11 July 2025 Market Close & Major Financial Headlines: Markets Cool After S&P, NASDAQ Records & Trump’s Tariff Threats

Summary Of the Markets Today:

The Dow closed down 279 points or 0.63%,

Nasdaq closed down 45 points or 0.22%,

S&P 500 closed down 21 points or 0.33%,

Gold $3,374 up $48.00 or 1.44%,

WTI crude oil settled at $69 up $2.00 or 3.00%,

10-year U.S. Treasury 4.423 up 0.077 points or 1.772%,

USD index $97.87 up $0.21 or 0.21%,

Bitcoin $117,838 up $1,943 or 1.68%, (24 Hours),

Baker Hughes Rig Count down 2 to 537

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

On July 11, 2025, stock markets pulled back, as late yesterday, President Donald Trump escalated tariff threats, announcing a 35% tariff on Canadian imports effective August 1 and signaling similar or higher tariffs for other major trading partners, including Europe and Brazil. At this point, the talking heads are blaming any market pullback on President Trump, and I suggest the market is taking a rest after the S&P 500 and NASDAQ reached all-time highs the day before. In the bond market, U.S. Treasury yields edged higher. Meanwhile, Bitcoin surged to a new record above $118,000, boosting crypto-related stocks ahead of a potential stablecoin bill in Congress.

Read the June 2025 Economic Forecast: Recession Winds - Is the Glass Half Empty or Half Full

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

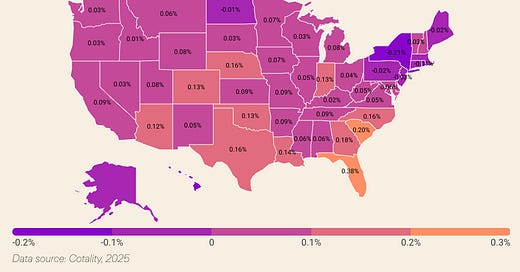

For decades, the bedrock promise of American homeownership was stability—a fixed mortgage meant a predictable monthly payment, offering families a rare sense of financial security even as rents and jobs fluctuated. That promise is unraveling as rising property taxes and soaring insurance premiums have made the true cost of owning a home increasingly volatile and, for many, unaffordable. Across the U.S., mortgage delinquencies are creeping upward—not because people bought homes beyond their means or took on risky loans, but because the costs that follow the purchase, especially taxes and insurance, are surging at unprecedented rates. In states like Florida, South Carolina, and Georgia, where natural disasters have driven up insurance costs, delinquencies have climbed sharply. Florida, for example, has seen property taxes jump nearly 50% over five years, and average escrow payments—covering taxes and insurance—have soared 62% in the same period, straining household budgets beyond the mortgage itself. In South Carolina, the collapse of multiple insurers has left homeowners facing higher premiums, while Georgia’s average property tax bill has risen by more than $700 in five years, alongside a 65% spike in home prices since 2019. These escalating costs are squeezing both new buyers and existing homeowners, with government-backed FHA and VA loans—designed to help those with modest incomes—now exhibiting delinquency rates several times higher than conventional mortgages, reflecting how little margin these borrowers have for unexpected expenses. The situation is compounded by broader economic headwinds: property taxes are up over 15% since before the pandemic, unemployment is ticking up, and extreme weather events—hailstorms, wildfires, hurricanes—are inflating insurance premiums nationwide. In the first quarter of 2025, property tax delinquency rates reached their highest point since 2018, with more than half the states with the worst delinquency rates also suffering above-average unemployment. Areas hit hardest by natural disasters, like Mississippi and parts of North Carolina, are seeing mortgage delinquencies rise as insurance costs spike and incomes lag. The myth of the stable mortgage payment is fading; as taxes and insurance climb unpredictably, the very feature that once made homeownership a safe investment—payment stability—has eroded. For many, the risk of losing their home is no longer tied to the original mortgage, but to the mounting, variable costs that follow, turning what was once a path to wealth into a source of financial insecurity.

In 2024, foreign direct investors spent $151.0 billion to acquire, establish, or expand U.S. businesses, reflecting a 14.2% decrease from the $176.0 billion recorded in 2023 and falling below the annual average of $277.2 billion for 2014–2023. The majority of these expenditures—$143.0 billion—were directed toward acquiring existing U.S. businesses, while $6.3 billion went to establishing new businesses and $1.8 billion to expanding current foreign-owned operations. Planned total expenditures, including both immediate and future commitments, reached $157.0 billion. Newly acquired, established, or expanded foreign-owned businesses in the U.S. employed 204,200 people in 2024.

Sponsored Content:

Why Billionaires Are Stockpiling This "Boring" Token

The world's largest financial institutions are building massive positions in a protocol most retail investors consider too "unsexy" to notice. As markets are volatile post-tariffs, this coin continues setting transaction records while flying almost completely under the radar.

Discover the "boring" financial token that's making the elite wealthy for only $3.

ref: 7306/3

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

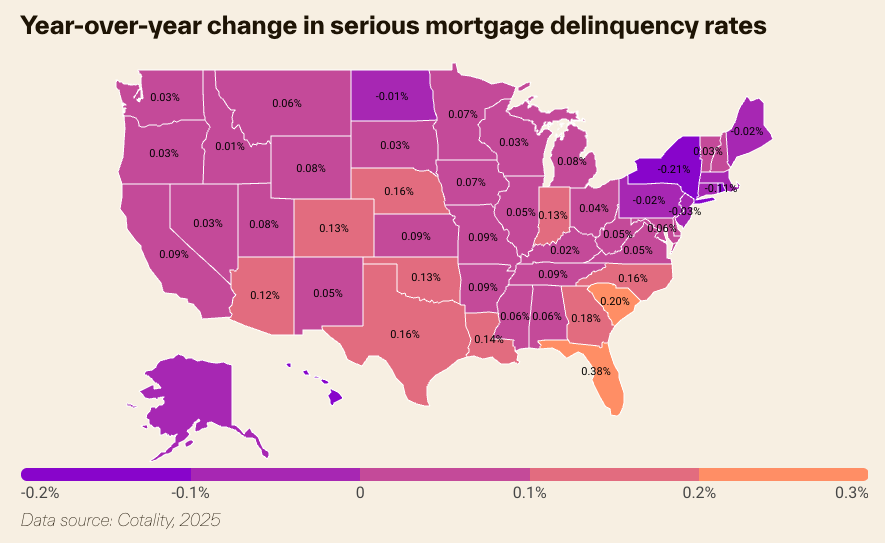

Infographic of the Day from Visual Capitalist:

Statista Graphic of the Day:

You will find more infographics at Statista

The headlines we are reading:

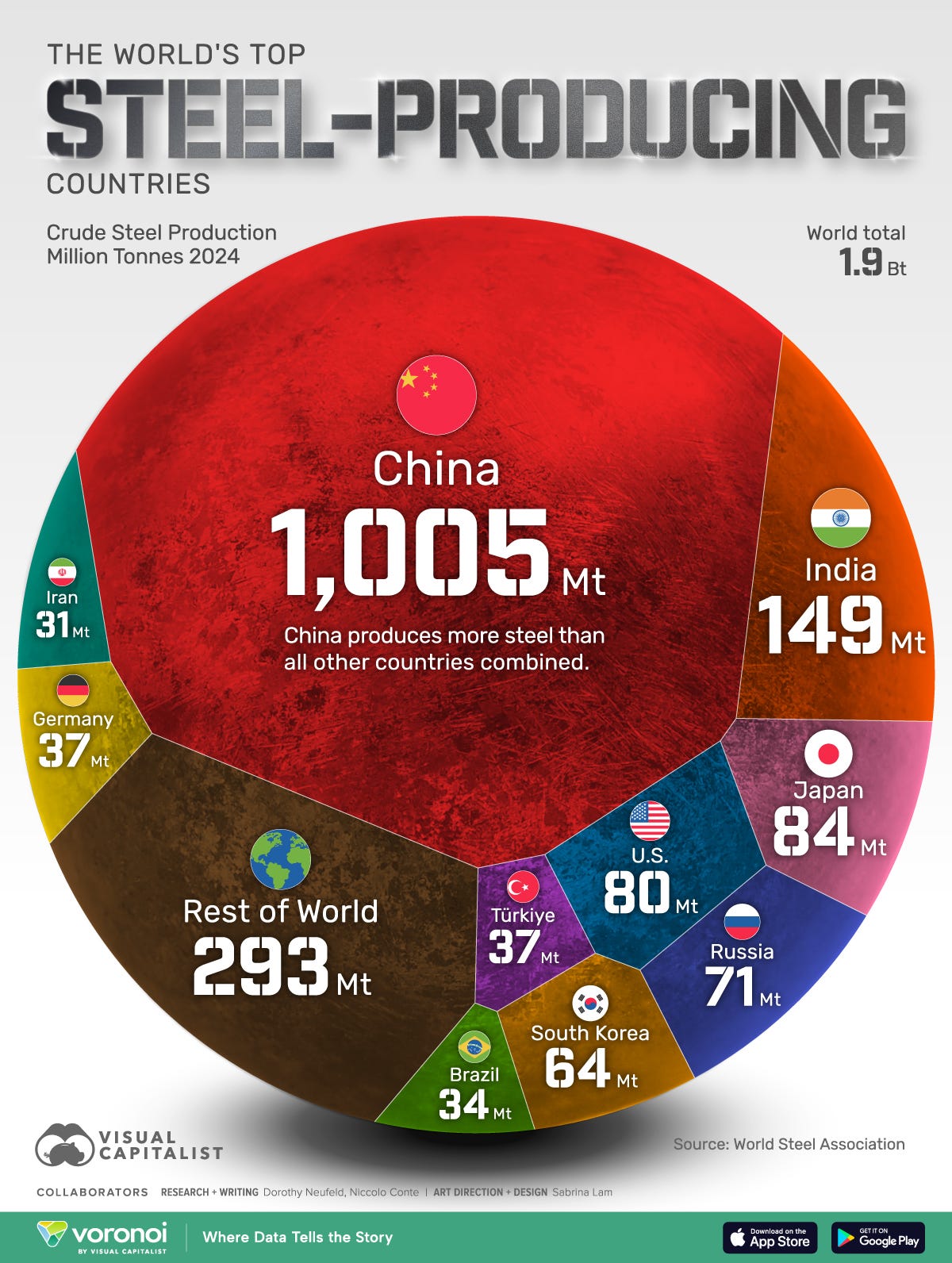

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks, which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings, click HERE and enter your city, state or zip code in the upper left corner.

Goldman Sachs is piloting its first autonomous coder in major AI milestone for Wall Street

The arrival of agentic AI at Goldman Sachs, in which programs don't just help with tasks but execute complex jobs, signals a shift on Wall Street.

Trump budget chief Vought ramps up criticism of Powell, vows investigation into Fed renovations

Office of Management and Budget Director Russell Vought spoke Friday on CNBC's "Squawk Box."

Dow drops 200 points, S&P retreats from record as Trump escalates trade battles: Live updates

Investors continued piling into risk assets while shrugging off worries around the latest in trade developments.

UBS likes these high-quality stocks — and they pay dividends

UBS uses quantitative models and fundamental analysis to determine which stocks pay dividends and are also high quality. Here are some names that made the cut.

TikTok loses bid to dismiss lawsuit alleging its 'addictive design' exploits kids

President Donald Trump granted ByteDance, TikTok's parent company, a third extension on time to sell off its U.S. TikTok operations.

Some Walmart garment orders from Bangladesh on hold due to U.S. tariff threat: Reuters

Bangladesh is the third-largest exporter of apparel to the U.S., and it relies on the garment sector for 80% of its export earnings and 10% of its GDP.

Ron Insana: Why Trump’s new attack on Powell should be so troubling to investors

Is President Donald Trump on the verge of firing Federal Reserve Chair Jerome Powell?

'Superman' snares $22.5 million in Thursday previews on way to $140 million opening

"Superman" is expected to tally between $130 million and $140 million at the box office during its full three-day opening weekend.

Stocks making the biggest moves midday: Penn Entertainment, Robinhood, Levi Strauss and more

These are the stocks posting the largest moves midday.

These are America's cheapest states in 2025, winning battle against inflation

Cost of living continues to be a major issue for consumers, but some states are handling inflation better than others: America's cheapest states to live in.

These are America's most expensive states in 2025, where inflation still hits hardest

Even as prices have come down, the cost of living is still elevated in many states across the U.S.

Nvidia's Jensen Huang sells more than $36 million in stock, catches Warren Buffett in net worth

Nvidia CEO Jensen Huang has caught up to Berkshire Hathaway's Warren Buffett in net worth, according to analysis from Fortune and Bloomberg.

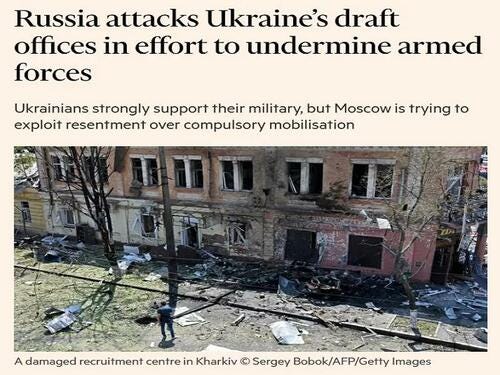

It's A Smart Move For Russia To Strike Ukrainian Draft Centers

Authored by Andrew Korybko via Substack,

The Financial Times (FT) reported that “Russia attacks Ukraine’s draft offices in effort to undermine armed forces”, which drew attention to its latest strategy nearly three and a half years into the conflict.

What began as a special operation quickly transformed into a proxy war that’s since become a “race of logistics”/“war of attrition”.

Accordingly, without ...

Trump Threatens To Pull Endorsements From GOP Senators Opposing DOGE Cuts

President Trump on Thursday night threatened to withhold endorsements from any Republican senators who oppose his $9.4 billion "DOGE" rescissions package targeting foreign aid and leftist public broadcasting outlets. This is setting the stage for a weekend showdown between the White House and GOP holdouts ahead of a planned vote next week.

"It is very important that all Republicans adhere to my Recissions Bill and, in particular, DEFUND THE CORPORATION FOR PUBLIC BROADCASTING (PBS and NPR), which is worse than CNN & MSDNC put together," Trump wrote on his social media platform Truth Social, using a hilarious nickname for MSNBC.

Trump added: "Any Republican that votes to allow this monstrosity to continue broadcasting will not have my support or Endorsement."

The proposal would codify some DOGE spending cuts, effectively asking lawmakers to reverse funding they had previously approved. Trump's pressure campaign is centered on Sens. Susan C ...

Is Immigration Not Tariffs Becoming Powell's New Excuse

Via RealInvestmentAdvice.com,

Jerome Powell has made it clear that tariffs could induce higher inflation.

Accordingly, the Fed has resisted cutting interest rates.

Despite his concerns, fears of tariff-based inflation, as judged by individual and business surveys, are fading. Moreover, even some Fed members are backing away from their prior outlook that inflation would be transitory due to the effects of tariffs.

As tariff fears subside, is immigration the new inflation concern for the Fed?

To help us better appreciate how President Trump is impacting immigration and the labor market, we share the insight of Greg Valliere, a long-time Washington, DC insider.

The following are quotes from his daily newsletter:

BE CAREFUL WHAT YOU WISH FOR:

The White House has been demanding the deportation of immigrants, ASAP - but that may backfire as hundreds of thousands of workers flee, leaving crops rotting in the fields and hotels without enough employees.

THE LABOR MARKET HAS BEEN TIGHT for the past few years, but not like this.

The epicenter is in California, where workers are scarce as they leave the state in droves.

THE IMMIGRATION SHORTAGE HAS AFFECTED FIRMS like Disney and Walmart as their workers’ temporary legal status has been revoked.

This has prompted firms to hike their salarie ...

Trump Teases 'Major Statement' On Russia Coming In Days

President Donald Trump has stated that America's NATO allies will be required to pay the full cost for US-made weapons while hinting that some of those arms may eventually be transferred to Ukraine.

As is well known, Trump has long pushed European NATO members to take on greater defense cost-sharing burden, and in new remarks given to NBC published Friday he said "We send weapons to NATO, and NATO is going to reimburse the full cost of those weapons." He emphasized, "NATO is paying for those weapons, 100%."

He went on to preview that once the weapons are purchased by NATO allies, "then NATO is going to be giving those weapons" to Ukraine. He described that the deal was struck in June at the NATO summit in the Netherlands:

"We’re sending weapons to NATO, and NATO is paying for those weapons, 100%. So what we’re doing is the weapons that are going out are going to NATO, and then NATO is going to be giving those weapons [to Ukraine], and NATO is paying for those weapons," Trump said.

Another very interesting part of the interview came when he teased a major Russia-related announcement planned for Monday.

Could it be new sanctions, which Ukraine's Zelensky and others have been aggressive ...

U.S. and Brazil Become Key Oil Suppliers to India

India has sharply increased its crude oil imports from the United States and Brazil in the first half of 2025, marking a strategic deepening of ties with non-OPEC suppliers amid heightened global volatility and supply risk recalibrations. According to new data from S&P Global Commodity Insights cited by Indian media outlets, US crude shipments to India rose 51% year-on-year to 271,000 barrels per day between January and June, up from 180,000 bpd a year earlier. Imports from Brazil surged 80% to 73,000 bpd, compared to 41,000 bpd during the

U.S. Oil Rigs Continue to Slump On Price Uncertainty

The total number of active drilling rigs for oil and gas in the United States slipped again this week, according to new data that Baker Hughes published on Friday, following a 8-rig decrease in the week prior. The total rig count in the US fell by 2 to 537 rigs, according to Baker Hughes, down 47 from this same time last year. The number of oil rigs fell by 1 to 424 after falling by 7 during the previous weekand down by 54 compared to this time last year. The number of gas rigs stayed the same this week, to 108 for a gain of 8 active gas

Saudi Arabia's Production Increase Sparks Credibility Concerns

After two years of playing the role of OPEC+ model citizen, Saudi Arabia has decided its time to loosen the tieat least according to the IEA. According to the International Energy Agency, the Kingdom overshot its June production quota by a whopping 700,000 barrels per day, pumping 9.8 million bpdthe highest in two years. OPEC's official production figures are due Tuesday, and some analysts have already suggested theyll show near-perfect compliance. But speculating about manipulated data before its released

Alaska Sinks to Bottom of Business Rankings on Oil Price Woes

The high dependence on oil for state revenues is squeezing Alaskas budget when oil prices decline and making its economy grow below the national average. The struggling economy amid volatile oil prices is the key reason why Alaska has been rated as the worst state for doing business in America in 2025 by CNBC. Alaska ranks 50th in CNBC Americas Top States for Business rankings in 2025. The state of the economy has the biggest weight in compiling the rankings, but workforce, infrastructure, the cost of doing business, and technology

Russias Oil Export Revenues Dip 14%

Russias export revenue from crude oil and petroleum products slumped by 14% in June compared to the same month last year, the International Energy Agency (IEA) said in its monthly report published on Friday. The Kremlin received $13.57 billion from sales of crude and refined oil products last month, down by nearly 14% from a year earlier, according to the IEAs estimates. The report also showed that Russian crude oil production remained broadly flat at almost 9.2 million barrels per day (bpd) for each of June and May. Russias

Geopolitical Risk and Tariff Delays Push Oil Prices Higher

Oil prices are set to end the week higher after geopolitical risk climbed and Trump delayedtariff announcements. Friday, July 11th, 2025Oil prices are set for a marginal weekly gain after the commodity markets worst-case scenario US President Trump announcing tariffs on most of the world was temporarily averted, with the White House postponing the decision-making deadline to August. Meanwhile, the return of the Houthi missile factor adds to oils geopolitical risk premium and helped to keep

European Heatwaves Trigger a Solar Power Boom

1. OPEC Turbocharges Long-Term Demand Outlook Meeting in Vienna this week for its biennial seminar, OPEC has projected an even more bullish outlook for crude oil consumption than its previous forecasts, expecting global demand to hit 122.9 million b/d by 2050. Discarding environmentalist agendas promoted by Western governments as unworkable, the oil group is seeing India, Southeast Asia, the Middle East and Africa as the four main pillars of demand growth in the next 25 years. Simultaneously, OPEC has also cut its 2026-2029

India Needs Strong Petrochemical Sector to Compete With China

India should boost its petrochemicals production to meet local demand and counter Chinas growing global lead in the sector, a senior executive at Indias top private refiner, Reliance Industries, said on Friday. India needs to bolster its petrochemicals presence as China is taking over the entire petrochemical industry, Vikram Sampat, senior vice-president, strategy and business development, for the polyester chain at Reliance Industries, said at an industry conference, as carried by Reuters. Chinas petrochemicals

Trump to Announce Major Russia Statement Monday

The United States is sending weapons to Ukraine through NATO, US President Donald Trump said on July 10, a week after the Pentagon said some weapons deliveries to the war-torn country were being paused. Trump also said he would make a "major statement" on Russia on July 14. He did not elaborate on what the statement would be but provided an explanation about the supply of US weapons. "We're sending weapons to NATO, and NATO is paying for those weapons, 100%. So what were doing is the weapons that are going out are going to NATO, and then

Both Russia and the Houthis Are Escalating Attacks

Politics, Geopolitics & Conflict Russia has escalated aerial attacks on Kyiv, launching over 400 drones and 18 missiles against military-industrial targets, as Ukraine's Western allies recalibrate support amid growing fatigue and fragmentation. The U.S. has resumed weapons shipments under the Trump administration, while the EU is doubling down on economic pressure, proposing a floating oil price cap that would replace the static $60/barrel ceiling with a benchmark-linked mechanism starting just above $45. This would adjust to global market

Libya Remains on Edge as Oil Majors Return

We continue to watch Libya unravel as rival power centers attempt to reassert territorial and institutional control, but international oil majors are re-engaging nonetheless, and analysts like to opine that their big oil money could help stabilize the country. That is a possibility; however, the reverse is currently more likely unless Benghazi and Tripoli find a way to split the spoils (as the only thing that would prevent another civil war). The Tripoli-based Government of National Unity (GNU), led by interim Libyan PM Dbeibah, is now in

Traders Weigh OPEC+, Tariffs, and Resilient Demand

The crude oil market traded with sharp volatility this week as traders balanced OPEC+ production increases, renewed geopolitical risks, and the threat of U.S. tariffs against evidence of strong underlying demand. This interplay shaped price action, with the market testing downside levels but finding bids on signs that supply additions may be absorbed more easily than feared. OPEC+ Supply Increases Pressure Oil Prices Forecast OPEC+ made headlines by announcing a 548,000 bpd production increase for August, a sharp acceleration from the previous

Taking Advantage of a Disparity in Lithium Stocks Performance

I have said it before a few times, but, in general, if a market move doesnt make sense to me, the first thing I do is check my own assumptions. It is, after all, much more likely that I have made a mistake in my analysis than it is that the collective wisdom of thousands of highly paid experts has missed something important. Every now and again, though, try as I might, I cannot see why a particular stock is being bought or sold, or why there is a disparity in performance within a sector or industry. Lithium stocks are right now a puzzle

Shell Obtains Permission to Drill for Oil and Gas Offshore South Africa

Shell has received environmental authorization to drill up to five deepwater wells to explore for oil and gas off the west coast of South Africa. Should viable resources ?be found offshore, this could significantly contribute to? South Africas energy security and the governments economic development programmes, the supermajor said in a statement carried by Reuters. The company did not provide details of the drilling plans. Shell applied last year for environmental authorizations to drill ultra-deepwater wells offshore

IEA Sees Oil Supply Outpacing Demand Despite Tight Summer Market

Global oil supply growth is expected to materially exceed demand growth this year despite the tight market balance in the peak summer consumption season, the International Energy Agency (IEA) said in its monthly report on Friday. Following OPEC+s supersized production hike for August, the IEA revised up its estimate of global oil supply growth to 2.1 million barrels per day (bpd) for 2025 in its Oil Market Report for July, up by 300,000 bpd from last months projection of 1.8 million bpd growth. At the same time, global oil demand

Reeves disappointed after economy unexpectedly shrinks

The economy contracted in May for the second month in a row, adding to pressure on the chancellor.

Plans for cash Isa changes on hold after backlash

There had been reports in recent weeks that the chancellor was going to cut the £20,000 limit.

National Trust blames tax rises as it cuts 550 jobs

The heritage and conservation charity says it is under "sustained cost pressures" and is looking to save £26m.

NSE, BSE issue advisory to bond investors. Here are 10 things to know

BSE and NSE have jointly advised investors using online bond platforms to understand key concepts like Yield to Maturity, credit risks, and interest rate effects, as bond investments carry no guaranteed returns. The move comes amid rising popularity of OBPPs.

After a 1,300% rally, consolidation hits Suzlon shares. 6 triggers that may energise bulls

After a remarkable 1,300% surge, Suzlon Energy's shares are consolidating, signaling a potential shift in momentum despite a 980% return. Supported by financial restructuring, a strong order book, and a positive energy outlook, the company's turnaround story is fueled by technical indicators and robust earnings. Brokerages initiate 'Buy' ratings, anticipating further growth in India's renewable energy sector.

Motilal Oswal sets the highest-ever target price for Suzlon Energy shares at Rs 82; here’s why

Motilal Oswal has issued a “Buy” call on Suzlon Energy with its highest-ever target price of Rs 82, implying a 24% upside. The brokerage cites benefits from upcoming local content mandates, a strong order book, and improved execution through land acquisition and EPC expansion. The RLMM policy, mandating local sourcing, is expected to be formally adopted in Q2FY26.

Kraft Heinz is reportedly weighing a breakup. Some analysts have already said it ‘should slim down.’

Kraft Heinz’s stock jumps after a Wall Street Journal report that the packaged-food giant is planning a breakup, 10 years after its megamerger.

What can the Labubu toy craze tell investors about markets? A lot, actually.

From time to time, investors like to look for fresh insights outside the world of markets.

Nursing homes may start sedating your elderly parents — and, eventually, you — because they don’t have enough workers

Staffing levels “significantly impact” the use of antipsychotic medication, new research has found.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.