14 FEB 2025 Market Close & Major Financial Headlines: Weak U.S. Retail-Sales Data Sends The S&P 500 Down Along With The Dow Off Over 200 Points At One Point

Summary Of the Markets Today:

The Dow closed down 165 points or 0.37%,

Nasdaq closed up 81 points or 0.41%,

S&P 500 closed down 44 points or 0.01%,

Gold $2,892 down $53.210 or 1.80%,

WTI crude oil settled at $71 down $0.58 or 0.81%,

10-year U.S. Treasury 4.478 down 0.047 points or 1.039%,

USD index $106.79 down 0.52 points or 0.49%,

Bitcoin $97,293 up $915 or 0.94%, (24 Hours),

Baker Hughes Rig Count: U.S. +2 to 588 Canada -4 to 245

U.S. Rig Count is up 2 from last week to 588 with oil rigs up 1 to 481, gas rigs up 1 to 101 and miscellaneous rigs up unchanged at 6.

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

On February 14, 2025, U.S. stocks closed mixed, with the NASDAQ 100 reaching a record high, capping a busy week of tariff news, inflation updates, and disappointing retail sales data. The S&P 500 dipped slightly, while the Nasdaq Composite increased marking its best week of 2025, with both indexes gaining for a third consecutive week. The Dow Jones Industrial Average fell after Thursday's gains. January retail sales saw their largest monthly drop in a year, declining 0.9%, significantly below the expected 0.2%. Markets paused after a week of policy shifts from President Trump, including tariff announcements and a review of CHIPS Act terms. Despite this, stocks were on track for solid weekly gains, boosted by Thursday's positive reaction to a delay in reciprocal tariffs.

Click here to read our current Economic Forecast: –

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

January 2025 Industrial production (IP) increased 2.0% year-over-year. Subcomponents Manufacturing increased 1.0% year-over-year; Mining up 3.4% year-over-year; and Utilities up 6.9% year-over-year. If the manufacturing growth continues, the recession in manufacturing which has been underway for the last two years is over. Capacity utilization stepped up to 77.8%, a rate that is 1.8 percentage points below its long-run (1972–2024) average.

Advance estimates of U.S. retail and food services sales for January 2025 were up 4.8% from January 2024 (blue line on the graph below). That sounds like the consumer is pigging out at the trough. But if one inflation adjusts, sales were up 1.2% year-over-year (red line on the graph below). It worsens as you look at different criteria to visualize retail sales. Population growth factored into inflation-adjusted retail sales shows growth at 0.4% annual growth (orange line on the graph below). Finally, employment growth in retail sales is up 0.4% year-over-year. My point in looking at all these metrics is to validate and correlate retail sales - and as far as Main Street is concerned - retail sales is most likely growing well under 1%. Looking at the detailed data, the growth came from non-store retailers like Amazon.

Prices for U.S. imports advanced 1.9 percent from January 2024 to January 2025. Prices for import fuel rose 2.4 percent for the year ended in January. The price index for U.S. exports increased 2.7 percent over the past year, the largest 12-month advance since the year ended December 2022. prices for export agricultural goods increased 0.5 percent over the past 12 months, the first over-the-year advance since February 2023. As the graph below illustrates, inflation has been edging up for the last 18 months in the import/export sector.

40 forecasters responding to the First Quarter Survey of Professional Forecasters think things are looking up compared to a few months ago. They predict the economy will grow by 2.5% this quarter, which is better than their previous prediction of 1.9%. For the whole year of 2025, they expect the economy to grow by 2.4%, a slight increase from their earlier estimate. While growth is expected, the unemployment rate might rise a bit, from 4.1% to 4.3% by the end of 2025. On a positive note, companies are expected to add around 152,100 jobs per month this quarter. For 2025 as a whole, the forecast is about 145,000 new jobs each month, which is also higher than previously predicted.

Sponsored Content:

The Guy Who Beat Buffett Shocks the World Again...

The New York Times called him "an icon among growth stock investors."

The Wall Street Journal said "Most money managers can only dream of having the same success" he's had.

His investment fund produced a 4,000% return over a 15-year span, outperforming even the great Warren Buffett.

His name is Louis Navellier.

And he's just issued an astonishing financial prediction.

Click here to see it.

ref: 5707

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

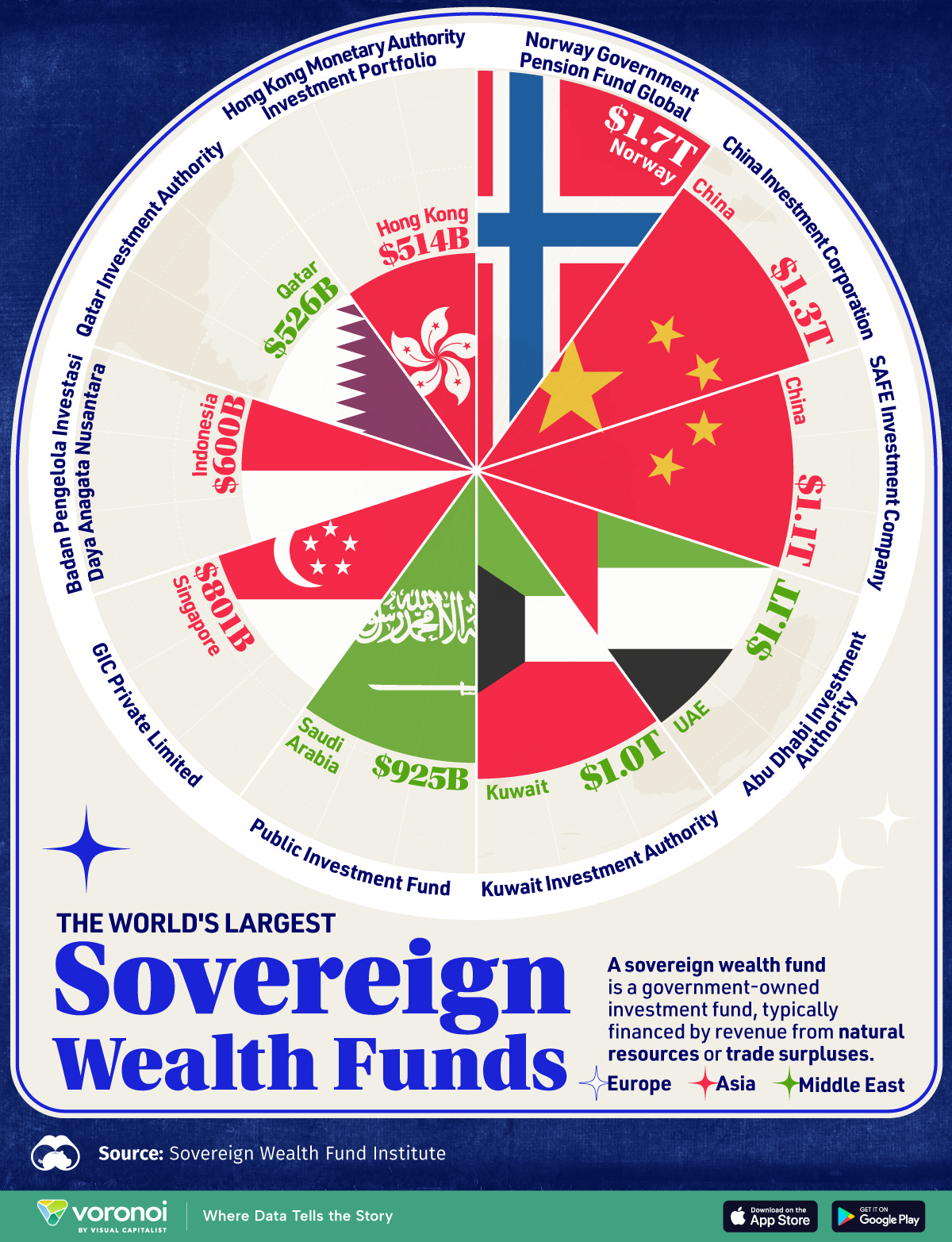

Infographic of the Day from Visual Capitalist:

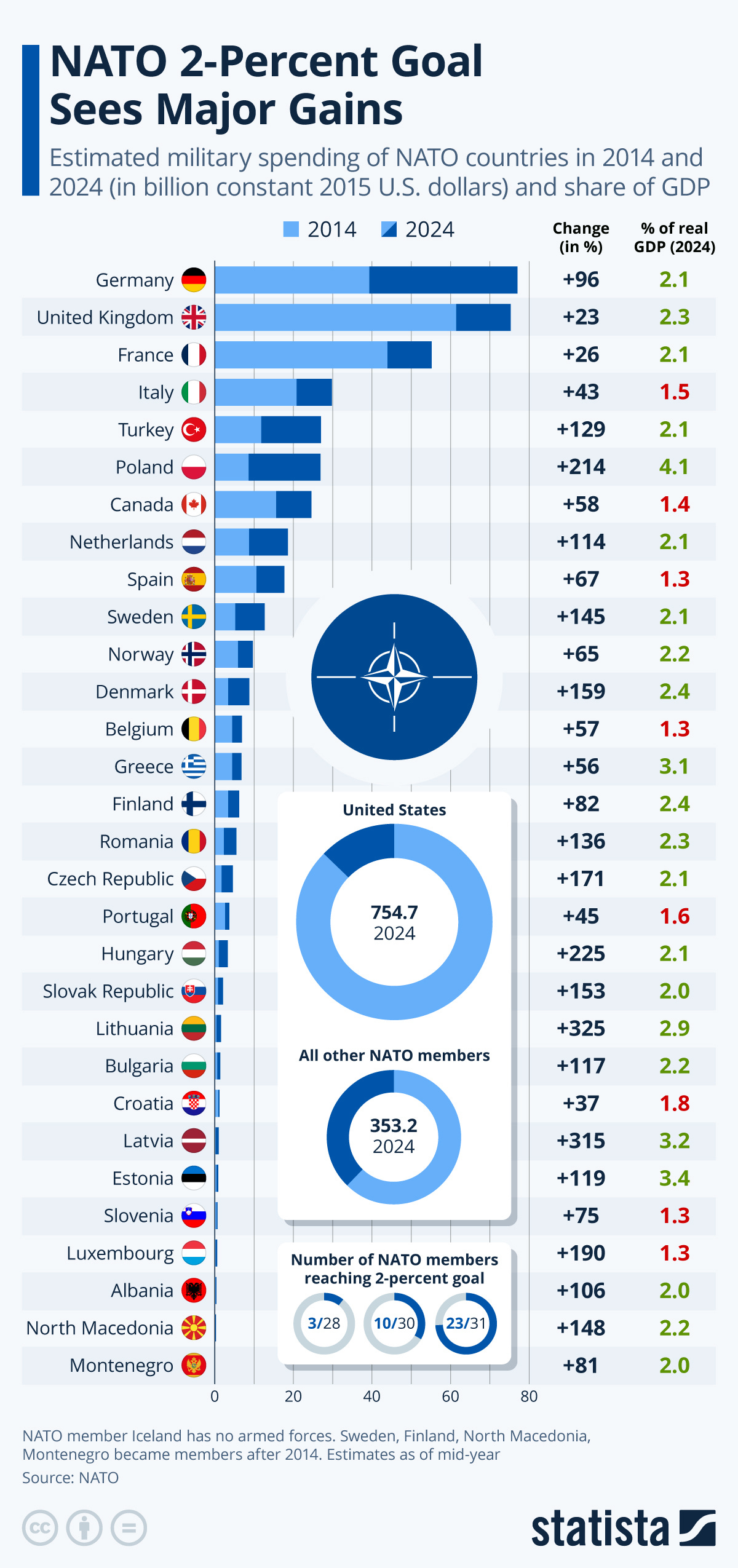

Statista Graphic of the Day:

You will find more infographics at Statista

Here are the headlines we are reading:

Weather Outlook for the U.S. for Today Through at Least 22 Days and a Six-Day Forecast for the World: – Posted on February 14, 2025

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and a six-day World weather outlook which can be very useful for travelers. To get your local forecast plus active alerts and warnings click HERE and enter your city, state or zip code in the upper left corner.

Tajikistan Faces Challenges in Its Pursuit of AI Dreams

Tajikistans minister of industry and innovation has made a bold prediction that the Central Asian nation is going to become a global leader of artificial intelligence (AI) and microchip development. He clearly must have been wearing a virtual reality headset when making the pronouncement, given the existing state of Tajikistans IT sector and educational base. The fifth industrial revolution will begin right here, in Tajikistan. We have not only natural resources, but also a strategic vision for the development of artificial

US Rig Count Inches Up but Still Trails Last Year

The total number of active drilling rigs for oil and gas in the United States rose this week, according to new data that Baker Hughes published on Friday, after a 4-rig increase in the week prior. The total rig count rose by 2 rigs, to 588, according to Baker Hughes, down 33 from this same time last year. The number of oil rigs rose by 1down by 16 compared to this time last year. The number of gas rigs also rose by 1, reaching 101, a loss of 20 active gas rigs from this time last year. Miscellaneous rigs stayed the same at 6. The latest

U.S. Sanctions on Russias Crude Create Chaos in Global Oil Trade

Last months U.S. sanctions on Russian oil exports have upended global oil trade as Asia rushes to cover Russian barrels with alternative supply and tanker rates soar amid significantly decreased availability of non-sanctioned vessels. The Biden Administrationsfarewell sanctionson Russian oil trade were the most aggressive yet and sanctioned dozens of vessels that Russia used to ship the ESPO crude blend from Kozmino to Chinas independent refiners. Many of the vessels, specialized tankers, and shuttle tankers transporting

ADNOC Drilling to Seek $1 Billion Financing to Fund Growth

ADNOC Drilling Company, the drilling unit of Abu Dhabis national oil company, plans to borrow $1 billion from banks this year to refinance expiring debt, the companys CFO Youssef Salem told Bloomberg Television in an interview on Friday. ADNOC listed ADNOC Drilling in 2021 in what was one of the largest share sales in the United Arab Emirates (UAE) at the time. ADNOC Drilling, the largest national drilling company in the Middle East by rig fleet size, is the primary provider of drilling rig hire services and certain associated rig-related

Trump Cracks Down on Iran Oil but Sanctions May Not Stick

The Trump administration is back on the maximum pressure train, and this time, Treasury Secretary Scott Bessent says theyre gunning to slash Irans oil exports to a mere 100,000 barrels per daydown from its current 1.5-1.6 million bpd. That would equate to a 90% drop. The announcement sent oil prices slightly higher today as traders mull the likelihood of potential supply disruptions. It sounds bold, except history suggests that Irans oil trade is a lot slipperier than Washington would like. The Islamic

India to Hike Oil and LNG Imports From the U.S. to Avoid Trumps Tariffs

India, which has a massive trade surplus with the United States, will aim to buy more American oil and LNG to reduce the surplus and avoid potential tariffs from President Donald Trump. India is likely to significantly increase its energy purchases from the U.S., Indias Foreign Secretary Vikram Misri said in Washington after a meeting between President Trump and Indian Prime Minister Narendra Modi. I think we purchased about $15 billion in US energy output, Bloomberg quoted Misri as telling a news conference. There is

China's Insatiable Demand for Coal

OPEC+ Heavyweights Stick to Quotas, Smaller Producers Become a Liability - OPEC+ countries produced 40.54 million b/d in January, continuing a three-month streak of relative stagnation as month-over-month changes remained as low as 20,000 b/d amidst improved compliance. - Nevertheless, Kazakhstan will become a problem for the oil group as it is set to become the largest overproducer with Tengiz ramping up production from 600,000 b/d in January to 900,000 b/d this month. - OPEC+ plans to start gradually easing its 2.2 million b/d voluntary cuts

Will the Bulls Defend $70 Oil?

This week in the crude oil market was a rollercoaster of price swings as bullish supply concerns clashed with bearish macroeconomic and geopolitical developments. The early week saw oil extend its gains on supply constraints from Russia and Iran, but prices reversed sharply midweek as rising U.S. inventories, a hawkish Federal Reserve, and renewed optimism about a resolution to the Russia-Ukraine war weighed on sentiment. With crude prices now struggling to hold gains, traders are questioning whether bullish momentum can be sustained or if further

Opposition Grows to Trump's Gaza Plan

Politics, Geopolitics & Conflict Libya's Minister of State in Tripoli (the Dbeibah government), Adel Jumaa, survived an assassination attempt on Wednesday on a Tripoli highway. He remains in stable condition in the hospital after being shot. Despite the fact that the oil is still flowing, Libyas cities have serious security issues with various factions still jockeying for power. These armed groups have continued to amass more power, and we expect fairly frequent security disruptions, some of which may impact the oil and gas industry.

Is the War in Ukraine Finally Coming to an End?

Is this the end of the war in Ukraine? Sure. This can be whatever we spin it to be. It will be a messy eternally-frozen conflict one way or another. On February 12, we saw a declaration from Washington to the effect that Ukrainian territory will be handed over to Russia and Ukraine will not be joining NATOever. There will be some banal peacekeeping force in the benign Western European style (Bosnians will tragically remember this), and thats about it. Trump and Putin have agreed to start the peace process immediately.

Oil Refiners Boost Biofuel and Petrochemical Production

Refiners have started to produce growing volumes of cleaner fuels and petrochemicals, betting on the next big drivers of global fuel and chemical demand, as consumption growth of conventional transportation fuels has weakened. Due to the pivot to fuels from renewable feedstocks and increased petrochemical volumes, refiners have raised demand for catalysts and additives to process renewable feedstocks such as cooking oil. What we see is alternative feedstocks, the blending in of some components with biomass background at refineries in the

Oil Prices Rise Despite Multiple Bearish Catalysts

Oil prices are rising despite concerns about Trump imposing tariffs on trading partners and talk of a peace deal between Russia and Ukraine. Oil prices are now set to end the week with a gain, ending a three-week losing streak. Backwardation has eased in global crude futures and oil is set to rebound from three straight weeks of losses. This weeks largest geopolitical development the prospect of a Russian-Ukrainian negotiated settlement has oddly failed to push prices significantly lower, even though it had a massive and

China Starts Ultra-Deep Onshore Oil and Gas Drilling Campaign

Chinese companies have launched a new ultradeep drilling campaign in the Taklimakan Desert in northwest China, hoping to unlock more oil and gas resources from deep underground. The drilling campaign, in Chinas Xinjiang Uygur Autonomous Region, aims to reach oil and gas resources that are about 8,000 meters (26,247 ft) underground. One well, the Manshen 72-H6 in Xayar County, is planned to reach a depth of 8,735 meters (28,658 ft). In recent years, China has intensified ultra-deep drilling, both onshore and offshore, looking to unlock more

Indias Petrochemical Demand Stays Resilient Amid Global Slowdown

Demand for petrochemicals in India is expected to remain resilient as consumption of products is rebounding, executives in the industry told Reuters this week. Indias petrochemicals demand will be a bright spot among the major markets, amid a slowdown in demand in other markets, most notably China, and new supply coming from new plants in Asia and the Middle East, according to the executives who spoke to Reuters on the sidelines of the India Energy Week 2025 conference. We are seeing good local demand in the sectors like propylene

UK Regulator Moves to Fast-Track Clean Energy Connections to Grid

The UKs energy regulator, Ofgem, is seeking feedback on proposed changes to the grid connection policy from a first-come first-served approach to prioritizing projects where generation capacity is needed the most and projects are at a more advanced stage of development. Ofgem is seeking to reform the current connections regulation which has become inadequate as some early-queued projects have fallen behind schedule while more advanced projects are waiting for years to connect to the grid. The proposed reform will fast-track solar and wind

Zuckerberg's rightward policy shift puts Meta staffers on edge, targets Apple

Meta CEO Mark Zuckerberg's actions to curry favor with the president have rattled employees, but people familiar with his efforts say there's a clear strategy.

Stock pickers are on a record run with investors. Don't be fooled, says index fund guru

What's in store for the next chapter of passive vs. active investing, according to Charley Ellis, the indexer who wrote the book on what's best for your money.

Trump Attorney General Bondi expects Eric Adams case to be dismissed Friday after mass resignations

Emil Bove, the top DOJ official who told prosecutors to dismiss the case against New York's mayor, represented Donald Trump in a criminal trial last year.

Retail sales slumped 0.9% in January, down much more than expected

Excluding autos, prices fell 0.4%, also far off the consensus forecast for a 0.3% increase.

S&P 500 closes little changed on Friday, but Wall Street notches weekly gains: Live updates

All three major averages are on pace to end the week higher.

Philippe Laffont’s Coatue moves away from China-related stocks in most recent quarter

Philippe Laffont's Coatue Management was lessening its exposure to key Chinese e-commerce companies at the end of 2024.

Trump border czar warns New York Mayor Eric Adams not to violate 'agreement' as DOJ orders dismissal of case against him

A top Justice Department official and former defense lawyer for President Donald Trump has seen six top prosecutors quit over Mayor Adams' case.

Coinbase shares slide after posting Q4 revenue surge: CNBC Crypto World

On today's episode of CNBC Crypto World, bitcoin closes the week trading at the $97,000 level. Shares of Coinbase drop after reporting a surge of more than 130% in revenue from last year. Also, Tether CEO Paolo Ardoino reacts to a recent JPMorgan research report suggesting the stablecoin issuer may have to sell its bitcoin to comply with new U.S. proposals.

Dell shares pop on report of $5 billion deal for AI servers for Elon Musk's xAI

Elon Musk's high-valued artificial intelligence startup relies on Nvidia chips, and is reportedly buying a hefty amount from Dell.

Amazon 'anti-union propaganda,' employee surveillance loom over labor vote at North Carolina warehouse

Amazon workers at a facility near Raleigh, North Carolina, are wrapping up a vote this weekend over whether to unionize.

MSG Networks faces financial turmoil despite Knicks' promising season

MSG Networks, the New York Knicks' regional sports channel, is facing financial woes even as its team is in the middle of a competitive season.

CNBC's Official NBA Team Valuations 2025: Here's how the 30 franchises stack up

The average National Basketball Association team is worth $4.66 billion, according to CNBC Sport's official NBA valuations.

These Biden clean energy rules are top targets for Senate Republicans to roll back

Senate Majority Leader John Thune is spearheading efforts to repeal Biden-era regulations, starting with key rules impacting energy and banking.

Musk's xAI Reportedly In Talks For $10B Raise At $75B Valuation As Grok 3 Launch Nears

Elon Musk's artificial intelligence startup, xAI, is reportedly seeking to raise more than $10 billion in new funding, which would value the startup at $75 billion. The latest fundraising round comes amid reports that Dell is finalizing a major deal with xAI to supply advanced AI servers. Additionally, earlier this week, Musk and a group of investors made an offer to acquire Microsoft-backed OpenAI.

Bloomberg cited folks familiar with the fundraising talks and noted that Sequoia Capital, Andreessen Horowitz, and Valor Equity Partners will be existing investors in the deal. They said that xAI is canvassing potential investors, adding that the terms of the new funding round have yet to be finalized and could still change.

Data compiled by PitchBook shows that xAI has raised billions at a breakneck pace, with its most recent valuation at $51 billion. More recently, The New York Post reported that the AI startup could be valued at upwards of $75 billion. The company secured $6 billion in funding during a Series C round in December, following another $6 billion raise in May.

The Series C round included Andreessen Horowitz, Fidelity Investments, BlackRock, Kingdom Holdings, Lightspeed Venture Partners, MGX, Morgan Stanley, Oman Investment Authority, the Qatar Investment Authority, Sequoia, Valor, and Vy Capital, among others.

Earlier Friday,

What Snapped? OJ Futures Crash Most Since 1968

Orange futures in New York are on track for the sharpest weekly drop in 57 years. Over the past several weeks, the market has been engulfed in a downright panic, with prices sliding for ten consecutive sessions. The catalyst behind the sharp selloff remains unclear.

By Friday afternoon, the weekly percentage change for orange juice futures in New York was 22.5%, marking the worst weekly decline since the first week of November 1968.

OJ futs established a record high of $5.5 a pound in mid-December on news that Florida's citrus production fell to the lowest levels since 1930. Since the peak, about two months later, the maximum drawdown has been a whopping 41%.

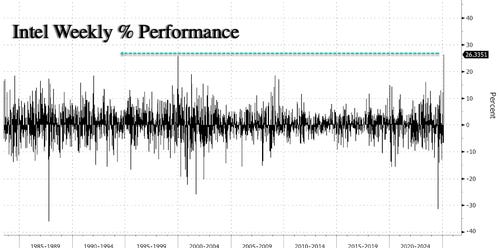

Taiwan Semi Weighs Buying Controlling Stake In Intel's Factories

Earlier today we noted that one-time chip giant Intel, which has devolved to a shadow of its former self after years of catastrophic management decisions which cost former CEO Pat Gelsinger his job, just had its best week in history...

... after VP Vance, speaking at an AI summit in Paris on Tuesday, noted the Trump administration would boost domestic chip production. Momentum continued on Wednesday after a report from Robert W. Baird analysts suggested that the Trump team is working to broker a joint venture between Intel and TSMC, one which would focus on something we said last August has excess value at the Intel enterprise, namely its fabs.

Intel has 15 fabs; the fabs alone are worth $10bn/each in liquidation value. The value created by management is negative $50 billion. https://t.co/HkqUQJ4A6J

— zerohedge (@zerohedge)

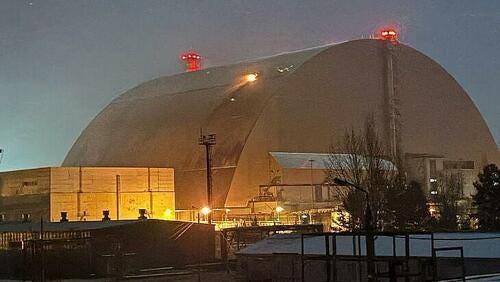

High-Explosive Drone Pierces Shell Of Chernobyl Nuclear Plant At Very Moment Trump Pushes Ukraine Toward Peace

On Friday just prior to high-level meetings among Western security officials and Ukrainian leadership commencing in Munich, including US Vice President J.D. Vance and Zelensky, there was a dangerous incident at the Chernobyl Nuclear Power Plant in Ukraine's Kyiv oblast.

Ukraine's President Zelensky accused Russia of launching a drone equipped with a high-explosive warhead at the historic, defunct power plant, site of the April 1986 nuclear disaster and meltdown. The drone reportedly hit the protective containment shell of the Chernobyl plant.

Image: IAEA/X

Zelensky's office released footage showing an impact to the giant concrete and steel shield protecting the remains of the nuclear reactor. BBC writes that "The shield is designed to prevent further radioactive material leaking out over the next century

Trump tariff VAT threat raises fears of hit to UK

The surprise inclusion of VAT to calculate tariffs prompts questions over the possible impact on British businesses.

Uber and Bolt drivers strike on Valentine's Day

Thousands of drivers are taking part in the strike action over pay and working conditions, a union says.

Call for parents to be able to use loyalty card points to buy baby milk

Parents should be able to use vouchers, the regulator says, but restrictions on discounts should remain.

BSNL Q3 Results: Telco swings to black with Rs 262 crore profit, aided by network expansion & cost control

BSNL Q3 Results: The public sector telco reported a net loss of Rs 1,569.22 crore in Q3FY24. Its mobility services revenue grew 15% YoY, while fiber-to-the-home (FTTH) and leased line services saw YoY increases of 18% and 14%, respectively.

Samvardhana Motherson Q3 Results: Net profit rises 62% YoY to Rs 879 crore

Auto component maker Samvardhana Motherson International on Friday reported a consolidated net profit of Rs 879 crore for the third quarter ended December 31, 2024. The company had reported a net profit of Rs 542 crore for the October-December quarter of the last fiscal.

Tech view: Nifty faces bearish reversal, key support at 22,800. How to trade on Monday

Nifty’s weekly chart shows a bearish reversal, with key support at 22,800 and resistance at 23,250. Analysts foresee further downside unless Nifty decisively moves above 23,300, confirming a potential trend reversal.

Treasury yields end at one-week lows after surprisingly steep drop in retail sales

U.S. government debt rallied for a second day on Friday, sending yields to one-week lows, after January retail-sales data came in sharply lower than expected and raised questions about the strength of the economy.

Brent oil prices eke out weekly gain as U.S. targets Iran exports and tariff fears fade

Global benchmark crude prices posted their first weekly gain in a month Friday, finding support as the U.S. looked to reduce Iranian crude exports and after President Donald Trump did not immediately impose reciprocal tariffs on U.S. trading partners.

The stock market is ignoring what could be its No. 1 threat

“Tail risk” — uncertainty over inflation, tariffs, political chaos and other unknowns — could trigger a chaotic market downturn.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.