03 June 2025 Market Close & Major Financial Headlines: Wall Street Ends Slightly Higher as Tech Gains Offset Trade Worries

Summary Of the Markets Today:

The Dow closed up 2 14 points or 0.51%,

NASDAQ closed up 156 points or 0.81%,

S&P 500 closed up 34 points or 0.58%,

Gold $3,379 down $18.50 or 0.54%,

WTI crude oil settled at $63 up $0.90 or 1.44%,

10-year U.S. Treasury 4.466 up 0.004 points or 0.09%,

USD index 98.29 up 0.58 down or 0.59%,

Bitcoin $106,217 down $1,753 or 1.65%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

On June 3, 2025, stock markets ended trading slightly in the green. U.S. stock futures dipped after declines in major indices in early trading. The Organisation for Economic Co-operation and Development (OECD) downgraded its U.S. and global growth forecasts for 2025, citing the negative impact of tariffs and policy uncertainty, which further weighed on sentiment. Shares of major automakers like General Motors, Ford, and Stellantis dropped in response to the prospect of higher steel tariffs, while Dollar General bucked the trend with a double-digit premarket gain after strong earnings. Despite the volatility, some optimism lingered as investors looked ahead to upcoming employment data and potential progress in trade talks, while the tech sector, led by NVIDIA and chip stocks, continued to provide some support to the broader market. European markets fell and the dollar rebounded, reflecting the global reach of the trade dispute and economic concerns.

Read the June 2025 Economic Forecast: Recession Winds - Is the Glass Half Empty or Half Full

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

The number of CEO changes at U.S. companies surged 21% from 177 in March to 214 in April 2025, marking a 70% increase over the 126 CEO exits in April 2024, according to Challenger, Gray & Christmas. This spike is part of a record-setting trend, with 860 CEOs stepping down through April, up 15% from the same period last year and the highest total on record for the first four months of the year. The second quarter has become a key period for talent and workforce planning, with many companies making major leadership changes as they gain clarity on the outlook for 2025 and approach fiscal year-end. A growing share of departing CEOs are older, with the average age of exiting leaders rising to 63, compared to 55 last year, signaling a wave of seasoned executives choosing to step down while boards seek leaders adept at navigating uncertainty and rapid change. This leadership churn is also accompanied by a decline in the appointment of women CEOs and a sharp rise in interim appointments, reflecting both economic pressures and shifting corporate priorities.

The number of job openings changed little, to 7.4 million in April 2025. Over the month, both hires and total separations were little changed at 5.6 million and 5.3 million, respectively. Within separations, quits (3.2 million) and layoffs and discharges (1.8 million) changed little. Historically, the level of job openings correlates with the growth of employment. It should follow that employment growth in May 2025 should continue to grow at approximately the same rate we have seen so far this year.

For the past 2 years, manufacturing has been in the doldrums. New orders for manufactured goods in April 2025 is up 0.6% year-over-year (YoY) - down from last month’s 5.3% YoY. The Federal Reserve’s Manufacturing data in April shows a 1.3% rise YoY (red line on the graph below). In any event, manufacturing continues to show sluggish growth.

Sponsored Content:

Trump's Neighbor Reveals Truth Behind America's New Transformation

A mysterious financial figure — called "one of the most important money managers of our time" by national media — has issued a scathing economic warning. His controversial video exposes how an invisible force is rewriting the rules of wealth creation. The question everyone's asking:

Who dared to break ranks with the financial elite?

ref: 7151/2

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

Infographic of the Day from Visual Capitalist:

Statista Graphic of the Day:

You will find more infographics at Statista

The headlines we are reading:

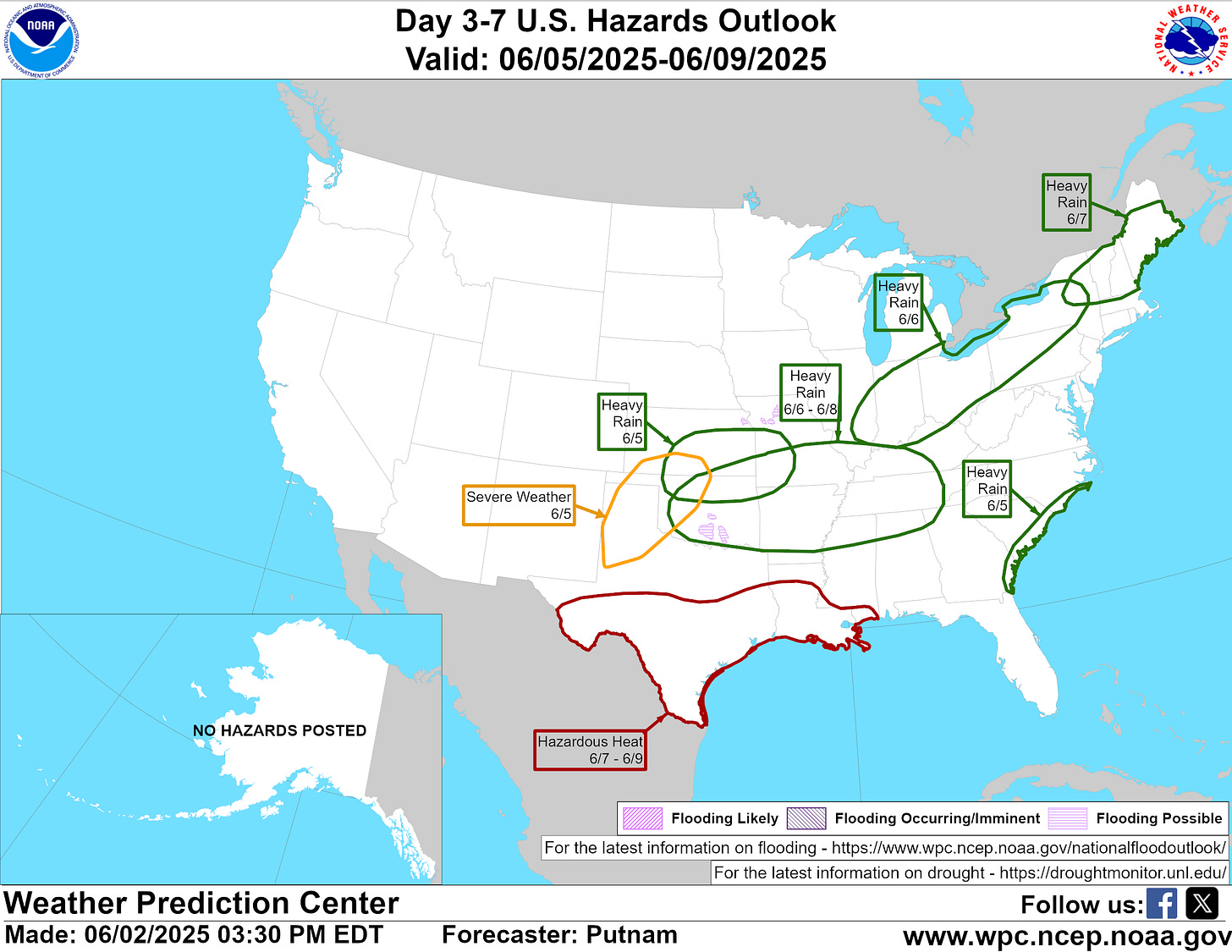

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks, which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings, click HERE and enter your city, state or zip code in the upper left corner.

Musk calls Trump budget bill a 'disgusting abomination'

Musk, the Tesla and SpaceX CEO who spent over $250 million backing Trump's presidential bid, led the president's DOGE group until last week.

Fed Governor Lisa Cook sees tariffs raising inflation and complicating rate policy

Cook expressed concern Tuesday with the progress on inflation, saying recent lower readings could reverse.

Job openings showed surprising increase to 7.4 million in April

Employers increased job openings more than expected in April while hiring and layoffs also both rose.

Dow closes 200 points higher, S&P 500 climbs as Nvidia lifts tech sector: Live updates

The three major stock averages extended May's gains by posting modest advances on the first two trading days of June.

Robinhood shares climb after trading app completes Bitstamp deal: CNBC Crypto World

On today's episode of CNBC Crypto World, Robinhood shares climb after the retail trading platform completes its acquisition of Bitstamp, which gives the firm an immediate international footprint. Plus, Bitwise CEO Hunter Horsley sits down with CNBC from Bitcoin 2025 to discuss bitcoin's new record, crypto ETFs and regulatory advancements for digital assets in the U.S. And also speaking from Bitcoin 2025, Kraken CEO Dave Ripley discusses crypto regulations he's hoping Congress will pass.

The 40/60 portfolio has 'paid off' this year and should boost future returns, says Vanguard

It's been a good year so far for Vanguard's strategy of 40% stocks and 60% bonds, the firm said.

DHS takes family of Colorado fire attack suspect Soliman into ICE custody, Noem says

Mohamed Soliman yelled "Free Palestine!" as he attacked with a flamethrower a group calling for the release of Israeli hostages by Hamas, officials say.

$TRUMP crypto wallet launches for meme token. Eric Trump denies knowing about it

An NFT marketplace is building a $TRUMP meme coin wallet, complete with bitcoin trading, referral rewards and $1 million in token giveaways.

Tesla's planned robotaxi launch in tech-friendly Austin has Musk playing catch-up in his hometown

Tech companies are testing self-driving cars in Texas, with Elon Musk and Tesla getting set to join the growing market.

Inmate forged Trump death threats to get star witness deported: Prosecutors

A man who was allegedly framed for sending letters threatening to kill President Donald Trump still faces possible removal from the United States.

4-time NBA champion Stephen Curry says even he suffers from impostor syndrome

In addition to his basketball accolades, Curry owns a media company, a bourbon brand, a golf league for kids and a philanthropic foundation.

Here's why Applebee's owner Dine Brands hasn't found Chili's recent success

Applebee’s hasn't put the same level of investments into its restaurant as Chili's and its franchising model makes revitalization efforts more challenging.

This biotech stock rallying on cancer treatment data has more room to run, analysts say

Shares have surged nearly 40% over the past month and rallied to a new all-time high on Tuesday.

Romanian Man Pleads Guilty To 'Swatting' US Officials, Including A Former US President

Authored by Arjun Singh via The Epoch Times,

A man from Romania has pleaded guilty to felonies after he made false reports to elicit tactical police responses—known as “swatting”—against a former U.S. president, several members of Congress, federal judges, and state officials.

“Swatting” derives its name from “Special Weapons and Tactics” (SWAT) teams that are organized by police departments across the world, who respond to particularly dangerous emergencies, such as terrorist attacks, mass shootings, and other weapons of mass destruction.

The phenomenon of “swatting”—i.e., falsely reporting such an emergency to elicit a SWAT response—has emerged in recent years as a means of intimidation or to drain national resources.

Several high-pro ...

More Details: Kerch Bridge Explosion In Crimea, What Did Trump White House Know?

Update(1208ET): More details have emerged of what marks the third major Ukrainian sabotage bombing of the key bridge linking the Russian mainland to the Crimean peninsula, as the pace of the war heats up:

Ukraine said it attacked the Crimean Bridge with explosives as Russia closed traffic on the route linking the annexed Black Sea peninsula with the Russian mainland.

Agents planted mines on underwater supports and detonated them on Tuesday, the Ukrainian Security Service, known as the SBU, said in a statement on Telegram. The SBU said the operation took place over several months and left the bridge in an emergency condition, which couldn’t be independently verified.

Ukrainian intelligence over the weekend was busy blowing up other civilian bridges inside Russia as well, resulting in the deaths of seven people, and scores more casualties, as we detailed.

"The bridge was originally shut for more than three hours starting in the morning local time, and then again for almost two-and-a-half hours, the news agency said," according to Bloomberg. "Maritime passenger transportation was suspended in Sevastopol, the city’s road and transport infrastructure authority said, also without explaining what prompted the interruption, ...

Biden Autopen Scandal Widens As DOJ Investigates Pardons

The Department of Justice (DOJ) is investigating pardons granted by former President Joe Biden - specifically looking at whether he was mentally competent to make decisions, and whether he knew about his administration's copious use of Autopen.

According to an email from DOJ pardon attorney Ed Martin seen by Reuters, the investigation involves whether Biden "was competent and whether others were taking advantage of him through use of AutoPen or other means."

Martin's email states that the investigation is focused on said pardons to members of the Biden family, as well as clemency which spared 37 federal inmates from the death penalty - converting their sentences to life in prison.

Shortly before he left office, 'Biden' pardoned five members of his family, claiming he wanted to protect them from politically motivated investigations. Siblings James Biden, Frank Biden and Valerie Biden Ow ...

Airline Crews Say DEI Persists, Despite Safety Concerns And Trump Orders

Authored by Janice Hisle via The Epoch Times,

For one veteran airline captain, a routine flight to Denver changed her view about aviation safety—but not because of an in-flight crisis.

Rather, the captain heard a story that—for the first time in her decades-long career—made her uneasy about putting her loved ones on a plane.

During a 2024 conversation, a flight instructor described unusual steps managers took to salvage the career of a young female trainee pilot. The instructor described an “egregious” example of standards apparently being relaxed to meet DEI goals, the captain said.

The trainee repeatedly failed rudimentary pilot-training tests. By “crashing” a computer simulation “flight,” she proved her inability to operate an airplane’s three most basic control mechanism ...

Singapore Becoming a Southeast Asian Green Power Hub

Long reliant on gas to meet its energy needs, Singapore is now turning to regional interconnections, primarily via subsea cables, to link national grids and enable cross-border electricity trade. This shift aims to accelerate decarbonization and decouple domestic electricity prices from global gas market volatility. Research from Rystad Energy indicates that if all proposed interconnections to Singapore are realized, they could unlock up to 25 gigawatts (GW) of renewable and energy storage projects worth more than $40 billion in investment across

Navigating Base Metal Price Swings Through Strategic Hedging

Via Metal Miner There are many hedge fund strategies organizations can employ to generate returns and manage risk. Now, metal buyers are looking to apply these same concepts to certain metals. Base metals like copper have seen notable swings so far in 2025. According to the CME group, copper oscillated in a roughly $4.55$4.80 per pound range throughout May as Chinese demand steadied and trade tensions eased. In contrast, aluminum has been much stronger. Analysts now predict that LME aluminum will average about $2,574/tonne in 2025

Space Economy Projected to Reach Trillions by 2035

Authored by Rainer Zitelmann via RealClearMarkets, The most undervalued industry in the world is the space industry. It is particularly unappreciated in Europe, which has now fallen hopelessly behind the United States and China. The US carried out 153 launches last year, China 68 and Europe three. The science fiction author Arthur C. Clarke wrote back in 1977: The impact of satellites on the entire human race will be at least the same impact as the advent of the telephone in so-called developed societies. And he was right. Satellite

G7 Oil Price Cap at the Heart of New Sanction Debate

When the European Commission started briefing EU states last month on the next sanctions package expected to be imposed on Russia, the 27 member nations expected concrete written proposals to follow. They're still waiting. Normally these sorts of documents -- in this case the potential 18th round of restrictive measures since the Kremlins full-scale invasion of Ukraine was launched more three years ago -- are provided only a few days after the briefings, or confessionals as they are known in Brussels. The documents outline

Oil Ticks Higher as Geopolitical Tensions Mount, but Gains Likely Capped

Oil prices posted modest gains Tuesday, fueled by renewed geopolitical risk and signs of tightening supply, though upside may be limited by ongoing uncertainty around Iran and soft macroeconomic indicators. As of late morning, WTI crude was trading at $63.76 (+1.98%), and Brent at $65.74 (+1.72%). Both benchmarks built on Mondays nearly 3% rally after OPEC+ confirmed it would raise output by just 411,000 barrels per day in Julybelow what some market watchers feared. Murban crude also rose to $65.51 (+1.13%), while U.S. natural gas

Venezuela Defies U.S. Sanctions as Oil Exports Hold Steady

Venezuelas oil exports remained largely unchanged in May despite mounting pressure from the U.S. and the expiration of key licenses that once allowed limited sanctioned trade. Increased shipments to China helped offset a sharp drop in U.S.-authorized sales as state-run PDVSA scrambled to re-route barrels ahead of tightening sanctions. According to internal PDVSA documents and vessel-tracking data, Venezuela shipped 779,000 bpd of crude and refined products last monthdown only slightly from Aprils 783,000 bpd. While exports

Russian LNG Exports Dip Amid Sanctions and EU Clampdown

Liquefied natural gas (LNG) exports out of Russia fell by 3% in January through May from a year earlier, amid tighter EU restrictions on transshipment and U.S. sanctions on a new LNG project that cant find buyers yet. Russias LNG shipments dipped by 3% year-over-year to 13.2 million tons in the first five months of the year, Reuters reports, citing preliminary data from LSEG. Exports to Europe slumped by 12%, while shipments in May alone declined by 14.3%, according to the data. Thats mostly the result of the EU ban on transshipment

The OPEC+ Nations That Were Reluctant to Boost Production

Unlike Russia and Oman, Algeria wasnt initially in favor of a pause in the OPEC+ oil production increases at this weekends meeting, Bachar El-Halabi, senior correspondent at Argus Media, reports, citing a senior source within the OPEC+ group. Initially, Russia and Oman two non-OPEC producers part of the OPEC+ alliance implementing the cuts since 2022 requested a pause in the monthly production increases, Argus Media has reported. But OPEC member Algeria didn't call for a pause, according to Arguss source. Algeria

The Geopolitical Risk Premium Is Here to Stay

While oil prices spiked due to a combination of OPEC+ underwhelming markets and wildfires in Canada, a rising geopolitical risk premium is lifting both Brent and WTI and is set to stick around for a while to come.- US-China trade war and OPEC+s flooding of oil markets with additional supply have lifted refinery margins across the world, with gasoline, jet fuel, and diesel cracks all staying in double digits since the beginning of May.- Global refining margins, as calculated by consultancy Wood Mackenzie, rose to their highest since March

Diamondback Unit to Buy Sitio Royalties in $4-Billion All-Stock Deal

Viper Energy, a subsidiary of Diamondback Energy, will buy mineral and royalty company Sitio Royalties Corp in an all-equity deal valued at around $4.1 billion, including the target companys debt. The buyer will acquire Sitios net debt of approximately $1.1 billion as of March 31, 2025, the firms said on Tuesday. Sitio is a pure-play mineral and royalty company that acquires quality oil and gas mineral and royalty interests in productive U.S. basins. Sitio has around 25,300 net royalty acres in the Permian Basin, as well as an additional

Crude Processing At One of Europes Top Refineries Goes Offline

BPs refinery in Rotterdam had both its crude units offline on Tuesday morning, Reuters reports, citing energy consultancy Wood Mackenzie. A crude unit with a capacity of 200,000 barrels per day (bpd) went offline early on Tuesday. This follows the shutdown of the other 200,000 bpd crude unit in early May for planned maintenance. As a result of the shutdowns, the 400,000-bpd oil refinery in Rotterdam now has both crude units offline. The Rotterdam refinery is one of Europes largest and has the capacity to process 400,000 bpd of crude,

Tight Fuel Markets Boost Profits for Oil Refiners

Refining capacity closures and resilient fuel demand have tightened global fuel markets in recent weeks, benefiting refiners globally. Refining margins have been rising this year and hit in May the highest global composite margin in more than a year. As the driving season begins and summer approaches, peak demand in the northern hemisphere is here. Refiners, including U.S. refining giants, are benefiting from the higher margins, although these margins are far below the record highs seen in 2022 amid the oil market turmoil. Still, global composite

Brazil Looking for $6.2 Billion From Its Oil Industry

Brazils government is looking to extract some $6.2 billion from the countrys oil industry in a bid to shore up state finances, Bloomberg has reported, saying one way to get more money out of oil producers was by reviewing the reference prices used to set oil taxes. Another way to raise money from the oil industry that the government is considering is the sale of more exploration licenses, Bloomberg also wrote. Brazil has been struggling to achieve its stated goals, confronted with a combination of higher spending and

Oil Prices Extend Gains on Supply Worry

Crude oil prices extended their climb that began Monday as concerns about supply security deepened. At the time of writing, Brent crude was trading at $64.85 per barrel and West Texas Intermediate was changing hands for $62.82 per barrel, after rising by about 3% on Monday, per Reuters. The benchmarks reacted to the latest escalation between Russia and Ukraine, which many seem to expect to spread to Russian oil targets, and to a report saying Iran was about to reject a U.S. proposal for a nuclear deal that would require Tehran to stop any uranium

Maintenance Season Causes Dip in U.S. LNG Exports

Maintenance season for liquefied natural gas plants in the United States caused a decline in exports of the superchilled fuel in May, with the number at 8.9 million metric tons, from an all-time high of 9.3 million tons in April. The data came from LSEG, as reported by Reuters, which noted that the largest LNG production facility in the country, Cheniere Energys Sabine Pass plant, operated at the lowest rate in two years due to maintenance. Of the total exports in May, the biggest chunk went to Europe, as is now usual, at 6.05 million tons,

Thames Water's future in doubt after investor pulls out

The setback increases the possibility that the company will collapse into a government-supervised administration.

Lower energy costs make retirement less expensive

A one-person household needs £13,400 a year for a basic standards of living in retirement, a report suggests.

Debt and trade issues weaken UK growth, OECD says

The policy group lowers its UK economy forecast due to trade barriers and Britain's "very thin" financial buffer.

Ericsson sells Vodafone Idea stake worth Rs 428 crore via bulk deal

Ericsson Vodafone Idea stake sale: Ericsson India offloaded its 0.6% stake in Vodafone Idea, selling 63.37 crore shares at Rs 6.76 apiece via a bulk deal, raising Rs 428.43 crore. Buyer details remain undisclosed.

Peak XV trims stake in Zinka Logistics in Rs 302 crore bulk deal; ADIA, MIT among buyers

Zinka Logistics Solutions (BlackBuck) saw a Rs 302 crore block deal as Peak XV Partners trimmed stake. ADIA, MIT, and ICICI Prudential emerged as key institutional buyers in the transaction.

Rs 804 crore worth block deals in Aptus Value Housing. Morgan Stanley, SBI MF are among buyers

Aptus Value Housing block deal: Aptus Value Housing Finance witnessed Rs 804 crore worth of block deals on Tuesday. Key buyers included Morgan Stanley, East Bridge Capital, SBI MF, Axis MF, and iRage Broking, acquiring shares at Rs 307 each.

America’s biggest lender is closing its wallet — and investors and homebuyers will feel it. Here’s what to watch.

Prepare for higher U.S. interest rates if Japan cuts its U.S. Treasury bond holdings. But there could be a silver lining.

Benadryl, Band-Aid parent says tariffs and late allergy season are hurting its business

Kenvue Chief Executive Thibaut Mongon said the consumer continues to be under pressure.

Elon Musk calls Trump tax bill an ‘abomination.’ Does he have the clout to stop it?

The Tesla CEO is giving support to a number of Senate fiscal hawks.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.