16 July 2025 Market Close & Major Financial Headlines: Inflation Meets Trade Storm as Trump Unveils Sweeping Trade Hikes

Summary Of the Markets Today:

The Dow closed up 231 points or 0.53%,

NASDAQ closed up 53 points or 0.25%,

S&P 500 closed up 20 points or 0.32%,

Gold $3,355 up $18.4 or 0.55%,

WTI crude oil settled at $67 up $0.05 or 0.08%,

10-year U.S. Treasury 4.453 down 0.036 points or 0.802%,

USD index 98.32 down $0.31 or 0.31%,

Bitcoin $119,340 up $2,804 or 2.35%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

On July 16, 2025, stock markets advanced amid a flurry of economic and political developments. Early optimism from a slightly better-than-expected inflation report was offset by concerns surrounding President Trump’s announcement of new tariffs on multiple countries, notably a 35% tariff on Canada and broad increases to 15–20% for nations lacking trade agreements, effective August 1. U.S. companies reported that tariffs were starting to inflate costs for goods like toys and apparel. Bond yields climbed as investors worried about more inflation from tariffs, further supporting a stronger dollar.

Read the June 2025 Economic Forecast: Recession Winds - Is the Glass Half Empty or Half Full

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

By studying the Ports of Los Angeles and Long Beach, you see a microcosm of global trade dynamics—supply and demand, geopolitical influences, and logistical challenges—all in one place. they are the largest port complex in the United States and a major gateway for international commerce, particularly with Asia. Together, these ports handle about 40% of U.S. containerized imports and 25% of exports. And their hard data is available weeks before the US Census produces national data. In June 2025, imports were down 4% year-over-year (YoY) whilst exports were down 3% YoY. This data suggests some impact from the tariff wars - but far less than the media would have you believe. Note that lower imports improves GDP.

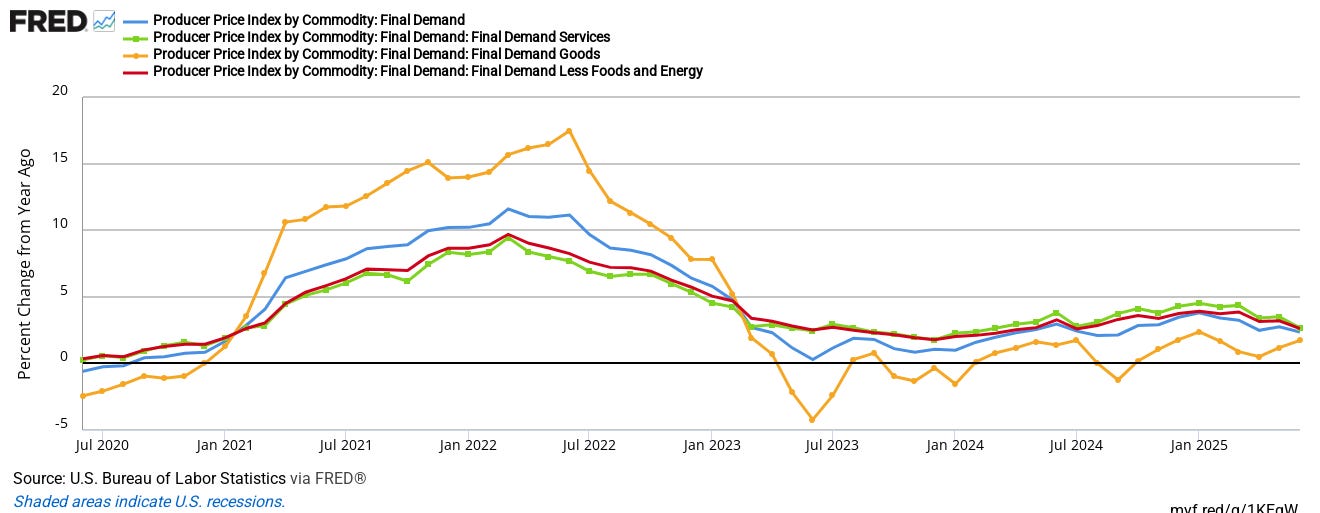

The Producer Price Index for final demand in June 2025 rose 2.3% YoY - down from 2.8% the previous month. Prices for final demand less food and energy were up 2.6% - down from 3.2% the previous month. This is a significant decline in inflation pressures, considering that the energy component advanced 0.6% this month. This is the first sign that inflation MAY be moderating - but one month of data is not a trend.

Industrial Production (IP) is showing signs of life with June 2025 up 0.7% YoY (up insignificantly from the previous month) with components manufacturing up 1.0% YoY (up from 0.8% the previous month); mining up 1.6% YoY (down from 2.7% the previous month); and utilities down 0.8% YoY (up from -1.8% YoY the previous month). Capacity utilization moved up to 77.6 percent, a rate that is 2.0 percentage points below its long-run (1972–2024) average. The improvement in manufacturing is not significant yet - but we can continue to hope President Trump’s tariffs will pump some life into manufacturing.

According to today’s release of the Beige Book by the 12 Federal Reserve Districts:

Economic activity increased slightly from late May through early July. Five Districts reported slight or modest gains, five had flat activity, and the remaining two Districts noted modest declines in activity.

Economic activity across the twelve Federal Reserve Districts showed a slight improvement compared to the previous report. Nonauto consumer spending softened slightly in most Districts, auto sales saw a modest decline following an earlier surge to avoid tariffs, and tourism, manufacturing, and nonfinancial services displayed mixed or slightly weaker performance, while loan volumes rose slightly and construction slowed due to rising costs. Home sales and nonresidential real estate activity remained mostly stable, but agriculture stayed weak, energy activity dipped slightly, and transportation showed mixed results, with a neutral to slightly pessimistic outlook as only two Districts anticipated growth. Employment edged up very slightly, with cautious hiring attributed to economic and policy uncertainty, improved labor availability, reduced turnover, and increased applications, though skilled trade shortages and reduced foreign-born worker availability were noted, alongside increased automation and AI investments to curb hiring needs; wages grew modestly, with limited layoffs mostly in manufacturing, and hiring or layoff decisions were often deferred pending reduced uncertainty. Prices rose across all Districts, with moderate to modest growth driven by tariff-related input cost pressures, particularly in manufacturing and construction, and rising insurance costs, leading many firms to pass costs to consumers via price hikes or surcharges, though some restrained increases due to price-sensitive customers, compressing margins, with expectations of sustained cost pressures likely pushing consumer prices higher by late summer.

Sponsored Content:

From the Wall Street legend with a 100% winning streak from Election Day through Q1...

The Top 3 "Trump Trades" for 2025

Here are the exact moves to position yourself for outsize gains BEFORE July 30 triggers a potential $194 TRILLION shockwave in the market.

Click here now to see his full presentation with names and tickers for Larry Benedict's top 3 stocks to watch.

ref: 7355/3

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

Infographic of the Day from Visual Capitalist:

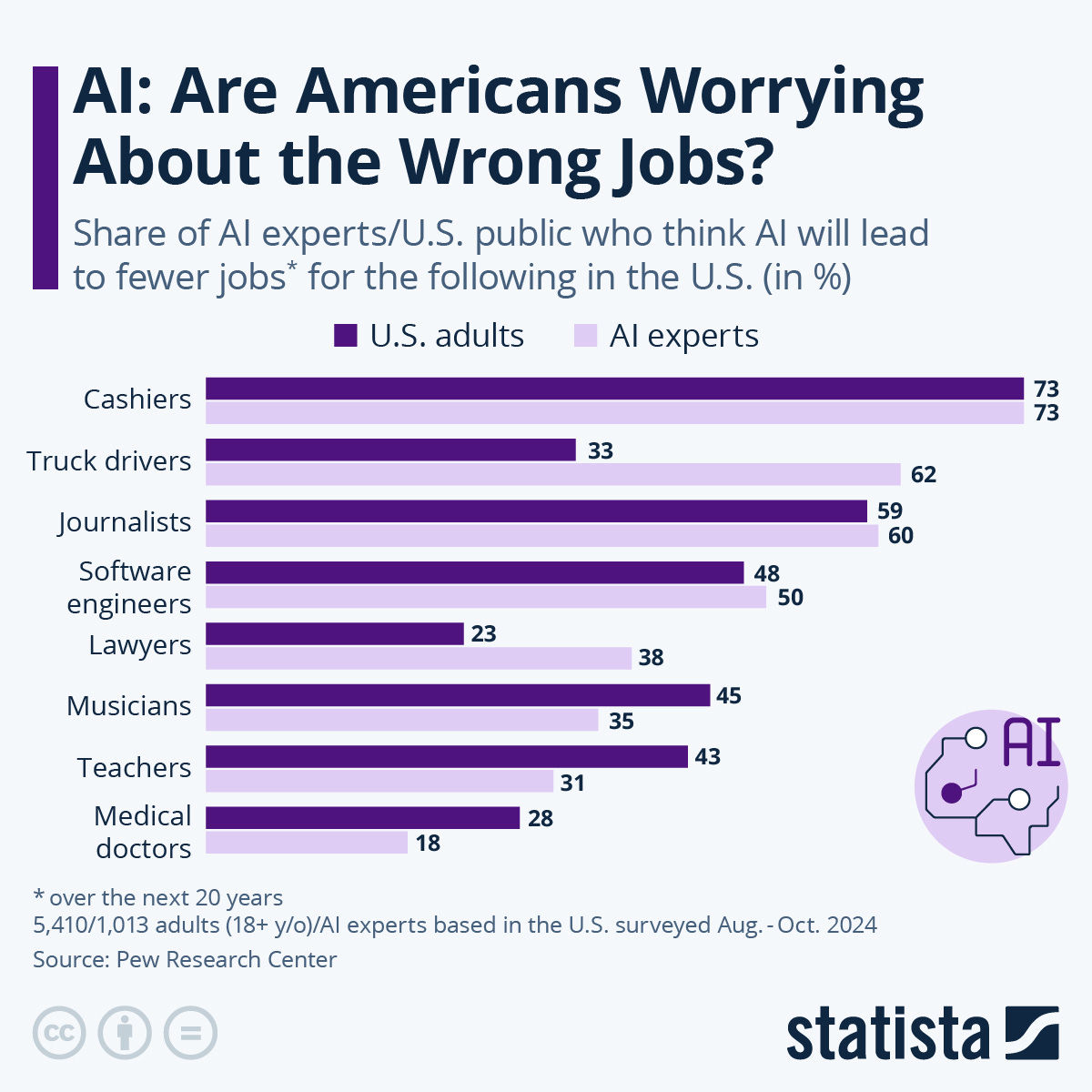

Statista Graphic of the Day:

You will find more infographics at Statista

The headlines we are reading:

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks, which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings, click HERE and enter your city, state or zip code in the upper left corner.

S&P 500 rises in volatile session as Trump denies he is firing Powell: Live updates

Stocks were taken on a wild ride Wednesday as a White House official indicated to CNBC that Trump was moving closer to firing Powell from his post as Fed Chair.

Peter Thiel just bought a big stake in Tom Lee's ether company and the shares are surging

Bitmine Immersion Technologies recently launched an ether buying strategy and named Fundstrat's Tom Lee chairman.

Scale AI cuts 14% of workforce after Meta investment, hiring of founder Wang

Scale AI said it's cutting 14% of its staff weeks after Meta invested $14.3 billion in the startup and hired a number of top staffers.

Shares of gun seller GrabAGun — backed by Donald Trump Jr. — tank after NYSE trading debut

The business is the latest example of President Donald Trump's family and allies backing companies related to conservative political causes

Tesla's change in bylaws to limit shareholder lawsuits slammed by New York state officials

New York state officials are pressing Tesla to repeal a company bylaw that limited investors' rights to sue the EV maker over breaches of fiduciary duty.

Ether is starting to outperform bitcoin - and further gains could be ahead for the crypto, charts show

Ether is on an upswing as of late, and charts are showing that further gains could be around the corner.

OpenAI says it will use Google's cloud for ChatGPT

Having faced supply shortages, OpenAI will now be drawing on computing resources from CoreWeave, Google, Microsoft and Oracle.

Bitcoin climbs as crypto regulation bills stumble in Congress: CNBC Crypto World

On today's episode of CNBC Crypto World, bitcoin climbed after the House approved a procedural vote to consider three key crypto regulation bills after GOP lawmakers halted their passage the day before. Plus, Zack Shapiro, head of policy at the Bitcoin Policy Institute, breaks down the three crypto-related bills currently sitting in the U.S. House of Representatives.

Nvidia CEO Jensen Huang sells another $37 million worth of stock

Huang has unloaded 1.2 million shares, totaling about $190 million, since he started selling stock this year, according to InsiderScore.

Trump lashes out at Republicans over Jeffrey Epstein file demands

Democrats have leaned into the rift emerging within Trump's political base over Jeffrey Epstein. The president has repeatedly urged his supporters to move on.

Why Blackstone is buying rental homes in the U.S.

Blackstone sees opportunities ahead for its rental housing portfolio, particularly in the growing U.S. Sun Belt and coastal cities.

These 10 states are America's best for workers in 2025

These 10 states are America's best at providing a strong workforce, and educational and career support within a tight national labor market.

Expect tariff 'cascade' effect across slowing global economy, top UN official warns

President Trump's tariffs will affect jobs and economic stability in many countries, and result in lower global growth, according to a top UN trade official.

Bitcoin, Ether Bounce Back As House Passes Procedural Vote On 'Crypto Week' Bills

After yesterday's disappointment - and a meeting with President Trump - conservative Republicans flip-flopped and voted to push forward with landmark cryptocurrency legislation.

As The Block reports, The House voted 215 to 211 on Wednesday to move forward and later take a vote on the Guiding and Establishing National Innovation for U.S. Stablecoins (also known as the GENIUS bill), which would create a regulatory framework for stablecoins and could be slated to head to President Donald Trump's desk before the end of the week.

Trump Sparks Market Chaos: Denies CBS Reports Of Imminent Firing Of 'Knucklehead' Powell

Update (1200ET): Well that didn't take long. President Trump was asked in the Oval Office whether he was looking to fire Powell 'soon'.

He responded 'no'...

*TRUMP: POWELL 'TERRIBLE' FED CHAIR

*TRUMP, ASKED IF HE WILL FIRE POWELL: HE HAS BEEN TOO LATE

*TRUMP: POWELL TRIED TO CUT RATES FOR DEMOCRATS

*TRUMP: POWELL DOES A TERRIBLE JOB, WE FIGHT THROUGH IT

*TRUMP, ASKED IF HE WILL FIRE POWELL: 'NOT PLANNING'

*TRUMP: NOT TALKING ABOUT FIRING POWELL

*TRUMP ON FIRING POWELL: HIGHLY UNLIKELY

*TRUMP DENIES DRAFTING LETTER TO FIRE POWELL

*TRUMP: POWELL A 'KNUCKLEHEAD'

Then Trump switched to the possible 'cause' for any firing:

*TRUMP ON POWELL, FRAUD PROBE: I THINK HE'S GOT SOME PROBLEMS

*TRUMP: POWELL SPENT MORE MONEY THAN EXPECTED

*TRUMP SAYS HE THINKS POWELL IS 'ALREADY' UNDER INVESTIGATION

And all those moves in markets below reversed!!!

Ghislaine 'Ready' To Testify As Trump Triples Down, Slams 'Weakling PAST Supporters Who Believe Epstein Hoax'

While President Trump continues to insist that the "Epstein List" of elites who partook in Jeffrey Epstein's sex trafficking ring is nothing more than a Democrat hoax, Epstein accomplice Ghislaine Maxwell is 'ready' to spill the beans.

According to the Daily Mail, "Despite the rumors, Ghislaine was never offered any kind of plea deal. She would be more than happy to sit before Congress and tell her story," adding "No-one from the government has ever asked her to share what she knows. She remains the only person to be jailed in connection to Epstein and she would welcome the chance to tell the American public the truth."

Maxwell argues she should have been protected from prosecution as part of a Non Prosecution Agreement made by Epstein - her former lover and boss - in 2007 when h ...

Status Of Tariffs With 15 Top US Trading Partners - What To Know So Far

Authored by Andrew Moran via The Epoch Times,

President Donald Trump’s administration is working to address trade imbalances with a group of 15 top trading partners.

When the president’s trade saga commenced this year, White House officials coined the term “Dirty 15” to describe a group of nations identified as having significant surpluses with the United States.

By grappling with multibillion-dollar trade deficits and various trade barriers, the Trump administration is signaling a broader realignment in international trade.

Ahead of the Aug. 1 reciprocal tariff deadline, many of these countries are scrambling to intensify negotiations, seek exemptions or reductions, and reach trade agreements.

Here is the state of trade with these foreign ...

China's Covert Support for Russia Raises EU Concerns

Publicly, Beijing has presented itself as a neutral party in the war sparked by Russia's full-scale invasion of Ukraine, claiming it respects the territorial integrity of Ukraine while also highlighting the need to address Russia's security concerns. But behind the scenes, that may be changing. According to EU officials speaking to RFE/RL on condition of anonymity, Chinese Foreign Minister Wang Yi told EU foreign policy chief Kaja Kallas last week that Beijing couldn't accept Russia's defeat in the war as it would free up Washington to focus on

IMF Praises Uzbekistan's Economic Transformation

The International Monetary Fund is upbeat on Uzbekistans economic liberalization drive but cautions that much remains to be reformed before Tashkent can realize its goal of qualifying for World Trade Organization membership. Since Shavkat Mirziyoyev assumed the presidency in 2016, Uzbekistan has averaged 5.7 percent GDP growth annually, while achieving year-on-year employment growth of about 3.6 percent, the IMF states in its latest country report for Uzbekistan. The growth rate is projected to hover around 6 percent over the next few years.

The Promise and Pitfalls of Mexicos Clean Energy Plan

For years, Mexico has been exploiting its vast oil reserves to meet its energy needs and boost its export revenues. During this time, several governments largely overlooked the countrys renewable energy potential. Many regions of Mexico experience abundant sunlight throughout the year, while the north of the country has high levels of wind. However, to date, its renewable energy sector is somewhat underdeveloped. Despite having expanded its renewable energy capacity in recent years, Mexico still relies heavily on fossil fuels. However, greater

India Rethinks Its Oil Strategy as Russian Discounts Dwindle

Indias romance with cheap Russian oil is coolingjust a touch. Russian crude imports into India crept up 1% in the first half of 2025, totaling about 1.75 million barrels per day. Thats hardly a surge, considering the price allure that first pulled India deeper into Moscows oil orbit after the 2022 Ukraine invasion. And while Russia still holds the top supplier spotaccounting for 35% of Indias crude inflowsthe real story isnt the volumes. Its the shrinking advantage. The discount on

Spot Market Tightness Boosts Aluminum Prices

Via Metal Miner The Aluminum Monthly Metals Index (MMI) remained sideways with an upside bias. Overall, the index rose 1.99% from June to July as aluminum prices slowed their ascent. Track other MetalMiner monthly indexes here, and compare how the overall industrial metal market is performing. Midwest Premium Returns to the Upside Stabilization proved temporary for aluminums Midwest Premium. After finding a peak in early June followed by a modest decline, the premium returned to the upside. By early July, it managed to surpass its previous

Indias GAIL in Early Talks for Long-Term Purchase From Alaska LNG

State-controlled natural gas firm GAIL (India) Ltd has started discussions about buying liquefied natural gas from the proposed $44-billion Alaska LNG project, industry sources familiar with the talks told Reuters on Wednesday. The potential deal to purchase LNG from the project is part of Indias push to buy and pledge to buy increased volumes of U.S. energy products and thus reduce its trade surplus with America and avoid steep tariffs. The cost of supply from Alaska LNG will be the crucial factor in GAILs decision whether to commit

Could Natural Hydrogen Reserves Really Power the Planet for Centuries?

Researchers from three respectable universities (Durham, Oxford, and Toronto) just issued a paper that lays out a guide to exploring for underground hydrogen deposits and also claims that the planets reserves, theoretically, could supply all energy needs for so many years that you would write off the number as delusional hyperbole if we repeated it. (See Ballentine, et. al.Natural hydrogen resource accumulation in the continental crust, Nature Reviews Earth & Environment). We dont know if the professors are right,

TotalEnergies Says Lower Oil and Gas Prices Will Weigh on Q2 Profit

TotalEnergies expects lower earnings in its upstream and LNG divisions for the second quarter amid a drop in oil, natural gas, and LNG prices compared to early this year and the same time last year. In an update note ahead of the Q2 results due out on July 24, the French supermajor said that its exploration and production earnings are expected to reflect the $7 per barrel decline in oil prices in the second quarter compared to the first quarter. Brent Crude prices averaged $67.90 per barrel in Q2, down from an average of $75.70

EIA Settles Market With Reports of US Oil Inventories Falling

Crude oil inventories in the United States decreased by 3.9 million barrels during the week ending July 11, according to new data from the U.S. Energy Information Administration (EIA) released on Wednesday. The build brings commercial stockpiles to 422.2 million barrels according to government data, which is still 8% below the five-year average for this time of year. The EIAs data release follows a rocky Tuesday after conflicting API inventory data shook oil bulls to their core, with initial reports on X suggesting that crude oil inventories

UK Revives Electric Car Grant but With Strict Limits

The UK government has reintroduced grants for electric vehicles (EVs) in a bid to boost lagging consumer demand, but industry insiders warn that most buyers may be left behind. Unveiled late last week, the new electric car grant will offer up to 3,750 off the price of a new EV, targeting models priced under 37,000 and meeting strict environmental production standards. Backed by 650m in public funding, the grant aims to accelerate the adoption of electric vehicles ahead of key net-zero deadlines and regulatory targets facing

Biggest U.S. Grid Operator Issues Alert for July 16

PJM Interconnection, the operator of the largest U.S. electric grid covering 13 mid-Atlantic and Midwest states, has issued a maximum generation alert and load management alert for July 16 due to expected high peak load demand. The alert does not require any action from customers, but it is mostly to notify neighboring systems that electricity exports from PJM may be curtailed on Wednesday. PJM expects a peak load of approximately 145,000 MW on July 16, the grid operator said. PJM coordinates the movement of electricity through all or parts of

U.S. Vows to Quit IEA if the Agency Keeps Pushing Green Transition

The United States could abandon the International Energy Agency (IEA) if the organization, created in the aftermath of the 1970s Arab oil embargo, doesnt return to forecasting energy demand without strongly promoting green energy. We will do one of two things: we will reform the way the IEA operates or we will withdraw, U.S. Energy Secretary Chris Wright has told Bloomberg in an interview. My strong preference is to reform it, Secretary Wright added. The official echoes voices in the U.S. Republican party that

Slovakia Holds EU Sanctions Hostage Over Russian Gas Exemption

Slovakia would drop its veto on the EUs new sanctions against Russia if it receives an exemption to continue importing Russian pipeline gas for nearly another decade, Slovakias Prime Minister Robert Fico says, as the European Union is struggling to reach a unanimous vote on the 18th sanctions package against Russia. Earlier this week, the EU failed to approve the package, which is set to include a floating oil price cap for Russias crude and a ban on the use of Nord Stream infrastructure, due to Slovakias veto. The ball

Several Oilfields in Kurdistan Halt Production After Drone Attacks

Several oilfields operated by foreign companies in Iraqs semi-autonomous region of Kurdistan have halted production in the past few hours following attacks with explosive-laden drones on infrastructure at the fields. On Tuesday, a drone attack forced the suspension of production at the Sarsang oilfield, operated by a U.S. privately held firm, HKN Energy. The attack took place hours before HKN Energy signed a preliminary agreement with the Iraqi oil ministry to develop another oilfield. HKN Energy confirmed production at Sarsang has been

Chinas Naphtha Imports Set for Record High in 2025

Expanding petrochemicals production and uncertainty about imports of U.S. ethane and propane amid the trade row are expected to boost Chinese purchases of another petrochemical feedstock, naphtha, to a record high this year, traders and analysts tell Reuters. Amid disrupted supply of cheap U.S. ethane and propane in the trade war, Chinese petrochemicals producers have boosted the use of naphtha in recent months, while uncertainties about the trade going forward are set to drive increased naphtha demand. With issues in imports of ethane and

Trump discussed firing Fed boss but 'highly unlikely' he will

The US president admitted he had broached sacking Jerome Powell but rowed back on removing him hours later.

UK inflation at highest for almost a year and a half

Food and clothing prices rose more quickly while fuel fell only slightly, boosting the overall rate of inflation.

Faisal Islam: Surprise inflation jump complicates interest rate decision

Higher inflation could give the Bank of England pause for thought over cutting interest rates.

Breakout Stocks: How to trade Biocon, RBL Bank & HDFC AMC that hit fresh 52-week high?

Indian market closed with a positive bias, as BSE Sensex and Nifty50 saw gains, led by auto, FMCG, realty, and IT sectors. Biocon, RBL Bank, and HDFC AMC hit fresh 52-week highs. Analysts suggest monitoring Biocon for a breakout above 425, RBL Bank for profit-booking, and HDFC AMC's bullish trend with resistance at 5,453.

Reliance Infra board approves Rs 6,000 crore fundraising plan via QIP

Reliance Infrastructure and Reliance Power boards approved plans to raise Rs 6,000 crore each via QIP or other modes. Both firms also cleared NCD issues worth Rs 3,000 crore.

Angel One Q1 Results: Profit dips to at Rs 114 crore on derivative trading curbs

Indian brokerage Angel One on Wednesday posted a 61% fall in first-quarter profit, as tighter rules for equity derivatives trading in India weighed on retail activity, a key driver for the brokerage's earnings.

Arm’s stock is rising as analysts say an intriguing move could be on the horizon

The chip designer looks to be evolving into making its own custom AI chips — and BNP analysts say the opportunity isn’t fully priced into its stock yet.

Goldman Sachs, Morgan Stanley earnings beats were fueled by trading surge as deal pipelines grow

Shares of Goldman Sachs and Morgan Stanley fell Wednesday despite stronger-than-expected profit from the two big banks, as investors saw little reason to bid up equity prices further after gains in recent weeks.

‘I enjoy vacations to Europe’: I’m 75 and have $1 million in an IRA. Why do I feel guilty?

“We have no long-term-care insurance. When I become debilitated, I plan to end my life at Dignitas.”

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.