15 July 2025 Market Close & Major Financial Headlines: Markets Juggle Inflation, Easing of China Chip Curbs, and Trade Tensions

Summary Of the Markets Today:

The DOW closed down 436 points or 0.98%,

NASDAQ closed up 37 points or 0.18%,

S&P 500 closed down 25 points or 0.40%,

Gold $3337 down $22 or 0.66%,

WTI crude oil settled at $67 down $0.31 or 0.46%,

10-year U.S. Treasury 4.487 up 0.06 points or 1.355%,

USD index 98.63 up $0.55 or 0.56%,

Bitcoin $116,596 down $3,243 or 2.71%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

On July 15, 2025, stock markets were influenced by several key developments. Tech stocks, particularly NVIDIA, led the NASDAQ to near record highs after the U.S. government signaled it would allow the company to resume AI chip sales to China, reversing earlier export restrictions and sparking a rally across the semiconductor sector. Meanwhile, a crucial June inflation report showed the U.S. Consumer Price Index (CPI) rising 2.7% year-over-year, driven by energy prices and tempering hopes for imminent Federal Reserve rate cuts. President Trump's recent threats to impose 30% tariffs on imports from the European Union and Mexico, and even higher duties on Russian goods, kept trade tensions high, while China’s strong Q2 GDP growth helped buoy sentiment in Asian markets. Big banks, including JPMorgan and Citigroup, kicked off the earnings season with mixed results: some surpassed estimates while others, like Wells Fargo, guided lower for the year, putting pressure on financial stocks. Treasury yields rose, especially on the 30-year bond, as investors processed the inflation spike and potential implications for future Fed policy. In commodities, oil and gold prices fluctuated modestly. Overall, markets showed resilience but remained cautious as investors weighed the first wave of corporate earnings.

Underlying Inflation Dashboard

Read the June 2025 Economic Forecast: Recession Winds - Is the Glass Half Empty or Half Full

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The June 2025 Consumer Price Index for All Urban Consumers (CPI-U) increased 2.7% year-over-year (YoY) - up from 2.4% the previous month. The index for all items less food and energy rose 2.9% YoY - up from 2.8% the previous month. The major driver for the increase this month was energy (gasoline, fuel oil, electricity, and natural gas). The indexes for used cars and trucks, new vehicles, and airline fares were among the major indexes that decreased in June.

In July 2025, the Empire State Manufacturing Survey saw a slight uptick with the general business conditions index rising twenty-two points to 5.5, marking its first positive reading since February. New orders and shipments increased, while delivery times lengthened and supply availability continued to deteriorate. Firms maintaining a fairly optimistic outlook. Could it be that manufacturing is beginning to improve? These surveys are very volatile, and I will wait until I see an uptick in hard data before I become optimistic.

Sponsored Content:

REVEALED: $194 Trillion Trump Market Pattern

Trump fires off a tweet and stocks tank...

He gives a speech and the markets soar...

Now, a new Trump executive order is set to set off a wave worth a potential $194 trillion in the markets.

And Wall Street insider Larry Benedict says it could hand investors who missed out on Trump's first term a second chance.

Click here to discover this exciting new trading pattern.

ref: 7360/3

Is the #Magnificent7 peaking?

They make up nearly 1/3 of the #SP500 — and Elliott waves suggest a major move could be near.

@elliottwaveintl is offering 30 days of trading lessons for just $30! GO (LINK)

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

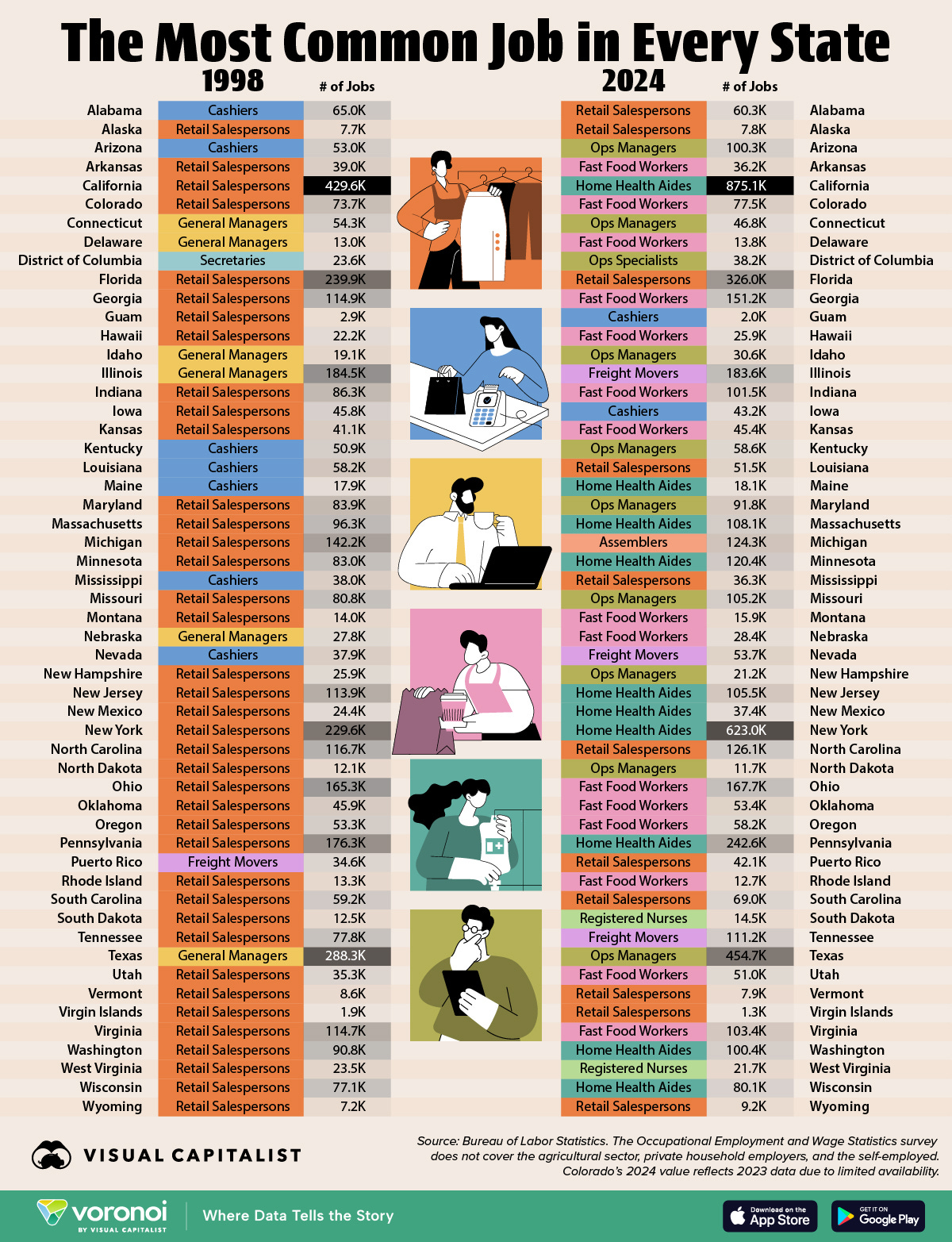

Infographic of the Day from Visual Capitalist:

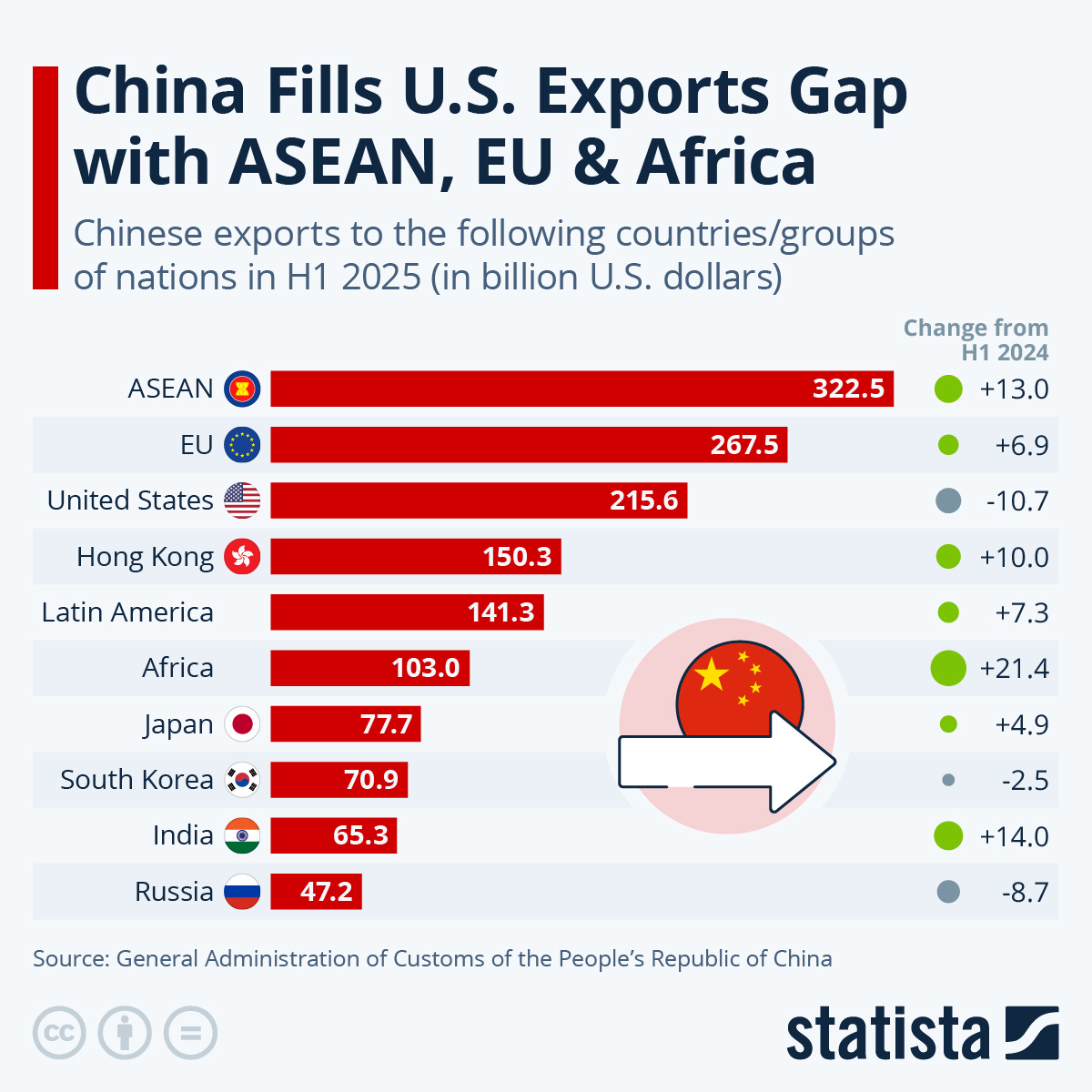

Statista Graphic of the Day:

You will find more infographics at Statista

The headlines we are reading:

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks, which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings, click HERE and enter your city, state or zip code in the upper left corner.

'Lost their identity': Why Target is struggling to win over shoppers and investors

Target is trying to bounce back from lower store traffic, inventory issues and customer backlash.

Trump-backed crypto regulation bills fail to clear key hurdle in Congress

Republicans who voted against the cryptocurrency regulation legislation objected to how the bills were structured.

Here’s the inflation breakdown for June 2025 — in one chart

June’s consumer price index showed how the Trump administration’s tariff policies have been affecting prices.

Dow drops 400 points on earnings, inflation woes; Nvidia lifts Nasdaq to record close: Live updates

June inflation data released Tuesday represented an increase from May levels, despite the headline numbers matching expectations.

Trump administration ends Polymarket investigations without charges

Closure of the criminal and civil probes come months after FBI agents seized a cellphone and other electronic devices of Polymarket CEO Shayne Coplan.

Circle stock drops after House blocks key procedural vote on stablecoin legislation

Circle shares slid Tuesday after the House blocked a key procedural vote, stalling momentum on legislation the industry has counted on for regulatory clarity.

Josh Brown talks two big bank stocks after earnings reports

The investor broke down the case for Citigroup and JPMorgan shares after the banks released their latest quarterly financials.

Trump says Indonesia trade deal features 19% tariff; Jakarta yet to confirm

Trump in a Truth Social post called it "great deal, for everybody," and said it followed direct dealings with Indonesian President Prabowo Subianto.

GM expands production of gas-powered SUV, trucks in Michigan

General Motors will produce the Cadillac Escalade at an assembly plant in Michigan, and expand the Chevrolet Silverado and GMC Sierra light duty pickups.

Jamie Dimon says JPMorgan Chase will get involved in stablecoins as fintech threat looms

JPMorgan Chase is a juggernaut in the global payments industry, helping move nearly $10 trillion daily, so it makes sense that it would explore stablecoins.

The world's 'football' is America's 'soccer': Trump signaled that could change

Trump appears to have caught the bug for what the British call "the beautiful game."

These 10 U.S. states are best positioned with electricity to power AI data center boom

Tech giants from Google to Meta to OpenAI are leading an AI data center boom. Some state electricity grids are better set to meet the massive power needs.

Bitcoin is nearly double where it was a year ago. This is what's behind the run

Firms like GameStop and Trump Media are following the Michael Saylor playbook and treating bitcoin as a strategic reserve.

Cal State Prof Arrested, Accused Of Assaulting ICE Agents During Cannabis Farm Raid

Authored by Emily Sturge via Campus Reform,

A California State University Channel Islands (CSUCI) professor was arrested July 10 after allegedly assaulting law enforcement agents during a U.S. Immigration and Customs Enforcement (ICE) operation targeting illegal labor at marijuana farms.

Jonathan Anthony Caravello, a math and philosophy lecturer, is among four U.S. citizens “being criminally processed for assaulting or resisting officers” during coordinated ICE raids at Glass House Farms cannabis grow sites in Camarillo and Carpinteria, California, according to the

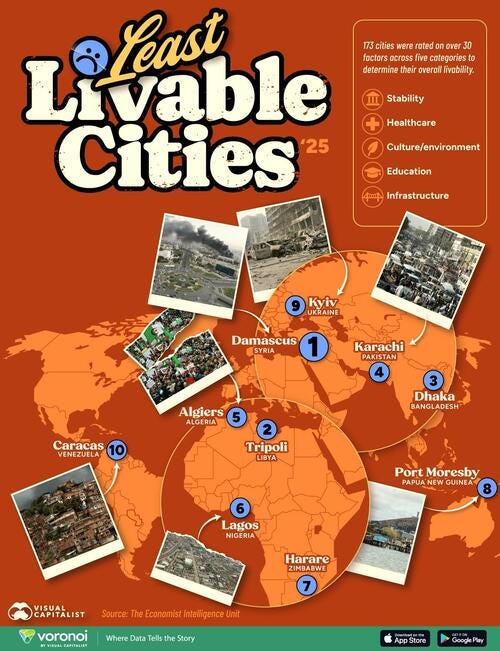

These Are The 10 Least Livable Cities In The World

While some cities are celebrated for their high quality of life, others are plagued by deep-rooted challenges that make daily life difficult and dangerous in many cases.

From ongoing wars and political instability to inadequate infrastructure, this map, via Visual Capitalist's Kayla Zhu, shows the 10 least livable cities in the world, according to The Economist Intelligence Unit’s Global Liveability Index 2025.

The index ranks cities on over 30 factors across five categories to determine their overall livability. Factors include:

Stability: Prevalence of crime, terror, military conflict, civil unrest/conflict

Healthcare: ...

Gold Revaluation: Trump's Red Button Option?

Authored by Matthew Piepenburg via VonGreyerz.gold,

Could a gold revaluation be on Trump’s mind? Below, we consider the options facing a debt-sick America.

A Bug Racing for a Windshield

As we’ve been warning for years, the US and USD are a bug rapidly seeking a debt-hard windshield.

The trend and speed of this collision (and debt trap) are becoming increasingly more obvious with each passing day and headline.

In simplest terms, as US debt levels soar moon-bound, trust and interest in its IOUs (and the currency/dollar backing those IOUs) are sinking toward the ocean floor.

The evidence of such otherwise “dramatic” statements is literally everywhere.

Hard Questions

For example, although not at war, the US is running World War 2 debt-to-GDP ratios at the 120% level. ...

Phoenix Taco Shop Owner Busted For Hiring Illegals - Time To Crack Down On Employers

Knowingly hiring illegal aliens is a major crime, and under President Trump's Border Czar Tom Homan, the federal government is cracking down on employers who exploit cheap migrant labor. In some cases, employers have even been caught hiring illegal alien children (or maybe even trafficked by labor mules), as exposed during last week's ICE raids on marijuana farms in Governor Newsom's far-left progressive utopia of California.

Hiring scrutiny on employers continues nationwide, with local media outlet 12 News in the Phoenix area reporting that Homeland Security Investigations arrested Blademir Angulo, 42, after a four-month-long investigation found he had hired at least a dozen illegal aliens at his restaurant, El Taco Loko.

Here's more from the local media outlet:

According to court documents, Angulo not only hired the workers but also allegedly paid them in cash and allowed them to live in recreational vehicles and trailers on property he owns in Laveen, near 63rd Avenue and Baseline Road. Agents also surveilled a second property near 16th Avenue and Southern Avenue as part of the investigation.

An 18-page federal complaint filed on July 11 charges Angulo with four federal crimes: Alien in Possession of a Firearm, Harboring Illegal Aliens, Improper Entry by an Alien, and a Pattern and Practice of Knowingly Employing Unauthorized Aliens.

In an interview, A ...

Why Trump is Giving Putin a 50-Day Window for Peace

When US President Donald Trump said he would make a major statement on Russia, it led to speculation he might tap nearly $4 billion in unused US military aid for Ukraine or finally slap sanctions on Moscow and its major trading partners. Instead, Trump announced that NATO members would send existing weapons like Patriot missile systems to Ukraine and backfill them by buying new ones from the United States. NATO Secretary-General Mark Rutte, who joined Trump in the White House for the July 14 announcement, said the dollar amount of

Puerto Rico's Energy Crisis Deepens with LNG Contract Dispute

Weeks after New Fortress Energy rallied on news of a temporary contract extension for LNG supply to Puerto Rico, Bloomberg now reports the island has idled temporary power plants after the company abruptly halted a critical gas shipment, raising the risk of power outages at the peak of summer demand. Puerto Rico Energy Chief Josue Colon slammed the LNG shipment cancellation as "unjustified," disputing New Fortress's claims of being owed millions of dollars since 2020. With 10 out of 14 temporary generators offline and the rest running on expensive,

Latin America Isnt Signing Blind Mining Deals Anymore

The mining sector continues to face new and growing challenges. President Trump only yesterday pushed copper prices to record highs after threatening 50 percent tariffs on the precious metal. Latin America is as exposed as any other region to the US tariff policy. But when it comes to the green energy transition, it's mining companies and governments that will play an outsized role. Understanding what drives relevant sectors across the region is therefore crucial. For decades, the regions abundant mineral wealth has positioned it as one

Central Asian Nation's Crypto Boom Sparks International Alarm

Silence from Kyrgyz officials is adding to international concerns about alleged transactions worth billions of dollars on a cryptocurrency exchange registered in the Central Asia country. Grinex, the platform at the center of the controversy, reportedly facilitated $9 billion in transactions between January and April this year, primarily using a ruble-pegged stablecoin (a type of cryptocurrency) known as A7A5. These revelations, first brought to light by The Financial Times in late June, raise concerns that Grinex could be a crucial player in Russian

UK Extends Renewable Energy Contracts to 20 Years in Latest CfD Overhaul

The UK government has confirmed it will extend the length of its renewable energy contractsfrom 15 years to 20under the Contracts for Difference (CfD) scheme. This change, confirmed July 15, kicks in with Allocation Round 7 (AR7), opening for bids in August 2025, and applies to solar, onshore wind, offshore wind, and floating offshore wind technologies. The CfD scheme, the governments flagship program for supporting low-carbon electricity, offers developers a guaranteed price for the power they generate. By stretching the contract

Dutch Industry Buckles Under Energy Transition and Global Pressure

From Dutch Disease to German De-Industrialization, the energy transition is no longer a distant threat but a pressing issue already impacting the Dutch economy. Europes ongoing energy transition, driven by the need to reduce dependence on risk-prone suppliers like Russia, the Middle East, and Africa, continues to receive support from the European Union and its member states. The push for more renewablesespecially offshore wind, solar, and increasingly biofuelsis not only reducing CO? emissions but

Kazakhstan Not Leaving OPEC+ Despite Constantly Busting Quotas

Non-OPEC producer Kazakhstan, which is boosting its oil output in defiance of its quotas in the OPEC+ deal, doesnt plan to leave the alliance of producers, the countrys top officials said on Tuesday. Kazakhstan is not considering leaving the OPEC+ pact as it believes it helps stabilize the oil market, Prime Minister Olzhas Bektenov said on Tuesday, as quoted by Russian news agency Interfax. We will do our best to fulfill our obligations, but well take into account national interests, the prime minister was quoted

Exxon Mobil Borrows From SPR Due to Mars Crude Quality Issues

As Trump officials signal plans to refill the Strategic Petroleum Reserve (SPR)drained under the Biden-Harris regimea new report reveals that ExxonMobil has begun drawing from the SPR due to contaminated crude supplies from offshore rigs in the Gulf of America to avoid refinery outages. Bloomberg reports Exxon is borrowing up to 1 million barrels of crude from the SPR due to quality issues with Mars crude a Gulf of America oil grade contaminated with high levels of zinc, which can damage refinery equipment. According

Google Signs a Record $3-Billion Hydropower Deal to Power AI

Google has signed a $3-billion agreement to source electricity for data centers from Brookfield Asset Managements hydropower facilities, in the worlds largest corporate clean power deal for hydroelectricity, the asset manager said on Tuesday. The first contracts executed under the agreement to deliver up to 3 gigawatts (GW) of carbon-free hydroelectric capacity across the United States are for Brookfields Holtwood and Safe Harbor hydroelectric facilities in Pennsylvania, representing more than 670 MW of capacity. The 20-year

Oil Markets Ignore Trump's Russia Threats

Oil markets have largely ignored Trump's threats to impose 100% secondary tariffs on any country that buys Russian exports, with prices dropping significantly on Tuesday morning.- European natural gas prices have posted a five-day hot streak as Northeast Asian heatwaves drained South Korean and Japanese inventories, prompting buyers to divert cargoes there, only for Europe to confront its own sultry weather.- Front-month TTF gas futures, the benchmark for the European market, moved up to 35 per MWh ($13/mmBtu) as US President Trumps

Gasoline Prices Rise Despite Oil Benchmarks Falling

U.S. gasoline prices climbed for a second consecutive week despite falling oil benchmarks, with the national average rising to $3.11 per gallon and diesel hitting $3.676, the highest since August 2024, according to GasBuddy. GasBuddy analyst Patrick De Haan cited tight inventories and strong seasonal demand as key factors, noting diesel remains under the most upward pressure due to export strength and regional supply constraints. The price increase comes as crude benchmarks see a small rebound. As of morning trading on Tuesday at 9 a.m. ET, the

OPEC+ Oil Production Fell Short of Targeted Hike in June

The OPEC+ producers pumped 41.559 million barrels per day (bpd) of crude oil in June, up by 349,000 bpd from May, but lower than the 411,000 bpd monthly increase under the alliances output hike plan. These production figures, reported by OPEC in its Monthly Oil Market Report (MOMR) out on Tuesday, suggest what market analysts have been saying for weeksthe actual monthly production hikes are lower than the headline quota number, which spooked the market, fearing oversupply when the output hikes were first announced. OPEC-only production

Germany Set to Miss Wind Power Targets Despite Soaring Additions

Germany saw the highest number of onshore wind turbines commissioned in the first half of 2025 for eight years, but the rebound in installations is still off track to reach the official targets, the German wind energy association, Bundesverband WindEnergie (BWE), said on Tuesday. As many as 409 new turbines of a total of 2.2 gigawatts (GW) started up between January and June, up by 67% from a year earlier, according to BWEs data. A total of 7.8 GW of new wind energy capacity was approved during the first half of 2025. Thats a record-high

Nigeria Seeks 25% Higher OPEC+ Oil Production Quota for 2027

Africas top oil producer, Nigeria, is seeking a production target under the OPEC+ agreement of 2 million barrels per day (bpd) for 2027, up from the current quota of 1.5 million bpd, Bashir Ojulari, chief executive of state-held oil firm NNPC, has told Argus. Nigeria has been pumping oil below its output quota for years, but has recently ramped up production, which now stands at about 1.4 million bpd, per Ojularis estimates. OPEC+ delegates have started talks about establishing the baselines for individual members production

Chinas Refinery Runs Hit Highest Level in Nearly Two Years

Improved fuel margins and the end of spring maintenance boosted Chinas oil refinery throughput in June to the highest level since September 2023. Chinese refiners processed a total of 15.2 million barrels per day (bpd) of crude oil into fuels last month, up by 8.5% from a year earlier, and up from the lows seen in April and May, according to Bloomberg calculations based on official Chinese data released on Tuesday. Amid heavy planned seasonal maintenance, crude oil processing at Chinas refineries dipped by 1.8% in May from a year

Stop being negative about savers buying shares, Reeves says

Chancellor tells the financial industry to change the narrative around consumer investment to encourage growth.

Savers to be targeted with offers to invest in shares under new plans

Banks will send savers details of possible investments and an ad campaign will raise awareness, the Treasury says.

Thames Water 'extremely stressed', warns boss amid huge losses

The company's future remains uncertain as it posts losses of £1.65bn for the year to March.

HDFC Life sees growth outpacing industry despite early-year slowdown

HDFC Life expects to outperform the life insurance industry in H1 FY26, even as sector growth slows due to regulatory changes and weak demand. Recovery is expected in H2.

SK Finance loan book jumps 27% to Rs 13,261 cr; eyes Rs 2,200 cr via IPO

Jaipur-based SK Finance Ltd, a non-banking financial company, on Tuesday reported 27 per cent rise in its loan book to Rs 13,261 crore for FY25, compared to Rs 10,476 crore in the previous year.

Spandana Sphoorty to raise Rs 400 crore via rights issue for FY26 plans

Spandana Sphoorty Financial will raise up to Rs 400 crore through a rights issue as part of its Rs 750 crore FY26 equity plan. Board meets Friday to finalize terms.

This legendary investor has been shorting Treasury bonds. Here’s how to trade with him.

Stanley Druckenmiller’s bet against America’s debt is no ordinary trade.

Bond market sends troubling signal on inflation that should concern investors

The U.S. bond market sold off on Tuesday in a manner that tends to spell fresh trouble for many stock investors.

NFL star Odell Beckham cheers bitcoin’s all-time high after taking his 2021 salary in the crypto. Here’s what it’s worth now.

“Safe to say we still happy with our decision,” Beckham says.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.