08 July 2025 Market Close & Major Financial Headlines: Trump’s Trade Gambit Causes Investors to Hold Breath

Summary Of the Markets Today:

The Dow closed down 166 points or 0.37%,

NASDAQ closed up 6 points or 0.03%,

S&P 500 closed down 4 points or 0.07%,

Gold $3,314 down $29.3 or 0.88%,

WTI crude oil settled at $68 up $0.53 or 0.78%,

10-year U.S. Treasury 4.413 up 0.018 points or 0.410%,

USD index 97.53 up $0.05 or 0.05%,

Bitcoin $108,791 up $681 or 0.62%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

On July 8, 2025, global stock markets were primarily influenced by President Donald Trump’s announcement yesterday of sweeping new tariffs targeting countries such as Japan, South Korea, Malaysia, and several BRICS nations, with duties ranging from 25% to 40% and a potential additional 10% for BRICS members if no trade deals are reached. This escalation in trade tensions led to a sharp sell-off on Wall Street yesterday. However, today, market reactions were more muted and futures stabilized, as Trump extended the tariff deadline to August 1 and signaled openness to further negotiations, which investors interpreted as a possible negotiating tactic rather than an imminent economic threat. Asian and European markets remained relatively steady, and the U.S. dollar strengthened, while oil prices rose on supply concerns despite OPEC+ increasing output. Overall, while trade policy uncertainty and political developments weighed on sentiment, markets showed resilience as investors awaited clarity on potential trade agreements before the new tariffs take effect.

Read the June 2025 Economic Forecast: Recession Winds - Is the Glass Half Empty or Half Full

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The NFIB Small Business Optimism Index held steady in June 2025, slipping just 0.2 points to 98.6, which remains slightly above the 51-year average of 98. The most significant factor in this modest decline was a notable rise in business owners reporting excess inventories. The Uncertainty Index dropped by five points to 89, indicating reduced uncertainty among small firms. Taxes resurfaced as the top concern, with 19% of owners naming it their most pressing issue—the highest rate since July 2021. Expectations for better business conditions and higher real sales volumes both fell by three points, and plans for capital outlays edged down. Labor quality remained a key challenge for 16% of respondents, while inflation concerns dropped to an 11% share, the lowest since September 2021, reflecting easing price pressures. Business health perceptions worsened: only 8% rated their business as excellent (down six points), and 49% as good (also down six), while those reporting fair or poor health increased, underscoring persistent challenges despite stable overall optimism.

According to the Federal Reserve:

In May 2025, consumer credit increased at a seasonally adjusted annual rate of 1.2 percent. Revolving credit decreased at an annual rate of 3.2 percent, while nonrevolving credit increased at an annual rate of 2.8 percent.

Our take, using year-over-year (YoY) instead of month-over-month annualized - total consumer credit grew 0.4% YoY. Revolving credit growth (primarily credit cards) declined 2.6% YoY whilst nonrevolving credit (auto loans and student loans) increased 1.4% YoY. These increases are below the inflation rate which means the consumer is avoiding the use of credit for purchases.

Sponsored Content:

3 Stocks to Change Your Life

Brace yourself... because I'm about to flip everything you thought you know about dividend investing on its head. I'm going to show you how you can achieve 101% yields from dividends in just a few years. Best of all, it's as easy as buying 3 stocks and clicking a few buttons. And if you invest in these 3 stocks. Let me show you the way.

Click HERE to learn more.

ref: 7518/2

The S&P 500 has made major moves in 2025 – and EWAVES nailed them.

This new video shows how the EWAVES engine anticipated the twists and turns before they happened. (LINK)

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

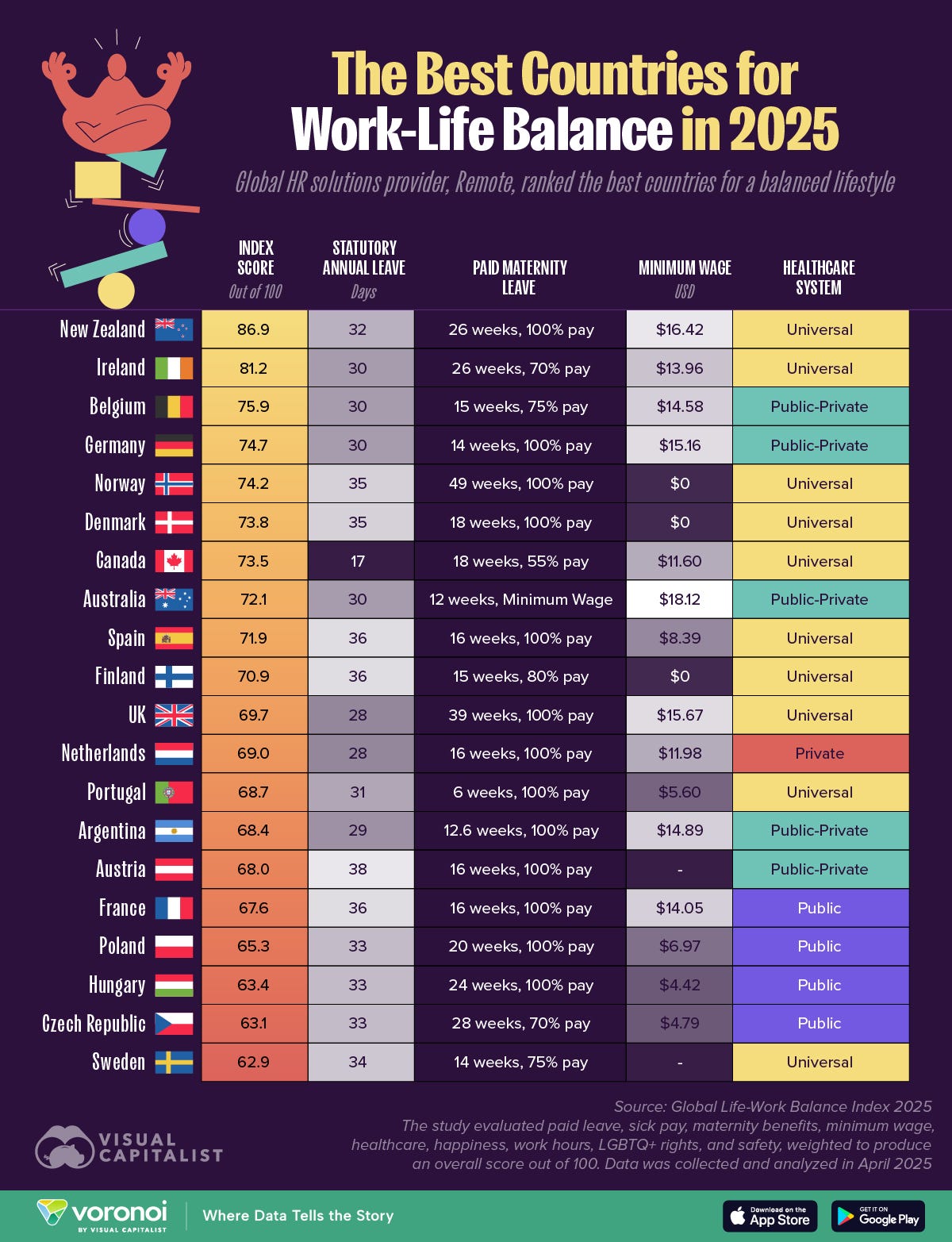

Infographic of the Day from Visual Capitalist:

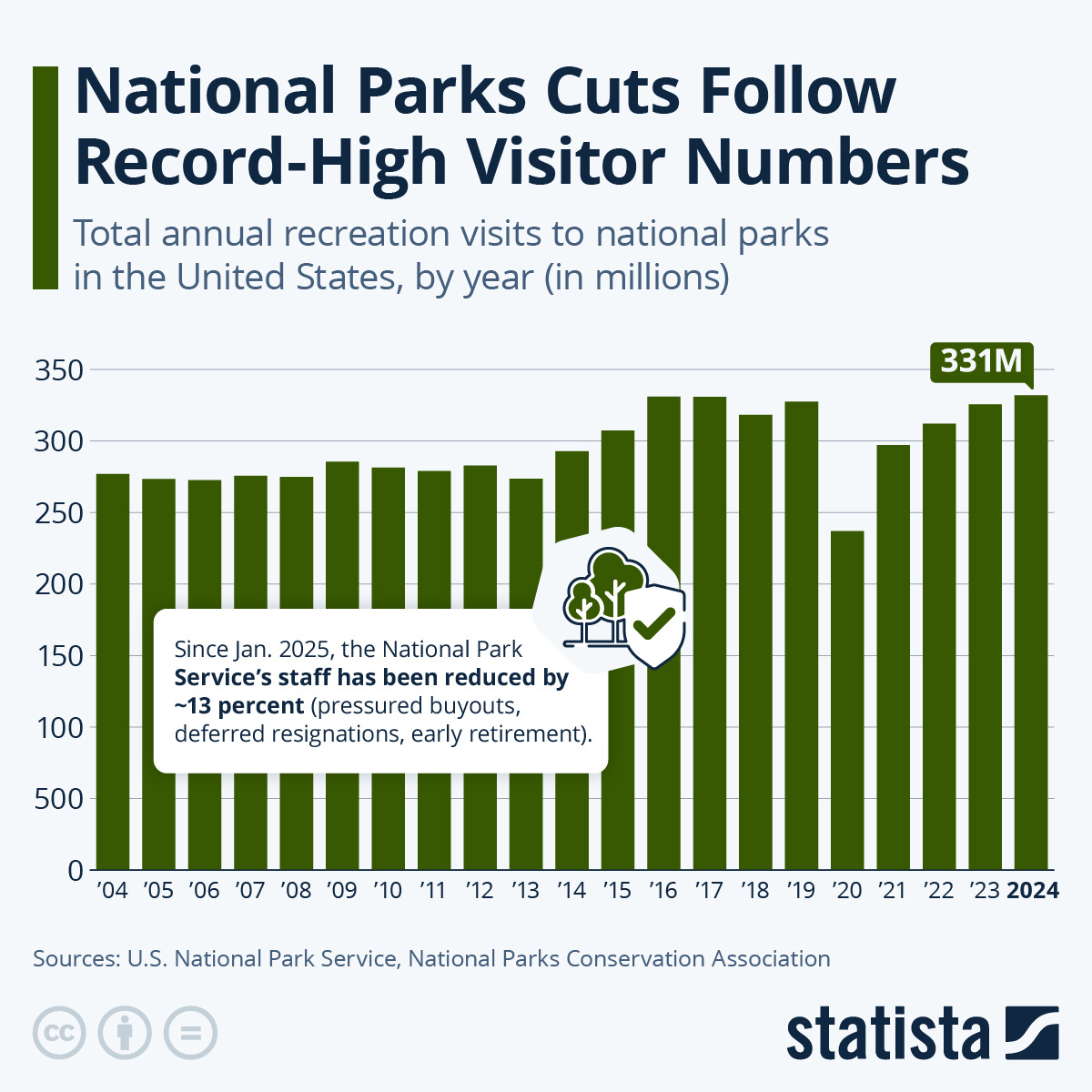

Statista Graphic of the Day:

You will find more infographics at Statista

The headlines we are reading:

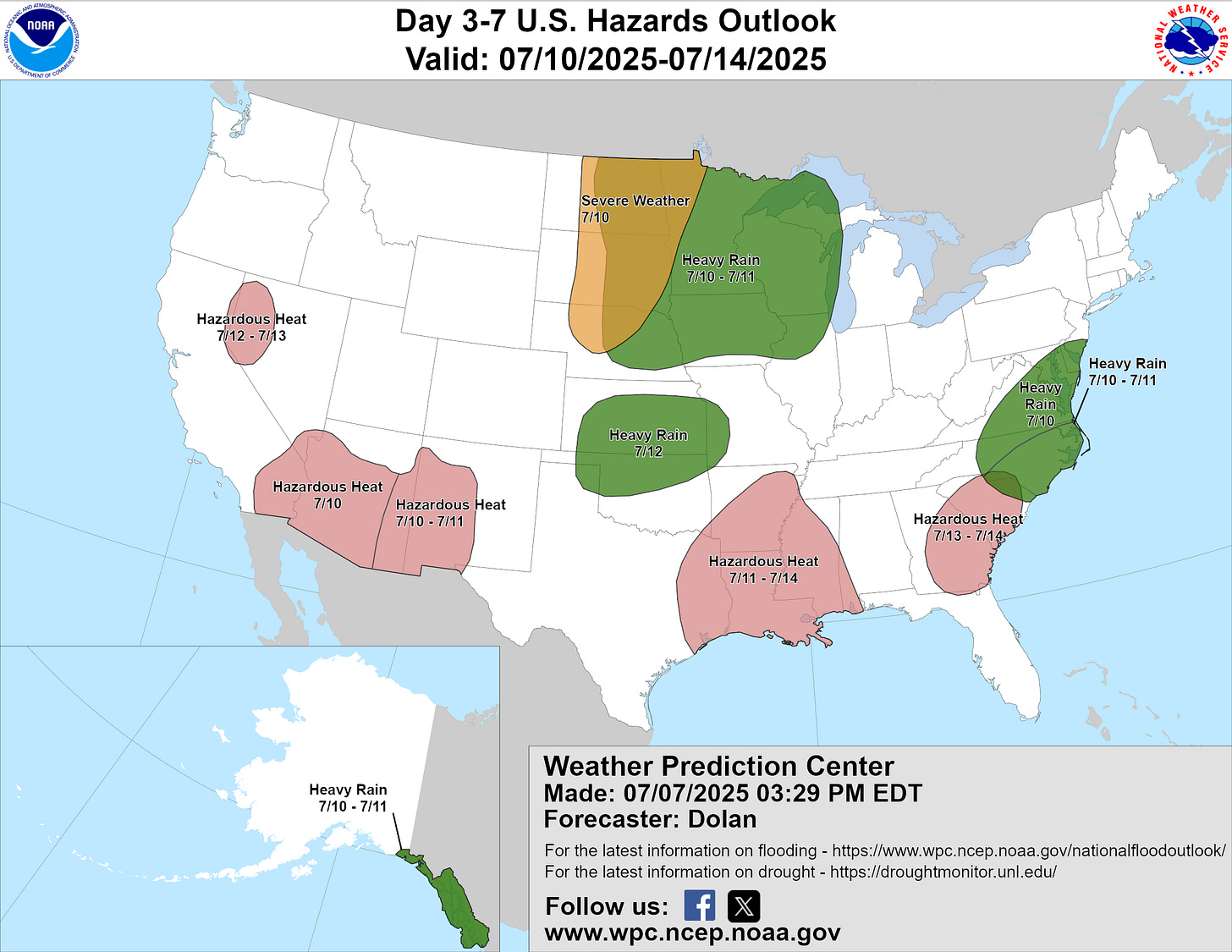

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks, which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings, click HERE and enter your city, state or zip code in the upper left corner.

S&P 500 ends Tuesday little changed as Trump’s tariff policy keeps traders on edge: Live updates

The major averages are coming off a choppy session as investors follow the latest trade headlines out of the White House.

Trump says he will impose 50% tariff on copper imports

President Donald Trump said he will impose a 50% tariff on copper imports and suggested more steep sector-specific duties are on the way.

Elon Musk lashes out at Tesla bull Dan Ives over board proposals: 'Shut up'

Dan Ives, an analyst and longtime fan of Tesla, was scolded by Elon Musk on Tuesday after posting three steps he said the company's board should take.

Trump threatens to impose up to 200% tariff on pharmaceuticals 'very soon'

Trump suggested that those levies would not go into effect immediately, saying he will "give people about a year, year and a half"

Trump 'not happy with Putin,' accuses Russian leader of throwing 'bulls---'

Trump has said the United States would resume weapons shipments to Ukraine to defend itself against Russia's invasion.

Goldman Sachs says these buy-rated stocks offer solid dividends

Goldman Sachs favors dividend growth stocks. Here are some of its picks.

IRS says churches can endorse political candidates without losing tax-exempt status

Two churches and a religious group sued the IRS in 2024, saying their First Amendment rights were violated by the ban on endorsing candidates in elections.

White House: Odds of tariff-related inflation are low, like 'pandemics or meteors'

President Donald Trump's tariffs have already driven up some prices, but they have not yet produced the overall inflation that many economists feared.

CNBC's Most Valuable Sports Empires 2025: Here's how the top 20 empires in the world stack up

The world's 20 most valuable sports ownership groups are worth a combined $225 billion, according to CNBC's Most Valuable Sports Empires 2025.

TSA plans to let travelers keep their shoes on at airport security checkpoints

TSA briefed industry members about the change on Tuesday.

'Revenge savings' can boost your bottom line, experts say — here's how to get started

Saving more money is a perennial resolution, but emotions shouldn't drive that habit, financial experts say. Instead, be intentional. Here's how to get started.

Here’s what the endowment tax in Trump's 'big beautiful bill' may mean for your college tuition

President Donald Trump’s megabill raises the tax on some college endowments, which experts say could cause schools to hike tuition, cut financial aid or both.

Elon Musk's X says Indian government ordered more than 2,000 accounts blocked, including Reuters

The statement by X is the latest development in a censorship legal battle between Musk's social media site and Prime Minister Narendra Modi's government.

DOJ Sues More States Over In-State Tuition For Illegal Aliens

Authored by Cully Stimson & Hans von Spakovsky via The Epoch Times,

Attention, all parents and college students worried about the ever-rising cost of college tuition. The Department of Justice has finally—after three decades—started enforcing the federal law that prohibits states from offering in-state tuition to illegal aliens unless they also offer in-state tuition to everyone else—including all citizen students from out of state.

The law it’s enforcing has existed since 1996, when Congress passed the Illegal Immigration Reform and Immigrant Responsibility Act.

Buried inside t ...

Copper Soars To Record High As Trump Unleashes 50% Tariff

Is President Trump 'weaponizing' copper?

Just over two months ago, we noted that drastic tightening of the Chinese copper markets and since then, copper stocks in China have continued to dwindle as stocks of copper at COMEX (US) have soared...

With COMEX copper stocks now at seven year highs while Chinese stocks are at multi-year lows...

"They Were Child Porn. They Will Never Be Released": Trump & Bondi Punt On Epstein Questions

President Donald Trump and AG Pam Bondi completely punted over a question over Jeffrey Epstein during Tuesday's televised cabinet meeting.

Reporter: "Your memo and release yesterday on Jeffrey Epstein - it left some lingering mysteries. I guess one is whether he ever worked for an American or foreign intelligence agency. The former labor secretary, who was Miami US Attorney Alex Acosta - he allegedly said he did work for an intelligence agency. So can you resolve whether or not he did..."

To which Trump responded : "Are you still talking about Jeffrey Epstein?!? This guy's been talked about for years. You're asking - we have Texas, we have this, we have all of the things that... And are people still talking about this guy? This creep? That is unbelievable. Do you want to waste the time? I mean, I can't believe you're asking a question about Epstein at a time like this when we're having some of the greatest success and also trage ...

Illiquid, Overvalued

Authored by Charles Hugh Smith via OfTwoMinds blog,

As "dip buyers" get eviscerated, more dominos fall, and at a tipping point, the herd realizes the tide has reversed and it's time to sell--but alas, it's too late.

Illiquid, Overvalued describes a great many assets that are on the books as "rock-solid investments." Illiquidity means there are few if any buyers for the asset being offered for sale, and this can arise from various conditions.

1. Credit is tight and expensive, limiting the pool of potential buyers to those with cash.

2. Nobody wants the assets because they're grossly overvalued.

3. The pool of buyers with the expertise and financial backing needed to buy the asset is inherently limited.

4. "Animal spirits" have left the room and buyers are "on strike" due to caution / fear of future losses.

Bill Ackman outlined some useful principles of illiquidity in a recent commentary on X in his discussion of the illiquid nature of many assets held by Ivy league university endowment funds:

"Harvard's endowment is principally invested in illiquid private assets including real estate, private equity, and venture capital funds.

Real estate and private equity funds are highly levered so relatively small changes in asset values can have a large impact on equity values. For example, if a real estate fund's ...

Oil and Gas Consolidation Reshapes African Market

Africas upstream oil and gas sector is undergoing a transformative shift. In recent years, majors have scaled back their exposure to mature, non-core assets across the continent, opening the door for a new wave of regional independents, traders, and non-African national oil companies (NOCs) to step in as consolidators and value creators. Angola and Nigeria have been the epicenters of this consolidation wave. Angola saw the formation of Azule Energy through the BP-Eni portfolio merger, where the new independent has already created value by

Nippon Steel Acquires U.S. Steel After Prolonged Battle

Via Metal Miner The Raw Steels Monthly Metals Index (MMI) trended sideways, with a 1.37% increase from June to July. With a few exceptions, steel prices remained largely steady as long-awaited trade deals with the U.S. began to materialize. Nippon Officially Acquires U.S. Steel After an arduous 18-month process, Nippon Steel officially acquired U.S. Steel. Initially blocked by former President Biden in January 2025, President Trump revived the deal, calling for a new review after months of lobbying efforts. As a result, the previous board stepped

Copper Prices Skyrocket 17% After Trump Announces 50% Tariff

Copper futures soared as much as 17% on Tuesday, their largest intraday gain in at least three decades, after former President Donald Trump announced a 50% import tariff on the industrial metal. Speaking at a Cabinet meeting, Trump confirmed plans to impose new duties on copper, part of a broader tariff push targeting metals, semiconductors, and pharmaceuticals. Were going to make it 50%, Trump said when asked about the copper rate. The announcement immediately jolted markets, highlighting how sensitive the global copper supply

Central Asian States Reconnect with Afghanistan

Relations between the five Central Asian countries and Afghanistan are warming as plans move ahead for new rail links, increased trade and creating opportunities for ordinary Afghans. Central Asian states are prioritizing bringing Afghanistan back into the economic fold with increased connectivity and trade focused on practical cooperation that serves their economic interests and, ultimately, helps improve regional security, analysts say. We try to look on Afghanistan more pragmatically because if we build a wall around Afghanistan,

Oil Prices Near 2-Week Highs On OPEC+ Output and U.S. Tariffs

Oil prices climbed Tuesday, hovering near two-week highs as markets absorbed the impact of a larger-than-expected OPEC+ production increase and ongoing uncertainty around US trade policy. As of mid-afternoon, Brent crude was up 89 cents at $70.47 per barrel, while US West Texas Intermediate rose 80 cents to $68.73. Both benchmarks are on track for their highest close since June 24. OPEC+ on Saturday approved a 548,000 barrel-per-day (bpd) production hike for August, outpacing the 411,000 bpd monthly increases seen earlier this summer. The move

EIA's STEO: Geopolitics Push Oil Up, But Glut Still Looms

Oil prices have inched up, but the EIA says dont get used to it. The July Short-Term Energy Outlook (STEO) raised its 2025 Brent forecast by $3 to $69/bbl, citing a spike in geopolitical risk from the mid-June Iran nuclear conflict. But that bump is expected to be short-lived. With inventories building, the agency sees Brent falling to $58/bbl in 2026a dollar lower than last months projection. Meanwhile, U.S. crude output is peaking. Production averaged just over 13.4 million bpd in Q2, an all-time high, but is expected to

Pentagon Shifts Stance on Ukraine Military Aid

US President Donald Trump on July 7 said the United States will send more weapons to Ukraine to help the war-torn country defend itself against Russian attacks. We're going to send some more weapons. We have to," Trump told reporters at the White House. They have to be able to defend themselves. They're getting hit very hard now. The United States will send primarily defensive weapons, he said, speaking at the start of a dinner with Israeli Prime Minister Benjamin Netanyahu. "At President Trump's direction, the Department of

U.S.-Colombia Diplomatic Clash Rattles Energy and Mining Stocks

The bilateral relationship between the U.S. and Colombia has continued to worsen, with both countries recalling their top diplomats last week amid an alleged plot against Colombias President Gustavo Petro. Washington acted first, recalling charge daffaires John McNamara on Thursday, with State Department spokesperson Tammy Bruce saying the move was taken following baseless and reprehensible statements from the highest levels of the government of Colombia. Hours later, President Petro announced he was calling home ambassador

Nissan to Curb Production of New EV Amid Chinas Rare Earths Export Controls

Japanese car manufacturing giant Nissan Motor is revising down production plans for its new Leaf series electric vehicle as the Chinese controls on exports of rare earth elements have created a shortage of car parts, Kyodo News reported on Tuesday. The setback for Nissans new EV is the latest in a series of hurdles that carmakers globally have faced since China announced export controls of rare earths in early April. Suzuki Motor, another Japanese giant, has reportedly halted production of its flagship Swift subcompact because of supply

Oil Markets Brush Off the OPEC+ Production Push

Oil prices have remained elevated at the start of this week despite expectations that OPEC+ will approve another big production boost for September.- Diesel was widely expected to be the main refined products underperformer this year but, defying Trump tariffs and lower Chinese demand, the middle distillate has been shining lately as Europe struggles to keep its refinery operations steady.- The front-month diesel East-West price spread rose to more than $73 per metric tonne this week, the widest it has been since December 2023, just as the ICE

EU Parliament Endorses Eased Natural Gas Storage Targets

The European Parliament approved on Tuesday eased rules and targets for natural gas storage refills in the EU in a move aimed at preventing price spikes. Earlier this year, the EU member states agreed to ease the blocs natural gas storage targets by allowing a 10 percentage point deviation in the 90% full storage goal. The greater flexibility comes in response to the fears of several large gas-consuming nations in Europe that they would have to either subsidize storage filling when its uneconomical or miss the targets. The new targets

Big Oil Is Back to Business in Libya

Libyas National Oil Corporation (NOC) has signed agreements with supermajors BP and Shell to explore and evaluate the oil and gas potential of several fields in the African country, marking another step in Big Oil returning to doing business in Libya. NOC signed this week a memorandum of understanding with BP under which the UK-based supermajor will conduct studies to assess the potential for hydrocarbon exploration and production in the Messla and Sarir fields, as well as in some surrounding exploration areas. Separately, the Libyan oil

Saudi Arabias Crude Oil Exports Jumped by 400,000 Bpd in April

Saudi Arabias crude exports soared by 412,000 barrels per day (bpd) in April from March, the latest data by the Joint Organizations Data Initiative (JODI) showed on Tuesday. Saudi Arabia, the worlds top crude exporter, saw its exports in April at an average of 6.17 million bpd, according to the JODI data which compiles self-reported figures from the individual countries. Crude oil production in Saudi Arabia rose by around 48,000 bpd in April compared to the March production level of 8.96 million bpd. Domestic refinery intake slumped

Iran Denies Trump Claim of New Nuclear Talks

Iran hasnt asked for nuclear negotiations with the United States to resume, Iranian Foreign Ministry Spokesman Esmaeil Baghaei said on Tuesday, disputing U.S. President Donald Trumps remarks that a new round of talks is scheduled to be held soon. During a meeting with Israeli Prime Minister Benjamin Netanyahu at the White House on Monday, President Trump said We have scheduled Iran talks, and they ... want to talk. They took a big drubbing. The U.S. President also said he would like to be able to lift the sanctions on

Venture Global Capitalizes on Spot Sales From Plaquemines LNG

U.S. LNG exporter Venture Global is cashing in on its recently launched Plaquemines LNG plant, which has yet to be commissioned, by selling cargoes on the spot market, making much more money from the facility than the commissioned Calcasieu Pass plant which now sells LNG under long-term contracts. In December 2024, Venture Global reached first LNG production at its second facility, Plaquemines LNG, in Port Sulphur, Louisiana. While the plant achieved first LNG production, its buyers under long-term contracts including ExxonMobil, Chevron,

Post Office scandal had 'disastrous' impact on victims

The scandal may have led to 13 suicides, the report says, as it criticises the "formidable difficulties" for victims getting compensation.

Exhausted, angry, heartbroken: Postmasters react as horror of scandal laid bare

As the initial findings of the Post Office inquiry are released, sub-postmasters tell the BBC how they feel.

Five things we now know about the Post Office scandal

A key report into the Horizon IT scandal details the huge impact on sub-postmasters and their families.

Tata Steel Q1 updates: India production flat YoY at 5.26 million tons on plant shutdowns

Tata Steel India’s crude steel output remained flat at 5.26 million tons in Q1FY26, while deliveries fell 4% YoY due to maintenance shutdowns at Jamshedpur and NINL. Overseas units showed mixed performance, with UK volumes down 12%.

Anthem Biosciences IPO: Rs 3,395 crore IPO to open on July 14

Anthem Biosciences' Rs 3,395 crore IPO will open on July 14 as a complete Offer for Sale by promoters and investors. The Bengaluru-based CRDMO firm provides integrated drug development and manufacturing services across advanced technology platforms and modalities.

Jane Street saga: Nilesh Shah gives 3 reasons why no HFT will do it in China

Kotak MF’s Nilesh Shah warned that India's capital markets are exposed to HFT manipulation due to regulatory gaps. Comparing India to China, he proposed five urgent reforms—from stronger enforcement to financial literacy—to counter potential threats like Jane Street and protect retail investors from unchecked speculation and systemic manipulation.

‘I’m single’: At 70, I have $500,000 in stocks and $220,000 in savings. How do I invest my $130,000 windfall?

“I’m receiving enough Social Security to live on.”

My job is offering me a payout. Should I take a $61,000 lump sum — or $355 a month for life?

“My S&P 500 investments have roughly doubled every seven years.”

Think you’ve missed the stock-market rally since ‘liberation day’? Think again.

A big, fast rally can look pretty scary to investors. New research says there may be reasons for optimism.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.