The last time we had such an accord (in 1951), there was Yield Curve Control in the US. Clear what's coming.

— zerohedge (@zerohedge) July 17, 2025

Most of the analysis about what may happen tends to fall along the lines of:

Probably cannot “fire” Powell anyways. Even if Powell is “fired” it is a committee and the committee won’t do anything drastic. The front end might rally a bit, but “we” will lose control over the long end.

Why not think more outside the box? There are a few things we know:

The President thinks rates are too high. The President (and Bessent) are focused on the 10-year and believe that is also too high. The President has no problem (at least on tariffs) dictating s ...

Watch: Chinese Military Unveils Robot Murder Wolves, Drones That Definitely Violate Asimov's Laws

Watch: Chinese Military Unveils Robot Murder Wolves, Drones That Definitely Violate Asimov's Laws

The Chinese military conducted tactical exercises integrating robotic wolves and infantry-operated drones, underscoring Beijing's push to deploy unmanned systems in modern combat operations, according to state-run media.

The 76th Group Army's drills focused on battlefield coordination between personnel and autonomous technologies for reconnaissance, strategic point clearing, fire support and breaching defensive positions, according to a military statement. The exercises represent China's latest effort to advance unmanned warfare capabilities amid growing global competition in military robotics.

Iran Seizes Foreign Oil Tanker in Gulf of Oman

It remains important for energy traders to closely monitor the Strait of Hormuz and other key critical maritime chokepoints in the region (recall Red Sea events last week, given persistent geopolitical tensions involving Iran and Israel. Tehran retains a diverse toolkit both asymmetric and conventional for disrupting tanker traffic through the Strait of Hormuz. These methods include naval mine deployment, anti-ship missile and drone launches, fast-attack craft swarms, and the seizure of vessels transiting the critical waterway

Africa Becomes Global Copper Battleground for Asian Powers

Via Metal Miner Both China and India are now jostling for exploration and mining rights across the African continent. Over the last decade, China has rapidly expanded its presence in Africas growing copper market, securing critical mineral supplies to fuel its green energy ambitions. With copper demand surging globally due to the growth of electric vehicles, renewable energy, and digital infrastructure, Beijing has intensified its investments across Zambia, the Democratic Republic of the Congo and Botswana. Now it seems that

Chevron Prioritizes Cash Flow Over Growth in Permian

Chevron has effectively reached its long-term production goal of 1 million barrels of oil equivalent per day (boe/d) in the Permian Basinand from here, its shifting gears. According to Bruce Niemeyer, president of Chevrons shale business, the company now plans to hold production steady through 2040 while cutting rigs and frack crewslocking in $5 billion in annual free cash flow by 2027. That number isnt just aspirational. Chevron has already reduced its rig count from 13 to 9 and cut frack crews from 4 to 3 this

BlackRock's 1 Billion Bet on Eni Fuels Carbon Capture Confidence

A long-anticipated deal just became a market signal: BlackRocks Global Infrastructure Partners is preparing to buy 49.99% of Enis carbon capture arm at a valuation of around 1 billion ($1.2 billion), according to sources familiar with the negotiations. That figure, revealed for the first time this week, isnt just a price tagits a fresh marker for how the worlds largest asset manager sees the future of decarbonization infrastructure. In a sector still viewed with skepticism over costs and scalability,

EU Proposes Record Budget with Ukraine Aid and Defense Boost

The European Commission has put forward its vision for the next long-term (2028-2034) European Union budget -- a record-high 2-trillion-euro ($2.3 trillion) framework, with a doubling of funds for both Ukraine and EU foreign policy in general, and a fivefold increase in defense-related investment. It is worth remembering that the July 16 proposal is just the opening shot in a battle that will consume Brussels for the next two years. All 27 EU member states, which provide the vast majority of the cash through national contributions linked to their

India's ONGC Eyes Major New Refinery Project

Indian state-owned Oil and Natural Gas Corporation Limited (ONGC), the biggest oil and gas explorer and producer in the country, is considering the construction of a new refinery with a capacity of between 200,000 barrels per day and 240,000 bpd, a source from the company told Reuters on Thursday. ONGC has undertaken a pre-feasibility study on the refinery project, which is planned to be set up at the coastal city of Jamnagar in the western Indian state Gujarat, according to the source. Jamnagar also hosts the huge refinery complex

Will China Abandon Its Non-Interventionist Foreign Policy for Iran?

After the recent attacks by Israel and the United States, Iran will likely upgrade its conventional defensive and offensive capabilities with Chinas help. Despite the well-publicized IranChina 25-year Comprehensive Strategic Partnership, Chinese officials, including Foreign Minister Wang Yi, temporized by criticizing Israels actions and expressing concern over regional instability; President Xi Jinping urged both sides to cease hostilities and proposed a four-point peace framework, avoiding direct blame on Israel. China maintained

Natural Gas Inventories Rise but Heat Wave Could Fuel Strong Demand

U.S. natural gas inventories climbed by 46 billion cubic feet (Bcf) last week, keeping total storage comfortably above seasonal norms. But while the headline number suggests plenty of supply, traders arent relaxing just yet not with record-breaking heat and LNG exports tightening balances beneath the surface. The build for the week ending July 11 brings total working gas in storage to 3,052 Bcf, according to todays figures provided by the Energy Information Administration. Thats 178 Bcf above the five-year average of

Coal Is Making a Comeback in the U.S. Under Trump

Under the Biden administration, the United States made strides in its green transition, supported by policies such as the Inflation Reduction Act (IRA) and the Bipartisan Infrastructure Law (BIL). The U.S. renewable energy capacity increased significantly, and a long-term shift away from coal was in the works. However, since President Trump came into office, his administration has begun to undo much of the green progress made over the last four years and is once again looking to coal to meet the domestic power demand. Coal is widely considered

India Unfazed by Trump Threat of Secondary Sanctions on Russian Oil Buyers

India is not concerned about President Trumps threat to crack down on Russias oil exports and slap secondary sanctions or tariffs on buyers of Russian crude if no peace deal on Ukraine is reached in 50 days. I'm not worried at all. If something happens, we'll deal with it, Indias Petroleum and Natural Gas Minister, Hardeep Singh Puri, said at an industry event in New Delhi on Thursday. Since the Russian invasion of Ukraine and the bans on Russian oil in the West, India has become a key buyer

Canada's New Energy Agenda Meets Resistance From First Nations

Its a quintessentially Canadian story. As other countries build infrastructure to support their burgeoning economies and the transition to clean energy, Canadas push to go big on major energy and mining projects is being held up by local First Nations who claim that Bill C-5 violates their constitutional rights. Also known as the one Canadian economy act because it aims to reduce interprovincial trade barriers, C-5 was recently passed by the House of Commons and the Senate. It became law on June 26th.

Goldman: The Boom Years of U.S. Oil Output Growth Are Over

The years of very rapid growth in U.S. crude oil production are behind us, in large part due to the maturing of the biggest growth engine, the Permian, according to Goldman Sachs. The investment bank expects declines in Americas crude oil output for this year and next because of the lower oil prices, Daan Struyven, oil research head at Goldman Sachs, told Bloomberg TV in an interview on Thursday. U.S. shale producers are the most reactive to oil price changes and they are typically quick to follow the price trends. Lower

Why Iran Fears a Syria-Azerbaijan Axis

Syrian interim President Ahmad al-Sharaas visit to Baku last weekend highlighted a dramatic shift in regional alliances, prompting a mix of concern, suspicion, and strategic recalculation across Iranian media. Official statements following Sharaas meeting with President Ilham Aliyev emphasized a new era in Syrian-Azerbaijani relations. Both leaders acknowledged past stagnation, directly blaming ousted President Bashar al-Assads unfriendly policy and pledged to restore and deepen cooperation. Notably, the visit

Oil Prices Rise on Tight Summer Market

Oil prices rose early on Thursday amid signs that inventories are low in the peak summer demand season and resurfacing geopolitical concerns in the Middle East. As of 8:33 a.m. EDT on Thursday, the U.S. benchmark, WTI Crude, was up by 0.98% at $67.01 per barrel. The international benchmark, Brent Crude, was trading at $68.88, up by 0.53% on the day. Tight markets and falling U.S. crude oil inventories supported oil prices early on Thursday, despite the volatility caused by the uncertainty about the U.S. tariffs and trade deals and the pace of global

Brazils Petrobras Weighs Return to Retail Fuel Market to Reduce Prices

Brazils Petrobras will discuss this week tweaking its mid-to-long-term strategic plan to potentially include a return to the retail fuel sector, amid complaints from the Brazilian president and the CEO of the state-owned oil and gas giant that wholesale fuel cuts dont reach retail customers. This week, Petrobrass board of directors will meet to discuss amending the 2026-2030 plan that could include a renewed presence in the Brazilian retail fuel sector, an anonymous source with knowledge of the matter told Bloomberg. Petrobras

UK's most powerful supercomputer comes online

The Isambard-AI supercomputer is made fully operational as the government unveils fresh AI plans.

Meta investors settle $8bn lawsuit with Zuckerberg over Facebook privacy

Shareholders accused Meta leaders of damaging the company by allowing repeat violations of Facebook users' privacy.

UK jobs market weakens as unemployment rate rises

The official data shows wage growth has slowed while the number of vacancies continues to fall.

Rs 700 crore IndiQube IPO to open on July 23

IndiQube Spaces’ ₹700 crore IPO opens July 23, comprising ₹650 crore fresh issue and ₹50 crore OFS by promoters. Proceeds will fund expansion, debt repayment, and general corporate purposes. Anchor bidding begins July 22.

Nuvoco Vistas Q1 profit surges to Rs 133 crore on higher sales, flat costs

Nuvoco Vistas reported a sharp jump in Q1FY26 profit to ₹133 crore from ₹2.84 crore a year ago, driven by 9% revenue growth and stable expenses. Cement sales hit 5.1 million tonnes and EBITDA reached ₹533 crore, the highest ever for Q1. The company also reduced debt significantly year-on-year, excluding new borrowings for the Vadraj acquisition.

Tata Communications Q1 Results: Cons PAT falls 43% YoY to Rs 190 crore, revenue up 7%

Tata Communications reported a 43% YoY drop in Q1FY26 net profit at Rs 190 crore. Revenue rose 7% to Rs 5,960 crore. Sequentially, profit plunged 82%, with mixed performance across key business segments like data, voice, and transformation services.

AMC stock soars as Benchmark raises estimates amid box-office rebound

Citing industry data, Benchmark estimates that AMC delivered nearly 37% year-over-year domestic admission growth per screen in the second quarter, well above the prior estimate of 12.5%.

‘I enjoy vacations to Europe’: I’m 75 and have $1 million in an IRA. Why do I feel guilty?

“We have no long-term-care insurance. When I become debilitated, I plan to end my life at Dignitas.”

This Tesla rival’s stock soars as Uber plans big investment, launch of robotaxi service

Lucid’s stock zooms to best day in months after Uber becomes the EV maker’s latest backer and the companies hatch a plan to launch robotaxis.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.