14 July 2025 Market Close & Major Financial Headlines: Wall Street Holds Steady as Trade and Fed Drama Dominate Headlines

Summary Of the Markets Today:

The Dow closed up 88 points or 0.20%,

NASDAQ closed up 55 points or 0.27%, (New Historic high 20672, Closed at 20,611)

S&P 500 closed up 9 points or 0.14%,

Gold $3,355 down $9.10 or 0.27%,

WTI crude oil settled at $67 down $1.36 or 1.99%,

10-year U.S. Treasury 4.425 down 0.002 points or 0.035%,

USD index 98.10 up $0.25 or 0.25%,

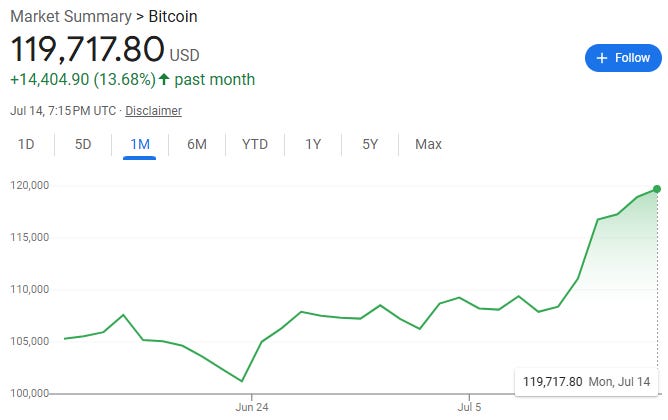

Bitcoin $119,839 up $887 or 0.74%, (24 Hours), (New Bitcoin Historic high 122,978)

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

On July 14, 2025, stock markets were treading water - but the NASDAQ was still able to reach a new high. Last week, it was announced that 30% tariffs on most imports from the European Union and Mexico would start on August 1, unless rapid progress is made on trade agreements. The EU responded by extending its suspension of retaliatory measures in hopes of a negotiated settlement. Wall Street likes cheap money and President Trump’s continued narrative to dismiss Federal Reserve Chair Jerome Powell over budget overruns was positive for the markets. Investors also braced for a packed week of economic data—including U.S. inflation and retail sales figures—and the kickoff of second-quarter earnings season, led by major banks. Notably, Bitcoin surged to a record high above $120,000 at one point today, and gold and oil prices declined amid speculation about further sanctions on Russia. Meanwhile, select stocks such as Boeing and cryptocurrency-related firms outperformed, while analysts flagged stretched valuations in growth stocks and recommended portfolio rebalancing in light of ongoing volatility.

Read the June 2025 Economic Forecast: Recession Winds - Is the Glass Half Empty or Half Full

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

no releases today

Sponsored Content:

Pres. Trump's Tariffs Just Created IRS "Wealth Protection Window"

President Trump is dead serious about returning America's manufacturing jobs.

But China's dumping of US bonds and its anti-dollar attack triggered a stock market bloodbath.

That's why retirement savers like you are using a little-known "wealth window" to shield their IRA, 401(k), and pension savings.

Best part? You can get started 100% TAX-FREE.

Grab Your FREE 2025 Wealth Protection Guide Now

ref: 7541/3

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

Infographic of the Day from Visual Capitalist:

Statista Graphic of the Day:

You will find more infographics at Statista

The headlines we are reading:

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks, which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings, click HERE and enter your city, state or zip code in the upper left corner.

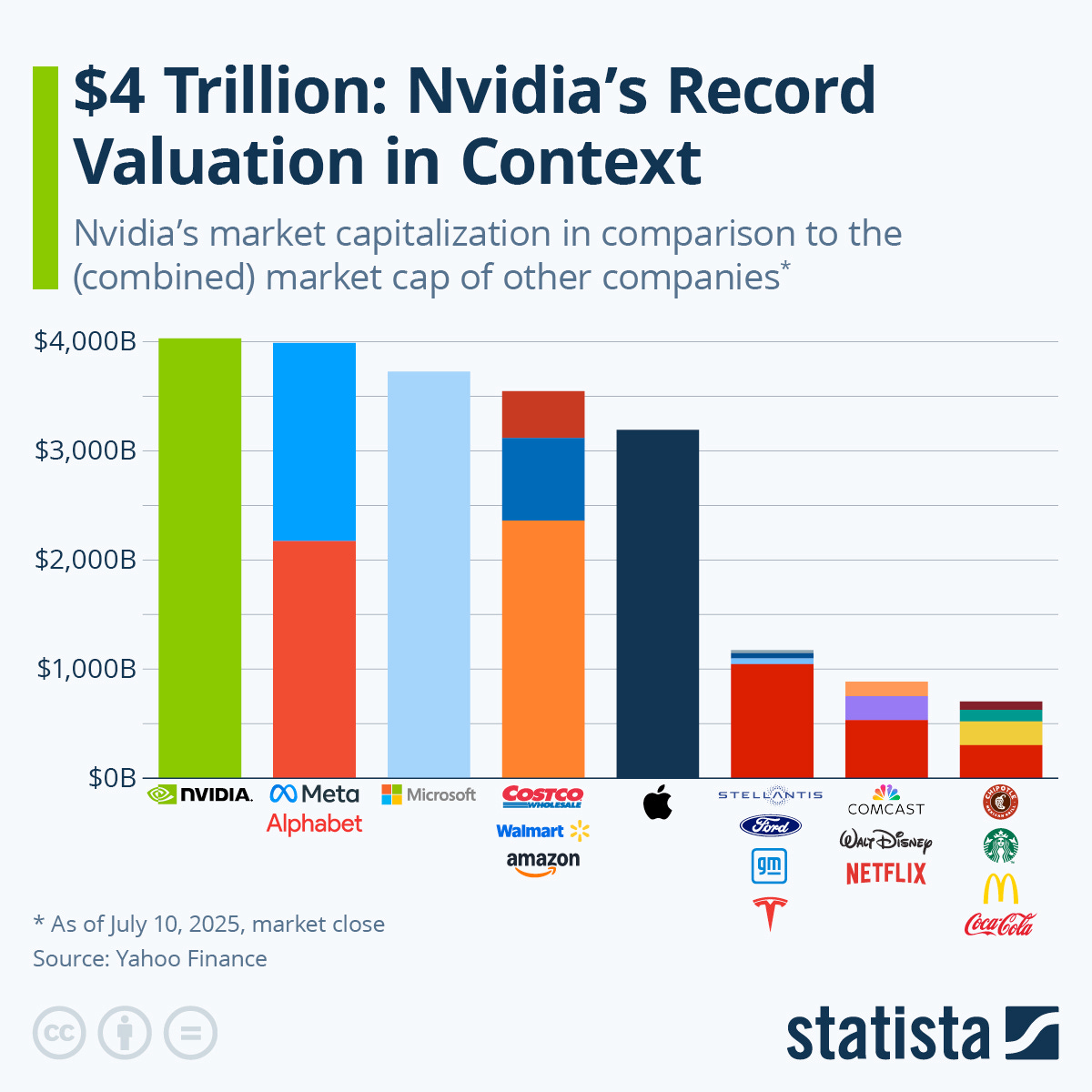

AI Story Gooses Stocks Into the Ozone

Nvidia became the world's first $4 trillion company last week, leapfrogging Microsoft, Tesla, Google and every other company struggling to stay in the AI game. Our money is on Musk to compete the hardest. He is Nvidia's biggest customer for their most powerful chips, which sell for as much as $200,000. Musk has been buying them by the tens of thousands.

Powell asks inspector general to review $2.5 billion renovation after Trump blasts Fed project

Powell asked for the review following blistering criticism of the project.

Nearly one-third of major U.S. housing markets now see falling home prices

Home price gains are shrinking quickly and in some cities are actually now lower compared with a year ago. This is due to high mortgage rates and more supply.

S&P 500 posts slim gain Monday as traders hope for lower tariffs before Aug. 1 deadline: Live updates

Losses were kept in check as investors bet those duties will eventually be negotiated down.

This $30 Labubu doll became an international status symbol—it brought in $423 million for its company last year

Labubu dolls are seemingly a worldwide obsession. Here's how the toy's maker Pop Mart built the viral fashion sensation, with some celebrity luck involved.

Dividend payouts could hit a record this year. These stocks are Wall Street's favorites

The cumulative dividend payment for the S&P 500 index is poised to hit a record in 2025, up 6%, according to S&P Dow Jones Indices.

Starbucks employees to return to the office four days a week — or take a payout

Starbucks CEO Brian Niccol wants employees back in the office four days a week to aid the company's turnaround.

Trump threatens 100% tariffs on Russian export buyers unless Ukraine peace deal is reached by September

Trump's tariffs could hit China, India and Brazil especially hard. All three countries are top buyers of Russian fossil fuels.

Bitcoin hits new record above $123,000 as 'Crypto Week' kicks off on Capitol Hill: CNBC Crypto World

On today's episode of CNBC Crypto World, bitcoin notches yet another new record, this time above $123,000. Plus, 'Crypto Week' kicks off on Capital Hill where the House of Representatives will debate a series of crypto-related bills. And, Cosmo Jiang of Pantera Capital discusses the growing trend of corporate crypto treasuries.

Cognition to buy AI startup Windsurf days after Google poached CEO in $2.4 billion licensing deal

AI startup Cognition on Monday said it's acquiring Windsurf in a deal that will include the coding company's IP and user base.

Trump tariffs don't cause inflation because of 'patriotism' buying: WH advisor

President Donald Trump recently issued a raft of new tariff threats, including steep rates on dozens of countries and a new duty on copper imports.

These states are America’s worst for quality of life in 2025

Quality of life considerations like crime rates, health and child care availability, and air quality dictate where people live, and where businesses locate.

These 10 states are America’s best for quality of life in 2025

These 10 states offer residents the best quality of life across several factors, such as low crime rates, good air quality, and access to health and child care.

Musk's xAI faces European scrutiny over Grok's 'horrific' antisemitic posts

Grok generated and spread antisemitic hate speech across X and praised Adolf Hitler.

What Seinfeld Teaches Us About Memecoins

Authored by Omid Malekan,

The 90s TV show Seinfeld — which is widely considered one of the greatest comedies of all time — was famously “a show about nothing.” Unlike most other sitcoms of that era, there was no overarching story across 9 seasons. It wasn’t about friendship or love or family, and the characters never grew or changed. This was such a core part of the show that it became one of the few continuous plotlines as a show within the show.

Being about nothing was a great setup to highlight the absurdities of daily life and an effective way of questioning social mores. This is also why it’s one of the most quotable shows of all time.

Memecoins, to me, are “an asset class about nothing.” Unlike Bitcoin, which is a powerful form of

The Pentagon Just Took An Equity Stake In A Goldman Idea Dinner "Consensus Short"

One month ago, when looking at the stocks most likely to benefit from the US government's transition to realpolitik statecraft, we listed two companies which we were confident would be on the receiving end of the Trump administration generosity, largely due to their critical position in the domestic rare earth element supply chain: MP Materials (MP) and USA Rare Earth (USAR).

Or just invest $10BN in MP and USAR to kick start US rare earth production. https://t.co/ZTluZnotTn

— zerohedge (@zerohedge) June 12, 2025

Then just to underscore how vast the bullish case in the name is, we showed that the short interest in (the very illiquid) MP is a whopping 21% of the float...

21% of MP float is short https://t.co/haptIKUYJs pic.twitter.com/68cZGr4QQ0

— zerohedge (@zerohedge) June 12, 2025

... and the piece de resistance, was our lengthy report for subscribers "

Inflection Time?

Authored by Russell Clark via Capital Flows & Asset Markets,

A well spent youth travelling around the world in my early 20s meant that I was very old to join UBS as a graduate trainee at the age of 25. I was even older to start as a fund management research analyst at the age of 27. I was extremely hungry for success, and I would spend all my time studying what the successful fund managers at my firm were doing. At the time the most successful manager at my firm as a chap called Andrew Green. He came to work maybe two or three days a week, and when asked about his investment ideas or philosophy, his answers were positively cryptic. He was the first, and probably truly most successful “contrarian” investor I have ever seen. Below chart is taken from an article announcing his retirement.

Pounce! Democrats Suddenly Care About Epstein Files, Move To Force Disclosure

And just like that, Democrats suddenly care about the Jeffrey Epstein... with House reps. preparing to introduce measures this week aimed at mandating the release of documents related to the late financier and convicted sex offender Jeffrey Epstein. The effort follows a recent Department of Justice memo claiming no official “ client list” of powerful individuals tied to Epstein exists - a statement the Trump administration appears eager to move past.

Rep. Ro Khanna (D-CA) announced Saturday he plans to introduce an amendment requiring a House vote on making the Epstein files fully public. The measure is intended to compel Speaker Mike Johnson (R-LA) to bring the issue to the floor, forcing lawmakers to take a public position on the transparency initiative tied to Epstein’s network.

Global Oil Consumption Reaches All-Time High

Each year, the Statistical Review of World Energy offers important insights into global energy trends. Now published by the Energy Institute in collaboration with KPMG and Kearney, the 2025 editionreflecting full-year 2024 datareveals that global oil production and consumption remained relatively steady, but there are meaningful shifts underway. These shifts reflect not only changing geopolitics and economic recovery patterns but also longer-term questions around energy security, investment priorities, and the uneven global evolution

Argentina Wins Brief Reprieve in $16 Billion YPF Legal Battle

A U.S. judge has temporarily delayed Argentinas court-ordered transfer of its 51% controlling stake in state-run oil giant YPF, granting the cash-strapped country three extra daysuntil July 17to pursue emergency relief from a $16.1 billion judgment. The delay, ordered Monday by District Judge Loretta Preska, comes after Argentina asked the 2nd U.S. Circuit Court of Appeals to intervene. Judge Preska made clear the stay is short-term only, chastising Argentina for its continued attempts to sidestep the ruling. The Republic

Copper Tariffs: A Risky Gamble for U.S. Industry

The mainstream news media has already figured out that the Trump administration's proposed tariffs on imported copper of 50 percent would dramatically hike copper prices for American industry and raise the price of products containing copper for consumers, which is just about everything electrical. The reason is simple; The United States is a net importer of 45 percent of its copper needs according the U.S. Geological Survey. All right, you may say, so there will be some short-term pain until the United States develops enough new copper mining

Why Stainless Steel Prices Are Rising Despite Low Consumption

Via Metal Miner The Stainless Monthly Metals Index (MMI) moved sideways, but the downside bias continued. Overall, the index fell 0.9% from June to July. Meanwhile, nickel prices continued their slow slide downward. Mill Price Hikes Hold June brought in a wave of price hikes from U.S. mills. NAS led the market, issuing possibly its largest ever increase in one single announcement. This was quickly followed by ATI and Outokumpu, which seemingly reinforced NASs move. While buyers with negotiated contracts have thus far been spared from the

Russias Cheap Oil Ride to India Hits a Fragile Plateau

Freight rates for Russian Urals crude from Baltic ports to India have dipped again in July, falling to $5.0$5.3 million per Aframax shipmentdown from $5.5$5.7 million in Juneas more tankers become available. But traders warn: dont get too comfortable. A new round of EU sanctions and a pending statement from Donald Trump could send ratesand risksright back up. The drop in shipping costs reflects a brief window of flexibility. With Urals crude still priced under the $60 per barrel price cap, Western

OPEC Claims the World Needs $18.2 Trillion in Oil and Gas Investments by 2050

The world needs $18.2 trillion in oil and gas investments through 2050 to ensure energy supply by the middle of the century, OPEC Secretary General Haitham Al Ghais has told Energy Connects in an exclusive interview. Oil demand is set to continue rising through 2050, with consumption expected at 123 million barrels per day (bpd) then, up from about 104 million bpd this year, according to OPECs annual World Oil Outlook (WOO) released last week. Oil is still expected to account for 30% of the global energy mix in 2050, according to OPECs

Why Aramco Cant Win Under Trumps Oil Price Doctrine

The broad view of the US President Donald Trumps first administration as exclusively told to OilPrice.com at the time by a senior legal figure in that team was: Were not going to put up with any more crap from the Saudis. That comment came after Saudi Arabia had yet again started another oil price war in early 2020 designed to cripple or destroy U.S. shale producers by dramatically increasing oil production to crash oil prices. It was exactly the same strategy it had used in the 2014-2016 Oil Price War, which had abjectly

Occidental Flags Lower Production and Oil Price Hit to Q2 Earnings

Occidental Petroleum Corporation expects its oil and gas production in the Gulf of Mexico for the second to have been lower than previously guided due to curtailments, while lower oil prices reduced realizations from sales. Ahead of the full Q2 earnings release on August 7, Oxy said in an SEC filing on Monday that its oil and gas output from the Gulf of Mexico or as many oil firms are now calling it the Gulf of America is estimated at around 125,000 barrels of oil equivalent per day (boepd). Occidentals Gulf of America

Hormuz Is a Warning Shot Europes Energy Strategy Is Stuck in the Past

The recent flare-up between Israel and Iran, followed by U.S. military engagement and a tenuous ceasefire, has once again exposed just how fragile the geopolitical architecture of global energy truly is. While open conflict has temporarily de-escalated, this latest episode shows that the risk of broader regional disruption remains very real. At the center of it all lies the Strait of Hormuz, the narrow maritime corridor through which a fifth of the worlds oil and a third of its LNG passes each day. Even in the absence of a full-scale blockade,

Indonesia Ties Purchase of More U.S. Oil to Reduced Tariffs

Indonesia will buy billions of U.S. dollars worth of American oil and oil products if the U.S. tariffs on Indonesian goods are lowered, Indonesias Energy Minister Bahlil Lahadalia said on Monday. Indonesia could scrap plans to import energy commodities from the United States if the Trump Administration refuses to lower tariffs on Indonesian goods, Indonesian media reported. If theres no agreement, then theres no deal. Well wait for the official decision from the chief economic minister, Jakarta Globe quoted

Trump Criticizes Putin Ahead of Ukraine War Announcement

US President Donald Trump has pledged to send additional Patriot air-defense systems to Ukraine, a policy shift coinciding with what he promised would be a "major statement" regarding Washington's approach to Russia. In comments late on July 13, Trump did not provide specifics on the planned Patriot deliveries to Kyiv -- which has long pleaded for the systems it sees as crucial to defending its cities from Russian air strikes, which Moscow has ramped up in recent weeks. He also criticized Vladimir Putin, the latest in a series of negative remarks

DOE Okays Exchange From SPR to Exxon to Ease Crude Quality Issue

The U.S. Department of Energy has authorized the exchange of up to 1 million barrels from the Strategic Petroleum Reserve (SPR) to ease the crude shortage at Exxons refinery in Baton Rouge, Louisiana, after quality issues with the Mars crude grade emerged last week. DOE has authorized an exchange from the SPR with ExxonMobil Corporation to address logistical challenges impacting crude oil deliveries to the companys Baton Rouge refinery. U.S. Secretary of Energy Chris Wright authorized this action to help maintain a stable

Chinas Coal Imports Plunge to Two-Year Low

Surging domestic coal production and weaker demand resulted in Chinas lowest volumes of coal imports in June for nearly two and a half years. China imported last month a total of 33.04 million metric tons of coal, down by 26% from a year earlier and down by 8% compared to May, according to data from the General Administration of Customs cited by Reuters. Chinese imports in June 2025 were at their lowest level since February 2023, the data showed on Monday. Coal imports dipped by 11% in the first half of the year from the same period of 2024,

BP-Eni JV Makes Major Gas Discovery Offshore Angola

Azule Energy, a joint venture of international majors BP and Eni, has discovered a major natural gas reservoir offshore Angola in the first gas-targeting exploration well in the oil-producing country. Azule Energy, the operator of Block 1/14, has announced a gas discovery at the Gajajeira-01 exploration well, located in the Lower Congo Basin in Angolas waters. Initial assessments suggest gas volumes in place could exceed 1 trillion cubic feet, with up to 100 million barrels of associated condensate, Azule Energy said, adding that these results

Puerto Ricos Energy Crisis Deepens Amid Dispute With LNG Supplier

Puerto Rico has temporarily shut most of the power generators on the island after not receiving an LNG shipment from New Fortress Energy amid a weeks-long dispute over supply contracts. Puerto Ricos power grid has been strained as-is, and now the shutdown of ten out of the 14 temporary power generating units threatens to lead to outages during the peak summer demand. U.S. gas supplier New Fortress Energy has canceled an LNG cargo shipment to the U.S. territory in a move described as unjustified by Puerto Rico energy czar Josue

Trump threatens Russia with tariffs while unveiling new Ukraine weapons plan

Under the new plan, the US will sell weapons to Nato countries who will send them to Ukraine.

Post Office could be owned by its postmasters, government says

The service could be turned into an employee-owned business, under options set out by the government.

Bank boss ready to cut rates if job market slows

Andrew Bailey tells the Times he believes "the path is downward" on interest rates.

IPO Spotlight: 7 IPOs in focus this week; 4 new issues to open, 3 listings on radar

The IPO market is gearing up for an eventful and busy week ahead. From July 14 to July 18, investors can expect a total of seven significant IPO-related activities across both the mainboard and SME. This includes three companies that will be getting listed on the stock exchange, as well as four new IPOs that will open for public subscription during this period.

JP Power shares rally 7% in one week. Should you buy, sell or hold?

Jaiprakash Power Ventures Ltd shares are seeing a surge. The stock price hit Rs 24.75 on the NSE. This extends a rally from the past week. Adani Group bid to acquire Jaiprakash Associates. JP Associates is undergoing insolvency resolution. Six bidders are in the race. Analysts see potential for further upside if the stock crosses Rs 24.

Gold prices hit 3-week high at Rs 98,132/10 grms, silver surges to record. Here’s how to trade

Gold and silver surge as renewed U.S. trade tariffs drive safe-haven demand, fueling fresh uncertainty in global financial markets.

These stocks are lagging the S&P 500’s record rally. Is it a red flag for markets?

The underperformance of small caps and discretionary stocks is not a reason for investors to reduce exposure in U.S. equities, says SentimenTrader.

MicroStrategy’s stock surges as bitcoin purchases resume, lifting holdings to above 600,000

MicroStrategy is buying bitcoin again after taking a one-week break. It now owns more than 600,000 bitcoin, valued at more than $73 billion.

Housing market is sending a stark warning to the U.S. economy, Moody’s economist says

Is the housing market on the verge of a meltdown? One economist seems to think so — and he blames 7% mortgage rates.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.