02 July 2025 Market Close & Major Financial Headlines: Markets Wobble as Weak Jobs Data, Trump’s Tariff Threats, and Senate Tax Bill Stir Volatility

Summary Of the Markets Today:

The Dow closed down 11 points or 0.02%,

NASDAQ closed up 190 points or 0.94%,

S&P 500 closed up 29 points or 0.47%, (New Historic high 6,228, Closed at 6,227)

Gold $3,368 up $18.0 or 0.54%,

WTI crude oil settled at $67 up $1.78 or 2.70%,

10-year U.S. Treasury 4.287 up 0.038 points or 0.894%,

USD index 96.75 down $0.07 or 0.07%,

Bitcoin $109,683 up $4,278 or 3.90%, (24 Hours),

*Stock data, cryptocurrency, and commodity prices at the market closing

Today’s Highlights – Market Summary

Stock markets on July 2, 2025, were shaped by a mix of economic and political developments, with the S&P 500 reaching an intraday record before retreating as investors digested unexpectedly weak U.S. private payrolls data and ongoing uncertainty around President Trump's looming tariff deadline and mega tax-and-spending bill. The disappointing ADP employment report heightened concerns about the labor market, prompting a rise in expectations for a Federal Reserve rate cut later in July. Technology stocks were volatile, with Apple gaining but broader tech names like Nvidia and Microsoft slipping, while health insurers tumbled after Centene withdrew its earnings forecast. Major banks saw modest gains after boosting dividends following positive Fed stress test results. Globally, Asian markets slipped and the U.S. dollar hovered near multi-year lows as investors assessed the likelihood of imminent U.S. rate cuts and the outcome of critical trade negotiations. Meanwhile, President Trump's tax-and-spending bill passed the Senate by a razor-thin margin, adding to fiscal uncertainty as it heads to the House. Overall, markets reflected caution amid mixed economic signals, sector rotation, and heightened policy risks.

Read the June 2025 Economic Forecast: Recession Winds - Is the Glass Half Empty or Half Full

Today’s Economic Releases Compiled by Steven Hansen, Publisher:

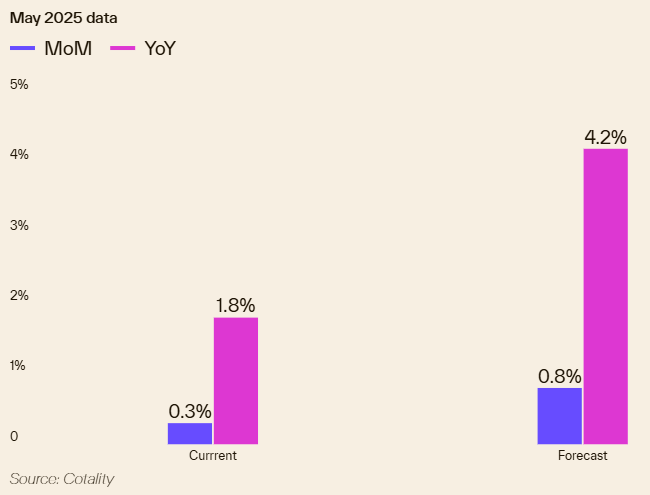

In July 2025, the U.S. housing market is characterized by sluggish price growth and subdued home-buying activity, with year-over-year price growth dropping to 1.8% in May 2025, the slowest since 2012. While affordable Midwestern markets like Indianapolis and Knoxville, along with areas near New York, show stronger seasonal gains, states like Illinois, Rhode Island, and New Jersey lead with robust year-over-year growth, contrasting with negative price growth in Florida, Texas, Hawaii, and Washington D.C. Chief Economist Selma Hepp notes that rising inventory, high mortgage rates, and affordability concerns are dampening demand, particularly in overvalued Southern and Desert West markets, where cumulative price increases since 2020 far exceed the national average. Escalating non-fixed costs like property taxes and insurance, which have surged 70% since 2020, are further pressuring markets like Cape Coral, FL, contributing to a 19% share of markets with declining prices, the highest since 2012, signaling potential affordability improvements as real home prices fall below inflation rates.

Construction spending during May 2025 was down 3.5% year-over-year (YoY). Components private construction was down 5.4% YoY whilst public construction was up 3.3% YoY. Unfortunately, construction went negative in December 2024 and remains on a fairly negative trend line.

The number of job openings (JOLTS) was little changed at 7.8 million in May 2025. JOLTS historically correlates to employment growth - so it is suggesting that the BLS employment report coming tomorrow will show little change in employment growth from what we have seen so far this year.

In June, the Manufacturing PMI® rose to 49%, a slight 0.5-percentage point increase from May’s 48.5%. A PMI® above 42.3% typically signals economic growth over time. The New Orders Index continued its five-month contraction, dropping to 46.4%, down 1.2 percentage points from May, whereas the Production Index rebounded to expansion territory at 50.3%, a significant 4.9-percentage point rise from May. The Backlog of Orders Index fell to 44.3 percent, a 2.8-percentage point decline from May. Manufacturing in the U.S. remains soft - and has been sickly for years.

In June 2025, private employers cut 33,000 jobs, with the most significant losses in professional and business services, and education and health services, though leisure and hospitality, and manufacturing sectors saw gains, according to Nela Richardson, Chief Economist at ADP. Despite rare layoffs, a cautious approach to hiring and reluctance to replace departing workers drove the job losses, but the slowdown in hiring has not yet impacted pay growth. Although ADP’s employment report has not been a good predictor of the BLS employment report which will be released tomorrow - I wonder if this time we might see a poor BLS report.

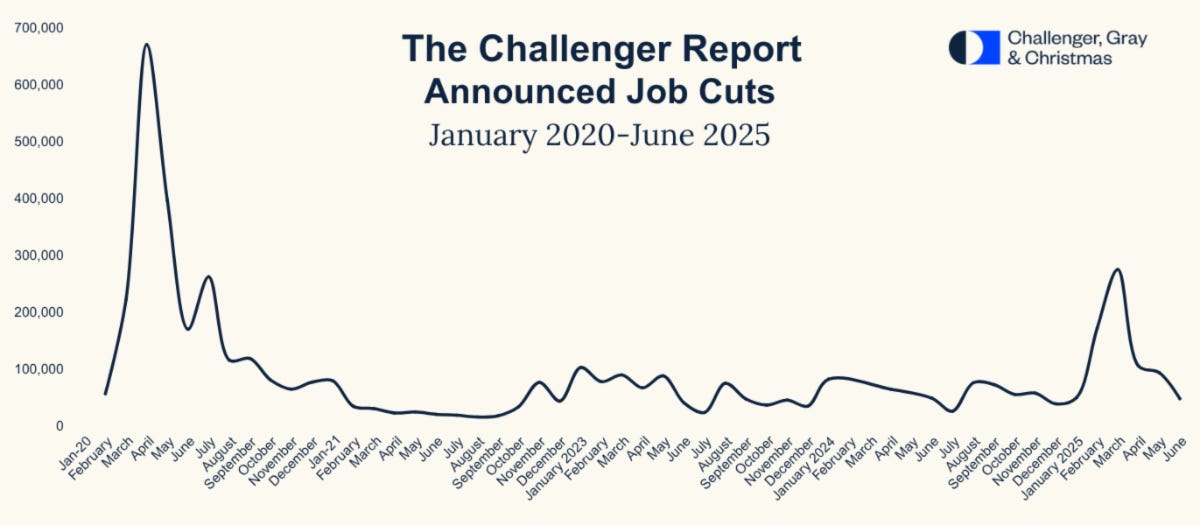

In June 2025, U.S.-based employers announced 47,999 job cuts, a 49% decrease from May’s 93,816 and a 2% drop from the 48,786 cuts in June 2024, according to a report from Challenger, Gray & Christmas. Despite the monthly decline, the second quarter of 2025 saw 247,256 job cuts, the highest Q2 total since 1,238,364 in 2020, marking a 39% increase from the 177,391 cuts in Q2 2024, though down 50% from the 497,052 cuts in Q1 2025.

Sponsored Content:

Trump: "Buy Stocks Now!" (Here's a Better Move)

President Trump just announced from the Oval Office: "You better go out and buy stocks now. The market will take off like a rocket ship." And he's absolutely right-stocks like Apple, Tesla, and Nvidia are soaring...

But here's something most investors are missing: You can turn this historic surge into immediate monthly income-potentially up to $5,917! No more waiting years for stock prices to rise...

Click Here to Learn How to Get "Made In USA" Monthly Checks

ref: 7600/2

That Can’t Happen in the US -- Can It?

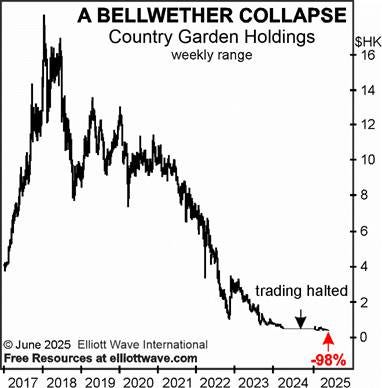

Imagine the common stocks of residential real estate developers D.R. Horton or Lennar Corp dropping 98%. What would that imply for US real estate? Back in 2022, Elliott Wave International's Global Market Perspective warned that China real estate developer Country Garden Holdings “is becoming a bellwether of contagion risk.” Here’s a June 2025 GMP update:

Country Garden shares hit a new all-time low of 38 cents a share this week, down 98% from its January 2018 peak:

The continued bearish potential is accentuated by calls for an imminent restoration of the Chinese housing boom. In recent weeks, for instance, The South China Morning Post finds a “more upbeat tone among property analysts.” When five repossessed homes recently sold at auction for multiples of the minimum bid, a Chinese news service called the “Sky-High Bids for Foreclosed Homes” a “Hint at a Real Estate Rebound.” One of the many bullish voices on China’s housing market holds that a “cocktail of conditions” will drive the “structural property market recovery.” The South China Morning Post attributes this “positive mood” to a “broader reassessment of China’s economy.” We rate this as too much optimism, too soon.

Are the Chinese and U.S. real estate markets linked? Learn about the Fear of Getting Out (FOGO) by subscribing to EWI's Global Market Perspective.

Not ready to subscribe? Get more samples of EWI's unique Global Markets analysis -- follow this link for FREE access.

The EconCurrents is primarily a reader-supported publication. To receive new posts and support our work, please consider becoming a free or paid subscriber.

Infographic of the Day from Visual Capitalist:

Statista Graphic of the Day:

You will find more infographics at Statista

The headlines we are reading:

Weather Outlook for the United States and the World – Continuously Updated

This article focuses on what we are paying attention to in the next 48 to 72 hours. The article also includes weather maps for longer-term U.S. outlooks (up to four weeks) and three- and six-day World weather outlooks, which can be very useful for travelers and understanding World News Events. We also provide continual coverage of world tropical events and special coverage for such events and other special weather situations impacting or likely to impact the United States. To get your local forecast plus active alerts and warnings, click HERE and enter your city, state or zip code in the upper left corner.

Trump announces Vietnam trade deal, 20% tariff on its imports to U.S.

Vietnam, whose exports to the U.S. reportedly comprised 30% of its gross domestic product last year, is especially vulnerable to Trump's tariffs.

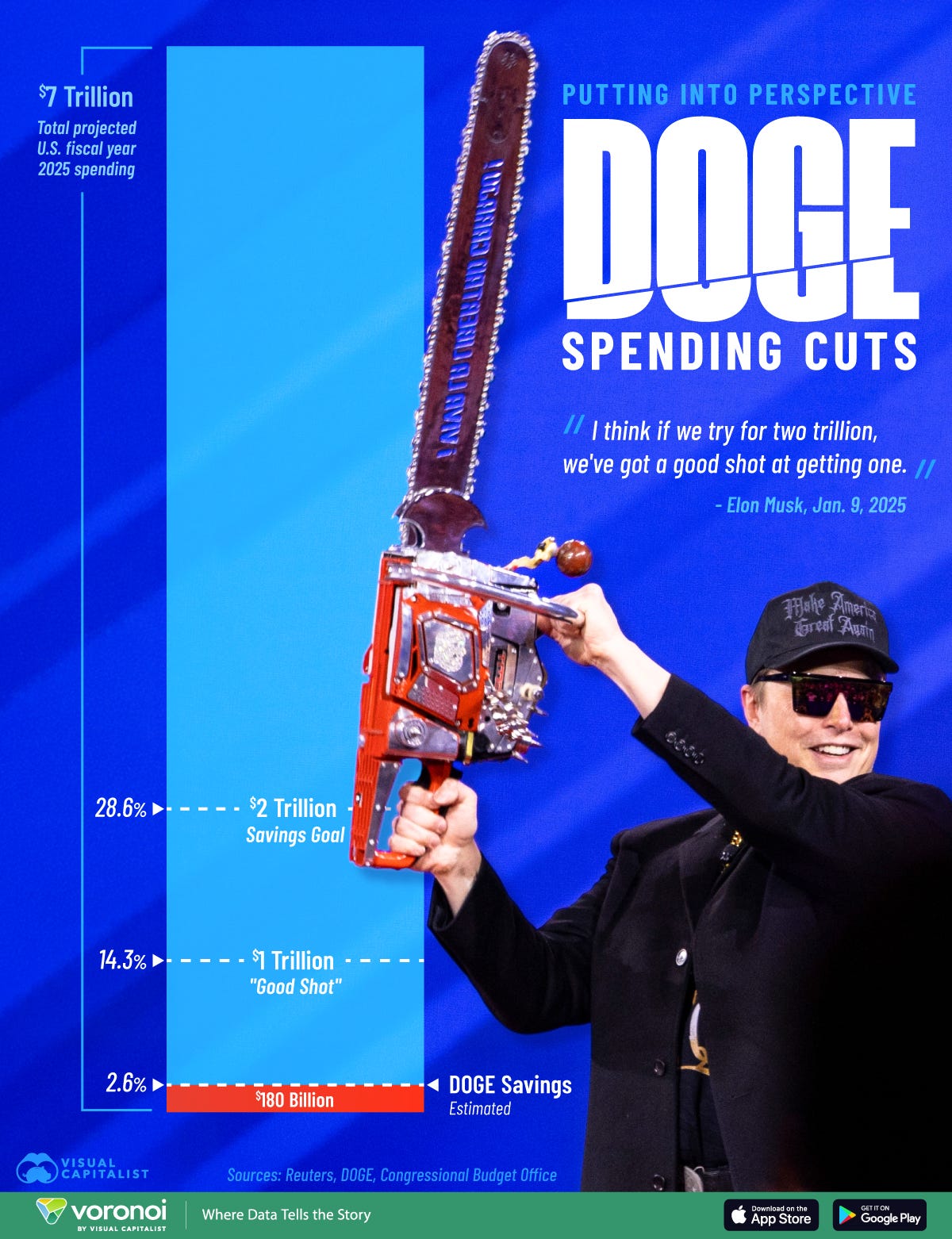

With June jobs report looming, DOGE government layoffs could start becoming a factor

A gradual pullback in hiring and job openings has come as hundreds of thousands of federal workers are out looking for employment.

Microsoft laying off about 9,000 employees in latest round of cuts

Microsoft surpassed expectations on revenue and profit but is slimming down across ranks, organizations and geographies.

House GOP infighting holds up key vote on Trump tax bill

Speaker Mike Johnson can lose just three members' votes and still pass the bill in a party-line vote. But more than a dozen Republicans are currently noes.

S&P 500 closes at another record on Wednesday after Trump announces Vietnam-U.S. deal: Live updates

The S&P 500 rose on Wednesday after President Donald Trump announced a U.S.-Vietnam trade deal.

With stocks at record highs highs, financial advisors warn not to chase the market. Do this instead

The last thing investors should be is reactionary, according to financial advisors.

The private sector lost 33,000 jobs in June, badly missing expectations for a 100,000 increase, ADP says

Economists polled by Dow Jones forecast an increase of 100,000 for the month.

Coinbase shares climb after acquisition of token manager LiquiFi: CNBC Crypto World

On today's episode of CNBC Crypto World, Solana's SOL token climbs after the launch of the first U.S.-listed ETF to provide direct exposure to the token while also offering access to staking rewards. Plus, Coinbase announces the acquisition of token management platform LiquiFi. And, Andrew McCormick, head of eToro US, discusses the retail trading platform's decision to further expand its crypto lineup to users in the United States.

Amazon to shut down Freevee streaming TV service in August

Freevee was originally born out of IMDb, the TV and movie service Amazon acquired in 1998.

Trump's deportations are hurting Constellation Brands' beer sales

The brewer, which owns Modelo, Corona and Pacifico, says that roughly half of its beer sales come from Latinos in the U.S.

Wisconsin Supreme Court strikes down state's 1849 near-total abortion ban

Abortion providers in the state resumed the procedure in 2023 after a judge ruled that the 176-year-old ban was superseded by a more recent law.

Homeowner’s insurance premiums vary widely from state to state, but they are all going up

Homeowner’s insurance premiums are going up as increasingly severe storms and other disasters, combined with rising housing costs, are pushing rates higher.

Tesla reports 14% decline in vehicle deliveries, marking second straight year-over-year drop

Tesla reported another year-over-year decline in vehicle deliveries as the company faces increased competition from lower-cost rivals.

Wisconsin Supreme Court Votes 4-3 To Invalidate State Abortion Law

Wisconsin Supreme Court Votes 4–3 To Invalidate State Abortion Law

Authored by Matthew Vadum via The Epoch Times,

The Wisconsin Supreme Court voted 4–3 on July 2 to strike down the state’s 176-year-old almost-total ban on abortion.

Justice Rebecca Frank Dallet wrote the majority opinion.

“We conclude that comprehensive legislation enacted over the last 50 years regulating in detail the ‘who, what, where, when, and how’ of abortion so thoroughly covers the entire subject of abortion that it was meant as a substitute for the 19th century near-total ban on abortion,” Dallet wrote.

“Accordingly, we hold that the legislature impliedly repealed [Section] 940.04(1) as to abortion, and that [Section] 940.04(1) therefore ...

Iran Reportedly Made Plans To Litter Strait Of Hormuz With Naval Mines

Iran Reportedly Made Plans To Litter Strait Of Hormuz With Naval Mines

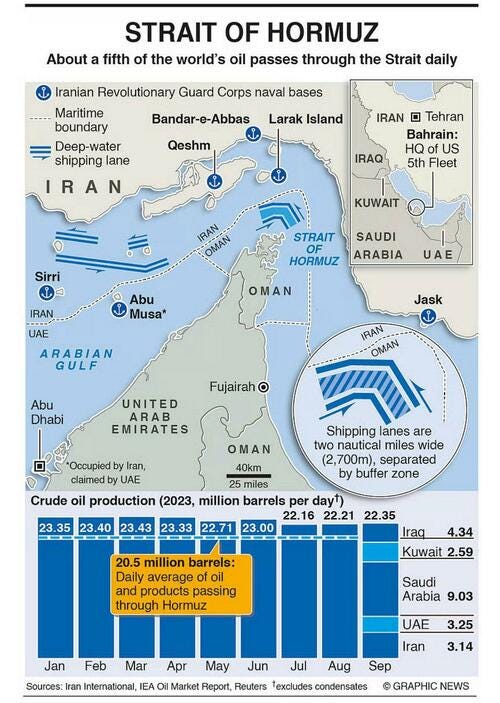

The U.S. launched "Operation Midnight Hammer" on June 22, deploying stealth bombers to strike Iran's nuclear facilities at Fordow, Natanz, and Isfahan using Massive Ordnance Penetrator bombs. President Trump declared the sites were "totally obliterated." In retaliation, Iran's parliament voted to authorize the closure of the Strait of Hormuz—a critical maritime chokepoint through which 20% of the world's oil flows—sparking renewed anxiety among global energy traders over the threat to vital tanker lanes.

As readers understand, any move by Iran to close the critical waterway would instantly disrupt nearly one-fifth of the world's oil shipments and trigger substantial—and potentially cascading—economic harm (energy inflation) worldwide. However, those threats ultimately fell short in the day ...

RFK Jr. Says Officials 'Revolutionizing The Vaccine Injury Compensation Program'

RFK Jr. Says Officials 'Revolutionizing The Vaccine Injury Compensation Program'

Authored by Zachary Stieber via The Epoch Times (emphasis ours),

Federal officials are working on revamping the program that provides compensation for people who suffer injuries from vaccines, Health Secretary Robert F. Kennedy Jr. said on June 30.

Health Secretary Robert F. Kennedy Jr. testifies on Capitol Hill in Washington on June 24, 2025. Madalina Kilroy/The Epoch Times

“We just brought a guy in this week who is going to be revolutionizing the Vaccine Injury Compensation Program,” Kennedy said during an interview with former Fox News host Tucker Carlson.

The National Vaccine Injury Compensation Program w ...

Not Just The EPA: Despite Warnings, Biden's Energy Department Disbursed $42 Billion In Its Final Hours

Not Just The EPA: Despite Warnings, Biden's Energy Department Disbursed $42 Billion In Its Final Hours

Authored by James Varney via RealClearInvestigations,

In its last two working days, the Biden administration’s Energy Department signed off on nearly $42 billion for green energy projects – a sum that exceeded the total amount its Loan Programs Office (LPO) had put out in the past decade.

The frenzied activity on Jan. 16 and 17, 2025, capped a spending binge that saw the LPO approve at least $93 billion in current and future disbursements after Vice President Kamala Harris lost the 2024 election in November, according to documents provided by the department to RealClearInvestigations. It appears that Biden officials were rushing to deploy billions in approved funding in anticipation that the incoming Trump administration ...

After Russia's Failure, Iran Seeks China's Military Might

The war with Israel last month decimated a senior echelon of Irans military leadership, crippled its air defenses, and exposed the vulnerability of its air force. Within days, Israel had established aerial superiority, paving the way for US air strikes on Irans nuclear sites. But the war also tested the limits of Irans alliance with Russia, which offered little more than diplomatic support to Tehran during the 12-day conflict. With faith in Moscow at a low point, Iran is now urgently seeking to rebuild its defenses -- and is

China Wins Big as Sanctions Cripple Russias Steel Industry

Via Metal Miner Ongoing geopolitical conflicts, including one active war, combined with market instability, declining steel demand in certain global regions and a rise in protective tariffs on exporting nations, have all come together to force some steel-producing countries, including China, to reassess and refocus their steel industry supply chains. Faced with weak domestic steel demand due to a slowdown in economic growth, Chinas steel industry has been revising its export roadmap. Its exports of metal alloys to Russia, for example,

Uzbekistan's Deepening Ties with China Fuels Public Debate

Rumors that the Uzbek government is handing over farmland to Chinese investors keep bubbling up despite repeated and categorical denials from officials, putting Tashkent in an uncomfortable spot. The latest flare up came after a video made the rounds online purporting to show a local agricultural official threatening that the government would hand unproductive farmland over to Chinese investors, local outlet Kun.uz reported in mid-June. The employee quickly walked back the comments and the Ministry of Agriculture strongly denied anything of the

Dallas Fed: Oilfield Inflation Surges as Shale Activity Contracts in Q2

Oil and gas activity in the U.S. Eleventh District slipped into contraction in the second quarter of 2025, according to the Dallas Fed Energy Survey released Wednesday, with firms citing falling production, deteriorating service margins, and deepening uncertainty. The surveys headline business activity index dropped from 3.8 in Q1 to -8.1, marking a return to negative territory. Executives pointed to declines in both oil and gas production, with the oil production index falling to -8.9 and the natural gas production index to -4.5, which

Bidens Climate Legacy in Jeopardy as Trump Targets LPO Spending

In its last two working days, the Biden administrations Energy Department signed off on nearly $42 billion for green energy projects a sum that exceeded the total amount its Loan Programs Office (LPO) had put outin the past decade. The frenzied activity on Jan. 16 and 17, 2025, capped a spending binge that saw the LPO approve at least $93 billion in current and future disbursementsafter Vice President Kamala Harris lost the 2024 election in November, according to documents provided by the department to RealClearInvestigations.

Disaster Looms As French Uranium Mine in Niger Faces Bankruptcy

French nuclear fuel giant Oranos uranium mining subsidiary in northern Niger is on the verge of bankruptcy, raising alarms over future nuclear fuel supply chains amid deepening tensions with the ruling junta, Reuters reported on Wednesday. The company cited a breakdown in talks with Niamey and the blocking of essential equipment at the border as the primary drivers of the crisis. The COMINAK mine in the Arlit region once supplied up to 30% of Frances uranium needs. Although the mine ceased production in 2021, Orano remains responsible

Europes Green Energy Stocks Jump on Watered-Down U.S. Bill

Shares in major European renewable energy companies jumped on Wednesday morning after President Trumps Big Beautiful Bill was passed by the Senate with less punitive provisions for green energy projects than initially proposed. The U.S. Senate passed on Tuesday the spending and tax bill with the narrowest of margins, with Vice President JD Vance casting a tie-breaking vote after more than 24 hours of debate. The Bill must also be approved by the House, where more opposition is expected to emerge. The original bill included

Big Oil Bids in Libyas First Exploration Tender in 18 Years

Supermajors ExxonMobil, Chevron, TotalEnergies, and Eni are competing in Libyas first oil bid round in 18 years, Masoud Suleman, chairman of Libyas National Oil Corporation (NOC), told Bloomberg in an interview published on Wednesday. Libya earlier this year launched its first oil and gas exploration tender since 2007, which is also the first since the civil war erupted in the country in 2011 after the toppling of Muammar Gaddafi. Exxon, Chevron, TotalEnergies, and Eni are among the 37 international companies that have expressed

Oil Falls as U.S. Crude, Gasoline Inventories Rise

Crude oil inventories in the United States increased by 3.8 million barrels during the week ending June 27, according to new data from the U.S. Energy Information Administration (EIA) released on Wednesday. The build brings commercial stockpiles to 419 million barrels, roughly 9% below the five-year average for this time of year. Crude prices were trading up ahead of the report. The American Petroleum Institute (API) on Tuesday had estimated a 680,000-barrel build for the week ending June 27 after analysts had estimated a much smaller 2.26-million-barrel

India Eyes New Sites to Boost Strategic Oil Reserves

India, the worlds third-largest crude oil importer, which depends on imports for about 85% of its daily consumption, considers building three new sites to raise its strategic petroleum reserves. Engineers India Ltd, a state-run engineering consultancy, is doing feasibility studies, L R Jain, chief executive at the state company managing the reserve, Indian Strategic Petroleum Reserve Ltd, told Reuters on Wednesday. In case of exigencies, we will be better prepared, Jain said. Currently, Indias underground Strategic Petroleum

Trump Presses for Speedy Gaza Ceasefire

US President Donald Trump urged Iran-backed Hamas militants to agree to what he called a "final proposal" for a 60-day cease-fire with Israel in Gaza. "I hope, for the good of the Middle East, that Hamas takes this Deal, because it will not get better -- IT WILL ONLY GET WORSE, he said on July 1 on Truth Social. Israel has agreed to the conditions to finalize a 60-day cease-fire during which we will work with all parties to end the War," Trump said. Representatives for Qatar and Egypt will deliver the proposal to Hamas, Trump said,

Australias Offshore Wind Plans in Limbo as Equinor Leaves Project

Norwegian energy major Equinor has walked away from a third offshore wind development project in Australia in another blow to the federal governments plan to build an offshore wind industry. Earlier this year, Equinor quietly walked away from the Bass Offshore Wind Energy project near the coast of Tasmania, as the oil and gas giant reduced its investments in renewables to boost returns for shareholders and adapt to an uneven energy transition. In a short statement to Australias Financial Review, Equinor and its partner

Russias Natural Gas Supply to Europe Drops

Russias natural gas exports to Europe via pipeline and LNG cargoes declined in the first half of 2025 from a year earlier as flows via Ukraine stopped and some buyers shunned Russian LNG. Total gas exports from Russia to Europe nearly halved to 8.33 billion cubic meters in the period January to June 2025, down from 15.5 billion cubic meters for the same period of 2024, when Russian gas was still flowing via a pipeline route through Ukraine, according to data compiled by Reuters. Russian gas supply via pipelines to Europe has slumped since

Northeast Asias Jet Fuel Flows to Europe Surge

High European jet fuel prices amid fears of Middle East supply disruptions prompted oil traders to ship in June the highest volumes in a year of jet fuel from South Korea and China to Europe. These flows from Northeast Asia to Europe were estimated at a total of about 3 million barrels last month, according to trade sources and vessel-tracking firms who shared their data and insights with Reuters. For most of last month, amid elevated concerns about supply flows due to the 12-day Israel-Iran war, the price of physical jet fuel in Northwest Europe

China Continues to Buy a Lot of Iranian Crude Oil

Chinese refiners continue to buy high volumes of crude oil from Iran, with first-half imports at the major port clusters estimated at nearly 1.4 million barrels per day (bpd), according to oil flow tracking data from Kpler cited by Bloomberg. Ports near industrial clusters Qingdao, Dalian, and Zhoushan are importing crude from Iran in several legs from the Persian Gulf via Malaysia with ship-to-ship (STS) transfers using shadow fleet vessels and tankers blacklisted by the United States. Officially, Chinas customs data show there havent

Borrowing costs jump and pound falls on Chancellor's tears

Markets react after a tearful appearance by Rachel Reeves in parliament after welfare reform u-turn.

Heathrow considering legal action against National Grid over fire that caused shutdown

An investigation finds National Grid had been aware of a problem at a substation since 2018.

Five things we now know about the fire that shut Heathrow down

A report into a fire that resulted in Heathrow Airport shutting down for nearly a day has been released - what are the key findings?

Tesla shares jump 4% as investors discount EV maker's lower than estimated Q2 deliveries

Tesla shares saw an increase despite lower-than-expected deliveries. Nearly 12 crore shares changed hands. This happened amid tensions between Elon Musk and US President Donald Trump. Trump threatened action against Musk. This followed Musk's criticism of Trump's bill. Wall Street indices showed mixed trading. The spat and its potential impact are making investors nervous.

Inox Wind jumps 4% after Motilal Oswal initiates ‘Buy’ call, sees strong growth on order book, O&M expansion

Shares of Inox Wind rose nearly 4% after Motilal Oswal initiated coverage with a ‘Buy’ rating and a target price of Rs 210. The brokerage cited strong order visibility, robust O&M capacity, and vertically integrated operations as key strengths, projecting a 21% upside from current levels and long-term potential in India’s growing wind energy market.

RBL Bank shares rally 3% as Dubai-based Emirates NBD Bank eyes up to 20% stake

RBL Bank shares: The stock, which has surged over 21% in the past month and more than 64% in the last six months, extended its winning streak by rising for the eighth time in nine sessions. It closed on Tuesday at Rs 259.95, up 4.6%, with a market capitalization of Rs 15,831.21 crore.

As the Fourth of July approaches, here are 4 reasons why ‘American exceptionalism’ isn’t going away

Don’t listen to the skeptics: The factors that make the U.S. economy great are likely here to stay, one Wall Street strategist says.

How hard is it to beat the market consistently? Even AI can’t do it.

Many ETFs and stock pros use artificial intelligence to get an edge. But most still don’t outperform their benchmark.

Trump’s tariffs are unfair to most Americans. Here’s how they could actually be beneficial.

Instead of blanket tariffs, an ethical policy shows a clear and justifiable need for protection.

Disclaimer

Nothing in this EconCurrents newsletter is financial, investment, legal, or any other type of professional advice. Anything provided in any newsletter is for informational purposes only and is not meant to be an endorsement of any type of activity or any particular market or product.