05 MAR 2025 Market Close & Major Financial Headlines: Wall Street Rallies, Dow Gains Over 400 Points, Private Jobs Sector Reports Well Below Expectations

Summary Of the Markets Today:

The Dow closed up 486 points or 1.14%,

NASDAQ closed up 267 points or 1.46%,

S&P 500 closed up 64 point or 1.11%,

Gold $2,931 up $11.10 or 0.39%,

WTI crude oil settled at $66 down $1.87 or 2.74%,

10-year U.S. Treasury 4.280 up 0.070 points or 1.663%,

USD index $104.30 down 1.44 points or 1.36%,

Bitcoin $90,350 up $3,759 or 4.16%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

On March 5, 2025, U.S. stock markets rallied following indications of potential easing in trade tensions. The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all gained ground after Commerce Secretary Howard Lutnick hinted at a possible compromise on recently implemented tariffs against Canada and Mexico. President Donald Trump granted a one-month tariff exemption to automakers, leading to significant gains in shares of major car manufacturers like Ford, General Motors, and Stellantis. The market's positive reaction was further bolstered by Trump's pledge to extend his 2017 tax cuts. However, concerns about the broader economic impact of tariffs and disappointing economic data continued to linger, with some analysts suggesting that improved economic growth would be necessary for a sustained market recovery.

Click here to read our current Economic Forecast: –

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

In February 2025, U.S. private employers added just 77,000 jobs, the smallest gain since July, reflecting a cautious approach to hiring amid policy uncertainty and slowing consumer spending, according to the ADP National Employment Report. Pay growth remained steady at 4.7% year-over-year for job-stayers, while job-changers saw a slight dip in pay gains to 6.7%. ADP chief economist Nela Richardson noted that recent data points to employer hesitancy as they navigate an uncertain economic climate, potentially leading to layoffs or reduced hiring. Jobs growth in the private sector has been poor since January 2023 (see graph below) - and this “poor” report is in the range of numbers seen in the last 2 years.

Change by Industry

Goods

Natural resources and mining: down 2,000

Construction: up 26,000

Manufacturing: up 18,000

Services

Trade, transportation, and utilities: down 33,000

Information: down 14,000

Financial activities: up 26,000

Professional and business services: up 27,000

Education and health services: down 8,000

Leisure and hospitality: up 41,000

Other services: up 17,000

In February 2025, the Institute for Supply Management’s Services PMI® rose to 53.5%, a 0.7 percentage point increase from January signaling continued growth in the sector. The Business Activity Index saw a slight decline of 0.1 percentage point to 54.4%. The New Orders Index increased to 52.2% up 0.9 percentage points from January, while the Employment Index grew for the fifth straight month reaching 53.9%—a notable 1.6 percentage point rise from January reflecting sustained positive trends across key indicators. Note that the reading of 53.5% is below 55 - and is a warning that a recession might occur, whilst below 50 is almost proof a recession is underway

source: ISM

CoreLogic's January 2025 report indicates that U.S. home price growth remained largely flat, with a 3.3% year-over-year increase. Despite the current stagnation, prices are expected to rise by 3.6% from January 2025 to January 2026, although growth will vary significantly across regions. The national median home price stands at $375,000, with a new peak for single-family home prices forecast for March 2025. CoreLogic's Chief Economist, Dr. Selma Hepp, suggests that the flattening trend points to further price deceleration, attributing the lack of home-buying demand to factors such as harsh winter conditions, natural disasters, and wary consumer sentiment. However, recent improvements in mortgage rates may potentially stimulate the spring home buying season.

Beige Book shows economic activity had a slight uptick since mid-January, with varied reports across districts ranging from modest growth to slight contractions. Consumer spending trends were mixed, with essential goods maintaining solid demand while discretionary items faced increased price sensitivity, particularly among lower-income consumers. Unusual weather conditions negatively impacted leisure and hospitality services in some regions. Manufacturing activity saw slight to modest increases in most districts, though concerns about potential trade policy changes were expressed. Banking activity and residential real estate markets showed mixed results, with ongoing inventory constraints in housing. Construction activity declined modestly for both residential and nonresidential units, with some concerns about potential tariffs affecting material costs. Agricultural conditions worsened in reporting districts. Despite these challenges, overall expectations for economic activity in the coming months remained cautiously optimistic. Note the amount of differing information coming from government and private sources on the direction of the economy. Further, the data in this government release is anecdotal and not based on quantitative data.

Sponsored Content:

13-Second Trump Video Could Trigger AI Shock

Louis Navellier, the legendary investor who picked Nvidia before shares exploded as high as 3,423%... Just released a video with this 13-second Trump clip about the current AI boom.

Please, do NOT buy any AI stock before watching that clip. What President Trump said in that clip could have implications for this AI boom.

Watch video here!

ref: 6277/2

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

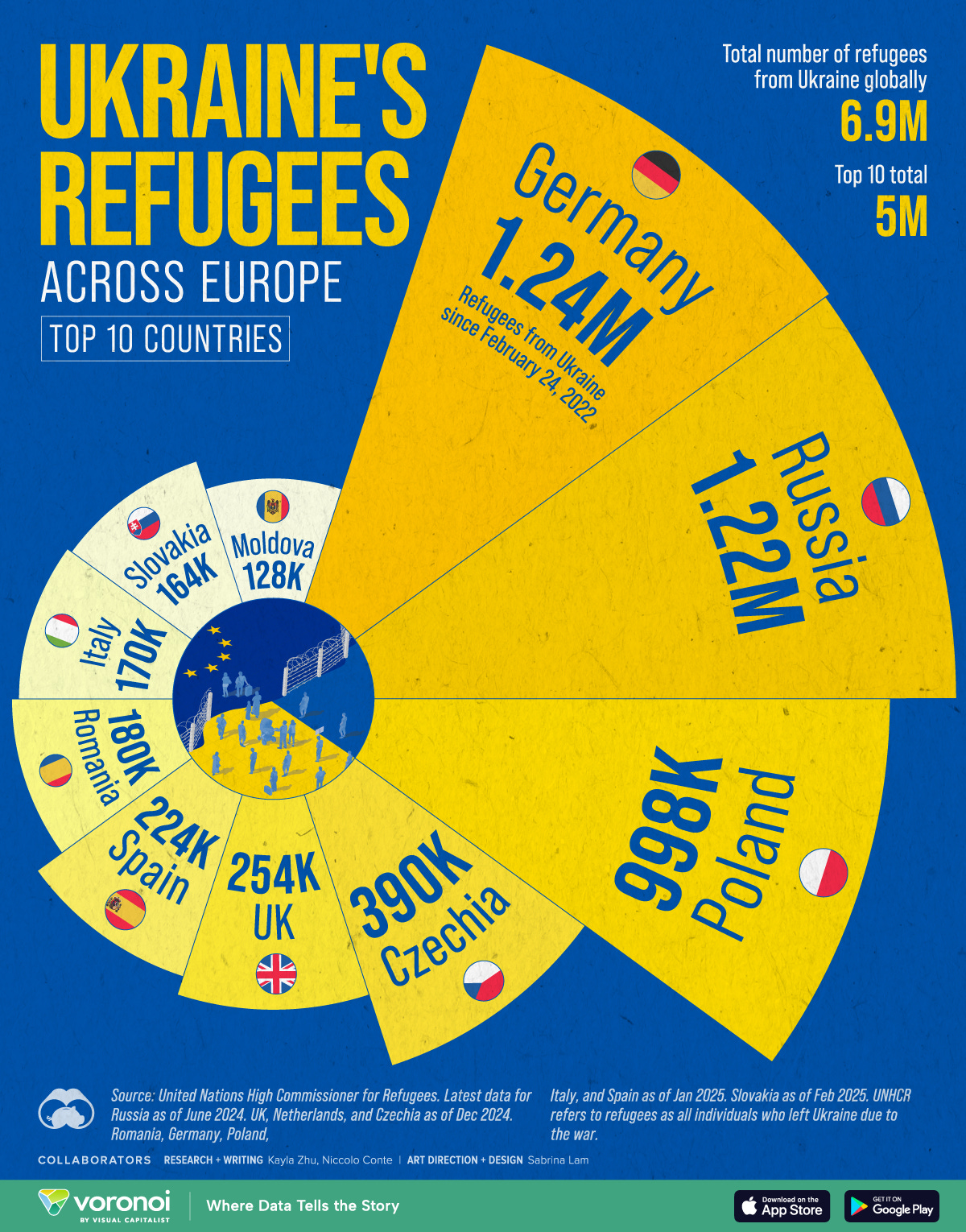

Infographic of the Day from Visual Capitalist:

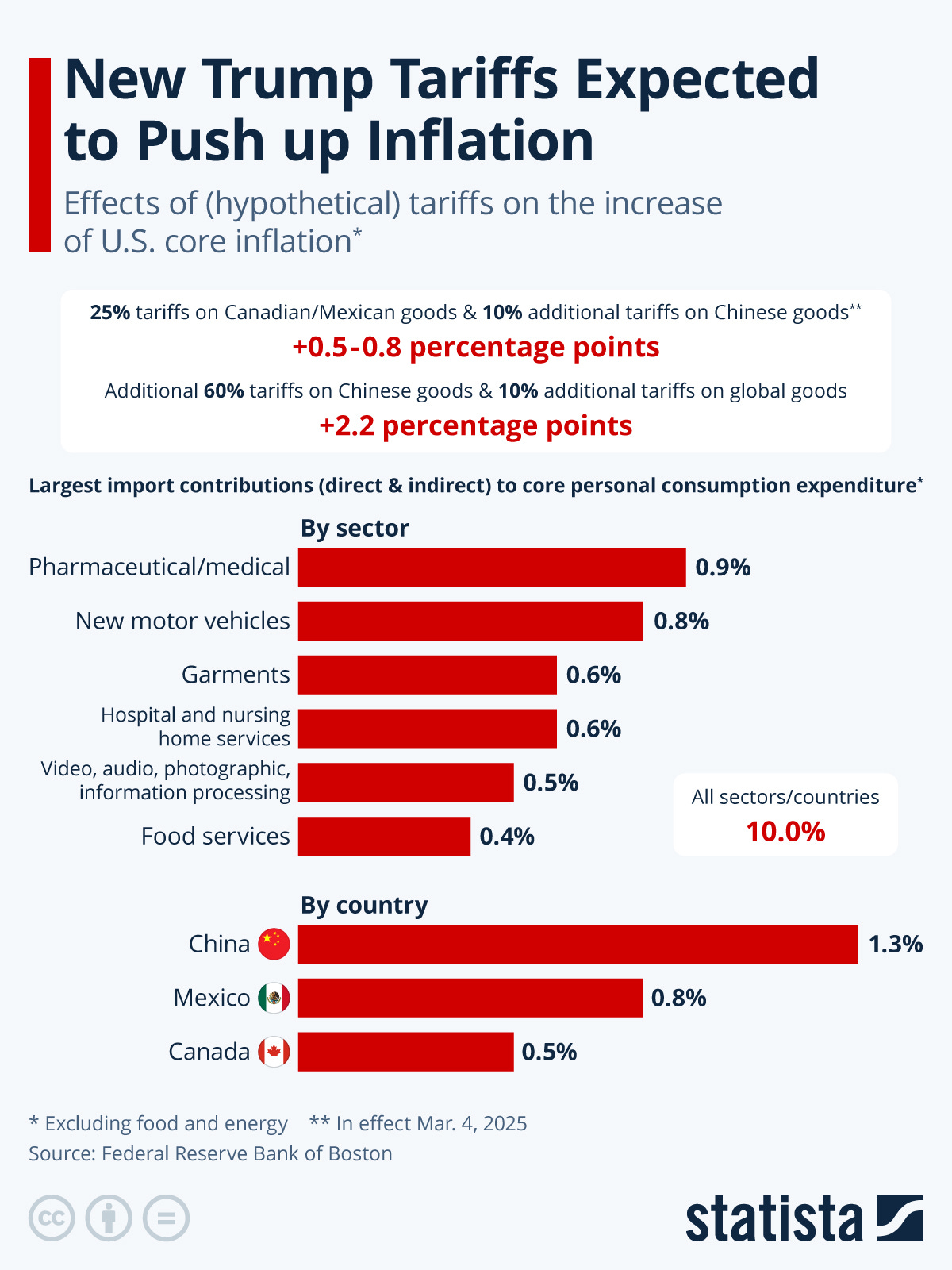

Statista Graphic of the Day:

You will find more infographics at Statista

Here are the headlines we are reading:

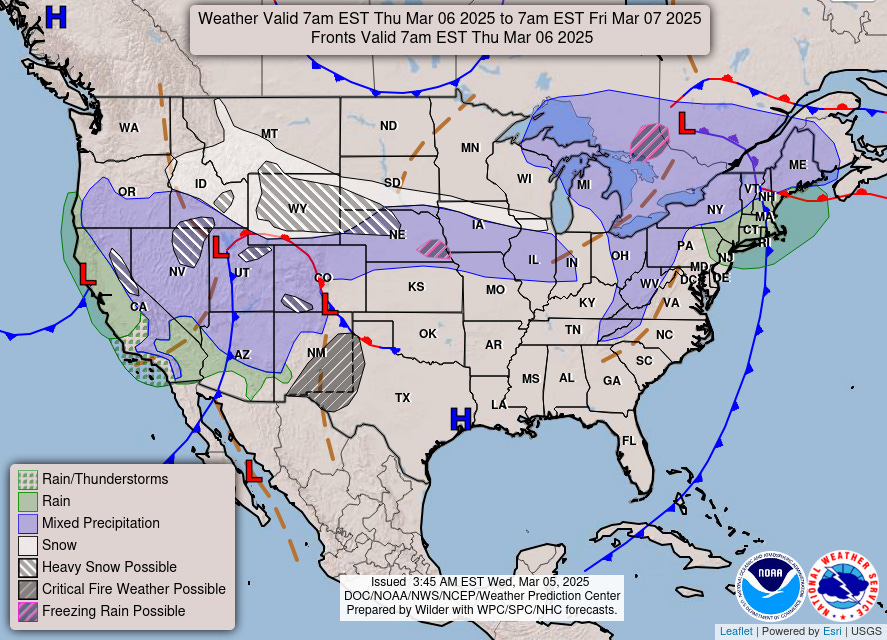

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings click HERE and enter your city, state or zip code in the upper left corner.

Understanding the Middle Distillate Supply Problem

My view haslong beenthat if the world economy does not have enough energy resources, it will have to contract. The situation is analogous to a baker without enough ingredients to bake the size cake he wants to make, or a chemist not being able to set up a full-scale model of a reaction. Perhaps, if a plan is made to make a smaller, differently arranged economy, it could still work. The types of energy with inadequate supplies are both oil (particularly diesel and jet fuel) and coal. Diesel and jet fuel are especially used in long-distance

Nuclear Power and Rare Earths Pique U.S. Interest in Armenia

Armenia, a country making a geopolitical pivot away from Russia toward the West, is finding success in attracting US diplomatic attention by playing up opportunities for trade and investment in the mining and nuclear power sectors. Since taking the reins of government in January, the Trump administrations outlook on Eurasia has fixated on securing deals involving rare earths and nuclear power, underscored not only by the White Houses attempted minerals deal with Ukraine, but also via comments made by Secretary of State Marco Rubio

Is Net Zero Worth the Price?

How many times have we heard the argument that there is no trade-off between pursuing Net Zero and economic growth? The argument lies at the heat of the countrys economic, climate and environmental policy debate. The energy secretary, Ed Miliband, repeats the mantra at every opportunity clean energy and Net Zero equals good jobs and economic growth and he is echoed in this article of faith by an entire industry (in the public and private spheres) that have thrown their lot in with the clean energy drive, whether

Oil Hits One-Year Low on Tariffs Fears, Rising Supply

Oil prices declined for the third consecutive day after U.S. crude oil stocks posted a larger-than-expected build, adding to worries about a looming return of more OPEC+ barrels to the market. Brent crude for May delivery fell 3.6% to $68.56 per barrel at 12.10 pm ET on Wednesday, the lowest level in more than a year, while WTI crude sunk 4.3% to change hands at $65.37 per barrel. U.S. crude stocks rose more than expected in the week ending February 28, while gasoline and distillate inventories fell, the Energy Information Administration reported.

Texas Seeks to Balance AI Growth and Grid Security

The AI infrastructure trade (aka the Power-Up America basket which we recommended one year ago before it soared into the stratosphere), had taken a back seat in recent weeks, with some marquee names such as a Vertiv, Contellation, Oklo and others, tumbling from record highs amid growing speculation that China's DeepSeek - and other cheap LLM alternatives - will lead to far lower capex demands than what is currently projected. But while the occasional hiccup is to be expected, the endgame for US infra/nuclear stocks looks (millions of degrees) bright.

Trumps Secret Plan To Restart Nord Stream 2 Sparks Backlash in Germany

Germany is exploring ways to prevent the resumption of the Nord Stream 2 pipeline under an agreement between the US and Russia as part of the settlement of the war in Ukraine, Bild has reported. According to Bild, secret talks between representatives of Russia and the United States have been going on for several weeks about American investors buying the damaged pipeline in the Baltic Sea. Last year, Russia's Foreign Minister Sergei Lavrov claimed the United States issued the order for the 2022 attacks on the Nord Stream gas pipelines. Back in September

Russian Oil Supply To Czech Republic Cut Amid U.S. Sanctions

Russian oil supply to the Czech Republic via the Druzhba pipeline was cut short on Tuesday due to sanction-linked payment issues between Czech refineries' Polish owner and Russian suppliers. According to CTK news agency, the disruption forced refiner Unipetrol to ask to tap state reserves, with the Czech government agreeing to release 330,000 metric tons of crude oil to the company. Middlemen who supply Russian oil have stopped offering cargoes after the latest U.S. sanctions imposed by the Biden administration targeting Russian producers, tankers

Battery Pack Prices Drop Below Key Threshold but China Rules the Market

The global average price of an EV battery pack dropped below the $100 per kilowatt-hour threshold, considered the milestone at which EVs are price-competitive with conventional cars, the International Energy Agency (IEA) said on Wednesday, but noted that China leads both in market share and low prices. Falling battery pack prices and rising demand have ushered in a new phase of development of the global battery market, IEA technology and clean energy analysts wrote in a commentary today. As the average price of a battery pack for a battery electric

U.S. Crude Stockpiles Climb as Oil Prices Tumble Below $70

Crude oil inventories in the United States saw an increase of 3.6 million barrels during the week ending February 28, according to new data from the U.S. Energy Information Administration released on Wednesday. Crude oil prices were down prior to the crude data release by the U.S. Energy Information Administration, even after the American Petroleum Institute (API) reported on Tuesday a dip of 1.455 million barrels in U.S. crude oil inventories. The market-moving force, rather, was OPEC+s decision to begin unwinding its production cuts starting

Ukrainian Energy Firm Discusses U.S. LNG Deliveries to Europe

DTEK, Ukraines biggest private energy company, is holding talks with U.S. developers to bring more LNG to Europe, the firms chief executive Maxim Timchenko told The Wall Street Journal in an interview published on Wednesday. My great hope is that this year DTEK will announce several deals with foreign companies, Timchenko told the Journal. Europe should replace Russian gas, primarily with LNG, said the Ukrainian executive. DTEK, which also operates power plants in Ukraine, is working to restore facilities hit by Russia

Macron Mulls Joint Washington Visit with Zelenskyy and Starmer

European leaders jumped to renew a push for an end to Russia's invasion of Ukraine after US President Donald Trump said President Volodymyr Zelenskyy wrote a letter stating he's ready for talks with Moscow while also offering to sign a deal on Ukraine's mineral resources "at any time." After a week of tumult that culminated with the United States announcing a suspension of military aid to Ukraine after a heated exchange between the two leaders, Trump told a joint session of Congress on March 4 that Zelenskyy sent him a letter expressing a willingness

Equinor Makes Gas Discovery in Norwegian Sea

Equinor on Wednesday announced a new gas and condensate discovery in the Norwegian Sea, which could contribute to Norways efforts to boost natural gas production and exports to Europe. Equinor and its partners, Okea and Pandion Energy, have proven gas and condensate in the Mistral Sr exploration well in the Halten area in the southern part of the Norwegian Sea. Early estimates put the volume of the discovery at 19-44 million barrels of recoverable oil equivalents. The important thing for the explorers is that the discovery was made

Russias Oil and Gas Revenues Dropped by 18% in February

Russia saw its oil and gas budget revenues drop by 18.4% in February from a year earlier, according to data from the Russian Finance Ministry. Last month, Russias budget received $8.6 billion (771.3 billion Russian rubles) from oil and gas, down from $10.6 billion (945.6 billion rubles) in February last year. The lower oil prices have played a role in Russias lower revenues in February 2025 compared to a year earlier. Going forward, Russias revenues from oil are set to be volatile, due to the January sanctions on Russian oil

Egypt Launches New Oil and Gas Bid Round

Egypt is inviting international companies to bid for 13 offshore and onshore blocks in a new licensing round as it aims to boost domestic oil and gas production. Companies are invited to bid on six new exploration areas and seven undeveloped discoveries. The undeveloped discoveries are in the Mediterranean, while the six exploration areas include three offshore exploration blocks in the Gulf of Suez and three onshore exploration areas in Egypts Western Desert. The so-called Open Blocks Licensing Program (OBLP) will close on May 4, 2025.

Norways $1.8-Trillion Oil Fund Bets on Long-Short Equity Strategy

The worlds biggest sovereign wealth fund, Norways $1.8 trillion oil fund, has made its first investment in an external hedge fund with long-short strategies, amid changing and volatile markets, a top executive of the funds manager told the Financial Times. The fund, which is commonly referred to as Norways oil fund because it was created with oil and gas revenues, is a shareholder in many large companies in the world, including Big Oil. Government Pension Fund Global, as the Norwegian fund is officially

Trump tariffs live updates: White House says Canada's efforts 'not good enough,' open to exemptions

Investors and business leaders are looking for any signs that political leaders will walk back recent tariff hikes.

Dow closes nearly 500 points higher, S&P 500 surges over 1% on hopes for Trump tariff concessions

Stocks are coming off back-to-back losses as investors monitor tariff updates.

Latest negative economic data is 'Biden data' and Trump will fix it, Commerce chief Lutnick says

The stock market dropped sharply in recent days as investors worried about the effects of President Donald Trump's new tariffs on Canada and Mexico.

Digg founder teams up with former Reddit rival to buy and revive website

Content aggregator Digg is making a comeback thanks to a partnership with rival and Reddit co-founder Alexis Ohanian.

These funds offer investors attractive income - if they’re willing to make a few tradeoffs

Interval funds offer investors a way to tap private credit, with yields that can reach the high-single- to low double-digit range. But there are caveats.

Bitcoin bounces back as President Trump grants exemption to tariffs: CNBC Crypto World

On today's episode of CNBC Crypto World, cryptocurrencies rebound after the Trump administration adds an auto exemption to the recent rollout of tariffs. Plus, the Senate passes a resolution to undo a new IRS rule for DeFi brokers. And, JP Richardson of Exodus discusses the self-custody platform's fourth-quarter earnings.

Private employers added just 77,000 jobs in February, far below expectations, ADP says

Private sector job creation slowed to a crawl in February, fueling concerns of an economic slowdown,

Congress' proposed cuts may jeopardize Medicaid and negatively impact the economy, report finds

Federal cuts to Medicaid would impact more than 80 million people who rely on the program. It may also negatively effect the economy, new research finds.

California pauses home energy rebate program amid Trump funding freeze

California paused a Biden-era home rebate program tied to energy efficiency because it can't access federal funding to administer the program.

Apple unveils new MacBook Air models with $100 price cut despite tariffs

The MacBook Air price cut comes as Apple's U.S. pricing is closely watched by both Apple customers and investors in response to tariffs.

Apple co-founder Steve Wozniak blasts Musk's DOGE over 'sledgehammer' approach to government layoffs

Apple co-founder slammed the Department of Government Efficiency, or DOGE, over mass job cuts at various government agencies.

NHL commissioner says league could be affected by U.S.-Canada tariffs

NHL Commissioner Gary Bettman noted players in both countries are paid in U.S. dollars.

It's a great time to buy defense stocks as DOGE cuts fears are overblown, says Citi

Citi remains bullish on defense stocks, particularly given Europe's continued defense spending and Trump's recent missile defense dome and shipbuilding plans.

Beige Book: Economic Activity, Employment And Prices Rose Since January, Economic Expectations Are "Optimistic"

Was that it for the Atlanta Fed recession (which as we described, managed to fool everyone into believing the US economy is crashing because of... surging gold imports)?

Two months after the December Beige Book (published in January) reported that in the last month of Biden's presidency, "economic activity increased slightly to moderately across the twelve Federal Reserve Districts in late November and December", moments ago - and with everyone expecting fire and brimstone and perhaps a confirmation that the US is now neck deep in a recession if not depression (at least based on how the 10Y and USD are trading) - the latest Fed Beige Book found that in February, or one month into Trump's 3rd 2nd presidency, economic activity actually "rose slightly since mid-January."

Reading the latest Fed report we find that six districts reported no change, four reported modest or moderate growth, and two noted slight contractions.

Here are the specific details:

Consumer spending was lower on balance, with reports of solid demand for essential goods mixed with increased price sensitivity for discretionary items, particularly among lower-income shoppers. Unusual weather conditions in some regions over recent w ...

White House Delays Canada, Mexico Automaker Tariffs For One Month Amid Trump-Trudeau Deadlock

Update (1415ET): It's official, President Trump is exempting automakers from newly imposed tariffs on Mexico and Canada for one month, the White House said Wednesday.

Canadian Prime Minister Justin Trudeau is greeted by U.S. President Donald Trump as he arrives at the White House in Washington on June 20, 2019. The Canadian Press/Sean Kilpatrick

"We are going to give a one month exemption on any autos coming through USMCA," said WH spox Caroline Leavitt, referring to the trade deal negotiated with Canada and Mexico in Trump's first term.

"Reciprocal tariffs will still go into effect on April, 2, but at the request of the companies associated with USMCA, the president is giving them an exemption for one month so they are not at an economic disadvantage."

As noted below, the announcement came after administration officials met Tuesday to discuss the mat ...

Waste Of The Day: $95 Million Worth Of EV Buses Were Never Delivered

Authored by Jeremy Portnoy via RealClearInvestigations,

Topline: The Biden administration gave Canadian electric bus maker The Lion Electric Company $160 million in subsidies to manufacture 435 buses for schools around the U.S. The company is nearing bankruptcy and laid off almost half its employees, but $95 million of the buses have still not been provided, according to the Washington Free Beacon.

Some of the $65 million worth of buses that were delivered are not without problems. The Environmental Protection Agency is investigating Lion Electric for

New Filing In Anti-DOGE Lawsuit Cites Trump's Remarks On Musk's Role

Authored by Katabella Roberts via RealInvestmentAdvice.com,

Comments made by President Donald Trump on Tuesday night are being used in a lawsuit challenging the legality of his administration’s Department of Government Efficiency (DOGE).

In a filing with the U.S. Court for the District of Columbia, the National Security Counselors, a public interest law group, highlighted remarks made by Trump during his speech to a joint session of Congress.

“To further combat inflation, we will not only be reducing the cost of energy, but will be ending the flagrant waste of taxpayer dollars,” Trump told lawmakers in attendance.

“And to that end, I have created the brand-new Department of Government Efficiency, DOGE. Perhaps you’ve heard of it.”

Trump exempts carmakers from tariffs temporarily

Donald Trump says carmakers will be spared a day after tariffs went into effect.

US tariffs could hit UK consumers, Bank experts warn

Trump tariffs could affect UK economic growth, hitting UK consumers in the pocket, Bank experts warn

Chancellor set to cut welfare spending by billions

Cuts to areas including welfare will be put to the official forecaster ahead of the Spring Statement.

Biocon shares up 3% after US FDA nod for key cancer drugs

Biocon share price: Shares of Biocon Ltd rose 3% after Biocon Pharma received FDA approvals for cancer drugs Lenalidomide and Dasatinib, enhancing its US oncology market presence. The company also got tentative approval for Rivaroxaban. Despite recent stock declines, analysts suggest a potential 22% upside. Biocon's Q3 profits dropped sharply due to a previous one-time gain.

ETMarkets Smart Talk | Over 60% of the stocks are available at 25-50% discount highs: Value buys or traps? Manish Goel explains

Even though FIIs have pulled out a record amount in Rs 2.1 trillion since October 2024, DIIs have stepped in with even higher investments (Rs 3.2 trillion), keeping the market from falling sharply.

Sentiment on D-Street most bearish since Covid

A declining ADR means more stocks are falling as against the gainers and points to a weakening market. In January, the reading was 0.9, while in the period before October - when the market started declining, it was in the range of 1 to 1.28 on average.

Trump hates the U.S. Chips Act. Here’s what could happen next.

Intel is viewed as “being left on the side of the road” by the Trump administration.

10-year yield jumps by most in 2 weeks on tariff relief, better-than-expected data

Yields on U.S. government debt finished higher on Wednesday after automakers received a one-month exemption from tariffs and data from the manufacturing and service sectors came in better than expectations.

Eight Fed districts had flat or slightly negative growth in February: Beige Book

The report from the Federal Reserve comes as talk about a potential recession has picked up in recent days.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.